Subscribe to wiki

Share wiki

Bookmark

Hedget

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Hedget

Hedget (HGET) (Launched in September 2022) is a Decentralized platform for options trading. Users can buy and sell options products on the platform by providing collateral in the form of cryptocurrency (both Stablecoin and traditional Cryptocurrency). It also allows users to hedge risk for their Crypto holdings as well as their debt positions on other lending protocols such as Compound and Aave ($AAVE). [1][2][3]

Overview

Hedget is a protocol for options trading managed by the non-profit HLS Foundation based in Singapore which supports the growth and development of the Hedget protocol. Hedget is dedicated to creating a secure and Decentralized trading platform to protect users’ Crypto holdings.

By putting up collateral, users can create and trade different option series on the chain. Decentralized option products allow users to hedge price fluctuation and also risk in their collateralized lending positions. The protocol also adds in support on Layer 2 to existing Blockchain such as Ethereum to enable faster, cheaper, and more complex transactions. Hedget believes that risk mitigating Defi protocols like Decentralized options are necessary building blocks as the Decentralized finance sector grows and matures. Hedget Foundation issues the HGET token as the native token on the platform for governance and other utility purposes.

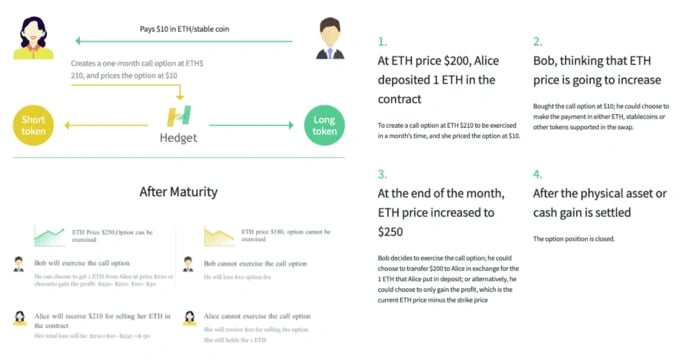

Hedget allows users to create and trade options on the platform. Each time option products are created, the system will mint a token to represent the option.[4][5]

Key elements for creating options include:

- The underlying asset being tracked: The first version will focus on ETH as an underlying asset, and later will be expanded to support ERC20 tokens and tokens on other Blockchain.

- Option type (call or put): When using a call option, the user is reserving the right to buy at the strike price when the option expires. When using a put option, the user is reserving the right to sell at the strike price when the option expires. There will be new options series added when the current trading price is above the highest or below the lowest strike prices available

- Maturity Dates: The time when options could be exercised. In the first version of Hedget, the maturity dates for the options are every Friday at 8:00 UTC+5.[6][7]

Uses of Hedget Protocol

As a decentralized price hedge:

For users, the option products offer a Decentralized price hedge against their current Crypto holdings. As ETH price fluctuates, buying a protective put option allows users to be able to sell at a certain price. Compared to selling ETH for Stablecoin, buying a put option gives holders the right to protect against downward price movement but also enjoy ETH appreciation because they could choose not to exercise the option.

As protection against liquidation for lending protocols:

Hedget could also be offered to other lending protocols as a security feature against user position liquidation.

As mentioned earlier, there is a significant risk for users using ETH as collateral for their lending positions. DeFi lending protocols currently adopt over-collateralized lending mostly. For instance, on MakerDAO, users need to put up 150% ETH collateral to mint DAI Stablecoin. There is a liquidation ratio, which means that if the ETH collateral is worth less than the DAI value, the ETH will be liquidated and auctioned to recover the DAI position. This design ensures that the DAI price is stable, but this is achieved at relatively low capital efficiency and risk of collateral liquidation. It is disadvantageous in the face of drastic market fluctuation as seen on March 12th, 2020. In Maker alone, more than 5 million dollars worth of loans was liquidated to recover the DAI positions even though ETH price bounced back to the pre-crisis level shortly thereafter. Users rather than the protocols are the ones that bear the cost.

This could be solved by using Hedget. Lending protocols could add a feature for users to select at the time that loans are generated to pay a premium to ensure that their positions would never be liquidated during the terms of the loan. This premium is priced by choosing the option product that matches the loan terms and price on Hedget. For example, if a user created a CDP position on Maker, to borrow DAI with ETH as collateral at the time when ETH price is $200, he could pay a premium which is used to purchase a put option for ETH at the price of $200 to guarantee that the price could always match the price when the CDP is generated. Hedget is interacting not directly with users but with the lending protocols to sell options available in the protocol. Since the users are only protecting their debt positions rather than trading the option product, the profit of the option (if any) will not be distributed to the users but registered in the protocol itself and used for token buyback and burn.

Leveraged Trading:

Hedget protocol allows users to trade on leverage with greater capital efficiency. The price that users need to pay to acquire the options is much lower than to hold actual positions. If a user believes that the ETH price is going to increase to $500 from the current price of $300, instead of using $300 to buy one ETH, he could pay the option price to buy a call option to buy ETH at $300 after a quarter. If the price increases to $500, it is essentially the same for the user for holding the call option and holding one physical ETH; but the cost of the call option is lower than the ETH price. If the user is a more aggressive trader, he could even exchange the current ETH positions into options holding in anticipation of price growth. Hypothetically, if the price of the previous call option is $30, the user could buy 10 call options using one ETH and also 10x the revenue at the expiry of the call option compared to holding 1 ETH. [9]

Hedget Component

There are three main components:

- ESC: Ethereum smart contract which handles ETH and ERC-20 token deposits and withdraws and implements physical settlement.

- CTD: Chromia-based Blockchain (dApp) which handles trades, tracks ownership of contracts and facilitates communication necessary to perform settlement through Ethereum Smart contract.

- CSW: Client-side wallet and trading user interface, which takes commands from a user and carries them out using Ethereum Smart contract and Chromia dApp. [10][11]

Protocol Features

- Token storage is non-custodial, which means that only a user can withdraw his or her funds.

- Money is moved between users’ accounts only when they trade or exercise the option contracts.

- The protocol is free from counterparty risk. Since it is impossible to algorithmically assess creditworthiness, we require full collateralization for option sellers.

- Since the team wants to give users the highest degree of assurance, constraints that control users’ funds are implemented directly on the Ethereum Smart contract.

- It aims to offer maximal flexibility and convenience within these constraints. Purchased options can be resold at any time. [12]

Hedget Token (HGET)

Hedget protocol introduces a native Token for the governance and utility in the network. Users need to stake a small amount of HGET tokens to create and trade options products; they could also earn HGET tokens in the process proportional to the size of the trade. It is also used in the governance process if users would need to propose updates to the protocol.

Token Utility

The HGET token is a native utility and governance token of the Hedget platform. It is issued on the Ethereum network as an ERC-20 contract and has representation on a Chromia Sidechain. Effective immediately upon launch, HGET will serve as the governance token of the HGET platform. In the preliminary stages, the token holders can vote on adding new assets, default options parameters, and UI improvements.

HGET token will be used as a security measure and reputation engine in the future when margined options are implemented. Options writers who wish to offer options without providing 1:1 collateral will need to stake HGET tokens which will be used to purchase fully collateralized options as a hedge in case of capital insufficiency risk. This mechanism ensures end users cannot be adversely affected by the insolvency of an options writer.[13][14]

HGET Use Cases

- Governance: HGET is the governance token of the protocol. Users can Participate in the system design, upgrade and allocation of reserve tokens once unlocked.

- Platform Utility: Sellers need to stake Hedget Token to participate in the option minting.

- User Incentive: To get market makers and users to contribute liquidity to the platform. Earn tokens through liquidity mining.[16]

Token Distribution

1. There is a Total Supply of 10M HGET tokens minted at the launch of the network. The protocol has a fixed token supply. 10% of the tokens will be reserved for the team and advisors, the tokens will be unlocked every month for 2 years;

2. 9.77% of the tokens will be distributed through private sale via SAFT;

3. 4.23% of the tokens will be distributed to users and investors through public sale; 50% of the tokens will be locked for liquidity mining, and tokens will be minted daily and distributed to users who participate in writing options (0.02% of underlying of each option settled and additional for native Hedget MM);

4. 7% of the tokens will be used for DEXes liquidity and trading (such as Uniswap), trading competitions, drops, and other activities to kickstart the usage of Hedget protocol;

5. 19% of the tokens will be locked in a reserve fund until 2 years after the platform is live and the usage of these tokens will be determined by Hedget DAO. [15]

Team Members

| Name | Position | Bio |

|---|---|---|

| Malcolm Lerider | CEO | Previously R&D Manager for NEO Blockchain, Senior Manager at PwC, Software Engineer at Accenture.M.Sc. in Industrial Management and M.Sc. in Computer Science.Fluent in Mandarin and has been living in China for ten years, deeply engaged in the local software industry and emerging technologies Andrew |

| Andrey Sarayev | Co-Founder | He has over nine years of experience in financial quantitative analysis, applications of Machine Learning, and high-performance software systems. During his career, Andrey has been highly successful in developing and deploying quantitative analysis software for hedge funds and financial services companies. Holds a Masters's degree in Computer Science and a Ph.D. in Computational Finance, both from Rensselaer Polytechnic Institute. |

| Serge Lubkin | Advisor and ex-marketing lead at Chromia. | M.Sc. in Economics. Serial entrepreneur and founder of several startups with 8+ years of experience in marketing and project management in various IT projects. Advisor at several Blockchain projects (Impactoria, Opporty) |

| Roger Lim | Founding partner of NGC Ventures | Roger is a successful entrepreneur and dynamic business leader with a track record of spotting disruptive opportunities, commercializing a business, and driving growth. |

| Alex Mizrahi | CTO of Chromia | Did the first implementation of Bitcoin 2.0 in the world. Lead the open-source Colored Coins project in 2012. Author of several academic papers about Bitcoin. Also known as “killer storm”. |

Partners

- Chromia

- bRing.Finance

- Alameda Research[17]

Roadmap

2020 Q3

Hedget Alpha

- Exercise and settle options

- Running on Ethereum testnet and Chromia testnet

2020 Q4

Hedget Beta

- ERC-20 underlying assets

- Chromia L2 for trading Exercise and settle options Real collateral and settlements on mainnets

2021 Q1

Hedget Launch

- DAO governed support of the protocol with settlements on Ethereum, and other chains

2021 Q2

Third-party hedge support

- Tool to query call and put options through API

- Optional processing of buy and sell orders at partner protocol to offer matching hedge

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)