Subscribe to wiki

Share wiki

Bookmark

BlackRock USD Institutional Digital Liquidity Fund (BUIDL)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

BlackRock USD Institutional Digital Liquidity Fund (BUIDL)

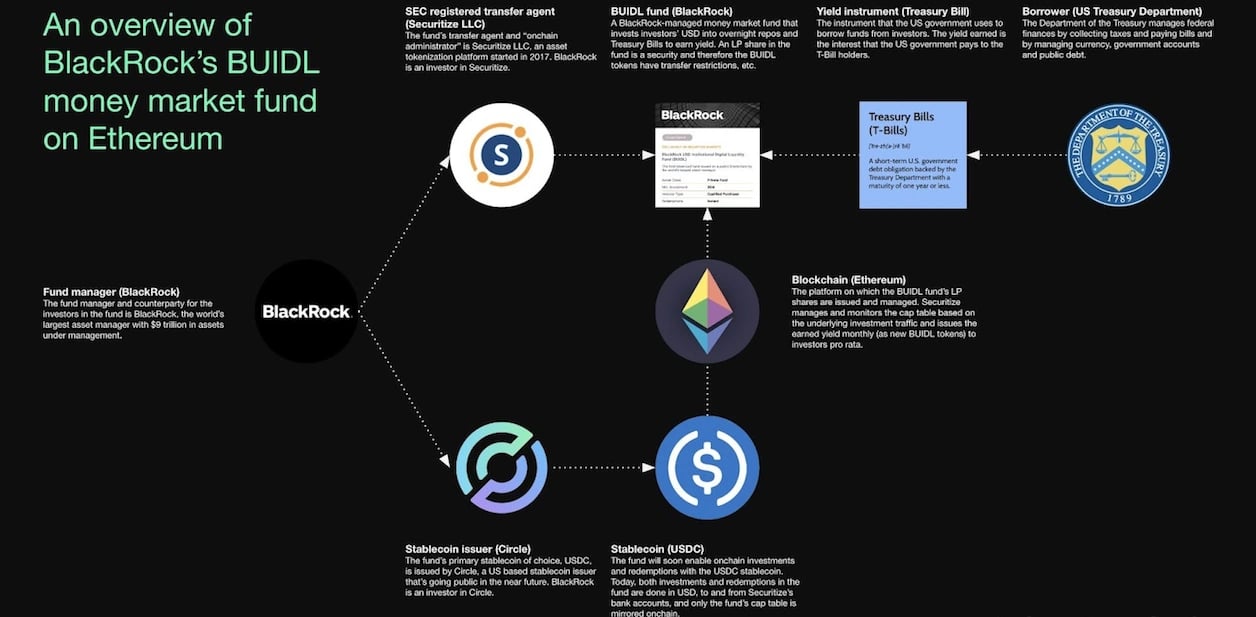

BlackRock USD Institutional Digital Liquidity Fund (BUIDL) is a tokenized money market fund launched by BlackRock, the world's largest asset manager. With over $2.5 billion in assets under management as of November 2025, it is the largest tokenized money market fund on public blockchains, designed to provide institutional investors with U.S. Treasury yields while maintaining the security and liquidity of traditional money market investments. [16] [1]

Overview

The BlackRock USD Institutional Digital Liquidity Fund (BUIDL) represents BlackRock's strategic expansion into the cryptocurrency domain. Launched in March 2024, the fund integrates blockchain technology with traditional money market funds. [16] Initially launched on Ethereum, BUIDL has since expanded and now operates across eight blockchains, including Solana and BNB Chain, allowing investors to leverage blockchain's ledger and payment capabilities. [2] [17] This initiative aligns with the financial sector's broader trend towards tokenization, which involves transitioning financial assets from traditional formats to blockchain-based systems. BUIDL is built on blockchain technology, enabling faster settlement times, enhanced transparency, and improved operational efficiency compared to traditional financial instruments.

As a money market fund, BUIDL primarily invests in short-term, high-quality debt securities, including U.S. Treasury bills, commercial paper, and other cash-equivalent instruments. The fund aims to maintain a stable net asset value (NAV) while providing competitive yields to institutional investors. BUIDL is integrated into the broader sector of real-world asset (RWA) tokenization, and the increasing interest in BlackRock's fund indicates a rising institutional demand for tokenized RWAs, driven by improved regulatory clarity, as noted by Edwin Mata, co-founder and CEO of Brickken, a European RWA platform. [1] [3] [8]

Key Features

BUIDL offers several distinctive features that differentiate it from both traditional money market funds and other digital assets:

- Tokenization: The fund's shares are represented as digital tokens on a blockchain, enabling programmable functionality and integration with digital asset ecosystems.

- Institutional Focus: Unlike many digital assets, BUIDL is specifically designed for institutional investors, with appropriate compliance, security, and reporting features.

- Regulatory Compliance: The fund operates within existing regulatory frameworks for money market funds while leveraging blockchain technology.

- Stability: As a money market fund, BUIDL aims to maintain a stable value, making it less volatile than many cryptocurrencies.

- Liquidity Management: The fund provides institutional-grade liquidity management with the efficiency benefits of blockchain technology.

- Ecosystem Integration: BUIDL can potentially integrate with various blockchain protocols and decentralized finance (DeFi) applications.

- Collateralization: The tokenized shares can be used as off-exchange collateral for institutional trading on exchanges like Binance, which increases capital efficiency for traders. [16]

Technology Infrastructure

The technological foundation of BUIDL combines traditional financial infrastructure with blockchain technology:

- Blockchain Platform: The fund operates on a multi-chain basis to enhance accessibility. Originally launched on Ethereum, BUIDL has since expanded to include Aptos, Avalanche, Arbitrum, BNB Chain, Optimism, Polygon, and Solana. [18]

- Smart Contracts: The fund likely employs smart contracts to automate various aspects of fund management, including issuance, redemption, and dividend distribution.

- Custody Solutions: BlackRock has implemented institutional-grade digital asset custody solutions to secure the fund's tokenized assets.

- Integration Capabilities: The technology stack includes integration capabilities with traditional banking systems, allowing for seamless movement between conventional financial rails and blockchain-based systems. For integration with digital asset exchanges, BUIDL is compatible with institutional custody solutions like Ceffu, Binance's custody partner. [18]

- Compliance Mechanisms: The infrastructure incorporates automated compliance mechanisms to ensure adherence to KYC/AML requirements and other regulatory obligations.

Investment Strategy

BUIDL's investment strategy follows traditional money market fund principles while leveraging the advantages of blockchain technology:

- Asset Allocation: The fund primarily invests in short-term, high-quality debt instruments, including U.S. Treasury securities, government agency debt, certificates of deposit, commercial paper, and other money market instruments.

- Risk Management: BUIDL employs conservative risk management practices typical of money market funds, focusing on capital preservation and liquidity.

- Yield Generation: The fund aims to provide competitive yields compared to traditional money market funds, potentially enhanced by operational efficiencies gained through blockchain technology.

- Liquidity Management: The investment strategy prioritizes maintaining sufficient liquidity to meet redemption requests while optimizing returns.

Tokenomics

BlackRock Token (BUIDL)

The fund is available on multiple blockchains, including Ethereum, Polygon, Avalanche, Optimism, Arbitrum, Aptos, Solana, and BNB Chain. [4] [5] [17]

Token Utility

- Asset-Backed Tokens: BUIDL tokens represent shares in the underlying money market fund, with each token backed by the fund's portfolio of short-term debt securities.

- Value Stability: Unlike many cryptocurrencies, BUIDL aims to maintain a stable value, similar to traditional money market funds.

- Collateralization: The tokenized shares serve as an interest-bearing collateral option, enabling institutional clients to back trading activities on exchanges like Binance without liquidating their holdings. [16]

- Supply Dynamics: The token supply expands and contracts based on investor inflows and outflows to the fund, rather than following a predetermined issuance schedule.

- Yield Distribution: Returns generated by the underlying assets are distributed to token holders as daily dividend payouts in the form of new tokens. [17]

- Redemption Mechanism: Token holders can redeem their tokens for the underlying value of the fund's assets, providing a direct correlation between token price and fund NAV.

Partnerships

AI Infrastructure Partnership (AIP)

BUIDL has formed strategic partnerships with Global Infrastructure Partners (GIP), Microsoft, MGX, NVIDIA, xAI, GE Vernova, and NextEra Energy as part of the AI Infrastructure Partnership (AIP). This collaboration focuses on investing in AI-ready data centers and energy infrastructure, addressing the growing demand for computational resources.

NVIDIA and xAI contribute technical expertise in AI acceleration and data center infrastructure, while GE Vernova and NextEra Energy work on energy solutions to support AI growth. The partnership aims to mobilize up to $100 billion in investments by leveraging capital from private and institutional investors.

BUIDL's involvement in AIP aligns with efforts to develop an open-architecture AI ecosystem, ensuring scalability and broad industry participation across the U.S., OECD nations, and key partner regions. [6] [7]

Ondo Finance & BUIDL

Ondo Finance has partnered with BlackRock's BUIDL to enhance liquidity within blockchain ecosystems. This collaboration aims to increase investor participation and leverage blockchain technology for improved asset management and liquidation. Ondo Finance, a significant partner in the BUIDL project, plans to diversify its reserves across five new blockchains by integrating BUIDL with its OUSG product, which supports decentralized treasury holdings. This initiative seeks to enhance liquidity across blockchain networks, fostering a more efficient trading environment for Ondo's investors. [9]

Integration with Frax Finance

In early 2025, Frax Finance introduced a new stablecoin, frxUSD, structured to be backed by tokenized assets held in the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). The issuance of frxUSD marked a use case in which on-chain stable value was collateralized by shares in a traditional asset fund managed by a regulated institution.

The issuance and tokenization of frxUSD are conducted through Securitize, which serves as both the tokenization platform and transfer agent. Each frxUSD token corresponds to an equivalent share in the BUIDL fund. The underlying fund assets include short-term U.S. Treasury instruments, cash, and repurchase agreements, structured to offer capital preservation and daily liquidity.

The shares backing the stablecoin are held in a segregated wallet, with on-chain visibility enabling independent verification of reserves. This model replaces off-chain attestations with blockchain-based auditability, using publicly accessible transaction data to confirm collateral holdings.

According to public disclosures, frxUSD operates within a framework that incorporates regulated securities into a blockchain-based infrastructure. The structure aligns with Frax’s objective of deploying stablecoins backed by real-world assets while integrating with decentralized finance (DeFi) protocols.

BUIDL’s role in this arrangement represents the use of tokenized representations of traditional financial instruments as collateral in stablecoin design. The frxUSD mechanism is positioned within a broader trend of applying fund tokenization to blockchain-native assets, providing new forms of interoperability between financial systems. [10] [11] [12] [13] [14] [15]

Binance and BNB Chain Integration

On November 14, 2025, BlackRock and Binance announced a partnership to integrate the BUIDL fund into the Binance ecosystem. As part of the collaboration, a new share class of BUIDL was launched on the BNB Chain, extending the fund's multichain presence. [17] [18]

A key component of the partnership is Binance's acceptance of BUIDL as off-exchange collateral for its institutional and VIP clients. This feature allows traders to use their yield-bearing BUIDL shares to back trading activities without moving the assets directly onto the exchange, leveraging custody partners like Ceffu. [16] [19]

Catherine Chen, Head of VIP & Institutional at Binance, noted that the move addresses client demand for "more interest-bearing stable assets they can hold as collateral." According to a joint statement, the partnership seeks to establish "BUIDL's role as a foundational building block of onchain finance." [16] [18]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)