위키 구독하기

Share wiki

Bookmark

Ramses

0%

Ramses

Ramses는 자동화된 마켓 메이커 모델을 사용하는 Arbitrum 기반의 탈중앙화 거래소입니다. 이 프로토콜은 RAM 토큰과 veNFT를 활용하며, 토큰 로커가 특정 토큰 쌍에 프로토콜 배출량을 할당할 수 있도록 하여 유동성을 장려합니다. 그 대가로 로커는 희석 방지 리베이스, 선택한 쌍에서 생성된 스왑 수수료의 일부, 그리고 이러한 쌍으로 향하는 모든 인센티브를 받습니다. [1]

개요

Ramses는 Andre Cronje가 설계한 ve(3,3) 모델을 사용합니다. 이 프로토콜은 다른 거래소와 같이 모든 프로토콜 수수료의 일부를 토큰 잠금 사용자에게 분배하는 대신, 사용자가 토큰 배출량을 받기 위해 투표하는 풀을 기반으로 스왑 수수료를 할당합니다. [2]

Ramses는 설계된 반복적인 가격 결정 함수를 사용하여 거의 제로에 가까운 슬리피지를 달성합니다. Ramses는 또한 사용자 또는 프로젝트가 특정 풀에 토큰 배출량을 할당할 수 있도록 하는 "뇌물"로 알려진 메커니즘을 통합합니다. 이는 초기 단계에서 프로젝트에 대한 초기 유동성 지원을 제공하는 데 도움이 됩니다. [3]

이 거래소는 Liquity, The Ennead, Frax Finance, Liquid Driver, fBOMB, Shrapnel DAO, DEUS, Tarot, YFX, Angle, EI-Ramses, Oath, Inverse Finance, QiDAO, xCAD, GND Protocol, GMD Protocol, Gains Network, Firebird, Jarvis Network, Radiant Capital, DAOMaker, Beefy, Yearn, Granary, Vela Exchange, UNIDEX, Root, Ankr Network, Alchemix, Olympus DAO, Gamma, BLOTR Protocol, Arken Finance, SYMM I / O, Gravita Protocol, Muon, Ethos Reserve, PaintSwap, Swell Network, DefiEdge, Ichi, Davos Protocol, 1inch, Paraswap, Odos, Kyberswap, LayerZero, Axelar, Savvy 등과 파트너십을 맺고 있습니다. [4]

기능

스왑

슬리피지 및 거래 가격은 유동성 쌍에 잠긴 총 가치와 차익 거래 활동이 풀을 시장 가격과 동일하게 만들었는지 여부에 따라 계산됩니다. Ramses는 서로 다른 스왑 곡선을 가진 두 가지 유형의 유동성 풀을 도입합니다. [5]

- 변동성 (UniV2 스타일): 이 유형의 풀은 토큰 쌍에 대해 동일한 달러 가치 가중치를 사용합니다. 변동성 스왑 곡선은 이러한 풀 내에서 거래를 실행하는 데 사용됩니다. [5]

- 상관 관계 (Andre 스타일): RAMSES는 다른 DEX에 비해 효율성으로 알려진 안정적인 스왑 곡선을 활용합니다. 이 곡선은 슬리피지를 최소화하고 안정적인 스왑에 대한 그의 혁신적인 접근 방식을 반영하는 것을 목표로 합니다. [5]

투표

veRAM NFT는 투표 프로세스를 통해 LP 토큰 쌍에 배출량을 할당하는 역할을 합니다. 배출량은 주어진 시대의 투표 비율에 따라 분배됩니다. [6]

뇌물

Ramses 내에서 두 가지 유형의 뇌물이 제공됩니다. [7]

- 투표 뇌물: 사용자와 프로토콜은 유권자에게 보상을 제공할 수 있습니다. 이는 유권자가 배출량을 위해 특정 토큰 쌍을 선택하도록 장려합니다. 투표에 대한 대가로 보상을 제공하는 사용자는 보상의 일부를 받습니다. [7]

- 게이지 뇌물: 배출량 외에도 토큰은 LP (유동성 공급자) 스테이커에게 직접 뇌물로 제공될 수 있습니다. 이는 특정 토큰 쌍의 유동성 확장을 장려하며, 특히 RAMSES AMM 내에서 유동성을 효율적으로 시작하는 것을 목표로 하는 프로토콜에 유리합니다. [7]

베스팅 (veNFT 관리)

veRAM을 관리하기 위해 사용자는 잠금을 생성하고 잠금 금액 늘리기, 잠금 길이 늘리기 및 veRAM 포지션 병합을 통해 관리할 수 있습니다. [8]

LP 스테이킹

RAMSES 모델에서 LP 공급자는 모든 수수료가 veRAM 보유자에게 전달되므로 스왑 수수료를 받지 않습니다. 대신 스테이킹 게이지는 사용자가 LP 토큰을 공급하도록 장려하는 데 사용되어 경쟁력 있는 APR을 얻을 수 있습니다. 쌍에 할당된 투표 수가 많을수록 후속 시대에 게이지에 분배될 RAM의 양이 많아집니다. 사용자의 게이지 부스트는 각 LP 포지션에 대한 보상률에 영향을 미칩니다. [9]

Ramses V2

Ramses V2는 원래 솔리드 모델과 함께 Uniswap V3의 집중 유동성 설계를 통합하여 ve(3,3) DEX 모델을 기반으로 합니다.

집중 유동성

Ramses CL은 뇌물과 집중 유동성을 사용자 정의 구현으로 결합하여 플랫폼 수익의 대부분이 veRAM 유권자에게 전달됩니다. [10]

집중된 범위에서 유동성을 제공하는 유동성 공급자는 더 넓은 가격 범위에서 유동성을 제공하는 공급자보다 더 많은 배출량 또는 보상을 받습니다. 이 모델은 활용된 유동성의 가장 높은 농도와 일치하는 경쟁력 있는 유동성 프로비저닝 및 시장 조성을 장려합니다. veRAM 게이지 부스팅 메커니즘은 Ramses 시스템에 적극적으로 유동성을 기여하는 사용자에게 보상을 제공하여 veRAM의 유용성을 높임으로써 이를 보완합니다. [10]

veRAM 유권자는 투표 뇌물 및 거래 수수료 청구와 같은 추가 기회를 갖습니다. CL 게이지 내의 거래 수수료는 유권자, NFP 및 생태계 인센티브 간에 분배됩니다. 모든 뇌물 보상은 유권자에게 할당됩니다. [10]

수수료 계층

RAMSES V2는 사용자가 집중 유동성 포지션을 설정할 때 고려할 수 있도록 다양한 수수료 계층을 도입합니다. 이러한 계층은 다양한 유형의 자산 쌍을 충족하도록 설계되었습니다. 옵션은 다음과 같습니다. [11]

- 0.01%: 이 계층은 USDC 및 USDT와 같이 상관 관계가 높고 페깅된 자산에 적합하며 유리한 요금을 제공합니다.

- 0.05%: 상당한 거래량을 생성하는 것으로 알려진 USDC/WETH와 같은 경쟁력 있는 자산 클래스에 이상적입니다.

- 0.3%: 앞서 언급한 범주에 속하지 않는 쌍에 대한 표준입니다.

- 1.0%: 변동성이 큰 자산에 맞게 조정되어 관련 위험을 상쇄하기에 충분한 수수료 생성을 제공합니다.

또한 RAMSES V2는 추가 수수료 계층 옵션을 제공합니다.

- 0.005%: USDC-DAI, USDC-USDC.e 및 USDC-USDT와 같은 초안정적인 토큰 쌍을 위해 특별히 설계되었습니다.

- 0.025%: 경쟁력 있는 우량주 쌍에 맞게 사용자 정의되었습니다.

경쟁적 파밍

경쟁적 파밍은 제공된 유동성의 생산성과 경쟁력을 기반으로 LP 공급자에게 보상을 제공하는 방법입니다. 집중 유동성 모델에서 사용자는 LP에 제공하려는 특정 유동성 범위를 선택할 수 있는 유연성을 갖습니다. 이를 통해 사용자는 광범위한 틱 값 중에서 선택할 수 있어 높은 수준의 사용자 정의가 가능합니다. [12]

RAM 토큰

RAM은 Ramses의 기본 토큰입니다. 사용자가 플랫폼에서 RAM을 잠그면 토큰 배출량 할당에 대한 투표에 활용할 수 있는 veRAM을 받게 되며, 결과적으로 어떤 풀이 유동성을 받는지 결정합니다. 사용자 포지션은 veNFT (투표 에스크로 대체 불가능한 토큰)를 사용하여 관리할 수 있습니다. [13][10]

토큰 분배

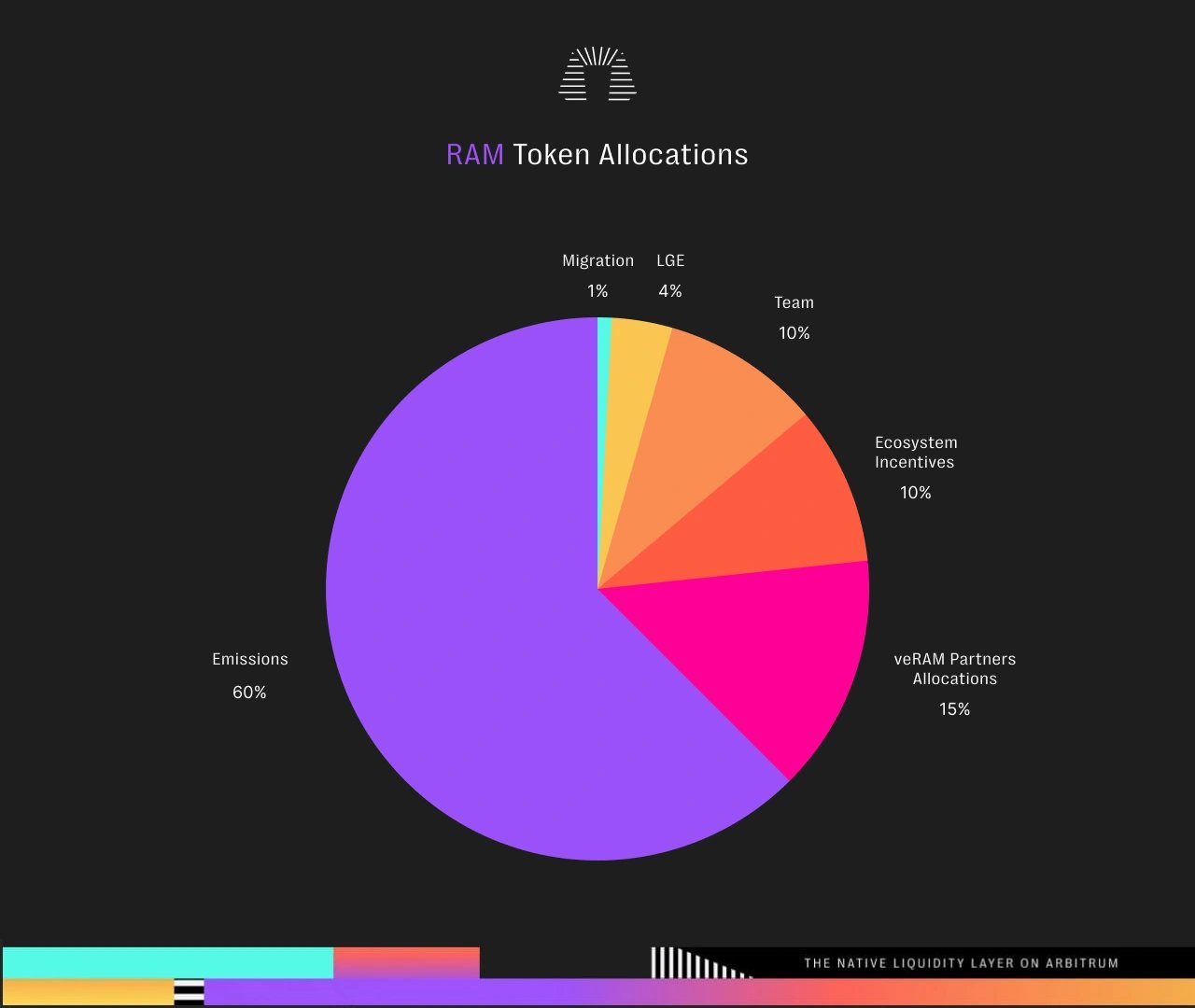

총 터미널 공급량은 500,000,000 RAM 토큰입니다. 이 중 초기 분배는 125,000,000 RAM 토큰으로 구성되며, 75,000,000 토큰은 veRAM으로 지정됩니다. [13]

총 공급량에서 1%는 moSOLID 마이그레이션 보너스, 4%는 LGE, 10%는 팀, 10%는 생태계 인센티브, 15%는 파트너 veRAM 할당, 60%는 배출량에 할당됩니다. [13]

토큰노믹스

RAMSES의 (3,3) 모델 채택에는 희석을 완화하는 메커니즘이 포함되어 있습니다. 처음에는 veRAM 보유자가 주간 50% 리베이스를 받아 프로토콜의 배출 일정으로 인한 희석을 상쇄하는 데 도움이 됩니다. 시간이 지남에 따라 이 백분율은 후속 시대 (주)마다 1%씩 증가하여 시대당 최대 75%의 희석 방지 한도에 도달합니다. [14]

veRAM (veNFT)

veNFT는 베스팅된 투표 에스크로 (ve) 모델을 구현하는 특수 ERC-721 토큰으로, 사용자의 기본 포지션을 나타냅니다. 이는 게이지 배출량, 투표 뇌물 및 스왑 수수료를 얻기 위한 풀에 투표하는 기능, NFT 포지션을 전송하거나 병합하는 기능 등 RAMSES 생태계 내에서 다양한 기능을 제공합니다. 또한 veNFT는 리베이스를 통해 희석으로부터 보호합니다. [15]

PaintSwap을 기반으로 하는 RAMSES Bazaar는 veRAM 거래 및 물물 교환 활동을 위한 마켓플레이스입니다. [16]

xoRAM

XoRAM은 xoRAM 토큰 스마트 계약 내에 안전하게 저장된 1단위의 RAM을 나타내는 양도 불가능한 표현입니다. 이는 사용자에게 RAM 및 veRAM 모두에 대한 다양한 변환 옵션을 제공하며, 각 옵션에는 특정 페널티 및 베스팅 기간이 수반됩니다. [17]

사용자는 특정 영향이 낮은 유동성 쌍에서 투표 뇌물 및 배출 분할을 통해 xoRAM을 얻을 수 있습니다. 각 게이지는 DEX의 건전성에 대한 유동성 쌍의 영향을 기반으로 RAM/xoRAM의 일부를 받을 수 있습니다. 코어 쌍은 액체 RAM에서 배출량의 대부분 또는 전부를 받게 됩니다. 반대로 거래량과 수수료 생성이 매우 낮은 쌍은 xoRAM에서 더 높은 비율의 배출량을 받게 됩니다. [18]

팀

팀은 두 명의 공동 창립자 DOG와 North, 프런트 엔드 개발자 Mali, 스마트 코트랙트 개발자 Ren, 고문 Lafa와 Dudesahn, 관리자 King, 커뮤니티 관리자 Achi로 구성됩니다. [19]

잘못된 내용이 있나요?