Subscribe to wiki

Share wiki

Bookmark

Aerodrome Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Aerodrome Finance

Aerodrome Finance is a decentralized exchange on the Base network that integrates multiple automated market maker models into a unified platform. It is a central hub for trading, liquidity provisioning, and governance within the Base ecosystem. [5]

Overview

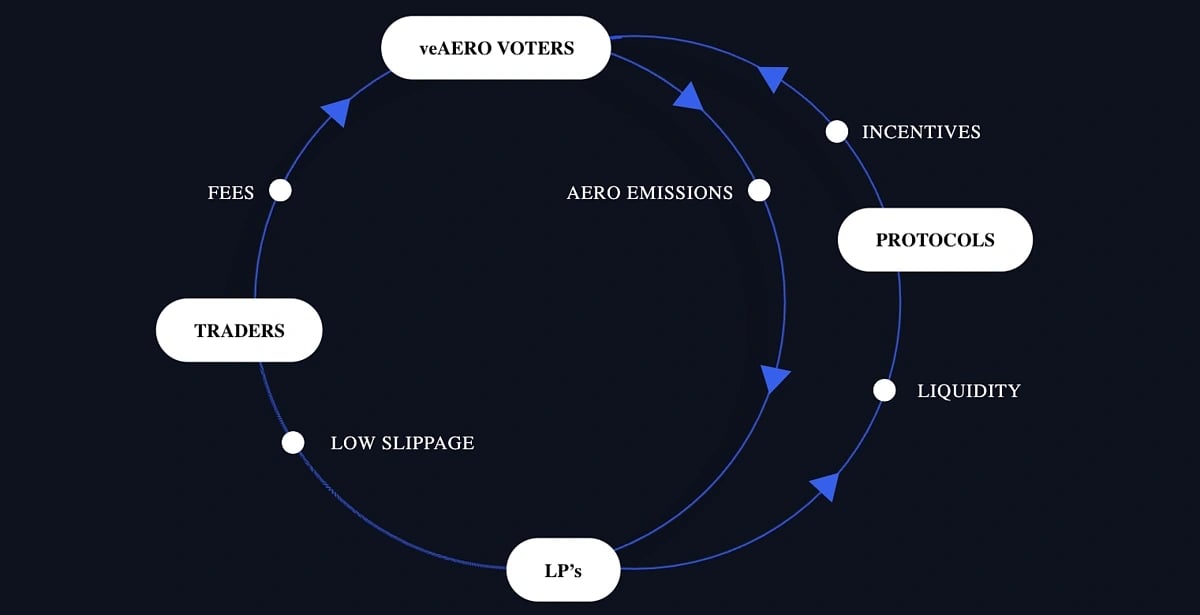

Aerodrome Finance is a decentralized exchange on the Base blockchain launched on August 28, 2023. It combines features from various AMM models—including Uniswap V2 and V3, Curve, and Convex—to serve as the primary liquidity hub for Base. The platform enables token swaps, generates trading fees, and incentivizes liquidity provision through AERO token emissions. Users can lock AERO to receive veAERO, which grants governance rights and a share of protocol fees.

Developed by the creators of Velodrome on Optimism, Aerodrome builds on elements of the Solidly protocol and applies them to Base, an Ethereum Layer 2. Without a native Base token, AERO is the main incentive and governance asset. Coinbase Ventures participates in the protocol by locking AERO tokens and voting on emissions, reinforcing Aerodrome’s strategic role within the Base ecosystem. [6]

Features

Flight School

Flight School is a recurring incentive program on Aerodrome Finance that distributes bonus veAERO to users who create new token locks. To qualify, a user must lock at least 2,500 veAERO during four weeks, referred to as a "class." At the end of each class, bonus distribution is proportional to each participant's share of the total qualifying veAERO. Coinbase One members receive a 1.3x weighting on their locks for bonus calculations. Since its launch, the program has distributed over 42.6 million AERO in veAERO form. [7]

AERO Fed

The AERO Fed is a governance mechanism on Aerodrome Finance that allows veAERO holders to influence the emission rate of AERO tokens. Initially, AERO emissions followed a fixed schedule, decreasing by 1% each week. Starting at epoch 67 (December 4, 2024), this system transitioned to a smart contract-controlled process, enabling veAERO voters to adjust emissions weekly by increasing, decreasing, or maintaining the current rate within set limits.

The AERO Fed aims to align emissions policy with market conditions and ecosystem needs. Emissions can range from a maximum of 1% of total supply per week (52% annualized) to a minimum of 0.01% (0.52% annualized). During the initial implementation phase, emissions are automatically reduced while the community becomes familiar with the new system. Once the transition ends, veAERO holders will take full control of emission adjustments through on-chain voting. [8]

Slipstream

Slipstream is Aerodrome’s custom implementation of concentrated liquidity pools, designed to improve capital efficiency and trading execution on the Base network. It offers up to 10 times higher trading volume per unit of TVL than standard clAMM pools, using customisable tick spacing, optimized fees, and a tailored fee algorithm. As its share of Base trading volume grows, veAERO voters benefit from increased fee rewards, reinforcing Aerodrome's liquidity incentives. [9]

ALM V2

ALM V2, introduced by Mellow and integrated by Aerodrome in January, updates Automated Liquidity Management for liquidity providers. The upgrade features strategies that automatically adjust with dynamic parameters, streaming rewards, vault caps to manage security and exposure, and optimizations for liquid staking and restaking tokens. It is designed to simplify participation in Slipstream and improve the overall efficiency of liquidity provision. [11]

Pool Launcher

Aerodrome’s Pool Launcher is a permissionless feature that enables the creation of liquidity pools for any token on its platform. It utilizes a guided process that enables users to set up either standard or concentrated pools, add liquidity through paired or single-sided deposits, and lock liquidity natively to signal a long-term commitment. The system supports emerging tokens, which can be flagged in the interface to make them more visible for trading and deposits.

Pools launched this way earn all swap fees directly, with no share taken by the platform, allowing creators to capture revenue or fund incentive programs. In addition, pools that meet certain criteria can automatically transition into emission-based pools, integrating with Aerodrome’s broader incentive structure without requiring migration. This setup combines ease of use with mechanisms for visibility, fee capture, and scalability within Aerodrome’s liquidity marketplace. [11]

AERO

The AERO token is an ERC-20 asset that rewards liquidity providers on Aerodrome Finance. While it can be traded or used in liquidity pools, its main function is to be locked for governance participation and incentive alignment. All tokens held by the Aerodrome Foundation are locked, with no liquid vesting allocations for contributors or team members, placing them on equal footing with other participants in the system. [2] [10]

veAERO

veAERO is an ERC-721 non-fungible token representing locked AERO tokens for governance purposes on Aerodrome Finance. Users can lock AERO for up to four years to receive veAERO, with voting power increasing linearly based on the length of the lock period. For example, 100 AERO locked for four years equals 100 veAERO, while the same amount locked for one year yields 25 veAERO. Additional AERO can be added to an existing veAERO NFT, and these tokens are used to participate in governance decisions. [10]

Tokenomics

AERO and veAERO have the following allocation: [10]

- veVELO Lockers airdrop: 40%

- Public Goods Fund: 21%

- Foundation: 19%

- Flight School: 10%

- Voter Incentives: 8%

- Genesis Liquidity Incentives: 2%

Funding

In February 2024, Aerodrome Finance received an investment from the Base Ecosystem Fund, a program led by CB Ventures to support on-chain projects within the Base network. While the amount was not disclosed, the investment signaled strategic backing for Aerodrome, which held a 30% market share on Base and over $132 million in total value locked at the time, according to DeFiLlama. The fund had previously supported other Base-based projects such as Avantis, BSX, Onboard, and Truflation. Aerodrome described the investment as a step toward deeper collaboration in advancing Base’s infrastructure and liquidity ecosystem. [3] [4]

Partnerships

- Base

- Coinbase

- Tairon AI

- Reserve Protocol

- Neiro

- Spheron

- FLock

- Syndicate

- AubrAI

- Tig Foundation

- Retake

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)