Subscribe to wiki

Share wiki

Bookmark

Liquis

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Liquis

Liquis (launched in September 2023) is a liquid governance wrapper for Bunni Pro[3], a liquidity management solution on top of Uniswap v3. Bunni[3] allows users to provide concentrated liquidity for specific ranges within Uniswap v3 pools and to have their position represented by a fungible ERC-20 receipt token. [2][1]

Ecosystem

Liquis integrates with Bunni[3] and Uniswap v3[4] to provide a full-stack liquidity solution for DeFi.

Uniswap

Uniswap v3[4], launched on March 23, 2021, introduced the concept of concentrated liquidity provisioning. Users can provide pool liquidity over the specific range of pool prices they want to cover, as opposed to providing liquidity for an infinite range as they would in Uniswap v2. These positions are represented by NFT receipts. While this design allows for increased capital efficiency, it did introduce the need for position management solutions so as to offer the same quality user experience liquidity providers have grown accustomed to in DeFi. [5]

Bunni Pro

Bunni Pro was launched to address the need for Uniswap v3[4] position management. It offers tokenized deposit ranges that enable users to commit to specific price ticks within a particular pool. Furthermore, by representing positions through fungible ERC-20 tokens, liquidity providers can more easily recycle their positions through other DeFi platforms. [5]

Bunni Pro has also introduced an incentivization layer on top of its tokenized ranges. This is achieved through the emission of oLIT which can be redeemed for LIT. It can then be plugged into a voting-escrow (ve-) governance system that allows existing holders to dictate the future distribution of emissions across Bunni Pro ranges. veLIT provides pool deployers with a pathway for greater efficiency on their liquidity subsidies. [5]

Liquis

Liquis aims to reduce the opportunity cost associated with the long-term locking of veLIT. Users can contribute LIT and various forms of it (like oLIT, BAL-80LIT-20ETH) to the Liquis protocol in exchange for the liqLIT liquid wrapper. This provides Liquis with corresponding governance power over Bunni Pro[3] and allows liquid wrapper holders to exit into available secondary liquidity whenever they want. Liquis offers depositors of Bunni Pro tokens the ability to earn maximum-boosted LIT rewards. Meanwhile, the liqLIT holders have the option to choose their position. [5]

The governance of Liquis is tied to the LIQ governance token. The holders of LIQ have influence over both the emission of oLIT across Bunni Pro ranges and the general Timeless Finance governance. [5]

Liquis Pre-Launch Program

Liquis conducted a pre-launch program in order to bootstrap the initial share of veLIT held by the Liquis protocol. Over the course of four weeks, users were able to commit the BAL20-WETH-80LIT Balancer Pool Token. After the pre-launch period, BPTs will be converted into liqLIT which can then be withdrawn and staked to earn liqLIT rewards. One BPT is equivalent to one liqLIT token. [6][7]

Partners

The following projects committed to bootstrapping Liquis in exchange for an allocation of its governance token supply.

Liquis x Gravita Protocol

On August 1, 2023, Liquis onboarded Gravita Protocol[10] as a launch partner in order to invest in the Bunni ecosystem to further scale its strategy. With Liquis, GRAI liquidity providers can benefit from boosted Bunni emissions regardless of their veLIT holdings, as well as any additional LIQ subsidies on top. [9]

Liquis x Swell Network

On August 8, 2023, Liquis onboarded Swell Network, a non-custodial liquid staking protocol (swETH) as a partner to bootstrap liquidity in Bunni. With Liquis, swETH liquidity providers on Uniswap v3 can benefit from boosted Bunni emissions regardless of their veLIT holdings, in addition to further LIQ emissions. [11]

Liquis x Paladin

On August 10, 2023, Liquis partnered with Paladin[13], a platform of applications that unlock governance power in other DeFi protocols in order to provide a marketplace for Liquis-held veLIT forms. [12]

Paladin's Warden quests could provide fixed-price markets for vlLIQ; eventual inclusion of LIQ in the Warlord index would further automate the supply side of the veLIT market. [12]

Liquis x Badger DAO

On August 18, 2023, Liquis partnered with BadgerDAO, with BadgerDAO committing to spend $100,000 on incentives for vote-locked LIQ (vlLIQ) holders to direct Bunni emissions toward eBTC and BADGER pools. Badger DAO has been a regular participant in Bunni, with the WBTC-BADGER pool claiming the fourth-highest all-time bribe total. [8]

Liquis x Mimo Labs

On August 23, 2023, Liquis partnered with Mimo Labs[15], the team behind two DeFi protocols: Parallel Protocol and Kuma Protocol, with Mimo Labs investing $25,000 in Liquis deposits throughout the Pre-Launch Program. Mimo Labs stands to be an active player at Liquis launch as it brings liquidity strategies for assets like PAR and EGK to Bunni. [14]

Liquis x Frax

On August 29, 2023, Liquis partnered with Frax, an existing player in the Bunni ecosystem in order for Liquis to make it easier for Frax to access concentrated liquidity on Uniswap v3[4]. Frax assets have driven close to $30,000 in subsidies to veLIT holders and its a trend Liquis hopes to maintain. [16]

Liquis x Idle DAO

On August 30, 2023, Liquis revealed Idle DAO, an open-source protocol maintainer as a launch partner to commit $10,000 to subsidizing vlLIQ holders and expanding IDLE liquidity onto Uniswap v3. [17]

Liquis x Davos Protocol

On September 1, 2023, Liquis partnered with Davos[19] protocol, a collateralized debt position (CDP) platform with Davos committing to subsidies for vlLIQ holders over the next six months in order to further deepen concentrated DUSD liquidity on Uniswap v3. [18]

Liquis x Inverse Finance

On September 6, 2023, Liquis partnered with Inverse Finance to allow them to experiment with concentrated liquidity for DOLA at minimal cost. Given the ability for concentrated liquidity to facilitate greater trading volumes per dollar of liquidity, Liquis is keen to see Uniswap and Bunni play a complementary role to Inverse’s existing liquidity strategies. [20]

Liquis x Bloom Protocol

On September 14, 2023, Liquis announced Bloom Protocol[22] as a launch partner in order for Bloom's TBY tokens to be traded on secondary DeFi markets like Uniswap v3 prior to their redemption. Given their perceived risk profile and short-term duration, concentrated liquidity that pairs them against cash liquidity, e.g., USDC, provides an efficient avenue for unlocking the use case. [21]

Liquis x Bond Protocol

On October 6, 2023, Liquis announced its initiative to scale Liquis further: a LIQ Bonding Program in partnership with Bond protocol. LIQ is the governance token of Liquis and 2M LIQ is set aside for liquidity bootstrapping efforts. [23]

The LIQ Bonding Program was set to start on October 10, 2023, with the following parameters: 350,000 LIQ for Distribution, Targeting WETH, and a 7-day Vesting Period. The proceeds of the bonding program are to be utilized solely for protocol-owned liquidity, to be held in the Liquis treasury. [23]

Liquis x Hidden Hand

On October 12, 2023, Liquis announced its onboarding on Hidden Hand[25], a governance vote marketplace. Hidden Hand is a governance vote marketplace stewarded by the contributors of Redacted Cartel. It hosts markets for governance power holders in supported projects to allocate their decision-making on emissions gauges to the highest bidders. Hidden Hand supports the governance holders of DeFi heavyweights like Aura and Frax, as well as Bunni. [24]

Liquis Tokens

Bunni Tokens

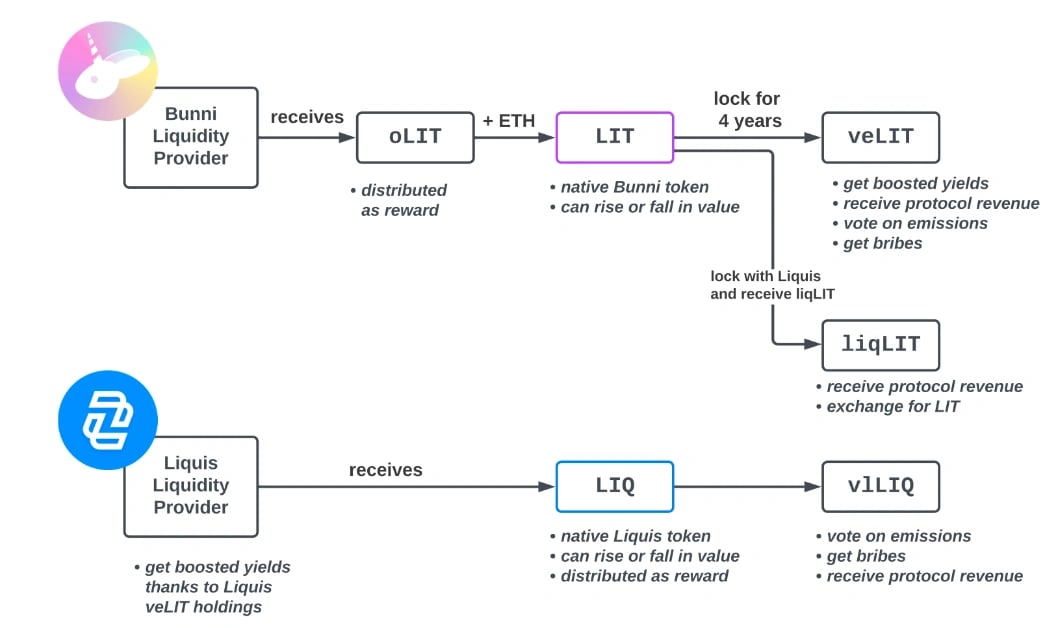

Bunni has 3 tokens: oLIT which is distributed as a liquidity mining reward, LIT which is the native token of Bunni (can be locked for up to 4 years to receive veLIT), and veLIT which is used to boost yields, govern on the Bunni Protocol, and receive protocol fees. [26]

liqLIT (Liquid veLIT)

liqLIT is the liquid governance wrapper for Bunni's veLIT. Users can receive liqLIT in exchange for permanently committing LIT to Liquis, liqLIT can be sold or used as collateral without the need for a locking position. Users can earn yield in the form of protocol revenue. [26]

LIQ & vlLIQ (Vote Locking Liquis Token)

LIQ is the native governance token of Liquis. It has three use cases: to allocate veLIT across Bunni gauge votes, to vote on Timeless Finance governance proposals, and to vote on Liquis Finance governance proposals. [27]

LIQ has a fixed supply of 100,000,000. 50,000,000 are to be emitted on the basis of oLIT earned by protocol liquidity providers and 50,000,000 will be emitted or vested on a fixed schedule. [27]

vlLIQ is used for both allocating Liquis-owned veLIT across Bunni Pro gauges as well as for determining the distribution of future LIQ emissions across its own gauges. Users can lock their LIQ for vlLIQ on the Liquis website. [27]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)