订阅 wiki

Share wiki

Bookmark

Particle Trade

Particle Trade

Particle 是一个平台,托管流动性再质押协议,通过其杠杆自动做市商 (LAMM) 促进无需许可的杠杆交易和利率互换。 [1]

概述

Particle的LAMM是一种无需许可的协议,旨在交易具有杠杆的ERC-20代币,类似于Uniswap普及AMM交易任何代币的方式。它确保流动性提供者(LP)获得更高的收益,而与传统的AMM(如Uniswap v3)相比,无常损失没有增加。流动性提供给LAMM最初支持在AMM中进行交换。当借用来进行杠杆交易时,这种流动性继续获得收益,就像仍然用于交换一样,并通过流动性重新质押获得头寸费用。借来的流动性在回收之前最多锁定3天。[2]

LAMM的运作不依赖于价格预言机,保证LP头寸在每次杠杆头寸中都以数学方式完整。这消除了与价格预言机操纵相关的风险。与具有基于价格的清算机制的协议不同,LAMM采用类似于固定期限借款的溢价模型,即使在不利的价格变动期间也能降低清算的可能性。此外,LAMM通过直接从标的资产的价格变动中获得损益来最大限度地降低交易对手风险,确保即使在动荡的市场条件下也能获得潜在的积极回报。[2]

功能特性

未平仓头寸

LAMM上的杠杆交易允许交易者使用其配对代币做多或做空ERC-20代币,这取决于可用的流动性。杠杆水平受每种代币对的流动性深度限制。开设杠杆头寸需要支付抵押品和溢价。如果价格不利变动,抵押品代表最大潜在损失。溢价涵盖利息累积,任何超额部分在平仓时退还。3

每个杠杆头寸都会产生三项费用:开仓掉期费、开仓费和平仓掉期费。这些费用补偿底层AMM的流动性提供者(LP),并从抵押品中扣除,计入损益计算。溢价相当于抵押品的2%,预先支付,利息根据底层AMM的掉期活动累积。前端显示每小时借款利率,反映了这种利息累积。当累积的利息超过溢价时,就会发生清算。3

平仓

前端根据入场价格、当前价格、杠杆率、累计利息和费用等因素提供模拟的盈亏(PnL)计算。然而,由于价格影响,平仓时的实际盈亏可能略有不同,这些影响受到滑点保护。 [4]

由于AMM的数学特性,准确跟踪掉期后的价格点可能具有挑战性。因此,当平仓时,可能会留下少量头寸代币(例如,如果交易者使用USDC做多WETH,则为WETH)。该剩余部分在平仓时会返回到交易者的钱包。随后,交易者可以将其转换回源代币。 [4]

清算

LAMM协议采用类似于定期借贷的溢价模式。如果头寸的累计利息超过预付溢价,或者在流动性提供者(LP)回收流动性后头寸达到3天,则会发生清算。在满足这些条件之前,头寸不受不利代币价格波动的影响。 [5]

利息累积率与底层AMM对齐。前端提供一个清算页面,列出所有可清算或即将清算的头寸。任何人都可以充当任何此类头寸的清算人,并获得该头寸溢价的5%作为奖励。 [5]

清算后,流动性提供者(LP)会收回借入的流动性以及借款期间累积的交易费用。借款人将收到清算事件价格实现的损益(PnL),并减去清算奖励进行调整。 [5]

Duo Exchange

Duo Exchange是一个收益互换协议,LP可以通过它来增加他们的空投积分或收益。一个中央金库合约整合了所有LP的流动性,并根据每个LP选择的偏好来分配积分或收益。对于每个LP存入Duo Exchange的原生ETH、WETH或USDB,都会铸造等量的Duo Restaking Tokens (DRTs),如DETH或DUSD。这些DRT可以用于各种协议,例如在借贷平台中作为抵押品、货币互换或杠杆交易活动。提款时,LP必须确保他们的钱包中有等量的DRT,才能以1:1的比例赎回原始本金。 [6][7]

积分-收益互换

Duo Exchange上的积分-收益互换允许LP在提升积分或提升收益之间进行选择。两种流动性流都包含在单个保险库合约中。保险库中有两种类型的流动性提供:LP1和LP2。LP1提供流动性以获得提升的积分,但放弃收益,而LP2提供流动性以获得提升的收益,但放弃积分。[8]

LP1享有更高的积分率,因为LP1和LP2的本金专门为LP1生成积分。相反,LP2获得更高的收益率,因为LP1和LP2的本金专门为LP2生成收益。[8]

浮动-固定收益互换

Duo Exchange上的浮动-固定收益互换允许LP选择固定利率收益直到到期,或者选择可能高于收益来源的浮动收益。两种选择都包含在一个Vault合约中,以适应两种流动性流向。 [9]

- 流动性流向:Duo Exchange上的vault促进了两种流动性提供方法:LP1和LP2。LP1锁定流动性以赚取固定收益率直到到期,而LP2选择浮动利率,通常会随着时间的推移超过来源利率。LP2受益于可能更高的利率,因为LP1以较低的固定利率从来源锁定。 LP1赚取的任何超额收益都会被导向LP2。此外,开设LP1头寸会产生支付给LP2的头寸费用。 [9]

- 固定利率收益:在收益波动的环境中,预先锁定特定收益变得有利。可用于锁定的利率由市场条件决定,使LP1能够有效地以折扣价购买资产并在到期时获得完全访问权限。LP1可以在到期前退出,但不会收到全部收益。 vault处理任何未到期的部分,剩余收益在所有LP2之间分配。 [9]

- 浮动利率收益:LP2受益于随着时间推移趋势高于收益来源的浮动收益。这种优势的出现是因为LP1和LP2都有助于产生收益。LP1锁定总收益的一小部分(选择低于瞬时估计的收益),为LP2留下更多收益。此外,LP2从LP1赚取头寸费用。LP2保留随时退出的灵活性,并获得与其相对于一段时间内LP2本金总额的本金成比例的收益和头寸费用。 [9]

PTC Token

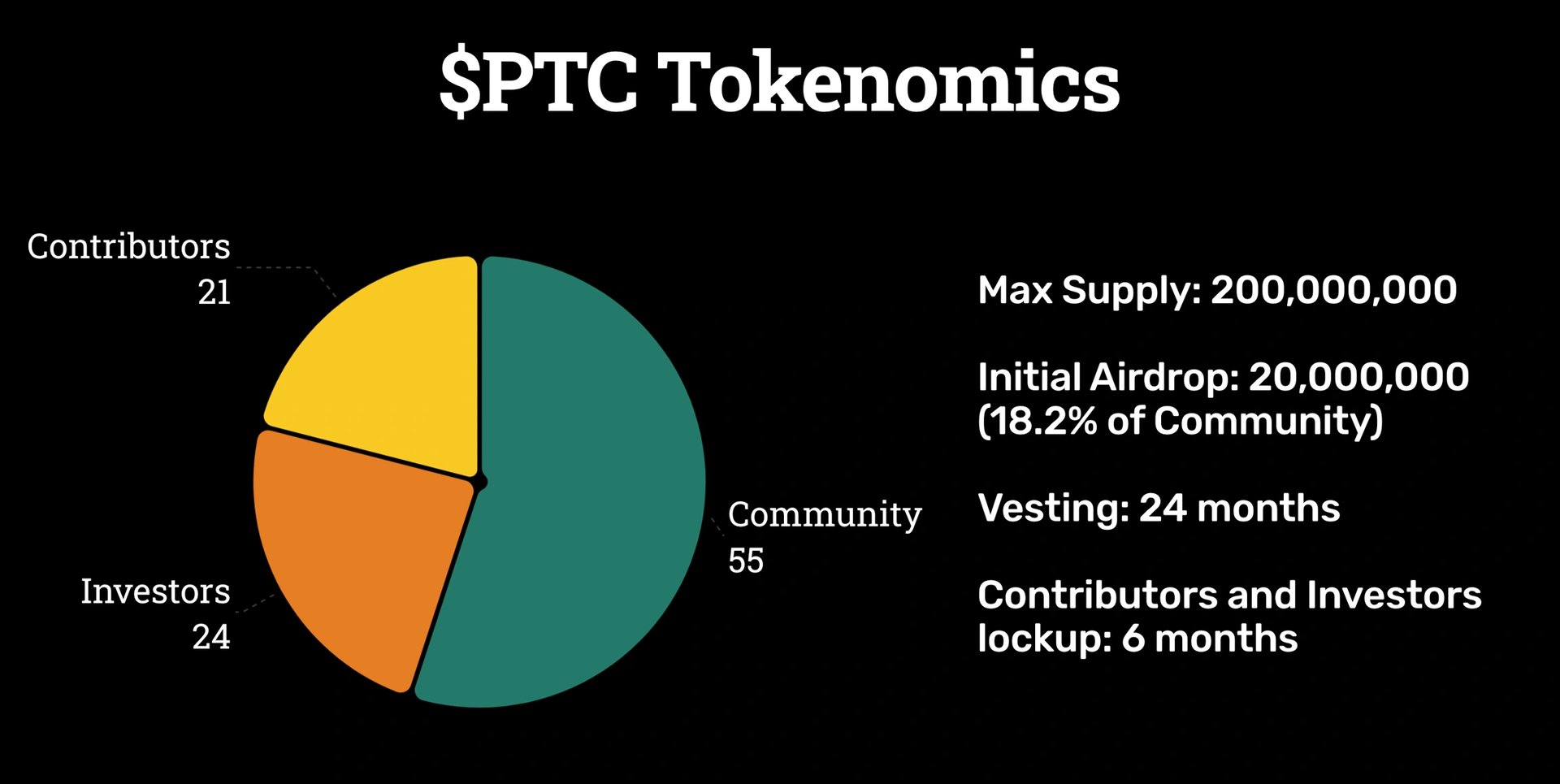

- 社区:55%

- 投资者:24%

- 贡献者:21%

合作关系

投资者

2024年1月,Particle完成了一轮由Polychain Capital领投的种子轮融资,以促进无需许可的杠杆交易。Nascent、Inflection、Neon DAO、Naveen Jain、Arthur Hayes、DCF God、Sam Williams、Kalos、Richard Ma、Palmer、vxCozy以及其他众多合作伙伴也为这一旅程提供了支持。[11]

Blast

2024年1月17日,Particle Labs宣布Particle将构建在 Blast 区块链 上,并参与 Blast 的大爆炸竞赛,以赢得开发者 空投,该空投将进入其社区基金。

发现错误了吗?