Subscribe to wiki

Share wiki

Bookmark

Hyperliquid

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Hyperliquid

Hyperliquid is a decentralized exchange (DEX) built on its Layer-1 blockchain. It combines the efficiency of centralized platforms with the transparency of decentralized systems. The platform provides fast transactions, low fees, and advanced trading tools, including perpetual derivatives, without reliance on intermediaries. [3]

Overview

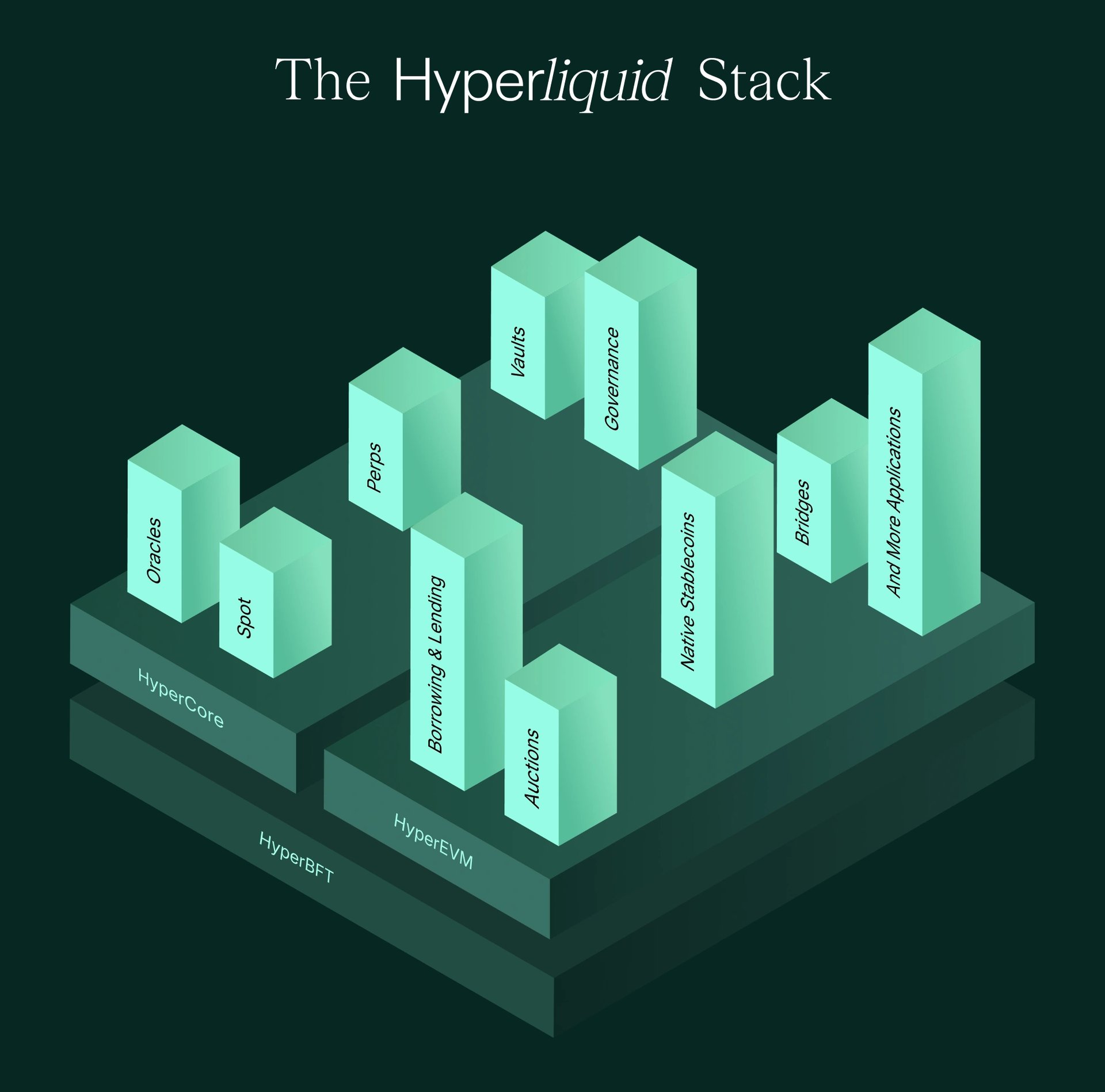

Hyperliquid is a Layer 1 blockchain designed for an on-chain financial system. It integrates liquidity, user applications, and trading activity on a single platform. It uses a custom consensus algorithm, HyperBFT, based on Hotstuff and its successors, optimized for specific requirements.

The blockchain's state execution consists of HyperCore and HyperEVM. HyperCore supports fully on-chain perpetual futures and spot order books, processing up to 200,000 orders per second with a one-block finality. HyperEVM extends Ethereum-compatible smart contract functionality to Hyperliquid, allowing users to build on its financial infrastructure. [2]

Features

HyperEVM

HyperEVM is an integrated Ethereum Virtual Machine (EVM) within Hyperliquid's Layer-1, secured by the same HyperBFT consensus as HyperCore. This design allows seamless interaction between the EVM and HyperCore, enabling the use of assets across spot and perpetual order books. HyperEVM utilizes a dual-block architecture, splitting throughput between fast, smaller blocks and slower, larger blocks to balance transaction speed and block size. Fast blocks occur every 2 seconds with a 2M gas limit, while slow blocks happen every minute with a 30M gas limit. The system’s throughput is expected to increase with future upgrades.

HyperEVM’s smart contracts can interact directly with Hyperliquid’s core functionalities, including on-chain spot and perpetual futures order books, enhancing compatibility with the platform’s trading infrastructure. The execution model of Hyperliquid allows both the L1 and HyperEVM to operate sequentially, enabling the EVM to access the state of the blockchain from the previous block and submit actions for the next block, ensuring consistent and predictable operations. ERC-20 tokens on HyperEVM are fungible with their native counterparts on Hyperliquid, offering minimal fees and deep liquidity for token trading and use within decentralized applications (dApps). [4] [5] [6]

HyperBFT

HyperBFT is Hyperliquid’s consensus algorithm, designed for high-frequency trading while ensuring security and consistency. Based on the HotStuff protocol, it enables block confirmation in under a second, with a median latency of 0.2 seconds and the capacity to process over 200,000 transactions per second. As optimizations continue, throughput could exceed 1 million orders per second. HyperBFT maintains Byzantine Fault Tolerance, allowing the network to function even if up to one-third of validators act maliciously. It also ensures a shared state across Hyperliquid’s Layer-1 and HyperEVM, providing seamless data availability and synchronization. [6]

Vaults

HyperCore vaults enable strategies to leverage the same features as the DEX, including liquidations and high-throughput market-making. Unlike simple token rebalancing vaults, these vaults allow more complex strategies.

Users can deposit into a vault to earn a share of its profits, with vault owners receiving 10% of the total profits. Protocol vaults do not have fees or profit-sharing. Vaults can be managed manually or automated by market makers. Each strategy carries risk, and users should evaluate performance before depositing. [7]

Hyperliquidity Provider

The Hyperliquidity Provider (HLP) protocol vault is designed for market making and liquidation. It earns a share of trading fees. The HLP allows the community to provide liquidity and share in the profits, making strategies typically reserved for select entities more accessible. HLP is fully community-owned and does not collect fees. Profits are distributed proportionally among depositors. Withdrawals are possible four days after the most recent deposit.

HLP aims to offer an alternative to traditional market-making deals often required for liquidity in early-stage DeFi projects, ensuring profits benefit users instead. Hyperliquid’s core contributors, who have a market-making background, initially provided liquidity during closed alpha. To address concerns about potential advantages or asymmetric information, the team’s strategies are housed in a publicly accessible vault.

HLP’s strategy uses tick data from Hyperliquid and centralized exchanges to determine fair prices. It executes orders through market-making and taking strategies to provide continuous liquidity. While the strategy operates off-chain, all vault positions, open orders, trade history, deposits, and withdrawals are visible on-chain for transparency.

Over time, external market makers are expected to contribute large volumes to Hyperliquid. Open-sourcing the API and SDK facilitates onboarding, and increased participation is expected to improve the strategy's risk management and efficiency. [8]

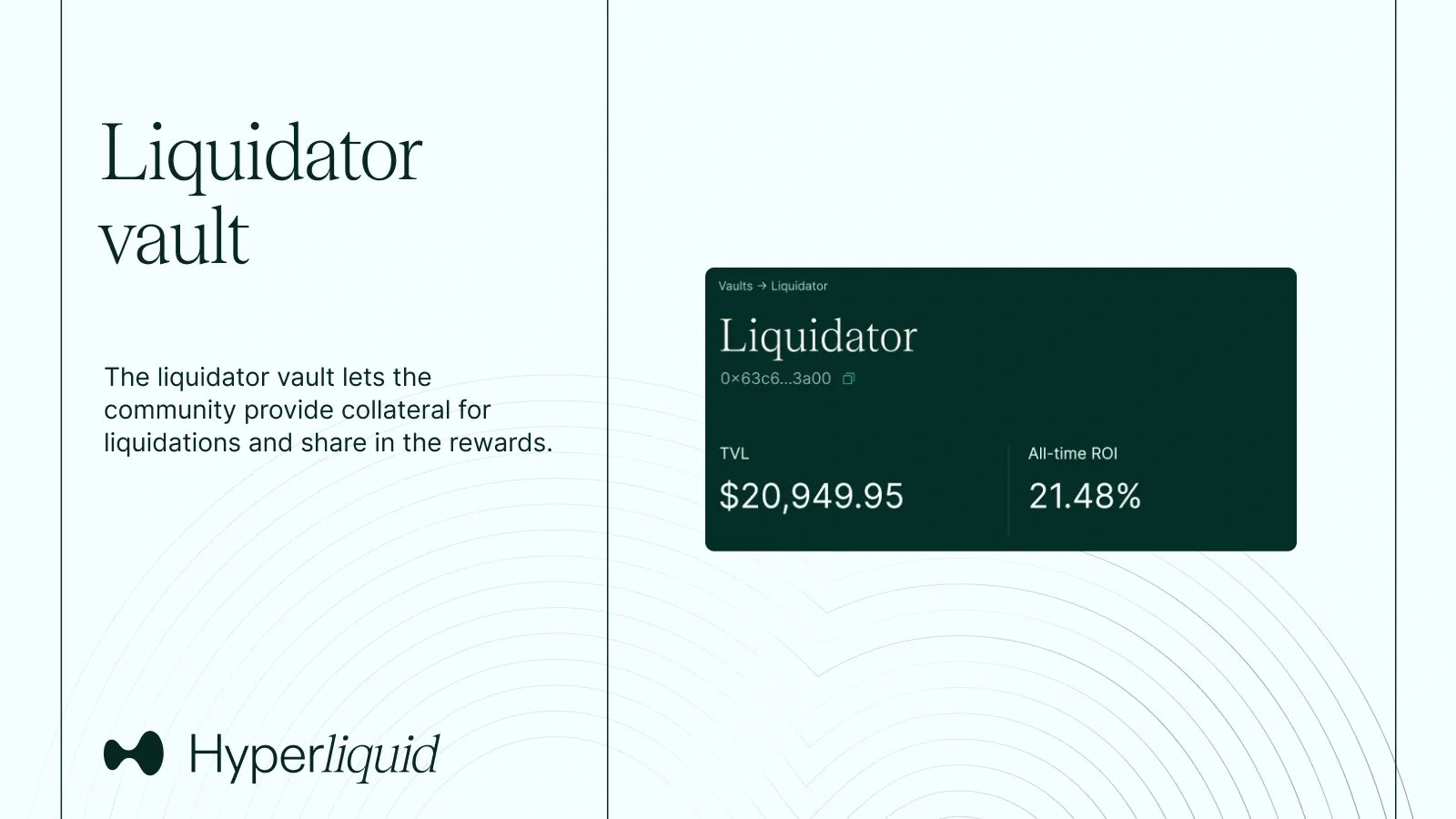

Liquidator Vault

The liquidator vault allows the community to provide collateral for liquidations and share profits. All liquidations occur on-chain and can be tracked through the explorer. Currently, liquidations are decentralized through the liquidator vault, with profits distributed among depositors.

While liquidations may later be accessible via API, the liquidator vault is currently the only way to profit from liquidations. It funds a strategy that capitalizes on liquidations of overleveraged traders, helping maintain stability during volatile periods. Deposits are open to anyone, and withdrawals are allowed after a short lock-up period. The vault only executes trades when a position is liquidatable and exits immediately after liquidation.

The liquidator vault is decentralized and profitable, with performance metrics publicly available. ROI and APY calculations account for historical performance, adjusting for vault lifetime to reduce statistical noise. [9]

HYPE

HYPE is a governance token allowing holders to participate in platform decisions. It can also be used for gas fees on the Hyperliquid blockchain. The total supply is capped at 1 billion tokens.

In 2024, Hyperliquid introduced HYPE through an airdrop. The distribution allocated 75% of tokens to current and future users, with a significant portion going to early participants. Since Hyperliquid did not rely on venture capital funding, most tokens were distributed to the community. Over 20% of HYPE tokens were allocated to core contributors, including Hyperliquid Labs developers. These tokens are set to vest between 2027 and 2028 to mitigate early sell-offs. [1]

Developments

Hyperliquid Delists JELLYJELLY

On Wednesday, 27th of March 2025, Hyperliquid faced a liquidity crisis after Solana-based meme coin JELLYJELLY pumped nearly 500% due to a potential whale manipulation. The pump triggered a temporary 700K profit. [10] [11]

"After evidence of suspicious market activity, the validator set convened and voted to delist JELLY perps. All users apart from flagged addresses will be made whole from the Hyper Foundation. This will be done automatically in the coming days based on onchain data. There is no need to open a ticket. Methodology will be shared in detail in a later announcement." - Hyperliquid tweeted

Hyerliquid added that the perpetuals exchange’s primary liquidity pool, HLP, has clocked a positive net income of around $700,000 in the past 24 hours. [12]

Gracy Chen, CEO of cryptocurrency exchange Bitget, criticized Hyperliquid’s handling of the on its perpetual exchange, saying it put the network at risk of becoming “FTX 2.0.” [13]

“#Hyperliquid may be on track to become #FTX 2.0. The way it handled the JELLY market and force settlement of positions at a favorable price sets a dangerous precedent. Trust—not capital—is the foundation of any exchange (CEX and DEX alike), and once lost, it’s almost impossible to recover. Moreover, the platform's product design reveals alarming flaws: mixed vaults that expose users to systemic risk, and unrestricted position sizes that open the door to manipulation. Unless these issues are addressed, more altcoins may be weaponized against Hyperliquid—putting it at risk of becoming the next catastrophic failure in crypto." [14]

Hyperliquid Facilitates First On-Chain $1B Bitcoin Bet

In May 2025, a trader known as James Wynn, operating under the pseudonym “moonpig,” executed a high-profile leveraged trade on the decentralized exchange Hyperliquid. [15]

Utilizing 40x leverage, Wynn opened a long position on Bitcoin that expanded to over 28.4 million in margin, capitalized on Bitcoin's price movements, yielding significant unrealized profits as the cryptocurrency's value approached $112,000. [17] [17]

Subsequently, Wynn reversed his market stance by closing the long position and initiating a 17 million reduction in overall profits. However, a rapid rebound in Bitcoin's price to $110,000 led to the liquidation of the short position. Despite this setback, Wynn's trading activities have been notable for their scale and impact on market dynamics. [18]

These trading maneuvers have drawn significant attention to Hyperliquid, a decentralized derivatives exchange built on the HyperEVM blockchain. The platform offers features such as real-time order books and deep liquidity without requiring KYC compliance. Wynn's high-stakes trades have not only highlighted the platform's capabilities but also influenced market sentiment and activity, as evidenced by increased on-chain engagement and a surge in the platform's native token, HYPE. [17] [18]

Prediction Markets and Options (HIP 4)

On February 2, 2026, following the passing of Hyperliquid Improvement Proposal (HIP) 4, the platform enabled native prediction markets and options. This feature, introduced as "outcome-based trading," aims to compete with other prediction markets. The prediction markets went live on the platform with initial wagers available on mainnet gas prices and Blast gold odds. [19]

"Outcomes are a work in progress and currently only being tested on testnet. Canonical markets based on objective settlement sources will be deployed once technical development is complete. Canonical markets will be denominated in USDH. Pending user feedback, the infrastructure will be extended to permissionless deployment." - the tweet concluded [20]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)