Subscribe to wiki

Share wiki

Bookmark

GMD Protocol

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

GMD Protocol

GMD Protocol is an aggregating and yield optimization platform that operates utilizing the GMD reserve token on the Arbitrum network. The GMD protocol aims to achieve maximum yields through the application of delta-neutral or similar strategies. This aggregates the yields from a group of assets while minimizing the risks of impermanent loss and unwanted exposure to assets. [1]

Overview

GMD Protocol was launched on October 24, 2022. It is built on the Arbitrum network and utilizes the GMD reserve token as its backbone, enabling the use of delta-neutral strategies to aggregate yields from an asset pool while minimizing risks. [2]

The GMD Protocol encompasses several key components, including the GMX decentralized exchange and GLP token. The GMX serves as a hub for liquidity and trading, while the GLP is an index of assets used for leveraged trading and swaps. The GMD Protocol's initial offerings are single-stake vaults for BTC, ETH, and USDC, which are built on GMX and GLP. The GMD reserve earns yield from the underlying $GLP and all revenue from single-stake vaults. The protocol also plans to expand its offerings in the future to include smart vaults for purposes such as long and short trading, as well as creating arbitrage pegged assets. [3]

GMX

The GMX decentralized exchange is a perpetual contract trading platform for popular cryptocurrencies. Users trade perpetuals by depositing collateral and taking long or short positions, and profits are paid in USDC for short positions or in the other token for long positions. GMX offers leverage of up to 50x and market prices are based on Chainlink's oracles that aggregate price feeds from leading exchanges, making positions safe from liquidations. As a decentralized and smart contract-powered platform, GMX provides security and stability for users, allowing them to trade digital assets around the clock with low fees. [4][5][6]

GLP

GMX Payments Provisioning Token (GLP) is an index token that represents the combined ratios of digital assets including ETH, BTC, UNI, LINK and stablecoins. To mitigate the risk of GLP's price volatility, the token adopts the Delta-Neutral Yield strategy which creates a short position for the ETH/BTC pair that is equivalent to the GLP asset, thereby insulating interest earned from GMX revenue from GLP's fluctuations. [7]

Staking

Staking on the GMD Protocol involves participating in its yield optimization and data aggregation processes. The protocol utilizes either delta-neutral or pseudo-delta-neutral strategies to pool returns from an index or liquidity provider and distribute them among its constituent holdings, thereby reducing the risk of temporary loss or exposure to unviable assets. [3]

In particular, the single-stake vaults of the GMD Protocol employ a technique referred to as pseudo-delta-neutral. This involves distributing and weighting assets held in each vault ($USDC, $ETH, or $BTC) based on the composition of GLP, with the aim of generating new $GLP and earning income from its sale. The vault’s exposure to these assets is protected from market-related volatility due to its identical composition to GLP. To maintain constant hedging parameters, the protocol rebalances the composition weekly, regardless of market fluctuations. [8][9]

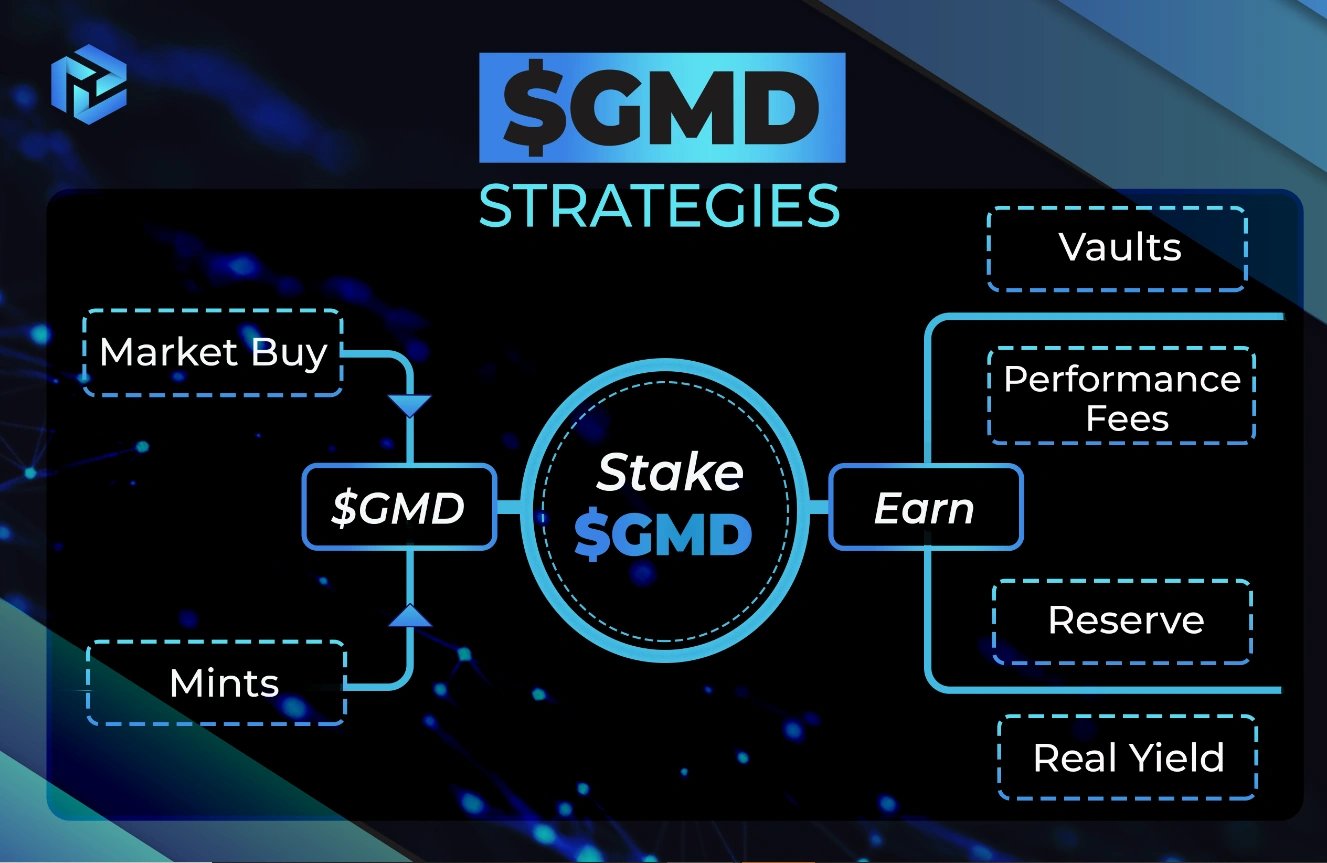

As a staker in the GMD Protocol, one can earn yield from its protocol-owned liquidity and underlying GLP assets. In addition, stakers can receive performance fees from single-stake vaults and other future revenue sources as the GMD Protocol continues to expand. [10]

Tokenomics

GMD Token

GMD (Governance and Monetary Distribution) is a governance token for the GMD Protocol. It has a maximum supply of 80,000 tokens, of which 17,000 tokens are locked as esGMD (Encrypted Seed GMD) for use in OTC swaps for partnership tokens and long-term investments. Another 9,000 tokens are used for adding liquidity on decentralized exchanges such as Uniswap V3 and those partnered with Arbitrum. The remaining 54,000 tokens are circulating within the community. [11][12]

esGMD

esGMD (Encrypted Seed GMD) is a variant of GMD that can currently only be obtained through private seed rounds with GMD Protocol. It has various use cases, such as OTC swapping for partnership tokens, which are likely to be staked for further user incentives. The funds raised through esGMD or swapped using esGMD will be used to generate yield for GMD stakers and support the operations of the protocol. esGMD can be locked for 365 days to receive GMD, and staked to earn higher APR compared to liquid GMD. [13]

Delta Neutral Vaults

Delta neutral vaults are a type of vault that employ pseudo-delta-neutral strategies and are built on top of the GLP protocol. The GMD Protocol provides single-stake vaults for three cryptocurrencies - BTC, ETH, and USDC. [15]

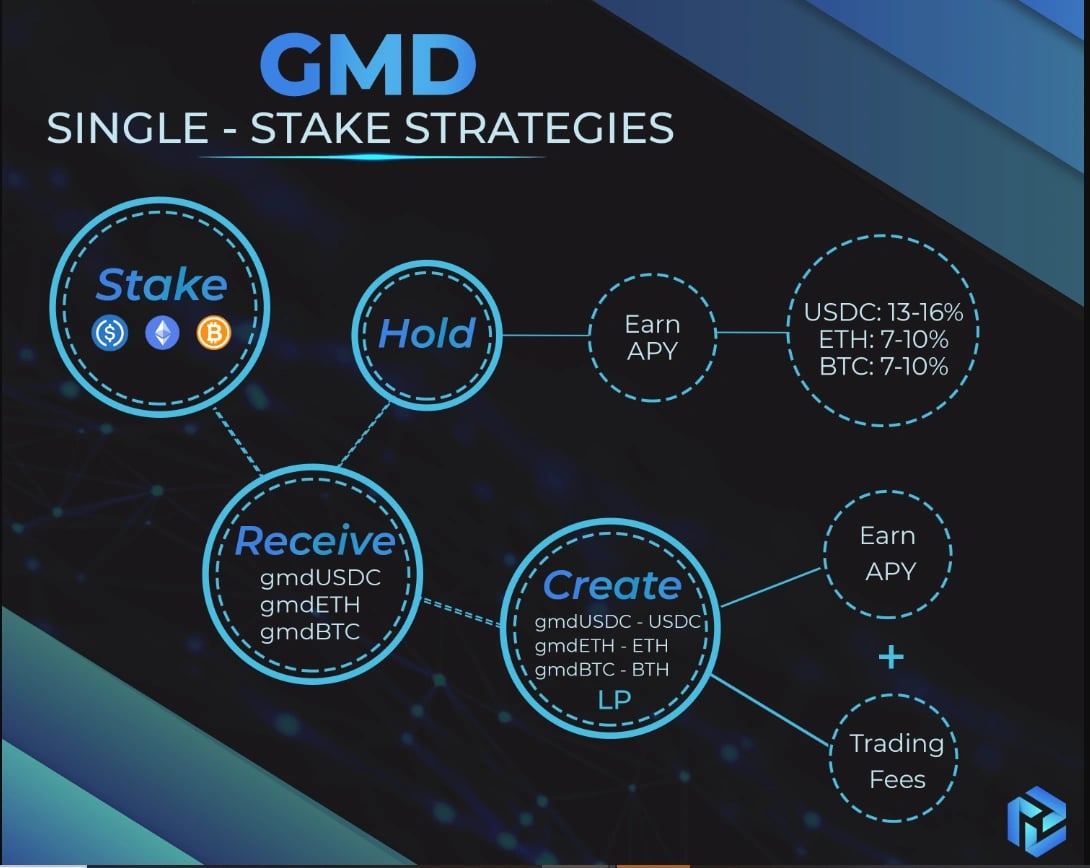

Staking and Receipt Tokens

When a user stakes their cryptocurrencies in the vault, they receive gmdTOKENS that represent their positions in the vault. The staker receives gmdUSDC, gmdETH, and gmdBTC as receipt tokens, depending on their original positions. The value of gmdTOKENS appreciates at their APY rate, similar to the mechanism of aUST. For example, if a user exchanges 100 USDC for 100 gmdUSDC, after a year, their 100 gmdUSDC will be worth 120 USDC if they decide to unstake. [16]

Liquidity and Trading Fees

Through gmdUSDC-USDC, gmdETH-ETH, and gmdBTC-BTC Uniswap V3 liquidity, these tokens can be used to form Uniswap V3 liquidity, allowing for instant entering of the vaults in case the vaults are completely filled. GMD Protocol encourages stakers to do this to earn extra trading fees from Uniswap with minimal to zero impermanent loss. [16]

Vaults Capabilities

Delta-neutral vaults have several capabilities. One of the capabilities is dynamic deposit fees that allow for higher deposit fees for assets in higher demand and lower deposit fees for assets in lower demand, which helps balance the vault's asset ratio according to GLP's ratio. Another capability is that the vaults are 100% liquid, as the 15-minute restriction for burning GLP has been removed from the new GLProuter contract, allowing for withdrawals at any time. However, this change may affect the vault's performance as the asset ratio may vary more significantly over time, and the GMD team will conduct more active management actions to accommodate any resulting changes. Another capability is that vaults' APY can be greater than 17% as the APY restriction has been removed from the contracts. During high fees week similar to when GLP yield was 50%, APY for vaults can go to any possible height. Finally, the vaults' performance can be tracked easily as there is a Dune Dashboard and a separate GMD Stats Page on the website where users can monitor the vaults' performance in real-time. [17]

Vaults Limit

The vaults cap will initially be opened at an $1,000,000 limit, consisting of $500,000 worth of USDC, $300,000 worth of ETH, and $200,000 worth of BTC. The vault limit will be raised incrementally for more deposits over time as the team monitors the performance and yield of the vaults. Vaults limit will also be actively monitored, changed, and rebalanced according to GLP's exact relative ratio for USDC, ETH, and BTC. [18]

APY and Deposit Fees

The APY's of the single-stake vaults depend on GLP's APR for each different week, but GMD Protocol guarantees that the rate will fluctuate in the following ranges: BTC: 7-30%+ APY, ETH: 7-30%+ APY, and USDC: 7-30%+ APY. Deposit fees will be charged for each of the vaults, as GMX takes 0.15-0.25% fees for minting and redeeming GLP. However, GMD Protocol will take the loss on deposit fees to encourage more vault stakers, and the fees will be as follows: BTC: 0.5% deposit fees, ETH: 0.25% deposit fees, and USDC. [19]

Launch

In November 2022, The GMD Protocol launched which consisted of a whitelist period where 7,000 $GMD tokens were minted at a 27-33% discount for whitelisted members, followed by a public period for token minting with a 15% discount and 13,000 tokens available for the public. 75% of the funds raised were used to purchase $GLP, while the remaining 25% formed protocol-owned liquidity. A single-stake vault was opened for deposits and the vault cap was increased incrementally. Minters were incentivized not to sell their tokens through the distribution of #realyield revenue to $GMD stakers 3 days after the mint day. This was intended to drive up demand and support the continued growth of the protocol. [14]

gBOT

On August 14, 2023, GMD protocol announced the incubation of the gBOT project. gBOT was first a Telegram trading bot that provided perpetual dex trading for users, now it is a Trading Hub that provides multiple trading options and specialized automated trading bots. [20][21][24]

Tokenomics

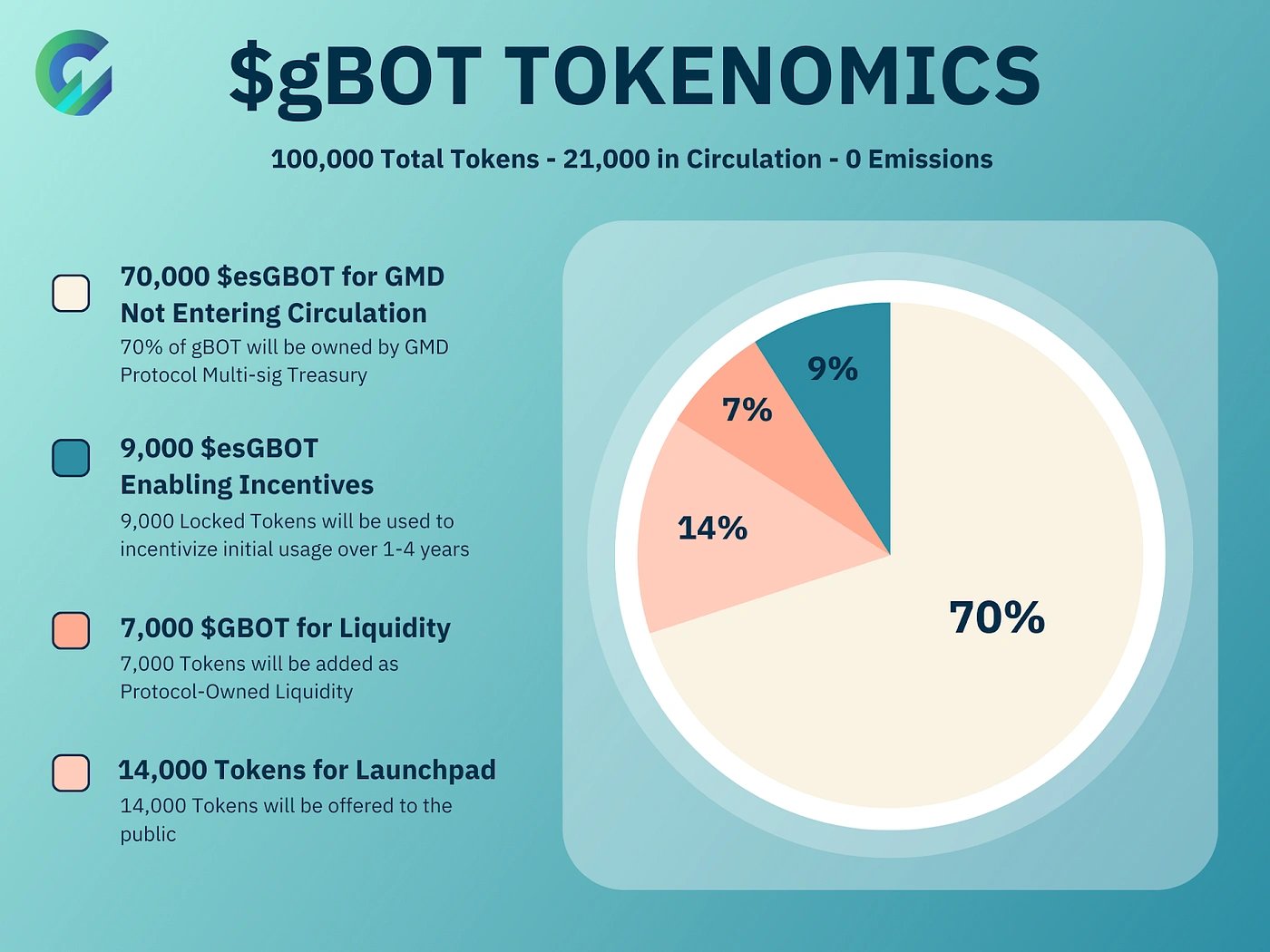

gBOT has a total supply of 100,000 tokens of which 70% will be held as 70,000 $esGBOT by GMD Multisig Treasury, 9% locked tokens will be used to incentivize initial usage over 1-4 years, 7% will be added as Protocol-owned Liquidity while 14% will be offered to the public. [21]

$esGBOT

$esGBOT is the escrowed token version of $GBOT. It can be obtained through locking from $GBOT on contract or from presale rounds. It can also be vested linearly over 365 days to obtain $GBOT. [22]

GBOT Scam Incident

The team experienced a complex scam during an OTC deal. The scammer(s) were able to access a large amount of gBOT and started selling it in the market. However, the GBOT team managed to eliminate the liquidity of $GBOT and put a stop to the scammer's ability to sell any further. [23]

The team also admitted to falling victim due to carelessness in an apology blog posted on August 31, 2023:

"Although this is the first time we were struck with this kind of evil, elaborate scam, it is our carelessness that ultimately led to the issue." - the blog stated[23]

As a result, the LP was immediately removed to stop the scammer from selling further, and a new $GBOT contract was launched and airdropped to the current holders based on their holdings. [23]

New esGBOT was also launched and airdropped to those who staked, currently holding, and are vesting. [23]

gBOT x Bond Protocol

On August 28, 2023, gBOT announced on X (fka Twitter) its collaboration with Bond Protocol to enable revenue sharing. The gBOT team would make use of Bond Protocol's bond mechanism to convert $GBOT revenue to $DAI. [25][26]

"We will be using Bond Protocol’s bond mechanism to convert $GBOT revenue into $DAI while also creating significant value for our users. We believe this would create an incredible opportunity for investors to acquire $GBOT tokens at prices below the market value." - the team tweeted[26]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)