Subscribe to wiki

Share wiki

Bookmark

USDD

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

USDD

USDD (decentralized USD) is a stablecoin and digital asset launched by TRON DAO on BNB Chain, Ethereum, and TRON on May 5, 2022. [1][2][3][4]

History

Open Letter

Founder of TRON, H.E. Justin Sun, announced the launch of USDD, a decentralized USD stablecoin in an open letter[5] on Twitter on April 21, 2022. In the open letter, USDD is described as bringing about Era 3.0 of stablecoins which is characterized by complete decentralization and the end of reliance on centralized institutions to ensure price stability. [6][7]

Era 1.0 refers to the initial stage of stablecoin development, exemplified by USDT, one of the first stablecoins, which was created on Bitcoin's network using the Omni Layer. However, due to its implementation on the Bitcoin network, Era 1.0 faced challenges such as low throughput, resulting in slow USDT transfers. Additionally, transaction fees were relatively high, and centralized institutions managed the US dollar reserves backing USDT. [7]

Era 2.0, referred to as the "TRON-based USDT 2.0 era" in Sun's open letter[5], involves the utilization of an independent decentralized layer on the TRON network to process transactions. The advancement enables faster transfers and reduced handling fees due to increased throughput. However, it's important to note that reserves and custodianship continue to be centralized. [7]

In Era 3.0, the focus is on a decentralized algorithmic stablecoin, where on-chain algorithms are employed to manage volatility. This approach aims to provide individuals with access to a stablecoin that has achieved full decentralization. [6][7]

Launch

On May 5, 2022, USDD was launched by TRON DAO with an initial supply of 100 million.[8] It was made available on Ethereum and BNB Chain via BitTorrent’s (BTCC) cross-chain protocol. The rollout of the stablecoin is in four phases (Space, International Space Station, Moon, and Mars), leading to the launch of USDD Mainnet. [9]

USDD is an algorithmic stablecoin managed directly by TRON DAO and is set to be pegged to the US Dollar at a 1:1 ratio, which means that the value of the digital currency is tied to the value of the US dollar.

Technology

Over-collateralization

USDD is collateralized by $580 million worth of TRX (TRON's native crypto), $235 million of BTC, and $442 million of USDT. This basket of assets accounts for over 200% of the value of USDD in circulation. Therefore, each USDD in the market is backed by more than twice its value. This over-collateralization is aimed at preventing the de-pegging of the USDD to the USD. [10]

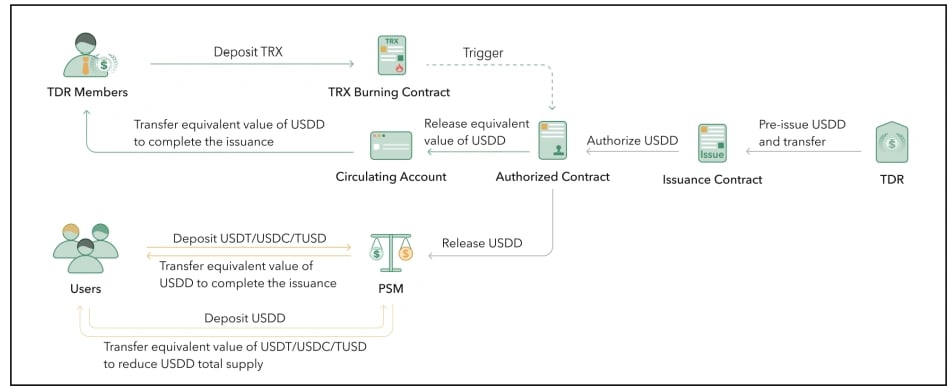

Mint & Burn Mechanism

When USDD’s price is lower than 1 USD, users can burn 1 USDD in return for 1 USD worth of TRX. And when USDD’s price is higher than 1 USD, users can burn 1 USD of TRX for 1 USDD. This is meant to keep the USDD pegged 1:1 to the USD. [11][10]

Peg Stability Module (PSM)

USDD provides a "Peg Stability Module" (PSM), which is an open-source software enabling users to exchange tokens between USDD and other stablecoins like USDT or USDC at a fixed 1:1 rate, with no price slippage. Users receive the exact amount of cryptocurrency they expect when initiating the transaction.[10][11]

Super Representatives

The Super Representatives are 27 TRX token holders within the TRON network who contribute to maintaining the price stability of USDD. They play a role in mitigating the impact of high volatility on the stablecoin through a specific mechanism. The selection of Super Representatives is a reversible process, where interested TRX holders can apply for the position and are voted upon by the TRX community. [11]

USDD Stablecoin Dip

Shortly after its initial launch on May 5, 2022, the USDD coin price fell to $0.93, sparking concern among investors. TRON DAO Reserve shed light on the situation by publishing a series of tweets claiming that it’s acceptable for a stablecoin to go through periods of high volatility (“within +

- 3%”). The claim was also supported by some crypto experts, while others remained skeptical. The token showed higher volatility for several days after its launch until the end of July 2022, when things stabilized.[12][11]

In November 2022, the USDD depegged slightly again, falling to below $0.97 at one point due to the FTX collapse. The USDD liquidity pool on the DeFi protocol Curve saw a significant imbalance, with almost 80% of the pool comprising USDD. More people wanted to sell USDD than buy it.[13][11]

Justin Sun addressed the situation, tweeting[14] that it was most likely due to Alameda Research (a crypto hedge fund headed by FTX’s Sam Bankman-Fried) selling their USDD to cover FTX’s liquidity issues and that the pool had regained balance.[11][13]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)