Subscribe to wiki

Share wiki

Bookmark

Bond Protocol

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Bond Protocol

Bond Protocol is a permissionless system that enabled the creation of Olympus Pro-style bond markets for any token pairs. Their mission is to be a credibly neutral permissionless platform that is solely focused on providing Bonds-as-a-Service to meet the needs of the DeFi community. [2]

Overview

Bond Protocol was launched on July 15th, 2022 following the success of Olympus DAO's bond services. Projects leverage Bond Protocol markets to obtain protocol owned liquidity (POL), expand their treasuries, or acquire strategic assets. This allows community members to access their capital requirements in a transparent and equitable manner, receiving vested tokens in exchange. The tokenized bonds and modular architecture offered by Bond Protocol serve as a foundation for sophisticated DeFi systems and applications that rely on auctions or vested token issuance. [5][6][14]

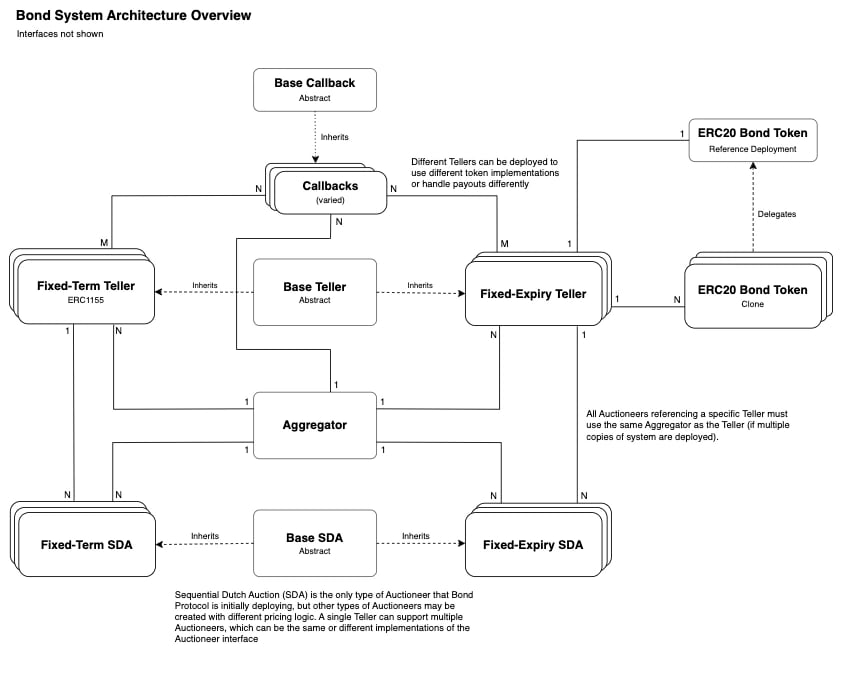

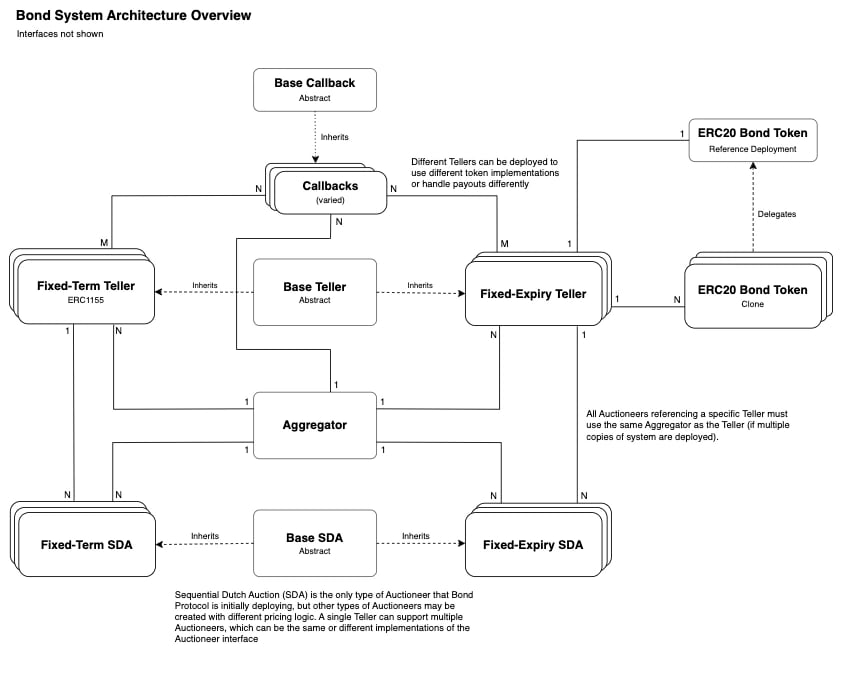

Bond Protocol also utilizes a smart contract architecture that enables the creation of OTC (over-the-counter) markets for ERC-20 token pairs with optional vesting. The protocol operates autonomously, with market contracts storing data and implementing pricing logic. The protocol consists of teller contracts for user transactions, auctioneer contracts for managing markets, and aggregator contracts that enables querying data across both tellers and auctioneers. This architecture provides flexibility and efficiency in OTC token trading with vesting options. [15]

Main Features

Bond Protocol offers innovative features that differentiates themselves from other Bond Protocols such as:

- Permissionless: Anyone can create a bond market to sell Payout Tokens for Quote Tokens

- Composable: Bond purchasers receive Bond Tokens (tokenized bonds) that represent their positions which allow for the creation of secondary markets

- Modular: Unified contract architecture enables easy creation of new bond assets and auction interfaces to be plugged into the system. [2]

Bonding

Bonding

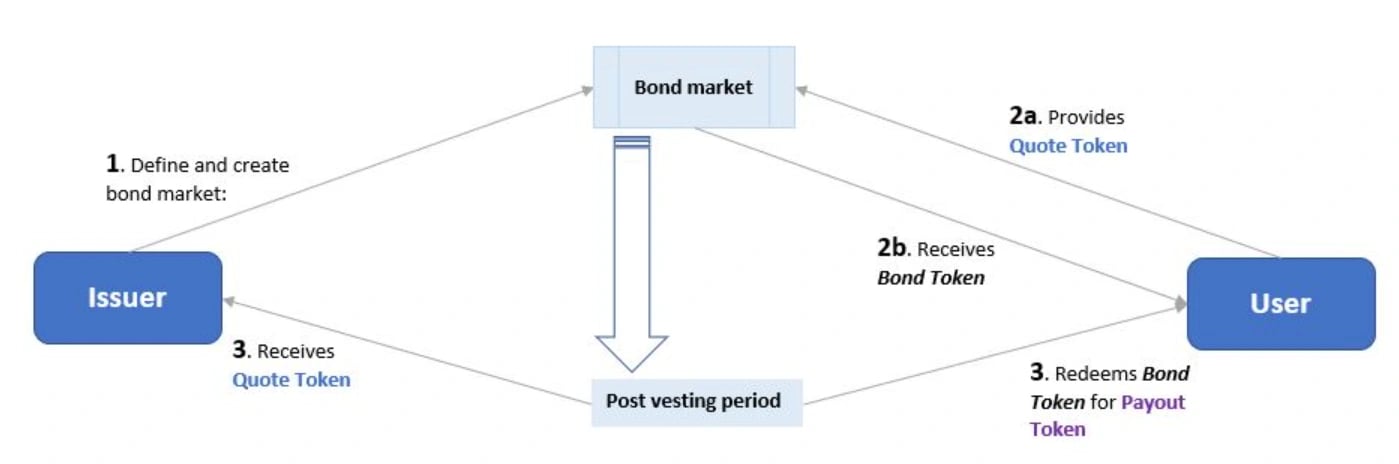

Bonding is a mechanism that enables users to sell an asset, known as the Quote Token, in the bond market to a protocol. In return, they receive discounted Payout Tokens at a future date. This incentivizes users to sell to the protocol rather than the open market. Bonds are offered at a discounted rate, but they come with a vesting period to prevent users from selling all the discounted tokens at once for quick profits. [4][5]

Dynamic Pricing through Continuous Dutch Auction

The pricing of bonds is determined through a continuous Dutch auction, which adjusts based on the supply and demand of bonds. The bond price increases when there is higher demand and decreases when demand is low. This dynamic pricing mechanism provides a real-time reflection of the bond price in the market. The competitive nature of bonding means participants strive to secure the largest discount. [5]

Benefits of Bonding

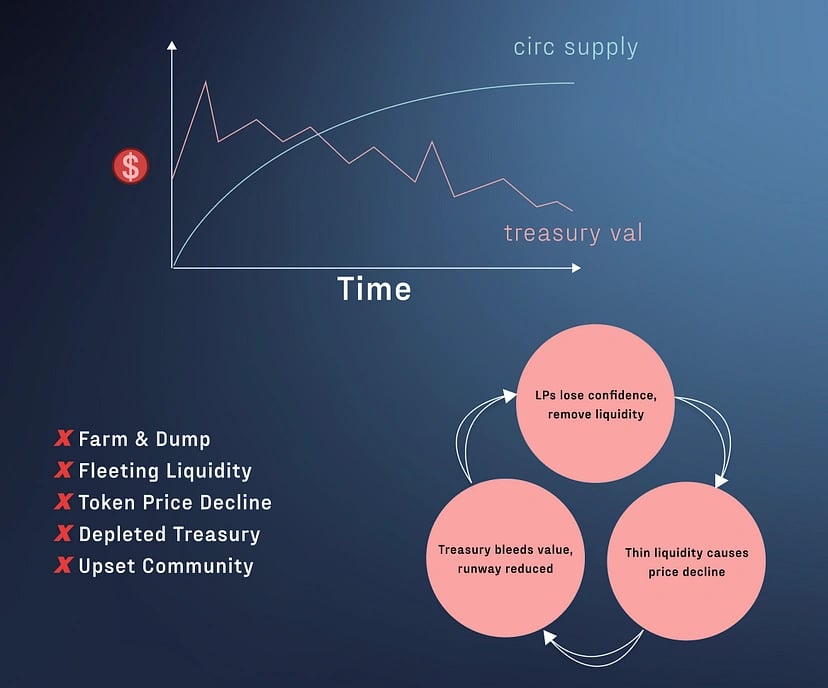

Protocol Owned Liquidity (POL)

Bonding allows protocols to build their own liquidity reserves, known as Protocol Owned Liquidity (POL). Having sufficient depth in POL assures users of consistent liquidity during normal market operations and volatile periods. Without POL, protocols relying solely on external liquidity providers may experience liquidity shortages during market distress, leading to a liquidity death spiral. [6]

Transforming Liquidity into Revenue Source

POL converts liquidity from a liability to a revenue source. Each swap transaction in a pool generates fees for liquidity providers (LPs), typically 0.3% to 0.25% on platforms like Uniswap and Sushiswap. With POL, as liquidity is permanently locked in the protocol's treasury, these fees become a constant revenue stream. [6]

Yield Farming Opportunities

POL opens up opportunities for yield farming. For example, protocols can have their liquidity pairs listed on platforms like Sushiswap and earn rewards in the form of SUSHI tokens. By depositing their SLP tokens into the Onsen menu, protocols can actively participate in yield farming activities. [6]

Bond Market Participants

Issuer

The issuer creates the bond market by defining the Payout Token to be paid out and the Quote Token to receive. [7][8]

User

Users purchase future-dated Payout Tokens with Quote Tokens at the current market price. They receive Bond Tokens representing their positions, which vest over time. Once the vesting period is complete, users can redeem their Bond Tokens for the corresponding Payout Tokens. [7][9]

Types of Bonds

Fixed-Term Bonds

Each position in a fixed-term bond vests after a specific amount of time from the purchase, based on the UTC timestamp. These bonds are tokenized as ERC1155 tokens. [10][11]

Fixed-Expiry Bonds

All purchases in fixed-expiry bonds vest at a specific timestamp. The vesting period for these bonds ranges from a minimum of 3 days to a maximum of 9 months, as presented on the Bond Protocol front-end. These bonds are tokenized as ERC20 tokens. [10][12]

Sequential Dutch Auction

Sequential Dutch Auction is a key mechanism employed by Bond Protocol. In this auction format, the initial price is set at a high value and gradually decreases (decays) until a bid is received. The first bid becomes the "winning" bid, leading to the sale of the bond. Subsequently, a new auction commences with a starting price higher than the previous "winning" bid, which then linearly decays until another bid is placed. This iterative process continues until it reaches the boundaries of the auction. [13]

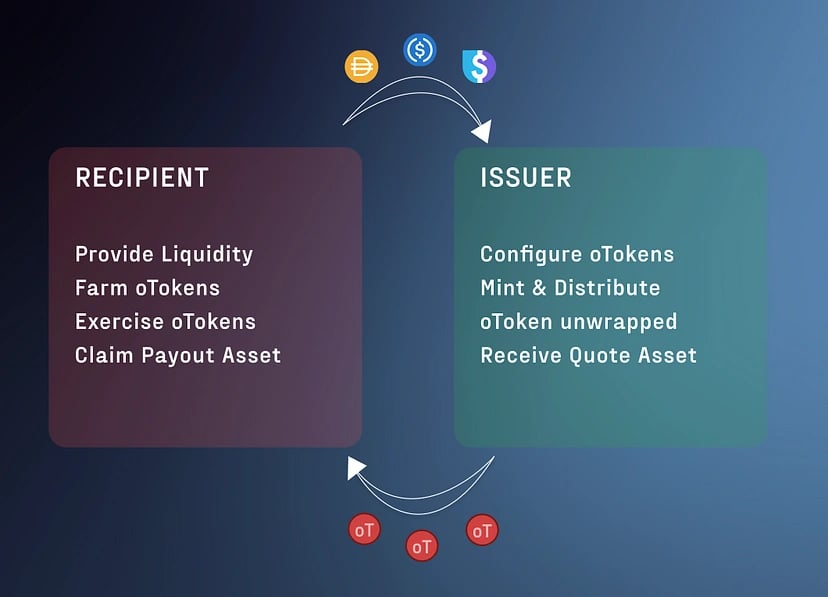

Options Liquidity Mining

Options Liquidity Mining (OLM) is designed to address the drawbacks of traditional liquidity mining incentives in crypto protocols. With OLM, protocols gain the ability to mint and distribute ERC-20 call options called oTokens. These oTokens can be fully customized with various configurations, including quote assets, payout assets, strike price, and the option eligibility window. The goal is to offer flexibility to maximize the effectiveness of emission strategies for different protocols. [16]

It allows assets to be taken in when oTokens are exercised within the eligibility window, preserving capital and curbing mercenary farming. This approach helps prevent thin liquidity, increased slippage, and token price decline, addressing the drawbacks of traditional liquidity mining incentives. OLM also eliminates reliance on oracles, making it accessible to newer protocols and streamlining adoption with ready-to-use contracts for liquidity mining and exercising operations. [16]

The process of OLM involves exercising oTokens within eligible dates at a fixed strike price, resulting in the issuer recouping the quote asset strike price required for exercise while the purchaser receives the upside payout. In the case of expired or unexercised options, the issuer can reclaim the payout collateral without paying out liquid incentive tokens, minimizing the negative impact of farm/dump activities. [16]

OLM Architecture

The OLM architecture within the Bond Protocol consists of Option Tokens, Option Teller, and Option Liquidity Mining Contract. Option Tokens represent instances of option tokens with specified parameters, while Option Teller handles tokenization, exercising, reclaiming, and custody of payout tokens. The Option Liquidity Mining Contract is responsible for the auto-creation of option tokens as rewards for liquidity mining. Overall, OLM empowers protocols to offer a more sustainable and efficient approach to liquidity incentives, ensuring long-term treasury sustainability and user engagement. [16]

Bond Issuers

As of February 2023, Bond Protocol has seen over $24,000,000 Total Bonded Value as of writing along with over 1000 bonds. [3] Issuers include:

Partners

DAOversified

On October 2, 2023, the Bond Protocol team introduced DAOversified, a podcast program "where builders lay out the blueprint for success in the decentralized world" [17]

The inaugural episode featured Matt from SMG (@specialmech) starting with the foundation for all DAOs — Treasury Management, Operations, and Governance.[18][17]

The podcast is also covered on Spotify[20] and Apple podcasts[21], and transcribed on Medium[19]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)