EAST Blue

EAST Blue 是一个平台,引入了一个新的可编程层,旨在增强 比特币 的可扩展性,以用于消费者应用程序和日常交易,并利用 NEAR 协议 来提高效率和可访问性。[1][2][3]

概述

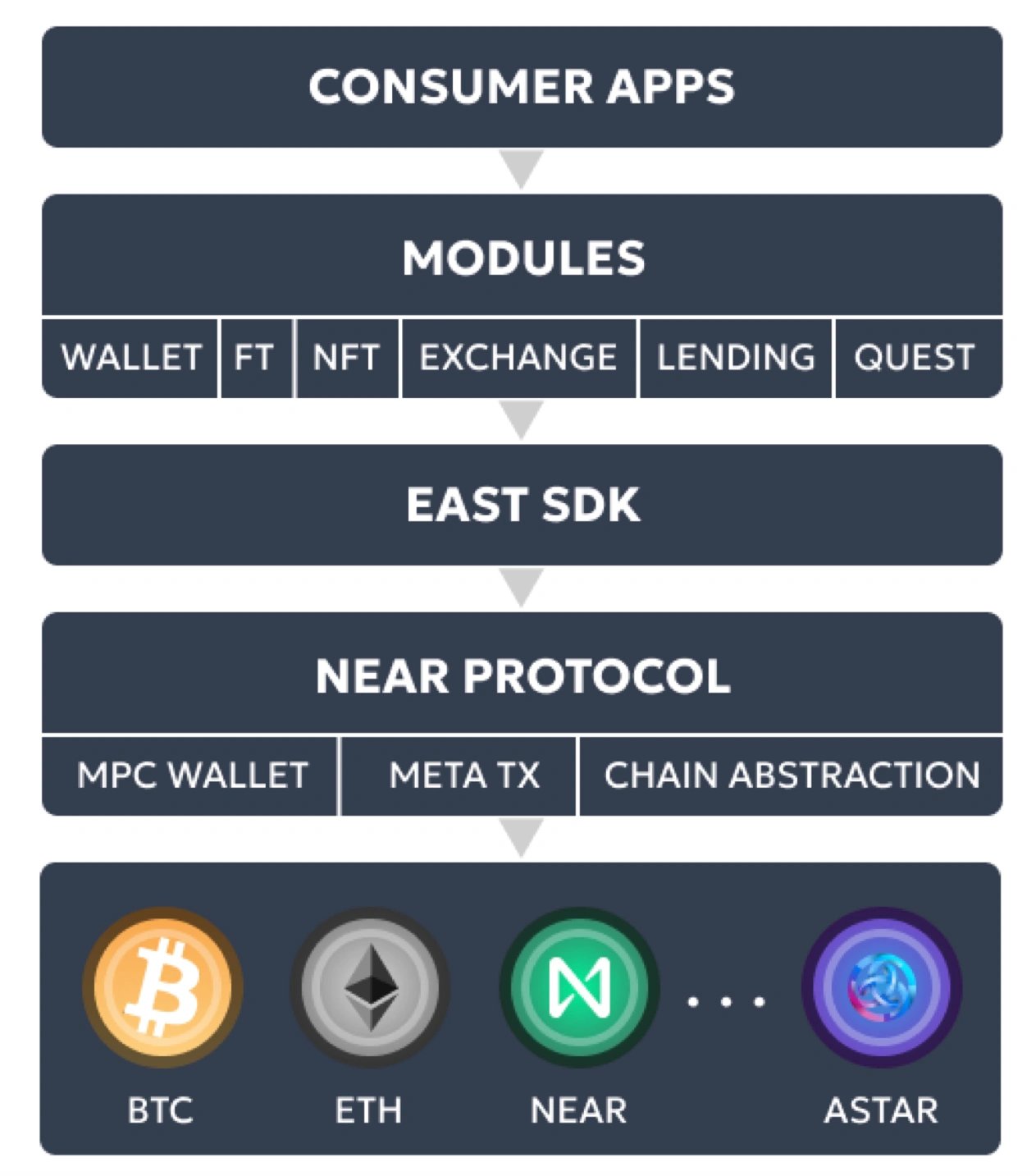

EAST Blue 是一个平台,引入了一个新的可编程层,专门用于扩展 比特币,以用于消费者应用程序和日常交易。该平台旨在提高 比特币 交易的效率和可访问性,使其对用户来说更具成本效益和速度。EAST Blue 为比特币提供了一个多 VM、多链 layer 2 解决方案,利用 NEAR 协议 的用户友好型 区块链 基础设施。

这种方法旨在提高 比特币 的可用性,同时满足消费者和开发人员的需求。通过这些努力,EAST Blue 旨在促进 比特币 的主流采用,并在 加密货币 领域创造创新机会。[1][2][3][4][5]

交易效率

它旨在降低 比特币 网络上的交易成本并加快处理时间,目标是使交易更加经济实惠和快速,可能提高 1000 倍。这项计划旨在解决高额费用和延迟确认所带来的挑战,尤其是在网络拥塞期间。[1]

界面

该平台优先考虑用户友好的体验,旨在简化与 比特币 生态系统的交互。通过最大限度地减少通常与 区块链 技术相关的技术复杂性,EAST Blue 旨在使用户能够无缝地参与 比特币,从而促进购买、销售、持有和交易等活动。这种方法旨在扩大主流用户对 比特币 的访问。[1]

经济扩张

EAST Blue 旨在扩展 比特币 的效用,使其超越其作为价值存储的角色。通过启用 比特币 的实际用例,该平台旨在挖掘 1 万亿美元 比特币 经济的潜力,从而促进更广泛的日常交易和金融活动。[1]

区块链支持

该平台旨在支持各种虚拟机 (VM) 和 区块链 网络,包括 WebAssembly (WASM)/以太坊 虚拟机 (EVM) 和 比特币 Layer 1 (L1)/Layer 2 (L2) 解决方案。这旨在使 EAST Blue 能够适应各种应用程序和用例,充当集成 去中心化应用程序 (dApps)、预言机和 Layer 2 解决方案的灵活层。最终,这旨在增强 比特币 生态系统的互操作性和功能。[1]

EAST SDK

EAST 软件开发工具包 (SDK) 是一个 JavaScript 包,专为 web3 消费者应用程序开发而设计,旨在简化与 区块链 基础设施的交互。它提供身份验证、识别和交易中继功能,使开发人员能够专注于产品开发。值得注意的是,该 SDK 旨在简化用户身份验证、管理 gas 费用,并促进各种操作,例如跨多个 区块链 的资产转移和交换。[2][6]

EAST 账户金库模型

EAST 账户金库模型 (AVM) 旨在作为一种去中心化、无桥且非托管的解决方案,以解决 比特币 网络中的可扩展性挑战。AVM 利用 NEAR 协议,使用账户金库模型将账户所有权转移到智能合约,从而促进跨链交易。通过采用 NEAR 的账户模型和账户聚合,账户被转换为账户金库,从而可以在 智能合约 中管理 BTC 或 Ordinals 等资产。

这种方法旨在启用各种应用程序,例如交易账户金库的 NFT 市场,或将代币作为 比特币 上的真实 BRC-20 资产启动的 BRC-20 启动板。此外,BTC 可以转移到 NEAR 区块链,从而可以在 DApps 上进行交易并与其他资产进行交互。[7]

代币经济学

EAST Blue 代币 ($EAST)

$EAST 代币是 EAST 生态系统内的主要交换媒介,促进交易和支付。此外,它还支持代币持有者的 治理 参与,并可用作社区贡献的激励或奖励。[2][8][9]

实用性

- 交易媒介:$EAST 代币是价值交换的媒介,并授予对 EAST 生态系统内独家功能的访问权限,旨在增强用户体验和网络功能。

- 治理:邀请代币持有者参与有关社区资金库和生态系统发展的决策过程,从而培养透明和民主的治理模式。

- 质押:通过 质押 $EAST 代币,用户有助于生态系统的稳定性,可能会获得奖励,并在治理决策中获得更大的影响力,这与生态系统的参与和社区赋权原则相一致。[2][10][11][12]

分配

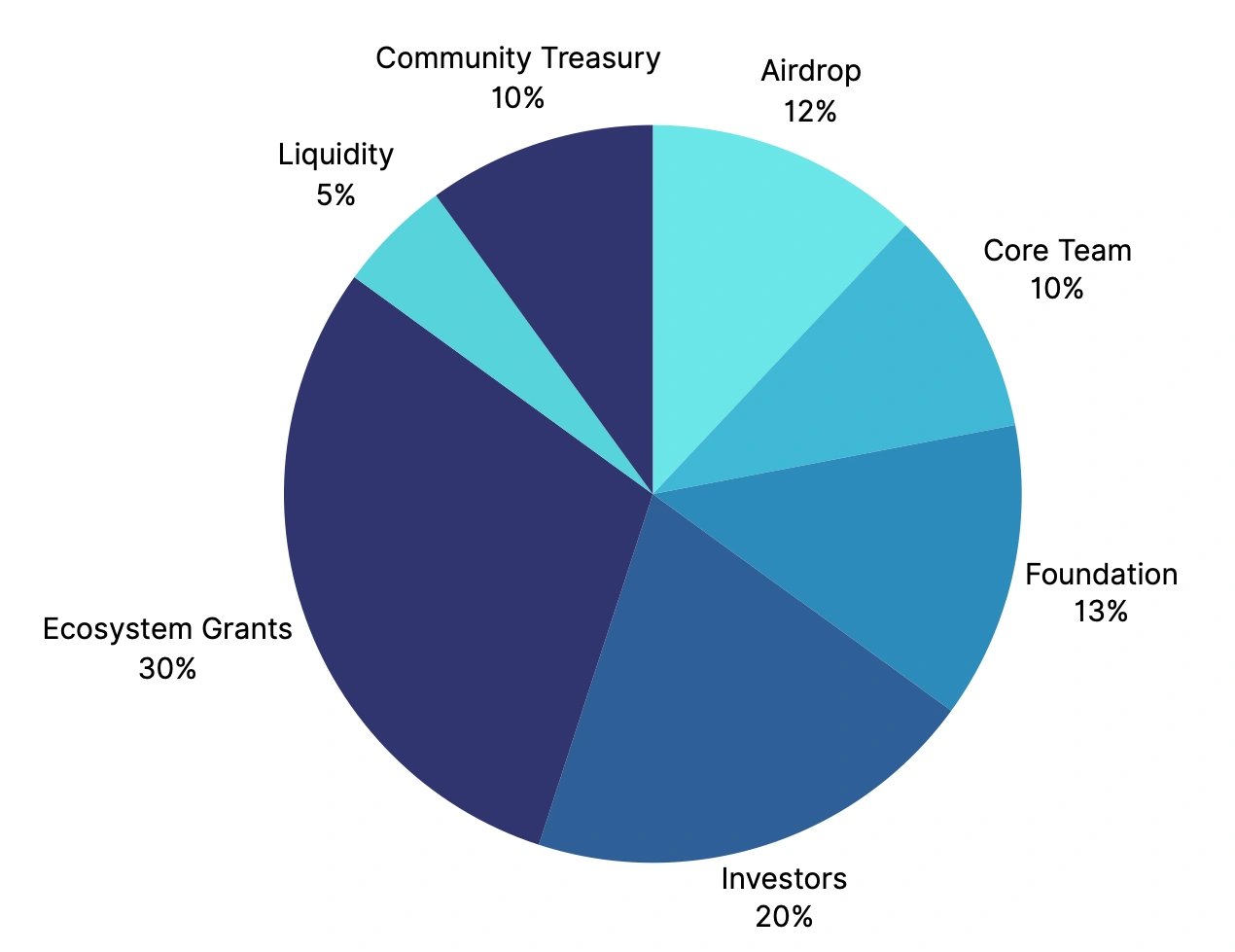

EAST Blue 的代币分配包括 10 亿个 $EAST 代币,其动态发行基于生态系统性能,以及 5 年的锁定期。代币分配如下:

- 空投:12%,没有指定的悬崖期,锁定期为 12 个月。

- 生态系统赠款:30%,没有指定的悬崖期,锁定期为 5 年。

- 社区资金库:10%,直到治理上线,没有指定的锁定期。

- 流动性:5%,没有指定的悬崖期或锁定期。

- 投资者:20%,悬崖期为 6 个月,锁定期为 3 年。

- 基金会:13%,悬崖期为 6 个月,锁定期为 5 年。

- 核心团队:10%,悬崖期为 12 个月,锁定期为 5 年。

这些分配遵循悬崖期和每月线性归属计划。虽然社区和生态系统发展的大部分代币可立即使用,但其余代币受各种悬崖期的限制,以确保开发人员、投资者和生态系统增长之间的利益一致。[2][13]

空投

$EAST 生态系统起源于 PARAS 社区,PARAS 社区是 Paras 生态系统的实用代币,以其在 NEAR 的 NFT 生态系统中的突出作用而闻名。虽然 PARAS 代币的重点主要在于 NFT,并且实用性有限,但向 $PARAS 持有者空投 $EAST 代币旨在将现有的 PARAS 社区整合到一个更广泛的生态系统中。这涉及一项为期 12 个月的 空投 活动,每月通过优先考虑 PARAS 代币持有者的方法分发多达 1000 万个 $EAST 代币。[2][14]

动态发行

$EAST 代币采用动态发行,根据生态系统使用情况和性能进行调整。每个 epoch 都会铸造新的代币,数量由交易量决定。60% 的铸造代币进入社区资金库,40% 进入质押奖励。该系统旨在维持经济平衡,适应市场条件,同时激励网络参与者。[2][15]