订阅 wiki

Share wiki

Bookmark

Ponder

0%

Ponder

Ponder 是一个 加密货币 比较工具,它聚合和分析 Web3 的选项,包括桥接、借贷、质押、链上入口、链下出口、NFT 市场等等。它通过 智能合约 和 API 与各种平台集成,允许用户在一个界面内比较服务和执行交易。[1]

概述

Ponder 是一款比较工具,旨在简化日益复杂的 Web3 生态系统。随着 区块链 技术的扩展,用户在浏览桥接提供商、DeFi 协议、NFT 市场和其他 去中心化应用程序 时面临挑战。Ponder 通过聚合和分析来自各种平台的数据来解决这个问题,提供清晰的比较,以帮助用户做出明智的决策。它的界面优先考虑易用性,允许用户与多个 Web3 服务进行交互,而无需手动搜索不同的平台。

Ponder 受 Web2 比较工具(如 PriceGrabber 和 CompareTheMarket)的启发,在 智能合约 和 API 级别与 区块链 基础设施集成,确保跨不同网络的无缝功能。此外,它还提供教育资源,以帮助用户更好地理解 Web3 机制,从而减少进入壁垒。

Ponder 采用模块化和可扩展的架构构建,旨在随着 Web3 的发展而保持适应性。它的模块化方法通过允许更新特定组件而不中断系统来提高可维护性。它还通过为不同的用例启用轻松定制来增强灵活性。可扩展性是一项关键特性,可确保 Ponder 在交易量增加时保持其性能和可靠性。

通过支持互操作性和简化用户交互,Ponder 有助于建立一个更易于访问和更高效的去中心化生态系统。它的目标是统一分散的 区块链 服务,使经验丰富的用户和新手都能更直观地浏览 Web3。 [2] [3] [4]

功能

Ponder 引擎

Ponder 引擎是连接和集成 Ponder 生态系统中各种提供商的核心框架。它通过与 LayerZero 和 Socket.Tech 等互操作性协议接口,促进跨多个平台的比较。该引擎专为可扩展性和适应性而设计,确保随着 Web3 领域的发展,可以无缝地集成新的和现有的提供商。[4]

作为统一层,该引擎通过直接的 智能合约 集成和互操作性协议连接到服务。这种结构能够对产品和服务进行广泛而灵活的比较,确保用户可以访问全面的实时数据以进行决策。[4]

Ponder Points (思考积分)

Ponder Points (PP) 作为 Ponder 生态系统内的奖励货币,可在 Ponder 商店兑换各种物品。用户通过平台互动赚取 PP,包括交易、交易量、质押、和每日登录。未来还将推出额外的赚取机会,例如空投活动。PP 可用于购买数字和实物奖励,包括代币、硬件和独家商品。通过质押 $PNDR 获得资格的 Ponder Plus 会员将根据其会员等级获得奖励积分。Ponder 商店以轮换库存的方式运营,提供限时商品和独家优惠。[5]

生态系统

Ponder的生态系统分为多个阶段,每个阶段都旨在简化Web3和DeFi的不同方面。目标是通过降低复杂性并提供一个统一的平台来评估各种服务,从而增强用户体验。每个阶段都扩展了Ponder的功能,整合了该领域的新旧提供商。通过抽象技术细节和简化交互,Ponder旨在创建一个可访问且全面的解决方案,以便浏览Web3。 [4]

第一阶段

Ponder生态系统的第一阶段侧重于桥接比较,使用户能够有效地评估和执行跨链传输。该平台与主要的、经过审计的流动性提供商(如AnySwap和Stargate)在智能合约层面集成,以提供原生支持。用户可以输入传输详细信息,Ponder将实时查询多个桥接提供商,以呈现关键数据,包括传输成本、桥接费用、交易时间、信任评分、路线概览和Ponder的费用。

Ponder使用户能够在自己的平台内直接执行资产转移,而不是将用户重定向到外部桥接界面。这种方法简化了流程,允许用户在单个工作流程中请求报价、比较选项和完成交易,而无需离开Ponder的界面。 [4] [6]

第二阶段

Ponder 生态系统的第二阶段扩展了第一阶段的基础,引入了一个旨在促进跨链和互操作交易的交换聚合器。本阶段旨在通过整合多个区块链网络上的去中心化交易所(DEX)来提高流动性,首先从EVM兼容链开始。Ponder 旨在通过聚合流动性并提供实时数据来优化交换率、减少滑点并提高交易效率。

Ponder 引擎将直接与智能合约和 API 级别的交易所连接,利用 LayerZero 和 Socket.Tech 等互操作性协议。用户可以访问关键数据点,包括汇率、费用、滑点、MEV 保护、通过 ZK 中继实现的私有交易选项、流动性可用性和风险评分。这种方法旨在提供无缝的交易体验,同时解决跨链的碎片化流动性。[4] [6]

第三阶段

Ponder生态系统的第三阶段整合了DeFi协议、质押和现实世界资产(RWA)市场,以简化用户访问产生收益的机会。此阶段使用户能够通过单一界面管理跨多个链的DeFi头寸,首先集成AAVE、Compound和Liquity等主要协议。鉴于DeFi的复杂性和快速发展,Ponder充当抽象层,简化了寻找、评估和进入以太坊质押、EigenLayer再质押、RWA借贷和DeFi货币市场等机会的过程。

Ponder自动化并整合了复杂的DeFi交互,以最大限度地减少摩擦,掩盖了抵押品管理、贷款发放、清算流程和信用评估等复杂性。用户无需浏览多个平台即可访问有关贷款池、清算风险和钱包健康因素的实时见解。第三阶段集中并以简化的格式呈现所有相关的链上数据,使个人和机构能够高效地做出明智的决策。 [4] [6]

第四阶段

Ponder的第四阶段侧重于集成NFT市场、Ordinals和BRC-20代币,使用户能够高效地比较和交易数字资产。Ponder连接NFT市场API和智能合约,为藏品和单个NFT提供实时报价。它还在其平台内直接促进交易。为了加强决策,Ponder整合了来自CryptoSlam、DeFiLlama、Dune、NFTBank.ai和hiro.so等分析平台的数据,提供对交易量、社交存在和市场趋势的洞察。

此阶段还引入了对Ordinals和BRC-20铭文的支持,使用户能够与基于比特币的数字文物和代币化资产进行交互。Ponder旨在建立一个复杂的比较和分析框架,帮助用户找到最佳市场价格。它为跨链NFT移动和与DeFi的更深入集成奠定了基础。随着DeFi平台探索使用NFT作为抵押品,Ponder弥合了这些生态系统之间的差距,为管理数字资产提供了统一的体验。[4] [6]

第五阶段

Ponder的第五阶段将引入对法币出入金通道、钱包、DeFi保险和去中心化物理基础设施网络(DePIN)的比较,使用户能够在数字金融的各个方面做出明智的决策。它将根据交易速度、成本和监管合规性评估法币出入金通道,而钱包比较将侧重于安全功能、托管选项和账户抽象。DeFi保险集成将提供个性化的保险选项,以降低投资风险。此外,Ponder将分析DePIN解决方案,包括去中心化云服务、边缘计算和基于区块链的存储,并根据成本、可扩展性和技术能力比较提供商。此阶段将简化决策过程,提供清晰的、数据驱动的见解,以帮助用户驾驭不断发展的Web3生态系统。 [4] [6]

第六阶段

Ponder的第六阶段将侧重于投资型DAO,这些DAO作为去中心化组织,管理用于各种资产投资的资金池,包括加密货币、NFT和现实世界资产。这些DAO在准入要求、费用和投资重点方面各不相同,这使得用户难以在其中进行选择。Ponder将通过在智能合约层面直接与DAO集成,简化研究、比较和进入流程,使用户能够以最小的摩擦投资和跟踪资金。此阶段将提供更清晰的DAO结构、费用和投资策略的见解,帮助用户找到合适的投资机会,而无需浏览复杂的独立平台。[4] [6]

治理

Ponder 的治理模式要求代币持有者积极参与。要获得治理奖励,代币持有者每月必须至少对一项提案进行投票。否则,没收的奖励将重新分配给国库,并在活跃参与者之间重新分配。与其他允许委托的治理模式不同,Ponder 强制直接参与,确保所有代币持有者都为决策做出贡献,而不是被动地进行质押。这种结构旨在维持一个积极参与且负责任的社区,引导平台的发展以惠及所有参与者。[4]

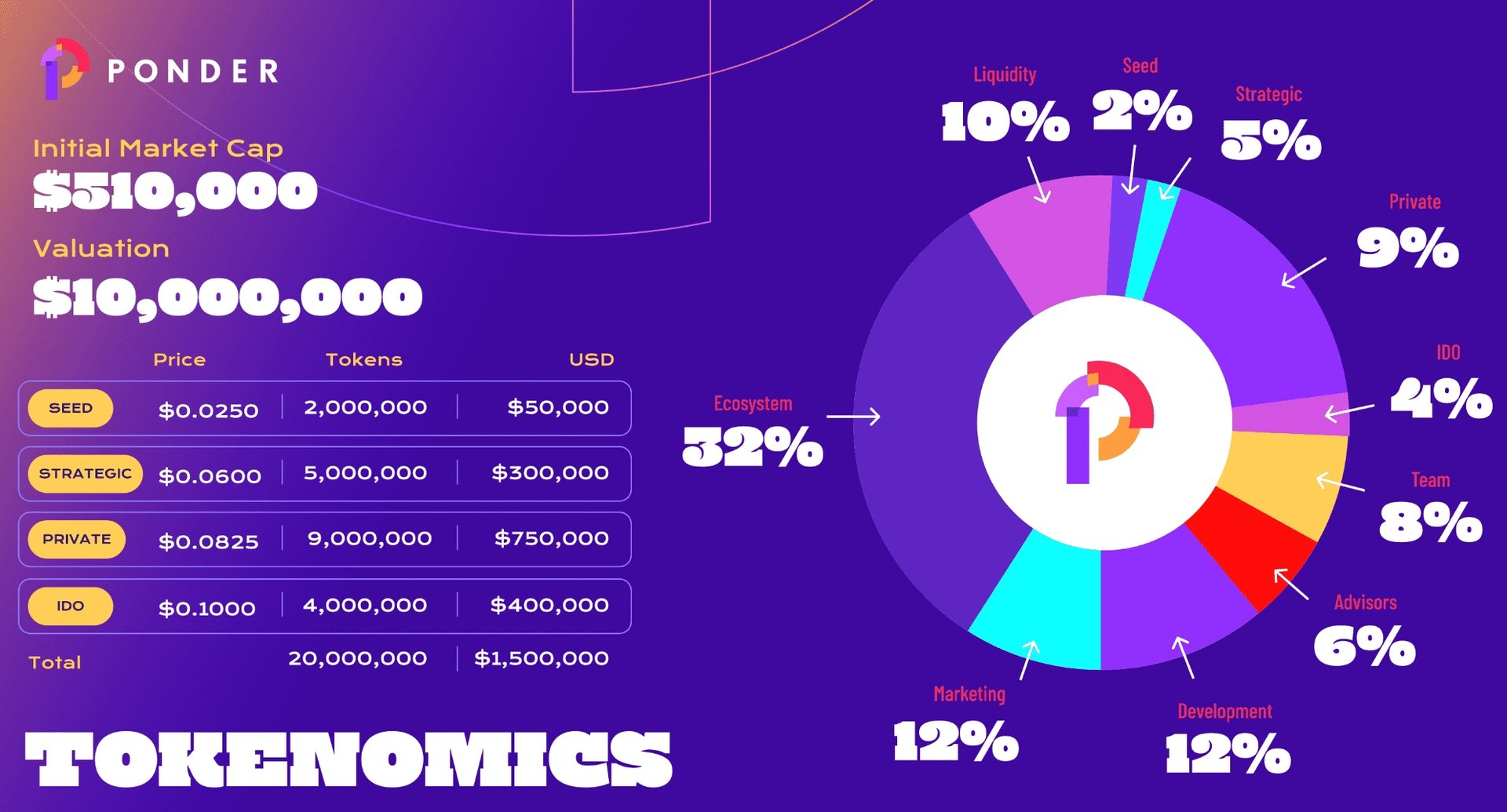

$PNDR

PNDR 的总供应量为 1 亿,分配如下: [4]

- 生态系统: 32%

- 市场营销: 12%

- 开发: 12%

- 流动性: 10%

- 私募: 9%

- 团队: 8%

- 顾问: 6%

- 战略: 5%

- IDO: 4%

- 种子轮: 2%

合作关系

- Socket

- Avalanche

- Quickswap

- Native

- Nuklai

- Connext

- Li.Fi

- Linea

- Swing

- Kyber

- OpenOcean

- ODOS

- Celer

- Ape Terminal

- Movement Labs

- CoinRank

- Fizen

发现错误了吗?