订阅 wiki

Share wiki

Bookmark

Lombard Finance

0%

Lombard Finance

Lombard Finance 是一个去中心化金融 (DeFi)平台,旨在通过其主要代币 Lombard Staked BTC (LBTC) 提供质押、借贷和其他去中心化金融服务,从而扩展 比特币 在 DeFi 生态系统中的实用性。 [1]

概述

Lombard Finance 专注于通过将 比特币 集成到 去中心化金融 (DeFi) 中来提高 比特币 的效用。Lombard 认识到 比特币 1.5 万亿美元的市值中的很大一部分通常处于非活跃状态,因此旨在将这部分资本中的一小部分转化为 DeFi 系统中的活跃用途。该公司推出了 LBTC,这是一种建立在 Babylon 上的 流动性质押 代币 (LST),使 比特币 持有者能够获得收益并为网络安全做出贡献,同时保留底层资产。这种方法旨在将 比特币 的经济价值与 质押 和 DeFi 机会联系起来,从而增强其在数字经济中的作用。 [5]

功能

Lombard Ledger

Lombard Ledger是一个在Cosmos下运行的权威证明应用链,通过提供所有操作的透明链上记录,构成Lombard协议的骨干。安全联盟维护并验证此账本——一个由独立的、与比特币一致的数字资产机构组成的网络,确保每个交易都经过多方签名。这种去中心化的验证方法消除了任何单点故障,并使用多方批准和时间锁来增强协议的安全性和完整性。

安全联盟负责验证比特币存款,授权LBTC的铸造和赎回,通过Babylon生态系统促进质押交易,并安全地管理跨链桥接,并具有额外的安全措施,如Chainlink CCIP。除了管理协议升级外,联盟还监督BSN奖励的收集和分配,同时维护一个拜占庭容错账本,该账本提供所有活动的可验证和不可变的记录。 [7] [8]

Luminary Program

Lux和Luminary计划是Lombard为奖励用户参与LBTC生态系统而推出的长期计划。Lux通过质押 BTC、持有LBTC或在批准的DeFi集成中使用LBTC来获得。仅LBTC就以基于数量和持续时间的速率累积Lux。用户还可以通过将LBTC存入高倍增选项(如Lombard DeFi Vault)或参与“LBTC in DeFi”页面上列出的白名单DeFi平台来获得更高的Lux奖励。建议在一个地址中累积奖励以提高效率,并且直接质押到Babylon的Finality Provider不符合Lux的资格。

除了定期累积之外,还可以通过特殊的Luminary计划活动来获得Lux。这些活动包括闪电机会、社区驱动的挑战(如推荐或内容创作)以及对持续参与的回溯奖励。Lux余额由Sentio跟踪,Sentio监控钱包和DeFi活动以计算持有量和持续时间。用户可以通过连接他们的钱包在Lombard App上查看他们的Lux。该计划通过提供透明和持续的激励措施,帮助用户参与与LBTC的增长保持一致。[4]

CubeSigner

CubeSigner是由Cubist开发的非托管密钥管理平台,集成了安全硬件,用于保护Lombard基础设施中使用的加密密钥。通过将密钥存储在HSM密封的Nitro enclave中,CubeSigner确保密钥永远不会暴露,即使对Cubist或Lombard也是如此,从而防止盗窃和未经授权的访问。签名会话在范围上受到限制,有时限且可撤销,从而降低了违规和内部威胁的风险。此外,每个密钥的策略控制密钥的使用,例如要求多方批准大型交易。CubeSigner还包括针对Babylon的特定保护措施,例如反削减措施,以防止验证者因操作错误而签署有害消息。

在Lombard的架构中,CubeSigner生成并管理与自定义、硬件强制执行的策略相关的比特币密钥——Cubist称之为链下、硬件固化的智能合约。这些策略定义了访问控制、交易类型、使用限制、多方授权和基于时间的限制。例如,用户密钥仅限于特定的Babylon交易类型,并且需要受信任的交易对手进行存款和取款。多方授权确保敏感操作需要多个签名者和身份验证因素,而时间锁通过强制延迟(即使对于已批准的操作)来增加另一层安全性。这种架构使Lombard能够安全地管理密钥,同时保持运营灵活性和去中心化。 [9]

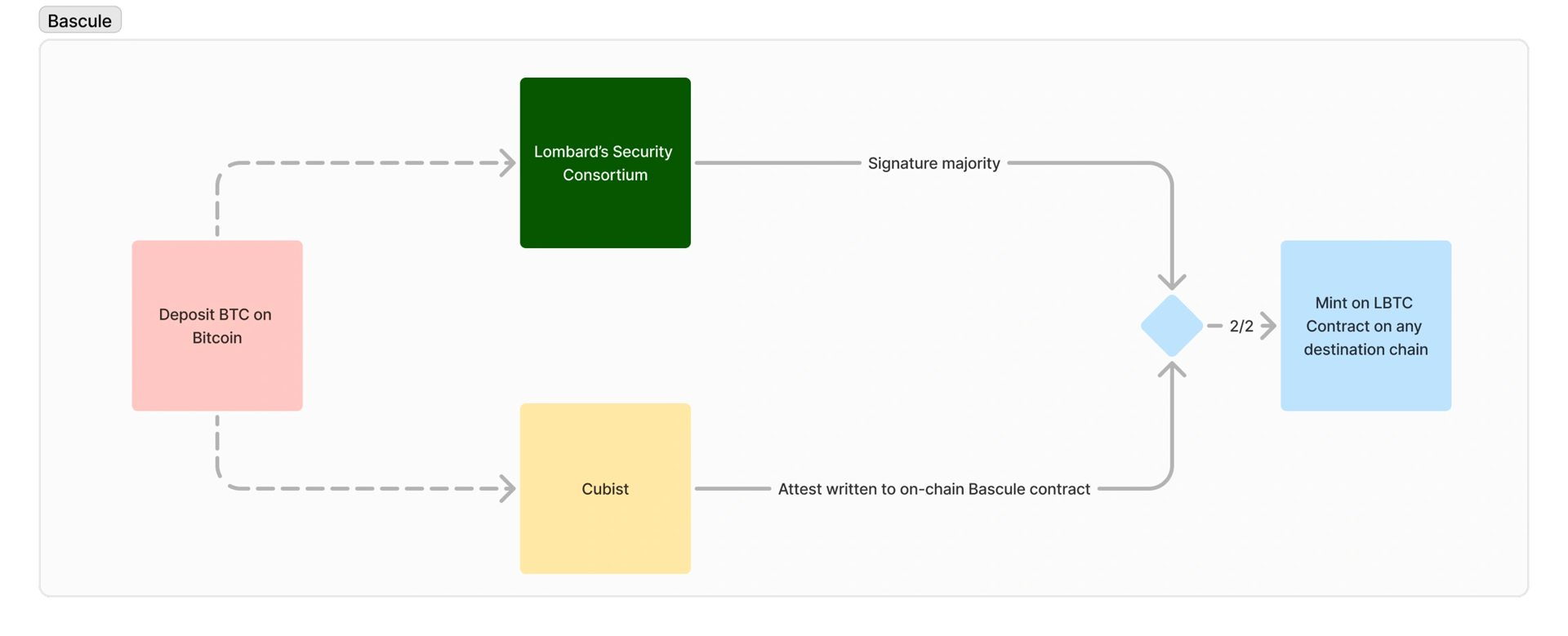

Bascule Drawbridge

Bascule Drawbridge 是 Lombard 架构中增加的一层安全保障,由 Cubist 独立运营,用于验证安全联盟执行的操作。它作为一个状态预言机,通过其智能合约验证受支持的目标链上 Bitcoin 网络数据的准确性。这种机制使 Bascule 能够充当二级权威,确保所有 Bitcoin 存款在被确认之前都经过六个区块确认。要铸造 LBTC,需要安全联盟的有效签名和 Bascule Drawbridge 的匹配证明,从而创建一个双重验证过程,增强对跨链桥漏洞的抵抗力。

Reverse Bascule Drawbridge 在链下运行,处理 LBTC 赎回。当用户发起赎回功能时,LBTC 在链上被销毁,Cubist 监控这些事件。经过确认期后,赎回状态被写入 CubeSigner。然后,CubeSigner 验证赎回是否发生,然后继续由联盟发起的 Bitcoin 提款。这种双向检查(链上和链下)确保了 Bitcoin 和 LBTC 生态系统之间的准确性和一致性,从而最大限度地降低了虚假或未经授权交易的风险。 [10]

PMM 模块

PMM(Private Market Maker)模块是由 Lombard 协议部署在特定区块链上的智能合约,旨在改善持有 BTC 衍生资产(如 BTCB)用户的入门体验。它允许在预定义的风险限额内将这些资产兑换为 LBTC,同时确保大部分 LBTC 仍由原生 比特币 支持。该模块根据兑换的资产收取费用,仅作为方便用户的功能,而非用于金融套利。如果检测到滥用行为,可能会实施额外的安全限制。

在 BNB 智能链 等链上,PMM 促进 BTCB 到 LBTC 的转换,同时跟踪可用于铸造的 LBTC 数量,并收取费用以支付运营成本。这些智能合约确保临时、有上限地暴露于非原生 比特币 资产,从而维持 LBTC 的稳定性。以这种方式获得的任何 BTC 都会被质押到 Babylon,以保持资产的底层 比特币 支持。 [11]

LBTC

LBTC是一种流动性强、能产生收益的比特币代币,与BTC保持1:1的抵押,专为跨链使用而设计。它将比特币集成到DeFi生态系统中,同时保留了资产的原始安全性。LBTC支持在主要区块链网络之间移动,而不会分散流动性,并且可以用作各种DeFi应用中的抵押品,例如借贷和交易。

LBTC通过Babylon质押和其他机制赚取原生收益,并通过参与支持的协议和生态系统获得额外奖励。其安全模型依赖于联盟结构,以提供比中心化或未经验证的封装代币更强大的替代方案。持有者可以通过使用LBTC参与DeFi活动来增加回报。 [6]

DeFi Vault

Lombard DeFi Vault 是一个自动化的收益管理系统,旨在将 比特币 支持的资产(如 LBTC、wBTC、eBTC 和 cbBTC)分配到各个 DeFi 协议中,以优化回报。该 Vault 与 Veda 合作开发,通过自动化策略选择、执行和奖励复利,降低了参与 DeFi 的复杂性。

用户将支持的 比特币 衍生品存入 Vault,并获得 LBTCv 代币,该代币代表他们在 Vault 总余额中的份额,包括本金、收益和额外的基于积分的奖励。该 Vault 将资金分配到各种策略中,例如 Uniswap 和 Curve 流动性提供、Gearbox 和 Morpho 借贷,以及通过 Pendle 进行的收益交易。性能会得到积极管理和重新平衡。

收益会自动再投资,奖励按比例分配给 LBTCv 持有者。提款通过队列处理,通常在三天内完成,并且可能包括少量费用,具体取决于代币类型。此外,还会奖励额外的积分激励,目前 以太坊 和 Base 网络上支持存款。 [12]

融资

2024年7月,Lombard Finance在由Polychain Capital领投的种子轮融资中筹集了1600万美元,以支持与Babylon合作开发的比特币再质押生态系统。参与者包括BabylonChain、dao5、Franklin Templeton、Foresight Ventures、HTX Ventures、Mirana Ventures、Mantle EcoFund、Nomad Capital、OKX Ventures和Robot Ventures,以及Bitget、Bybit、OKX和HTX等交易所对LBTC流动性和更广泛的DeFi集成提供的额外支持。

Lombard的工作重点是使用Babylon的协议,使比特币能够作为权益证明(PoS)系统中的抵押品,该协议允许BTC以原生和自托管的方式进行质押,以保护PoS网络。该团队成员包括来自Argent、Coinbase和Maple等公司的经验丰富的人员。Babylon由David Tse和Fisher Yu博士于2022年创立,致力于开发基础设施,将比特币的效用扩展到PoS生态系统中,同时保持其安全属性。 [2][3]

合作伙伴

- EigenLayer

- Babylon

- Polychain Capital

- Franklin Templeton

- OKX

- ByBit

- ether.fi

- Maple

- Chainlink

- Sui

- Pendle

- Veda

- Immunefi

- Halborn

发现错误了吗?