订阅 wiki

Share wiki

Bookmark

Credbull

0%

Credbull

Credbull 是一个专注于私人信贷和现实世界资产借贷的数字资产平台。它为机构和认可投资者提供结构性投资产品,并整合区块链基础设施,以促进透明的资本配置和收益生成。 [1]

概述

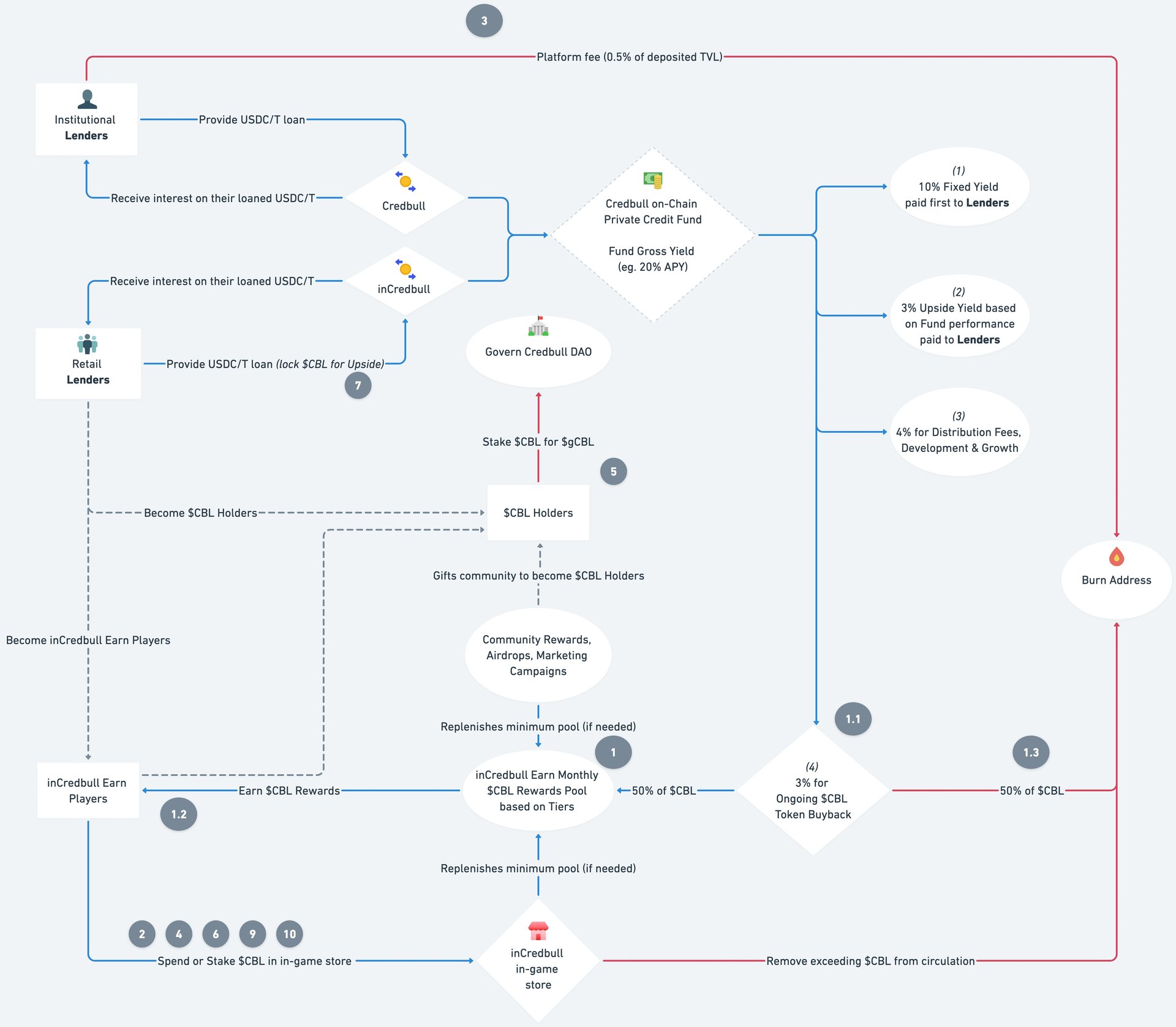

Credbull是一个链上私人信贷平台,提供固定收益投资产品。它运营一个获得许可的私人信贷基金,将资金部署给中小企业贷款发起人,从多元化的信贷交易组合中产生回报。该基金提供固定收益,并可选择基于业绩的上涨空间,且不要求最低投资额。

该平台与多个EVM链和RWA平台集成,以增强流动性和可访问性。它还允许用户转移ERC-4626认领代币,并在其生态系统内利用投资。此外,Credbull还提供一个游戏化的应用程序inCredbull Earn,用户可以使用$CBL代币参与与投资相关的活动和治理。其战略侧重于透明度、机构级风险管理以及连接TradFi和Web3投资者。 [2] [3]

功能

链上私人信贷基金

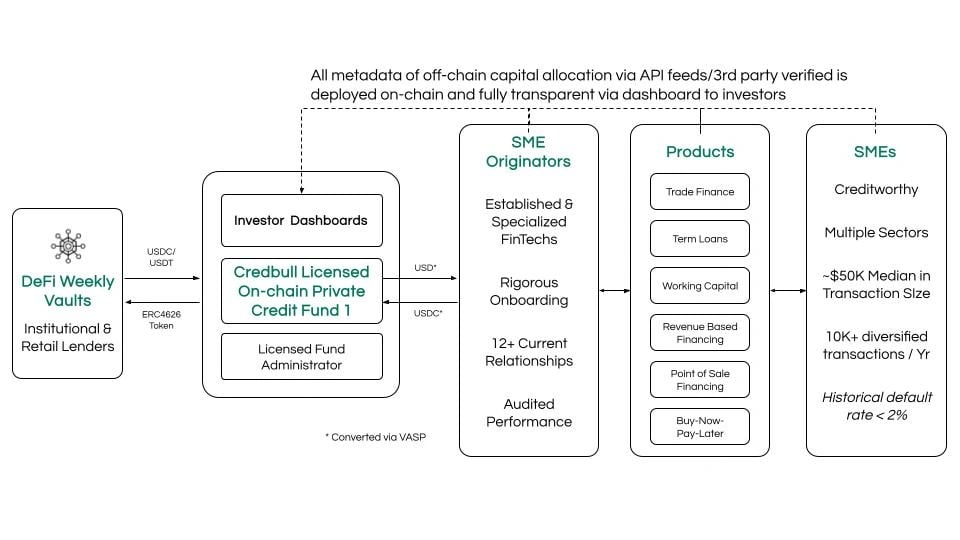

链上私人信贷基金是由 Credbull 管理的基于区块链的投资基金,旨在提供透明且易于访问的私人信贷机会。与通常在链下运营的传统现实世界资产 (RWA)投资不同,该基金将所有流程都放在链上,从而可以实时了解策略、风险管理和资产配置。

该基金发行自托管的债权代币,允许投资者跟踪其持股并参与去中心化治理。它将资本部署到中小企业贷款发起人,支持能源、农业和基础设施部门,同时保持风险调整后的回报。该基金提供固定收益和灵活的锁定期,吸引了在动荡的市场中寻求稳定回报的投资者。解决传统和去中心化金融中的低效率问题旨在提高私人信贷投资的可访问性和透明度。[4]

基金策略

Credbull 的基金策略侧重于在区块链上提供结构化的私人信贷投资,这些投资提供固定收益和潜在的上涨参与机会。私人信贷历来是一种表现良好的资产类别,通常为机构和高净值投资者保留。Credbull 旨在通过基于区块链的投资产品扩大对此类机会的访问。

该基金提供 10% 的固定收益率,并有可能根据业绩获得高达 30% 的额外回报。将私人信贷贷款与 DeFi 相结合,旨在提高可访问性,同时保持风险管理。该策略强调投资组合多元化和稳定回报,利用区块链提高信贷市场的透明度和效率。[5]

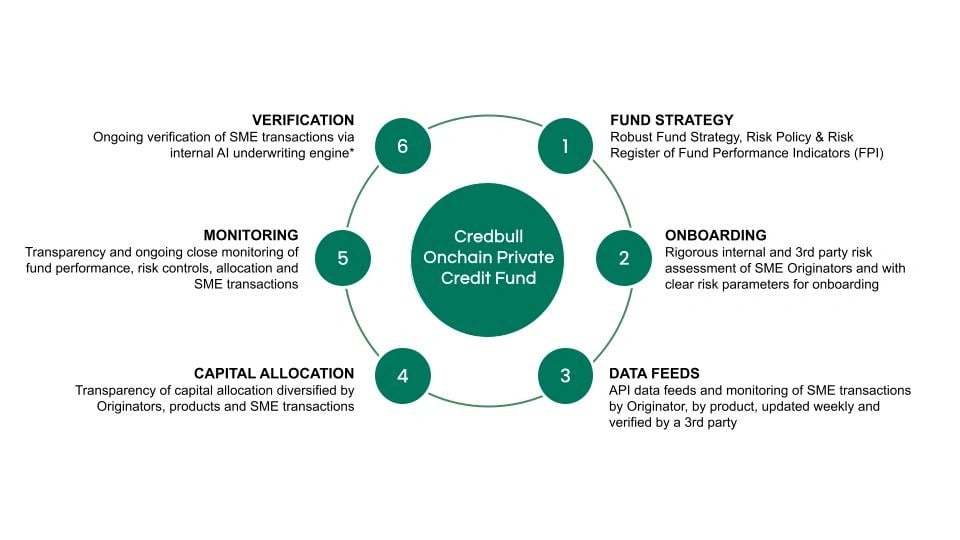

360 度风险管理

Credbull 的风险管理框架通过严格的监督、先进的技术和透明度来降低其运营中的风险。它在引入中小企业发起人时应用严格的尽职调查,使用内部和第三方评估来评估财务稳定性、监管合规性和运营可靠性。一旦加入,发起人的交易数据将通过 API 数据馈送进行持续监控,确保实时信用风险评估,同时保持数据隐私。

资金分配遵循多元化策略,将资金分配给多个发起人和产品,以降低集中风险并优化回报。该平台通过定期报告基金业绩、风险指标和投资组合构成来保持透明度。人工智能驱动的承销持续验证中小企业交易,从而增强风险评估和适应性。这些措施在确保有效信贷部署和风险调整回报的同时,保护投资者资金。 [6]

Orbit TVL 分配

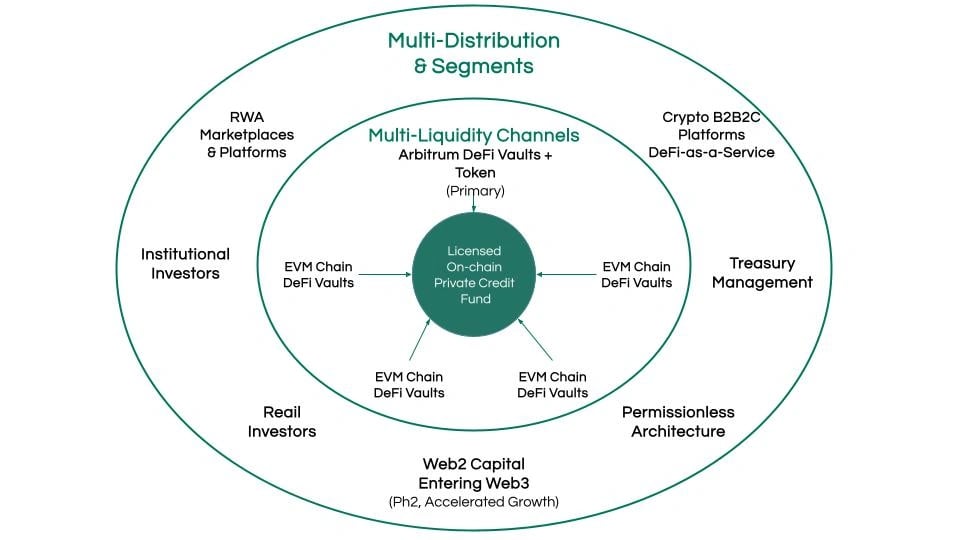

Credbull 的 Orbit TVL 分配策略侧重于使用 80/20 优先级模型在多个平台和细分市场扩展流动性。该基金专注于主要客户,以解锁大部分总锁定价值 (TVL)。该基金在 Polygon 上运营,并计划迁移到 Plume Network。它将利用 Centrifuge 的链上资产管理,同时保持链无关的 DeFi 借贷金库。最初部署在 Arbitrum 上,该金库将扩展到访问各种网络上的流动性。

该分配策略针对 RWA 市场和 B2B2C 平台,包括托管人、流动性提供商、DApp、中心化 和 去中心化交易所、稳定币 贷款人和 加密钱包。流动性 来源包括项目金库、机构投资者和寻求固定收益的 加密货币 原生参与者。在第二阶段,Credbull 的金库将变为无需许可,允许第三方 Web3 项目创建自己的金库。

更广泛的目标是通过提供不相关的高固定收益和低进入壁垒,吸引传统金融 (Web2) 的新资本进入 Web3。这解决了最近周期中缺乏净资本流入的问题。该策略旨在建立 Web2 和 Web3 金融之间的长期桥梁。 [7]

inCredbull Earn

inCredbull Earn是一个游戏化的奖励平台,旨在增强社区参与度并推动Credbull的DeFi生态系统的采用。它采用基于任务的模型,奖励用户$CBL代币,以鼓励他们参与社交、游戏和链上活动。用户通过参与活动积累积分,并在排行榜上晋升,排行榜等级决定了他们的奖励倍数。

用于奖励的$CBL代币是在公开市场上使用Credbull基金的利润购买的,而不是免费分发的。购买的代币有一半被销毁,引入了一种通货紧缩机制,而剩余的一半则根据用户的等级状态分配。等级越高,获得的倍数越大,从而激励用户持续参与。

inCredbull Earn奖励系统的资金来自结构化的回购计划,购买相当于平台总锁定价值(TVL)1-2%的$CBL代币。奖励分配遵循分层结构,倍数受社区治理约束。$CBL在Credbull生态系统中的其他用途包括访问独家功能、参与治理和质押机会,从而增强代币的长期价值。 [8] [9]

产品

LiquidStone

LiquidStone是Nest nRWA金库中的一项现实世界资产(RWA)投资产品,在该金库中占比最高,达到30%。它提供了对多种资产类别的敞口,包括零信用违约风险的即时结算发票融资、稳定币借贷和代币化的美国国债。LiquidStone在Plume网络上运行,提供30%的年化收益率(APY),并支持24/7赎回。用户可以随时质押和提取资金,没有最低限额、费用或锁定期。收益持续累积,确保灵活性和流动性,同时产生收益。 [10]

PureStone

PureStone 是一种私人信贷投资产品,为机构和合格投资者提供中小企业融资渠道,具有非相关的 15% APY。它提供即时结算发票融资,以现金应收款作为担保,并具有自动还款机制,可降低违约风险。PureStone 与 BlackOpal 和 Klub 合作开发,通过提前支付待处理应收款的方式,为海湾地区最大的电子商务平台 Noon 上的合格商家提供资金。投资者通过获得许可的链上私人信贷基金访问该产品,所有利润都分配给 $CBL 奖励池,从而支持产生收益的代币激励。 [11]

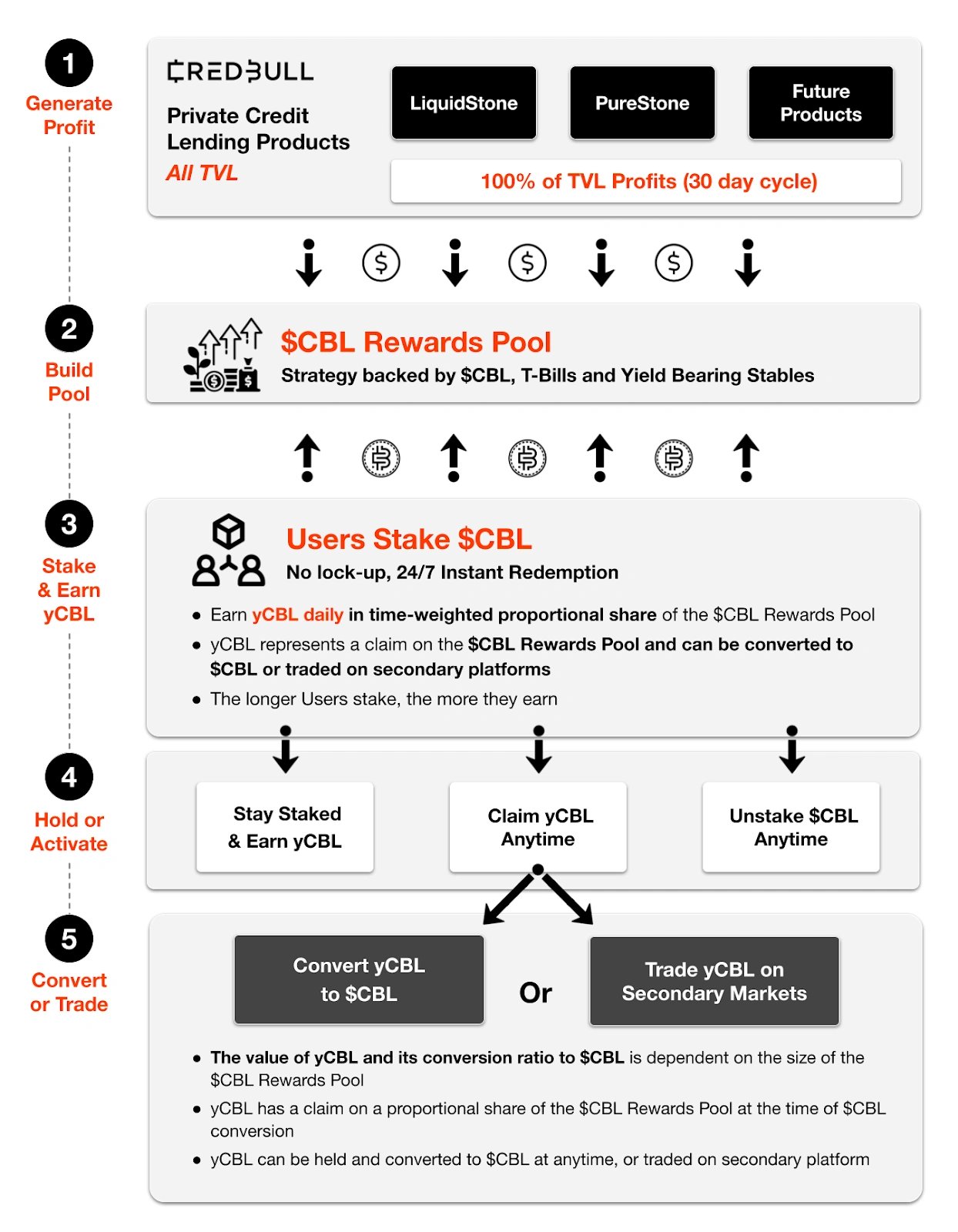

CBL 奖励池

$CBL 奖励池是一种链上私人信贷借贷机制,通过生息代币 yCBL 分配 Credbull 的借贷产品(如 LiquidStone 和 PureStone)的利润。yCBL 代表对借贷利润的比例索取权,将其价值与总 TVL 增长联系起来。利润流入由 $CBL、国库券和生息稳定币支持的资金池,确保稳定性和可持续收益。

参与者可以质押 $CBL 以赚取 yCBL,奖励根据时间加权质押进行分配。yCBL 可以转换为 $CBL 或在二级市场上交易。该系统暂时减少了 $CBL 的流通供应,在提供流动性的同时,使激励措施与平台的长期增长保持一致。 [12]

CBL

$CBL是inCredbull Earn生态系统中的一种实用代币,用于奖励、治理和平台费用。每周的回购机制使用平台运营利润的一部分回购$CBL,其中一半重新分配作为奖励,另一半销毁以减少供应。

用户可以锁定$CBL以提高奖励,访问独家游戏内容,并通过投票参与平台决策的治理。机构合作伙伴以$CBL支付费用,这些费用将被销毁,从而加强其通货紧缩模型。该代币还集成到游戏内经济中,允许持有者赚取更多货币并解锁外观物品和角色。[13] [14]

代币经济学

CBL的总供应量为10亿个代币,并具有以下分配:[15]

- 社区增长与奖励:30%

- 国库:20%

- 私募:19%

- 核心与未来团队:15%

- KOL轮:7%

- 流动性:5%

- 合作伙伴与顾问:2.5%

- 公募:1.5%

合作伙伴

- CryptoWedge

Nest

- Mountain Protocol

- Anemoy

- Plume

- HODL Ventures

- Outlier Ventures

发现错误了吗?