订阅 wiki

Share wiki

Bookmark

Plume

0%

Plume

Plume 是一个公共的、与 EVM 兼容的 区块链,它经过优化,可将 现实世界资产 (RWA) 集成和代币化到数字经济中,从而使它们更易于访问、更具流动性和效率。 [8]

概述

Plume 是一个公共的、与 EVM 兼容的 区块链,旨在支持将 现实世界资产 (RWAs) 集成到 去中心化金融 中。它专注于具有实际需求的资产,特别是那些产生收益并提供透明度和稳定性的资产。

该平台允许对房地产、商品和收入流等资产进行代币化,使其能够以数字方式用于交易、融资或 抵押。Plume 使用垂直集成的技术堆栈来增强这些资产的流动性和可访问性。

它还整合了合规性、透明度和互操作性的工具,以促进与现有金融法规的协调。通过这样做,Plume 旨在将传统金融与基于 区块链 的系统连接起来,并支持更广泛的投资机会。 [1]

技术

Plume Chain

Plume Chain是一个模块化区块链基础设施,专为现实世界资产(RWA)的代币化和管理提供安全性和可扩展性。其架构围绕三个主要组件构建:Arc、智能钱包和Nexus,每个组件都支持资产代币化、合规性和数据集成等不同方面。

Arc充当Plume的代币化引擎,支持物理和数字资产的上线和管理。它集成了合规性和数据系统,以保持监管一致性和资产准确性。这种设置允许发行人高效地代币化资产,同时纳入自动合规性检查。

智能钱包提供嵌入式托管和合规性功能,使用户能够在去中心化金融(DeFi)应用程序中与RWA进行交互。这些钱包支持生息工具和可定制的资产控制,有助于为原本静态的RWA持有解锁可组合性和金融功能。

Nexus是一个数据集成层,可将链下信息引入区块链。连接到外部来源可在DeFi应用程序(如借贷协议和预测市场)中实现实时数据使用。这提高了代币化资产在各种金融用例中的相关性和效用。[2]

特点

Plume为代币化和管理现实世界资产(RWA)提供基础设施,重点关注合规性、流动性和数据集成。内置的监管工具,由外部合规合作伙伴支持,有助于确保所有代币化资产交易符合法律标准。这简化了入门流程,并使用户能够以更少的监管摩擦参与RWA相关的金融活动。

Plume与去中心化金融(DeFi)协议集成,以支持交易和流动性,并提供诸如质押和收益耕作等功能。这些工具通过减少滑点和提高资产稳定性来增强市场参与度。通过促进代币化资产的流动性,Plume旨在使它们在更广泛的金融系统中更易于访问和使用。

数据访问通过Nexus处理,Nexus将链下信息连接到链上应用程序。这种集成允许用户使用当前数据实时决策,用于代币化资产的借贷、交易和估值。通过结合合规性、流动性和数据功能,Plume提供了一个统一的工具包,用于安全有效地参与RWA。 [3]

Arc

Arc 是 Plume 即将推出的全栈代币化引擎,旨在实现代币化现实世界资产 (RWA)的创建和管理。计划于 2025 年第一季度发布,Arc 将在 MIT 许可下开源且免费使用。虽然仍在开发中,但开发人员将能够自行托管它。有兴趣提前访问的发行人可以加入等候名单。

Arc 围绕模块化应用商店模型构建,允许发行人根据资产类型和监管需求定制代币化流程。可用模块涵盖各种功能,包括遵守美国证券法、KYC(了解您的交易对手)验证和 AML(反洗钱) 监控。它还支持链上入口和出口的基础设施,使用户能够将美元收益带到链上或从链上销售中兑现收益。

其他模块允许首次发行、二级交易以及与另类交易系统 (ATS) 的集成,从而扩大代币化资产在受监管市场中的覆盖范围。该平台旨在不断发展,定期添加新的应用程序和工具。开发人员或服务提供商可以为应用程序生态系统做出贡献,以支持 Arc 框架内更广泛的用例。 [4]

Nexus

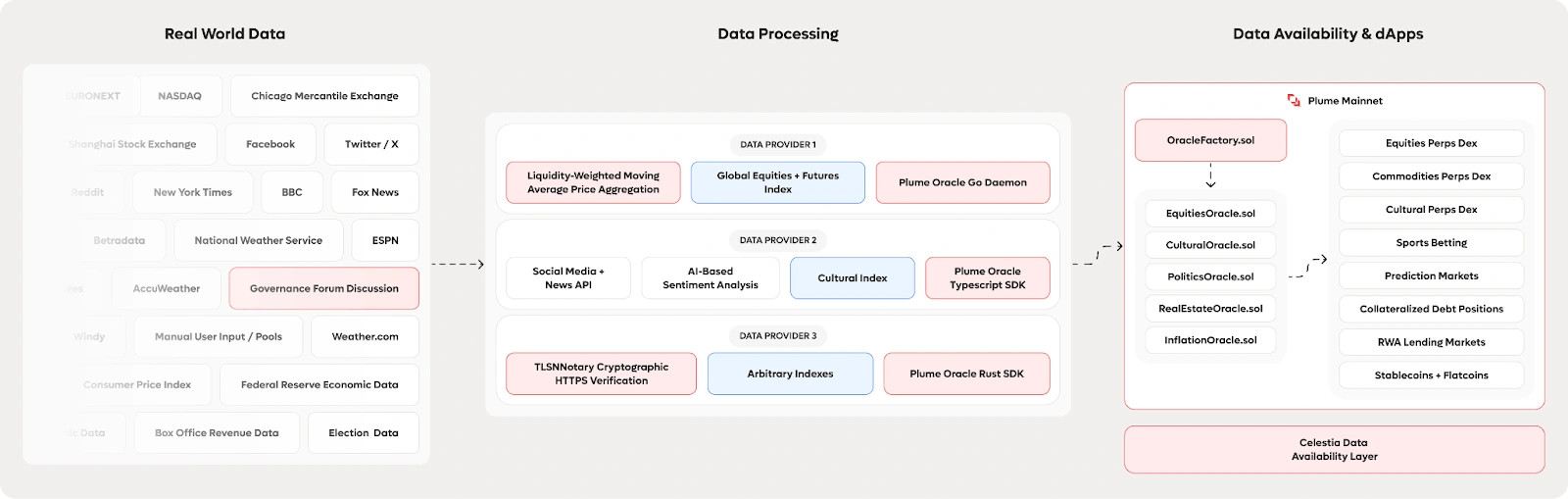

Plume Nexus 是一个区块链集成的数据基础设施,旨在提高现实世界数据上链的效率和可靠性。 Nexus 的实时数据集成能力解决了传统问题,如延迟和有限的数据可用性。 Nexus 与多个 预言机 提供商合作开发,支持将各种数据类型(从环境到经济指标)引入 Plume 区块链,从而支持超越简单资产代币化的用例。

该系统包括一个完整的开发者工具包,例如库、智能合约和容器化服务,以简化链上数据的发布和访问过程。 一个关键特性是其数据优先级交易模型,该模型为及时的数据更新预留了 区块 空间。 这种方法确保即使在高网络活动期间也能处理关键信息,同时通过在必要时将未使用的空间重新分配给其他交易来保持效率。

在 SEDA、Stork、Supra 等合作伙伴的支持下,Nexus 依靠 预言机 网络来提供准确且经过验证的数据流。 这些集成增强了依赖外部数据的链上应用程序的可靠性,使 Plume Nexus 成为需要连续、真实世界信息的去中心化系统的基础组件。 [5]

Passport

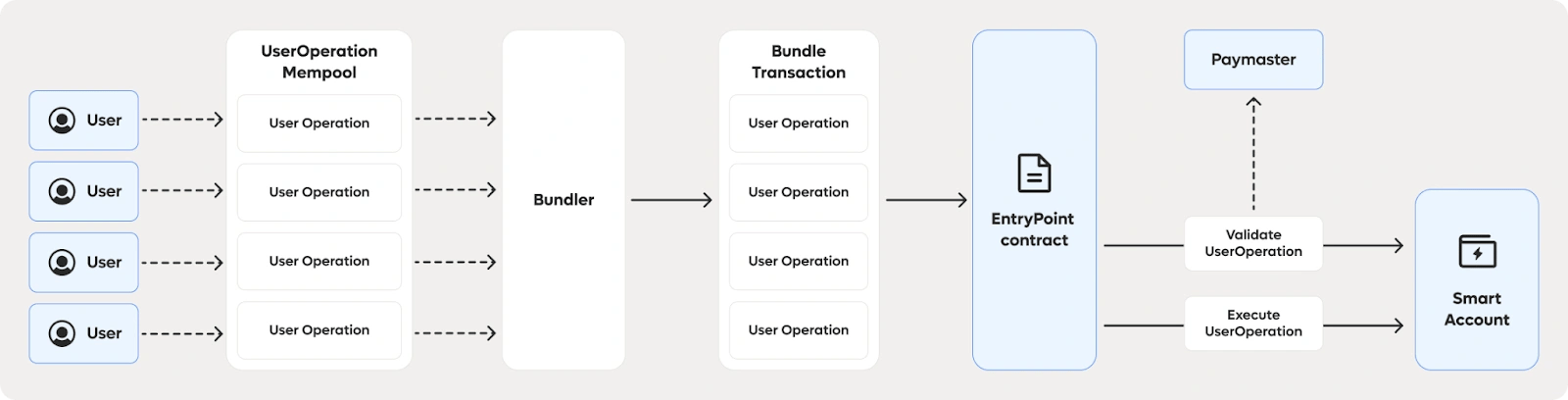

Plume Passport 推出了一款智能钱包,旨在使现实世界资产 (RWA)在 DeFi 中像原生加密货币资产一样可组合和实用。传统的 RWA 持有通常是静态和孤立的,因为存在合规性和托管障碍,限制了它们的可用性。Plume 通过将托管和监管合规性直接嵌入到钱包基础设施中来解决这个问题,无需外部提供商,同时简化用户体验。这种方法将 RWA 转变为可用的、产生收益的资产,可以参与 质押、抵押,以及更多跨 DeFi 活动。

智能钱包专门用于管理 RWA 的独特需求,这些资产从房地产或基础设施项目等现实世界来源产生收益。Plume 的钱包没有依赖外部合约或服务提供商,而是使用修改后的 Ethereum 客户端来集成基本功能,例如自动化工作流程、无 Gas 交易和批量操作。这种设置让用户可以完全控制钱包扩展和 DeFi 交互,而不会影响安全性或合规性。 [6]

Plume USD (pUSD)

Plume USD (pUSD) 是 Plume 区块链 的原生稳定币,旨在促进现实世界资产金融 (RWAfi) 生态系统中的交易和金融运作。它是 Plume 链上应用程序中的支付、交易和抵押媒介。它完全由流动资产支持,并支持与代币化现实世界资产的安全高效交互。

该稳定币与美元 1:1 挂钩,并由 USDC 和 USDT 等已建立的稳定币储备支持,旨在确保流动性和价格稳定。Plume USD 跨各种基于 Plume 的应用程序集成,支持现实世界资产的收益生成、借贷、交易以及访问去中心化金融协议等用例。

用户可以通过桥接来自 Ethereum 或其他支持网络的资产并存入稳定币来铸造 Plume USD。此过程允许轻松发行和赎回,并能够根据需要将 Plume USD 换回存入的稳定币。 [7]

合作伙伴

- Aconomy

- M^0

- Pond

- Goldfinch

- Moca Network

- 0G

- Ocean Finance

- Mercado Bitcoin

- Superstate

- Symbiotic

- Uniblock

- Mimo

- Qiro

- Royco

- PinLink

- Predicate

- Busha

- DigiFT

- RNDM

- Chronicle

- PARQ Street

SEC注册为转账代理人

2025年10月6日,Plume Network宣布已在美国证券交易委员会(SEC)注册为转账代理人。

此注册允许他们维护代币化证券的所有权记录,标志着在连接传统金融与DeFi以及增强其管理现实世界资产的基础设施方面迈出了重要一步。 [11]

这加速了我们使万亿美元的美国证券市场上链的使命。这是我们与SEC合作构建完全合规的代币化资本市场的第一步。 - 团队发推文说 [12]

联合创始人Eugene Shen去世

2025年5月29日,Plume Network宣布其联合创始人兼首席技术官Eugene Shen去世。

该消息通过该网络的官方X账号发布,但未透露死因,仅表示事发突然。团队表达了哀悼,声明:

“我们感到震惊。Eugene才华横溢,求知欲强,为他所做的一切带来了如此多的天赋和热情。我们向他的家人和亲人表示慰问。” [9]

Shen在塑造专注于现实世界资产代币化的区块链平台Plume Network方面发挥了关键作用。在他的技术领导下,该网络取得了重大里程碑,包括筹集了3000万美元的资金,并吸引了超过180个项目加入其生态系统。Plume Network还获得了币安的YZi Labs和Apollo Global等主要公司的支持。

在加入Plume之前,Shen曾在Robinhood和dYdX担任高级工程职位,为交易基础设施和区块链可扩展性解决方案的开发做出了贡献。 [10]

在Shen去世的消息公布后,Plume代币价格迅速下跌,一小时内跌幅超过10%。交易量激增46%,达到近3550万美元,交易员对此消息做出了反应。该代币的价格在约80分钟内从0.157美元跌至0.143美元,反映了市场对该项目关键人物意外去世的反应。 [10]

发现错误了吗?