Subscribe to wiki

Share wiki

Bookmark

Quant Network

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Quant Network

Quant Network is an open-source communication protocol that aims to connect businesses and developers with multiple distributed ledger technologies (DLTs) simultaneously. It is a blockchain network reputed as the first blockchain operating system that bridges blockchains globally without interfering with the efficiency and other properties of the connected distributed ledgers. [1]

Overview

Quant Network was established in 2015 by Gilbert Verdian, Quant Network is a solution to the growing problem of blockchain interoperability, offering an efficient and secure way to communicate with different DLTs. [11]

Quant (QNT) was primarily built to unlock the powers of blockchain technology previously hidden by the fragmented identity and the individualized progress of distributed ledgers. Quant’s network is classified as an interoperability blockchain platform and is powered by its eponymous cryptocurrency, Quant (QNT). Enterprises and developers may not be required to buy QNT tokens, but payment for licenses and other associated fees must be paid for in QNT tokens. [2][5]

The Quant Network operates through Overledger, a DLT operating system that acts as an API gateway for multiple blockchains. Overledger supports multiple blockchains such as Bitcoin, Ethereum, Hyperledger Fabric, R3 Corda, and BNB Chain, making it possible for developers to build multichain decentralized applications (mDApps) with ease. [11][12]

The Quant Network operates using its native cryptocurrency, QNT, which is an ERC-20 token but blockchain independent. QNT is used by developers to build on the Overledger platform, while end-users require QNT to access the mDApps and Overledger ecosystem. [11][12]

History

Quant was first announced and launched in 2018 by founders, Gilbert Verdian, Colin Paterson and Paolo Tasca. Verdain’s reputation as a renowned cybersecurity expert setting up the UK Financial Investments (UKFI) and working with the US Federal Reserve helped greatly facilitate Quant Network’s entry into the market. [10]

In April 2018, they raised $11 million through an initial coin offering (ICO) from a possible $36.9 million hard cap. Quant’s team burnt the leftover tokens from the fundraising event, totaling over 9.5 million QNT. [8][9]

On September 8th 2021, a major update to the Overledger, Overledger version 2.0.5 was released. The update enabled the bridging of multiple leading ecosystems, supporting various stablecoins, DeFi, NFT and ERC-20/ERC-721 assets. [21][22]

On August 4th, 2022, Overledger 2.2.12 was released with a new Overledger Tokenise feature, making it easier for users to create, deploy and manage secure, interoperable tokens and digital assets on supported networks. [23]

Utility

With Quant tokens, users of Quant Network can access the services and use cases of the platform. They can only make use of Quant’s blockchain operating system (Overledger) after paying for licensing and platform fees using QNT. Developers, enterprises, partners, or financial institutions can leverage Overledger to build decentralized multi-chain applications (MApps). In return, they must stake a predetermined amount in QNT tokens for MApp solutions to run. [4]

Quant’s ecosystem typically handles user access fees by locking up the token in a smart contract or moving them into the Treasury. When a user buys access to any of the services on Quant Network, QNT is taken out of circulation, locked in a unique smart contract, and released on the subscription’s expiration. Or the cryptocurrencies may just be moved to the Treasury when a user buys a license to create anything on the network. [4]

Infrastructure

The Quant Network utilizes an infrastructure, known as Overledger which operates as an API gateway that supports multiple distributed ledgers, allowing developers to create mDApps.

Overledger

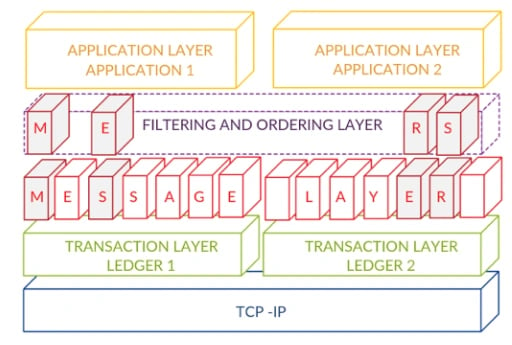

The Overledger is a solution to blockchain interoperability issues. The Overledger protocol architecture consists of four layers that work together to ensure seamless communication between multiple blockchains, making it possible for developers to create mDApps. [11][13]

Transaction Layer

This layer is responsible for storing verified transactions using distributed ledger technology. The consolidation of all related activities onto a single layer simplifies the process of reaching consensus across different blockchain domains. [11][13][14]

Messaging Layer

The messaging layer serves as a shared channel where all transactions from multiple ledgers are recorded. The layer collects transaction-related information, including smart contract data and messaging digests, from each ledger in the transaction layer. This makes it possible to combine transactions from all ledgers by wrapping all transaction information. [11][13][14]

Filtering and Ordering Layer

This layer filters and orders messages from the messaging layer that are referred to in the digest of out-of-chain messages. It ensures that the messages comply with the requirements of the application, such as specifying a certain amount of coins to be moved for a transaction to be valid or only allowing transactions from a specific address. [11][13][14]

Application Layer

The application layer is the topmost layer and controls all other layers. It establishes the guidelines and methods for interacting with blockchains, with each multichain application isolated from others in this layer. To use Overledger, mDApps must establish a set of rules for communication with other programs, users, and the Overledger system. Applications can interact with each other through the messaging layer, with messages passing from the filtering and ordering layer to the application layer if they meet the filtering requirements. [11][13][14]

Use Cases

Quant has several use cases, all of which are geared toward creating value, mitigating costs, and reducing risks.[2]

Capital Markets

The blockchain space is ever-changing and developing, with more asset tokenization expected. The Overledger operating system exposes these assets to newer liquidity pools, creating greater exposure to new markets and increased chances of portfolio diversification among investors. [15]

Payments

There are zero preferences for any specific blockchain with Quant, which creates a more flexible and secure payment channel for digital and fiat currencies. Transaction fees become cheaper because users do not have to move assets across multiple chains or swap assets to complete transactions. [6][16]

Digital Currencies

Central banks worldwide are exploring the adoption of digital currencies, and more stablecoins may debit in the future. Overledger makes it possible for a genuinely interoperable economy. [17]

Insurance

Go-betweens and intermediaries in the insurance industry make accessing policies challenging, expensive, and time-consuming, limiting the industry’s growth. Quant Network optimizes the superfluous insurance system to make its operations more effective. [18]

Supply Chain and Trade Finance

Trading and supply chains are complex, with several bottlenecks plaguing the system. Associated levels of logistics, payments, and customs are made more efficient with Quant Network. [19]

Compliance

Tracking payments across networks and blockchains can be problematic because the footprints are disruptive and not easily linked. Quant Network makes this information more relatable and trackable for humans and compliance operations. [20]

Quant Token (QNT)

QNT is an ERC-20 standard token on the Ethereum blockchain. Despite the team building on the Ethereum network for the sheer volume of support, it provided with wallets and exchanges, Quant is blockchain agnostic and can be adapted to any blockchain infrastructure, adopting its own plug-and-play solution it developed for enterprise solutions. [6]

QNT is the native cryptocurrency of the Quant Network and is used for transactions within the Overledger ecosystem. It is an ERC-20 token but blockchain independent, which means it can switch to any other blockchain. The Swiss Financial Market Supervisory Authority (FINMA) governs QNT as a utility token that aims to give users access to an application or service. [11][13]

Developers require QNT tokens to build on the Overledger platform, but they can purchase licenses using fiat currency which is then converted to QNT by the Quant Treasury. Additionally, payments for read-and-write operations to Overledger must be made in QNT. End-users also need QNT tokens to access mDApps and the Overledger ecosystem, including renewing their license key annually. [11][13]

QNT Tokenomics

QNT is set at a max supply of 14,612,493 tokens and is allocated as follows:

- 9,964,259 — Amount sold to the public during the ICO;

- 2,649,493 — Is for the company reserve and used for Research and Development, Facilities, Infrastructure, Legal / IP, Marketing, Exchanges;

- 1,347,988 — is for the company founders;

- 650,753 — is for the company advisors. [7]

Quant Tokenise

Overledger Tokenise is a premium API offered by the company that enables users to create, deploy, and manage digital assets, including next-generation tokens, on supported networks such as Ethereum, Polygon, and XDC. This API is user-friendly and can be accessed through Quant Connect. The company recently added a new token type called QRC-721, which is a non-fungible token that can be deployed on multiple networks and is ideal for digitalizing collectibles or artwork. Users can interact with their tokens via Quant Connect and mDApps can read data and initiate transactions through the QRC smart contract. This addition to Overledger Tokenise makes it easier for users to create, deploy, and manage secure, interoperable tokens and digital assets on supported networks. [24]

Team

- Gilbert Verdian: Founder and Chief Executive Officer

- Martin Hargreaves: Chief Product Officer

- Lara Verdian: Chief Operating Officer

- Peter Marirosans: Chief Technology Officer

- Andrew Carrier: Chief Marketing Officer

- Helen Kemmit: General Counsel

- Gagik Alaverdian: Chief Operating Officer of Americas

- Dr. Luke Riley: Head of Innovation

- Christopher Harrison: Head of Engineering

- Andy Nelson: Head of Systems and Architecture

Board of Directors

- Guy Dietrich

- Neil Smit

Participation in the UK Regulated Liability Network (RLN)

In September 2024, Quant Network took part in the United Kingdom’s Regulated Liability Network (RLN) Experimentation Phase, an initiative coordinated by UK Finance. The RLN initiative sought to examine the technical and operational considerations of a shared infrastructure that could support the issuance, transfer, and settlement of regulated digital assets, including tokenized commercial bank deposits and central bank money (CBDCs).

Quant, in collaboration with the enterprise software firm R3, contributed to the technical development and assessment of the proof-of-concept. The experimentation involved over 35 participating organizations from both the private and public sectors, including financial institutions and infrastructure providers. The core focus was on evaluating how a unified ledger architecture might facilitate real-time transactions involving multiple asset types within a regulated environment.

As part of the experimentation, Quant provided interoperability capabilities through its Overledger technology, which was used to connect various distributed ledger systems and existing financial infrastructures. The work concentrated on the issuance and lifecycle management of regulated liabilities in a framework aligned with compliance and security standards.

A report issued by UK Finance in September 2024 outlined the outcomes of the initiative. It presented the technical structure tested during the phase and highlighted the collaborative approach adopted by the participants. The document also listed areas for further exploration, such as the role of digital identity, programmability, legal considerations, and the potential integration of central bank digital currencies.

Quant Network’s involvement in this phase was part of broader efforts by participating entities to explore how digital infrastructures may be designed to meet regulatory requirements while maintaining interoperability across different platforms and systems. [29] [30]

European Central Bank’s Digital Euro Project

On 5 May 2025, the European Central Bank (ECB) confirmed that Quant Network was among a group of approximately 70 organizations selected to participate in the ongoing Digital Euro crypto initiative. The group comprises a range of entities, including financial institutions, payment service providers, fintech firms, merchants, and technology companies. This activity is part of the ECB’s broader effort to explore technical and operational aspects of a potential digital euro under its Preparation Phase.

As part of the project, Quant Network is contributing to the offline payments stream in cooperation with the Banque de France and Giesecke+Devrient. This stream focuses on developing mechanisms that would allow transactions to occur without real-time network connectivity, with the aim of replicating certain attributes of physical cash, particularly in terms of usability and accessibility in disconnected environments. Key areas under examination include transaction security, data protection, and system reliability.

Quant's involvement centers on designing and evaluating components of an offline digital payments framework. One area of technical focus includes the use of multi-party lock arrangements, a method by which digital funds are conditionally reserved and transferred upon confirmation of agreed criteria—such as the completion of a transaction in a peer-to-peer exchange.

The Digital Euro project remains in the assessment phase and is scheduled to continue throughout 2025. Its progress is linked to parallel legislative developments within the European Union. A final decision regarding the issuance of a digital euro will depend on the outcomes of both the technical evaluations and the legislative process. [26] [27] [28]

Overledger Fusion Launch (May 2025)

In May 2025, Quant Network introduced Overledger Fusion, a network layer developed to facilitate interoperability between permissioned and permissionless blockchain systems. The announcement was made by the company's CEO, Gilbert Verdian, through an official social media post on May 14, 2025.

Overledger Fusion is intended to support interactions between institutional and decentralized finance infrastructures. It incorporates functionalities such as asset issuance, cross-chain transaction processing, and compliance mechanisms that align with regulatory requirements. The framework is structured to operate in conjunction with the existing Overledger system, functioning as an additional layer rather than a replacement.

The platform architecture is designed to integrate with financial institutions’ current systems and to enable interaction between ISO 20022-based financial messaging standards and blockchain-based smart contracts. This approach aims to streamline cross-network operations without compromising regulatory alignment.

Following the release, market data showed an increase in activity related to Quant's QNT token, coinciding with the broader visibility of the announcement and associated institutional engagement. [32] [33] [34] [35]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)