Subscribe to wiki

Share wiki

Bookmark

OpenWorld Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

OpenWorld Finance

OpenWorld Finance is an automated protocol on Arbitrum that aims to improve liquidity pool investments by actively managing and diversifying positions. Its goal is to optimize returns for liquidity providers without requiring custody of their assets. [1][8]

Overview

OpenWorld is an automated protocol on Arbitrum designed to enhance liquidity pool investments through active management, diversification, and leveraging, aiming to optimize returns for liquidity providers. LP staking on Layer 2 chains like Arbitrum presents an opportunity in DeFi, though it involves impermanent loss, smart contract vulnerabilities, and liquidity risks. OpenWorld mitigates these risks with automation tools and offers leverage for activities like leveraged farming. [1]

The LP market has grown significantly, driven by platforms like Uniswap and Sushiswap, which continue to attract high trading volumes and TVL. Emerging next-gen AMMs and DEXs on Layer-1 and Layer-2 networks further expand investment possibilities. However, navigating LP investments requires expertise due to risks like price volatility and illiquidity, compounded by high gas costs on Ethereum. OpenWorld provides a comprehensive solution to simplify LP investing, automate strategies, and enhance efficiency in managing these complexities. [1]

Products

Leveraged Yield Farming

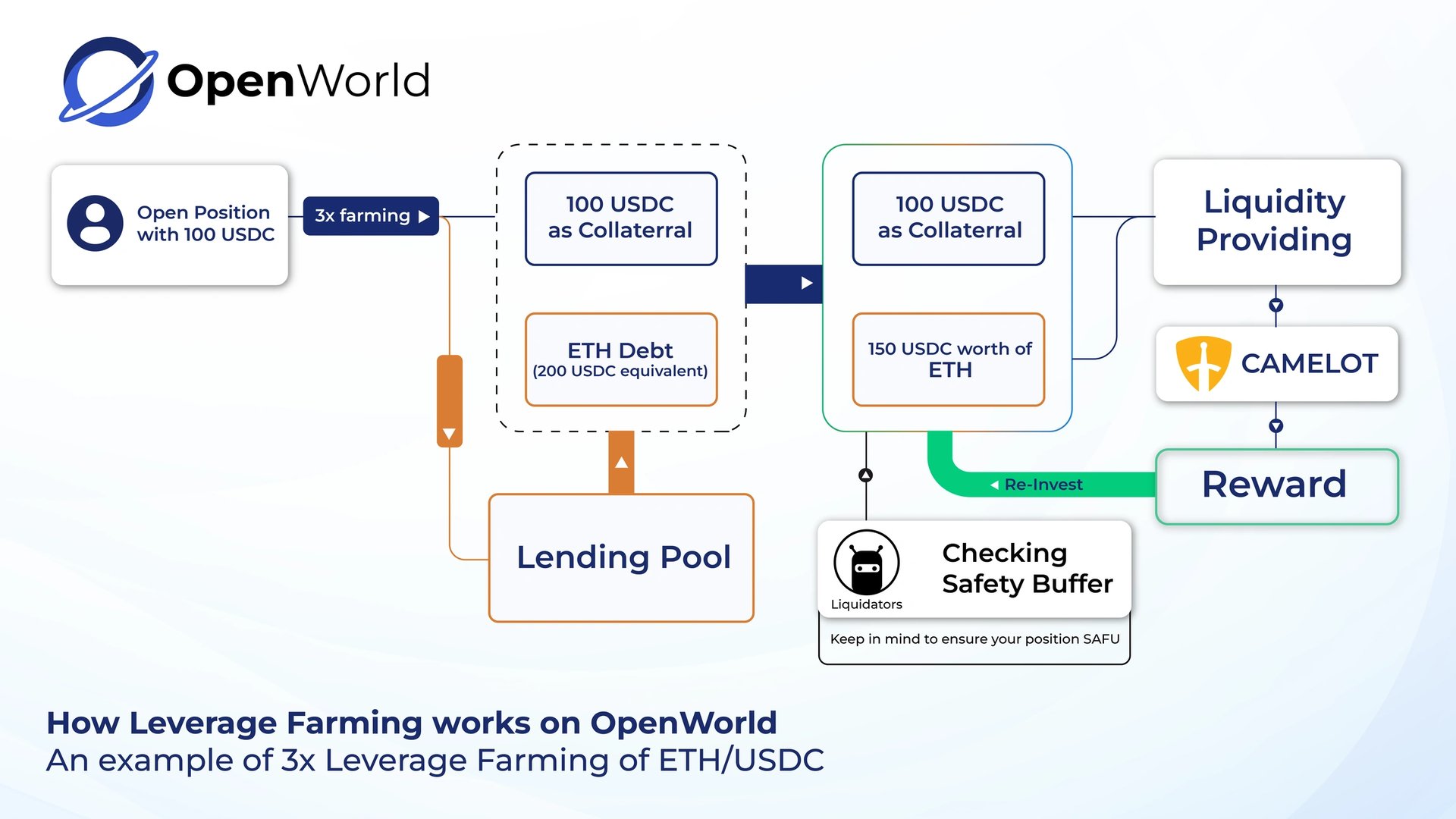

Leveraged Yield Farming (LYF) allows users to increase their investment returns by borrowing funds against existing collateral to acquire additional tokens for liquidity pools. This method aims to boost the pool's total value, potentially increasing user returns and exposing them to higher potential losses. [4]

LYF efficiently maximizes capital without extra collateral, leveraging existing assets for higher earnings. OpenWorld offers various strategies tailored to risk levels and market conditions to reduce impermanent loss impacts and optimize returns. These capabilities draw inspiration from platforms like Extra Finance. Additionally, OpenWorld supports strategies such as reinvesting trading fees and farming rewards, adjusting liquidity positions by unstaking and restaking to maintain optimal ranges, and implementing continuous auto-compounding to enhance overall returns. These features are designed to help users optimize investments and increase profitability in DeFi. [4]

Lending Platform

OpenWorld allows users to lend assets such as ETH or USDC and earn an Annual Percentage Yield (APY). It uses specific interest rate models tailored to different assets and yield farming pools, offering customized lending and borrowing experiences. Influenced by Aave and Alpaca Finance, the lending platform will support LP-related products and the broader OpenWorld ecosystem in future development stages. [5]

OPEN

$OPEN is the primary utility token for OpenWorld and its native currency. It has a total supply of 100,000,000 OPEN with 30% of the total supply allocated to Product Incentives/Investments, 15% to Ecosystem Developments, 20% to Team & Advisors, 10% to Security Fund, 10% to Future equity financing rounds and 5% each to Liquidity provisions, Reserve funds, and Lending. [8]

Staked OPEN Mechanism

The Staked OPEN Mechanism fosters a long-term connection between OPEN token holders and OpenWorld Finance. It allows holders to stake their OPEN tokens in exchange for ibOPEN tokens, which offer rewards based on the duration of the lock period and the demand for staking. [8]

Interest-Bearing-OPEN (ibOPEN)

This is a transferable NFT that represents the Time Factor and Demand Factor of a staking position. ibOPEN is created when a user stakes OPEN with a selected staking duration in weeks and a specified number of OPEN tokens. The system calculates the amount of ibOPEN the user will receive based on the published parameters. Upon confirmation, an NFT corresponding to the position is created. Unlike traditional locked token models, such as vote escrowing (vetoken), ibOPEN is transferable. [8]

Partnerships

HYVE

On July 14th, 2022, OpenWorld partnered with the HYVE platform. As a result, the $OPEN token from OpenWorld was integrated into the Binance Smart Chain (BSC), becoming one of the preferred payment methods for tasks, jobs, and offers on the HYVE platform. [6]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)