Subscribe to wiki

Share wiki

Bookmark

StakeWise Staked ETH (osETH)

StakeWise Staked ETH (osETH)

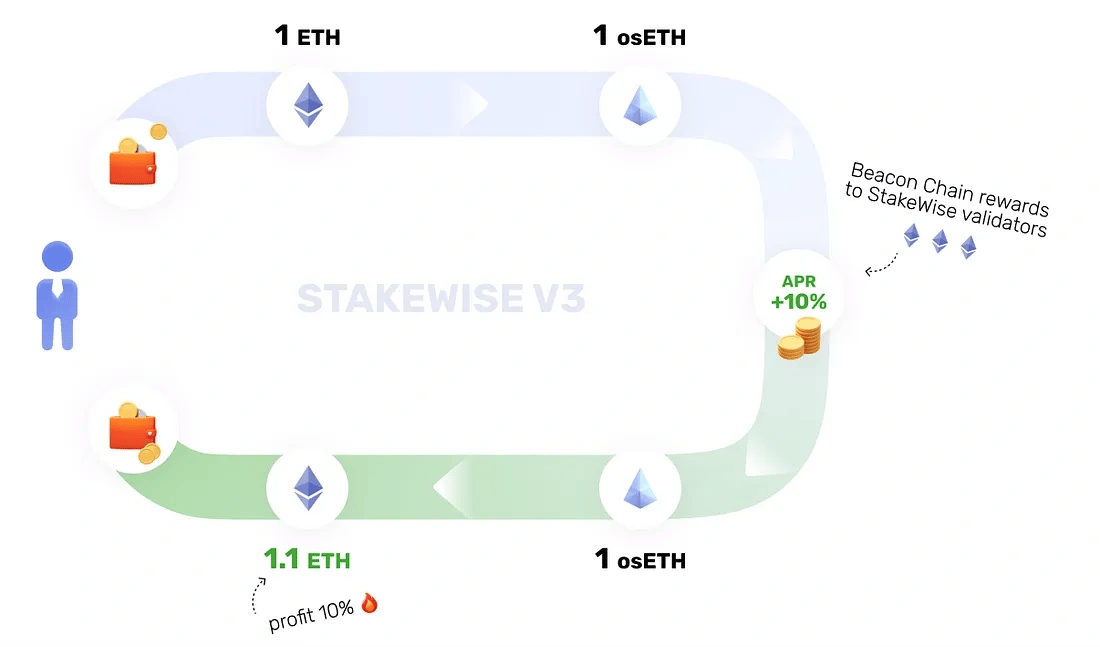

StakeWise Staked ETH (osETH) is a liquid staking token representing ETH deposited in StakeWise Vaults, earning validator rewards. It can be minted against any Ethereum node, offering non-custodial, permissionless access to staking. The token is overcollateralized to ensure accurate decentralized exchange pricing and protect holders from slashing risks. Users can mint osETH to access liquidity, use it in DeFi, and redeem it for ETH when available. [1] [2]

Overview

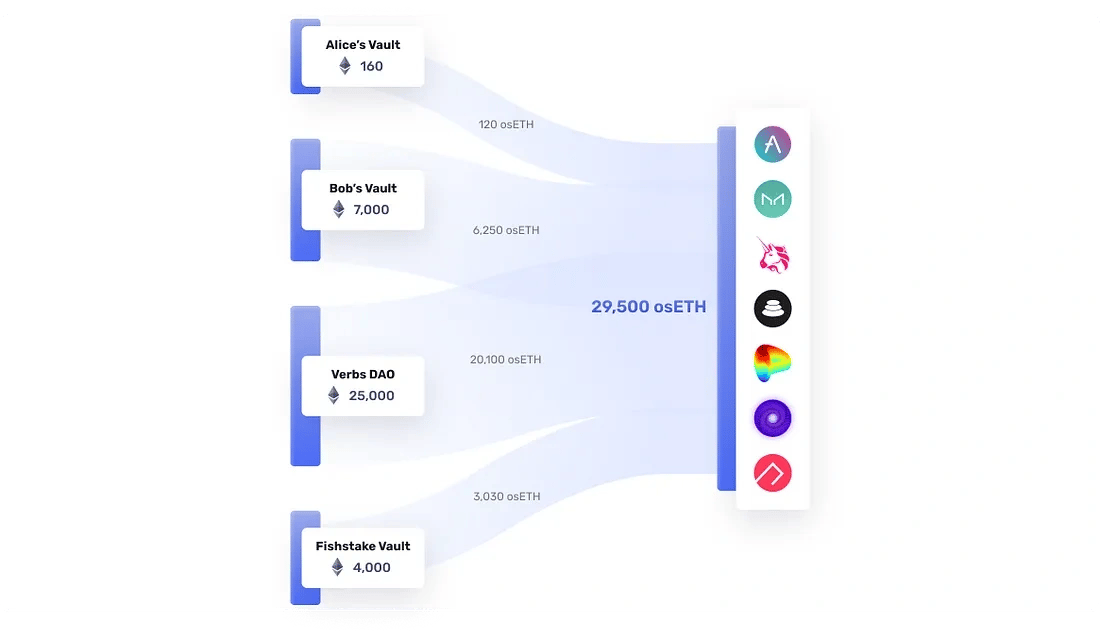

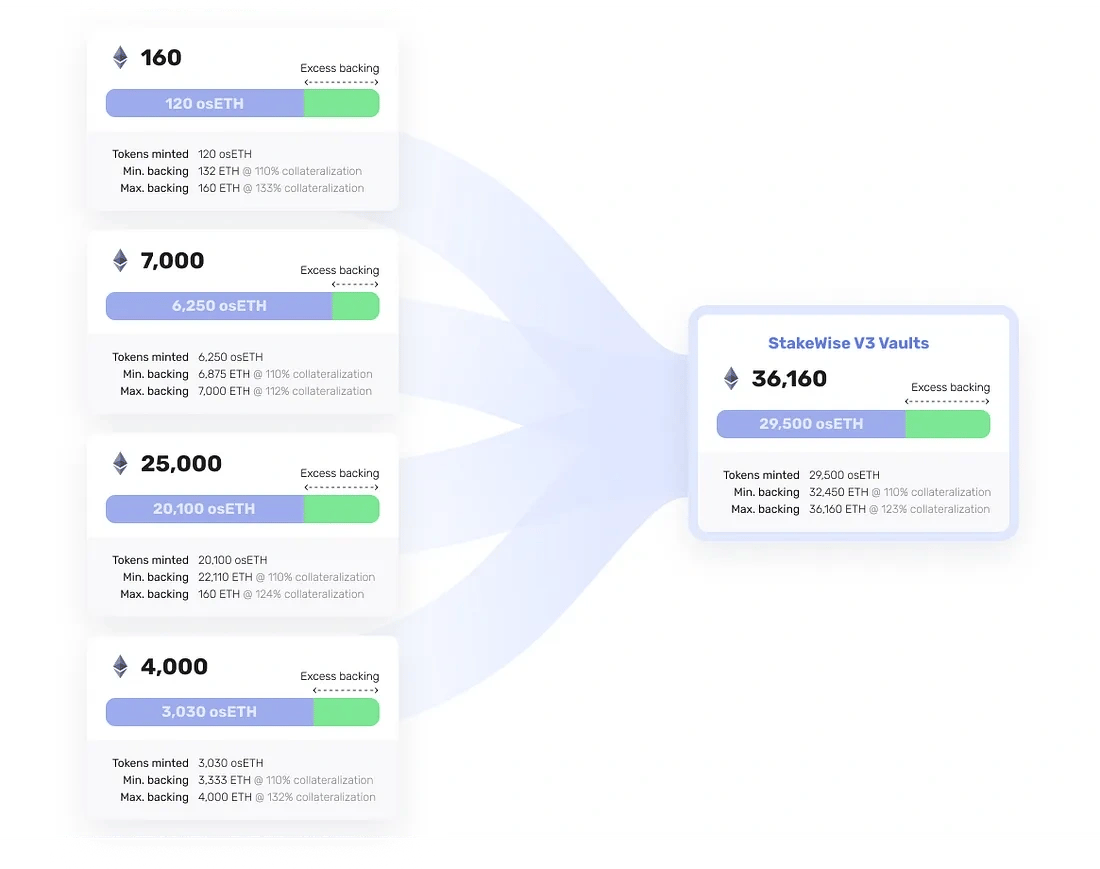

osETH is a liquid staking token representing ETH staked in Vaults and earning rewards from validators. It can be minted against any Ethereum node, offering permissionless and non-custodial access to staking, including solo staking, and can be used in DeFi. The token’s value increases over time as staking rewards accumulate, reflected in its fair exchange rate and APY, net of StakeWise DAO fees. osETH is redeemable for ETH at an exchange rate determined by StakeWise Oracles, with instant redemptions when enough unbonded ETH is available and validator exits initiated if needed. Buyers of osETH on decentralized exchanges are insulated from individual Vault risks, while excess staked ETH protects 90% LTV Vaults, and 99.99% LTV Vaults require a 5M SWISE bond from operators to shield other holders from slashing and performance issues. [1] [2]

Utility

osETH provides utility by enabling users to unlock liquidity from staked ETH while maintaining control of their assets. It can be minted against ETH staked in Vaults and used across DeFi applications such as trading, lending, and farming. As staking rewards accrue, the token’s exchange rate increases, capturing yield. Overcollateralization protects holders from slashing risks, and osETH can be redeemed for ETH through the protocol or on secondary markets. Solo stakers and node operators can also mint osETH, supporting decentralized and permissionless access to liquid staking. [1] [2] [3]

Minting

osETH is minted by staking ETH in Vaults, allowing users to convert a portion of their stake into a liquid token backed by staked ETH in validators. The amount of osETH that can be minted depends on the value of the staked ETH, the current osETH exchange rate, and the collateralization rules set by the StakeWise DAO. Minting requires excess backing to mitigate risks—either through overcollateralization in 90% LTV Vaults, where up to 90% of the ETH stake can be made liquid, or a SWISE bond in 99.99% LTV Vaults, where up to 99.99% of the stake is eligible. In both cases, ETH rewards continue to accrue on the full staked amount, but only a portion is made liquid as osETH. [2] [1] [3] [4]

Burning

To unstake ETH from a Vault, users must burn the osETH they previously minted, which involves returning the token to the protocol so the associated staked ETH can be unlocked. The required burn amount includes the originally minted osETH plus a 5% fee on any rewards it accrued, set by the StakeWise DAO. Fully burning osETH is necessary to fully exit a position; partial burns result in partial withdrawals, as the position must remain within the health thresholds defined for each Vault type (up to 90% for 90% LTV Vaults and up to 99.99% for 99.99% LTV Vaults). This ensures all osETH remains appropriately backed by staked ETH. [4]

Deprecation of V2 and Solo

StakeWise V2 (on both Ethereum and Gnosis Chain) and StakeWise Solo (on Ethereum) were deprecated starting June 1, 2025. While users can still withdraw their assets after this date, staking rewards stopped accruing from the moment of deprecation. For StakeWise V2 users, this meant sETH2 (sGNO) tokens in their wallets no longer accrued rETH2 (rGNO) tokens as rewards. For StakeWise Solo users, their validators were exited after June 1, 2025, stopping the accrual of staking rewards. [5]

To continue earning rewards, StakeWise V2 users were advised to migrate their stake to StakeWise V3 by connecting their wallet holding sETH2 (sGNO) and rETH2 (rGNO) tokens to the StakeWise app and using the Migrate button. This process burns the V2 tokens and issues osETH (osGNO) tokens in return. To withdraw assets from StakeWise after deprecation, users must first migrate to StakeWise V3 and then use the Unstake tab in the interface. [5] [6] [7]

StakeWise Solo users who had previously rotated their validator(s)’ withdrawal credentials to a 0x01 address did not need to take further action to withdraw ETH; it was automatically deposited into their wallet upon validator exits. Users who had not rotated their credentials needed to follow a specific procedure first before their ETH was automatically deposited. To continue earning rewards after withdrawing their ETH, Solo users could deposit it into StakeWise V3, either via the app for liquid staking with osETH or into one of the Vaults in the StakeWise Marketplace. [5] [8]

Recent News

On Monday, April 28th, 2025, the StakeWise DAO began incentivizing new liquidity pools for osETH on Balancer. These included a Boosted osETH-ETH pool on Ethereum mainnet and a Boosted osETH-ETH pool on Arbitrum. These pools became the new flagship liquidity pools for osETH on their respective networks. [9]

The Boosted pools were selected for their ability to lend out spare ETH capacity on Aave to generate extra yield for liquidity providers. Approximately 90% of the idle assets in the pool can be committed to yield-generating opportunities while remaining available for swaps. For the osETH-ETH pools, idle ETH is automatically deposited into Aave to earn a lending APY. Based on a recent StakeWise DAO decision, the new pools receive mostly ETH-denominated incentives, specifically using 75% osETH and 25% SWISE, which has the potential to allow the APY to exceed the network reward rate. Existing liquidity providers in the legacy osETH-ETH pools on Balancer were encouraged to migrate their liquidity to the new Boosted pools. [9]

Risks associated with the Boosted pools include potential liquidity crunch on Aave, Aave insolvency, and Balancer Boosted Pool exploits. StakeWise considers the risk of a liquidity crunch on Aave to be low due to typical ETH utilization rates and overcollateralized borrows. The risk of Aave insolvency is also considered very low given its battle-tested code and performance. The risk of a Balancer Boosted Pool exploit is deemed very low due to Balancer's increased attention to the security of Boosted Pools following earlier issues. [9]

See something wrong?