Subscribe to wiki

Share wiki

Bookmark

VEILON

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

VEILON

VEILON is a cross-chain privacy infrastructure protocol and wallet designed to enable confidential, secure, and auditable transactions across various on-chain ecosystems. It aims to function as a privacy layer for decentralized finance (DeFi) and other Web3 activities by utilizing zero-knowledge cryptography. [1] [2] [3]

Overview

Established in July 2025, VEILON was developed to address the inherent lack of privacy on public blockchains, where transaction histories and wallet balances are typically transparent and traceable. The protocol's objective is to provide users with the tools to conduct on-chain activities, such as asset transfers and swaps, without publicly exposing their financial data. It functions as a privacy layer that allows users to maintain confidentiality while their transactions remain verifiable on-chain. The system is designed to operate directly on existing mainnets, which mitigates the risks associated with bridging assets to a separate, dedicated privacy chain. [1] [2]

The core principles of the project are decentralization, security, and scalability. VEILON is structured as a community-driven and autonomous protocol governed by a Decentralized Autonomous Organization (DAO). This model means there is no central corporate ownership, and the protocol is maintained by a global community of contributors. The platform's architecture is built to support both EVM-compatible networks like Ethereum and non-EVM chains such as Bitcoin and Solana, positioning it as a multi-chain privacy solution. It also incorporates optional auditability tools, allowing for selective transparency to meet compliance or reporting needs. [1] [3]

Products

Veilon Wallet

The Veilon Wallet is a privacy-first, cross-chain crypto wallet designed for everyday use. It allows users to send tokens, receive private payments, and interact with dApps while maintaining confidentiality.

- Privacy by Design: The wallet utilizes stealth addresses for private fund reception, shielded transactions to keep transfers off the public chain, and stores transaction history locally rather than broadcasting it.

- Multi-Chain Support: The wallet has native support for Ethereum, Solana, and Bitcoin, with plans to add more networks.

- User Experience: It features a minimal interface with one-tap actions for shielding or transferring assets, QR code support for private payments, and a built-in contact book with shielded aliases. A "Privacy Score" feature is also planned.

- Compliance Tools: For DAOs, institutions, or users needing to report activity, the wallet includes optional view keys and compliance export functions. [4]

Veilon DEX

The Veilon DEX is a decentralized exchange built to protect a trader's identity, strategy, and transaction data. It enables users to swap tokens without linking their public wallet, exposing their actions in the mempool, or being vulnerable to front-running bots. The process works in four main steps:

- Shield Assets: Users move tokens from a public wallet into Veilon’s shielded pool, which hides the balance and identity.

- Initiate Swap: Within the wallet or via the SDK, the user selects the tokens to swap and generates a zero-knowledge proof of their intent.

- Relayer Submission: An encrypted version of the swap is submitted to the blockchain by a relayer, which conceals the user's wallet and IP address.

- Private Execution: The trade is executed, and the user's shielded balance is updated privately, leaving no public trace of the transaction flow. [5]

Veilon Trading Bot

The Veilon Trading Bot is a stealth trading engine integrated into the Veilon Wallet that allows users to buy newly listed tokens, such as meme coins or low-cap assets, at launch without revealing their strategy or identity. The execution flow is as follows:

- Define Strategy: The user sets up sniper rules inside the wallet, specifying the target token address, maximum buy amount, and slippage/gas settings.

- Generate ZK Intent: A zero-knowledge proof is generated on the user's device, which validates the trade's parameters without revealing them. This encrypts and seals the strategy.

- Relayer Detection: Sniper-aware relayers monitor mempools and on-chain events on DEXs like Uniswap or Raydium. When the user's predefined conditions are met, the sniper is triggered.

- Private Execution: A relayer executes the trade on-chain, paying gas on the user's behalf. The transaction is routed through the private DEX, ensuring the user's wallet address never appears in the mempool. [6]

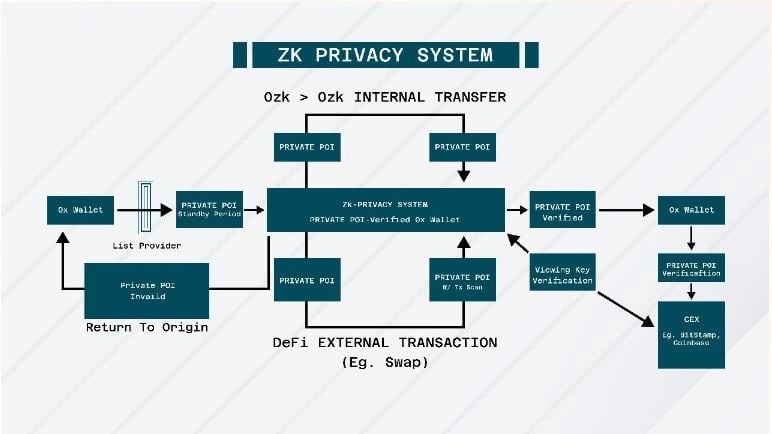

Proof of Innocence (POI)

The Proof of Innocence (POI) feature is a compliance tool that allows users to prove their funds are not from illicit sources without compromising their privacy. It is a zero-knowledge proof demonstrating that a user's shielded funds do not originate from any known blacklisted or suspicious addresses. [9]The system works by maintaining an updated list of blacklisted addresses. When a user needs to prove the origin of their funds, such as when unshielding to a centralized exchange, they can generate a ZK proof. This proof confirms their funds are not from a blacklisted source without revealing their wallet address, transaction history, or balances. The proof is verifiable both on-chain and off-chain. This allows users to interact with regulated platforms while maintaining their identity and financial privacy. [9]

DAO Governance

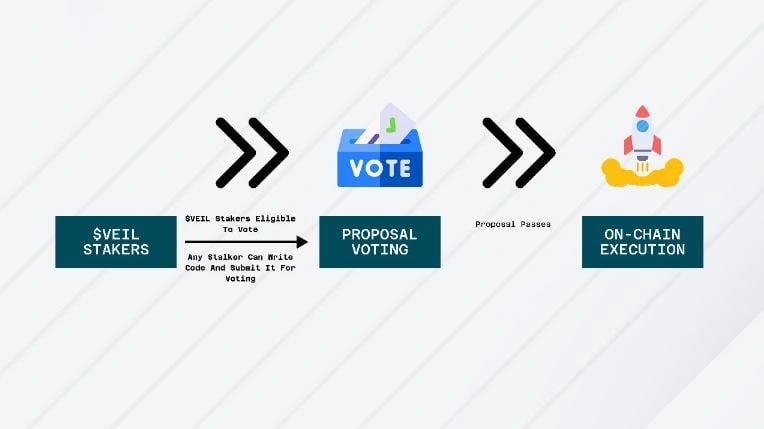

The VEILON protocol is governed by a decentralized autonomous organization (DAO), allowing the community to direct its evolution. Key decisions, such as protocol upgrades, fee adjustments, and new chain integrations, are made through on-chain governance. [10]

- Participation: To participate in governance, users must stake the native VEILON token. This requirement ensures that voters have a vested interest in the protocol's long-term success.

- Voting Process: The governance process includes proposal creation by any user with a minimum stake, a voting period, and an execution timelock for passed proposals to allow for community review before implementation.

- Private Voting: The governance model supports shielded voting, which allows participants to vote on proposals without publicly linking their wallet addresses to their decisions.

- Token Utility: Beyond governance, the native token is used for paying protocol fees, accessing certain compliance features, and rewarding ecosystem contributors like relayers and DAO participants. [10]

Use Cases

- Executing confidential transactions and shielding everyday wallet activity from public view.

- Engaging in private DeFi activities, including swapping, lending, and earning, without exposing trading strategies.

- Protecting DeFi traders from front-running bots by obscuring transaction details.

- Integrating privacy features directly into new or existing dApps using the developer toolkit.

- Providing auditors or regulators with view-only access for compliance purposes without full disclosure.[1] [3]

Revenue Generation

VEILON generates revenue through a series of protocol fees collected from its various services. These fees are directed to the DAO treasury, which funds ongoing development, rewards ecosystem contributors, and supports the overall growth of the protocol.

Treasury Growth and DAO Revenue Flow

All protocol revenues, including those from fees, relayers, snipers, and APIs, are routed to the Veilon DAO Treasury. The DAO governs the allocation of these funds, which are used for token buybacks, community grants, liquidity provider incentives, and developer rewards. This model is designed to ensure the protocol remains decentralized and self-sustaining through community-led reinvestment. [12]

Shielding and Unshielding Fees

A small protocol fee is collected each time a user shields assets into the private system or unshields them back to a public chain. This fee is transparent, non-custodial, and can be configured by the DAO. The revenue generated from these fees is routed directly to the Veilon DAO treasury to support the ecosystem. [13]

Private DEX Swap Fees

The Veilon Private DEX charges a minimal swap fee for every private token swap executed through its shielded router. This fee serves as a primary revenue source for the protocol. The collected revenue is directed to the treasury and can also be used to provide optional rewards to relayers who facilitate the transactions. Fees may be split between the treasury, relayers, and liquidity incentives. [14]

Private Sniper Execution Fees

A premium execution fee is applied to trades made using the Veilon Sniper tool, which allows traders to anonymously acquire newly listed tokens. This fee is set by the DAO as either a percentage or a fixed gas equivalent and compensates for the custom routing, monitoring, and relayer overhead required. This revenue stream is tied to time-sensitive activities from high-volume users and contributes to the DAO treasury. [15]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)