Subscribe to wiki

Share wiki

Bookmark

Symbiosis

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Symbiosis

Symbiosis is a decentralized exchange (DEX) facilitating liquidity across multiple blockchain networks, including Layer 1 (L1) and Layer 2 (L2), EVM and non-EVM compatible.[1]

Overview

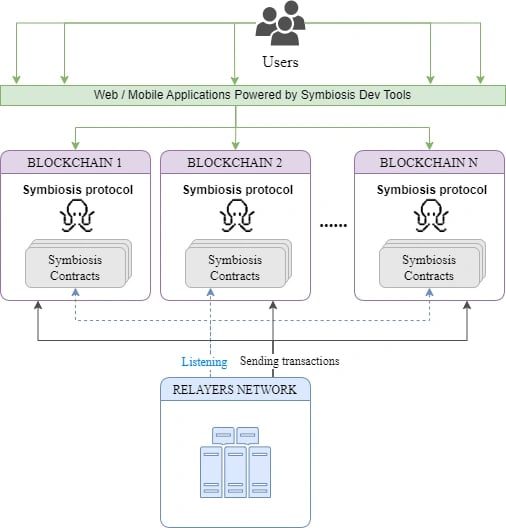

Symbiosis, established in 2021 by Nick Avramov, operates as a decentralized exchange (DEX) that consolidates liquidity from various blockchain networks, facilitating straightforward token trading and asset transfers. It prioritizes decentralization and interoperability, aiming to connect different blockchain ecosystems to enable efficient cross-chain operations. On-chain functions such as swaps and interchain communication are managed through smart contracts, while an off-chain relayers network ensures secure data transmission.

Key functionalities include cross-chain swaps for token exchange, an Interchain Communicating Messenger for streamlined DeFi liquidity provision, and efficient cross-chain zaps to Symbiosis Octopools. The protocol also offers farming incentives and hosts the Symbiosis Explorer for transparency and reward distribution among liquidity providers. Through veSIS, users can stake SIS tokens to potentially earn rewards, reduce fees, and participate in governance through the Symbiosis DAO.[2][3][4]

History

2021

In 2021, Symbiosis made significant progress in developing its cross-chain decentralized exchange (DEX). They completed the minimum viable product (MVP) for their cross-chain DEX in Q1, which included launching a testnet for ETH <-> BTC swaps. The establishment of the Symbiosis relayers network, leveraging ChainLink technology, was also a milestone.

Throughout the year, Symbiosis expanded its cross-chain capabilities to include Polygon, BSC, and Ethereum, introducing concepts such as smart-routing and defining the SIS tokenomics framework. By Q4, Symbiosis focused on preparing for its Mainnet launch, including implementing staking for relayers and upgrading their Mobile App SDK. These developments aimed to position Symbiosis within the cross-chain DEX market by the end of the year.[5][6][9]

2022

In 2022, Symbiosis achieved key milestones in decentralized finance (DeFi). Binance Labs strategically invested in Symbiosis Finance to support its multi-chain liquidity protocol. The launch of Symbiosis V1 β-mainnet marked its entry into global DeFi.

Integration with 1inch aimed to simplify asset swaps between EVM and non-EVM networks. Cross-chain Zaps automated LP token acquisition across chains, enhancing DeFi liquidity provisioning. Rubic integration streamlined swap processes, while veSIS incentivized SIS token staking for rewards.

The addition of renBTC and Telos expanded swap options on Binance Chain. Partnerships with BENQI, Milkomeda, and Rango Exchange strengthened liquidity and blockchain interoperability. Symbiosis Protocol V2 introduced a multi-coin liquidity pool, offering increased flexibility for DeFi participants.[7]

2023

In 2023, Symbiosis made significant advancements in decentralized finance (DeFi) through strategic partnerships and innovative features. The year included collaborations with TRON and AAVE, as well as the introduction of SIS Octopool. By expanding from 10 to 20 networks, Symbiosis aimed to broaden its platform capabilities and operational scope.

In December, Symbiosis integrated Metis as its 20th network and secured a grant from GMX. November saw participation in Scroll Mainnet Alliance Week and the launch of SIS Scroll Pool and Token Teleport to enhance token movement. October marked the introduction of SIS Octopool and partnerships with Mantle, Rubic, and HTX, aimed at expanding swap options and liquidity.

Closing the year with over $1 billion in total transaction volume, Symbiosis remains committed to advancing DeFi accessibility and functionality.[8]

Technology

Threshold Signature

Threshold signatures are a key cryptographic feature integrated into the Symbiosis protocol, utilizing Multi-Party Computation (MPC) to facilitate secure digital signatures across diverse blockchain networks. This method allows a subset of participants to jointly create signatures without any single participant possessing the complete signing key, thereby ensuring decentralized security.

Despite being a relatively recent development in cryptography, MPC leverages proven algorithms to enable off-chain signature generation, which is crucial for supporting Symbiosis's cross-chain transactions. Future articles will delve deeper into these cryptographic concepts, seeking to enhance comprehension of these essential mechanisms underlying the protocol's operations.[15]

SIS Octopool

SIS Octopool represents a significant advancement within the Symbiosis ecosystem, facilitating efficient token swaps through advanced bridging technologies. By integrating SIS bridging technology seamlessly into its platform, Symbiosis aims to enhance user experience across multiple blockchain networks. Octopool streamlines the swap process by eliminating intermediary steps, providing faster and more cost-effective transactions.

This innovation enables direct swaps, reducing transaction costs and enhancing transaction reliability. Users benefit from simplified token swaps, leveraging Octopool's capabilities to achieve seamless cross-chain transactions and improve overall efficiency.[16]

Products

Swap

Symbiosis enables cross-chain token swaps across diverse blockchain networks, facilitating straightforward trading of tokens. The protocol supports swaps between tokens available on decentralized exchanges (DEXs) across different blockchain ecosystems. It ensures secure and efficient cross-chain operations through its relayers network, utilizing technologies like ChainLink for bridging reliability.

Symbiosis aims to provide users with a straightforward process for transferring assets across various blockchain environments. For detailed instructions on swap functionalities, users can explore the Symbiosis WebApp.[1][10]

Pools & Zaps

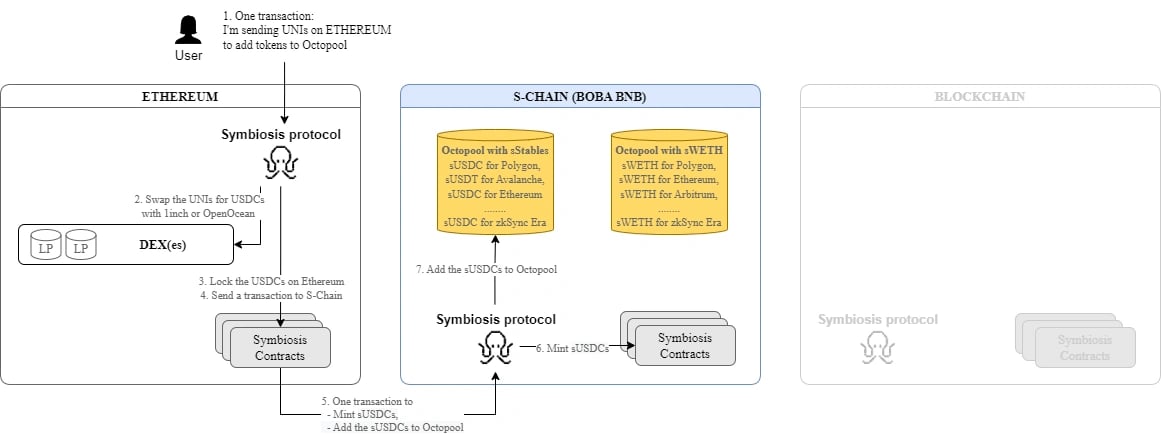

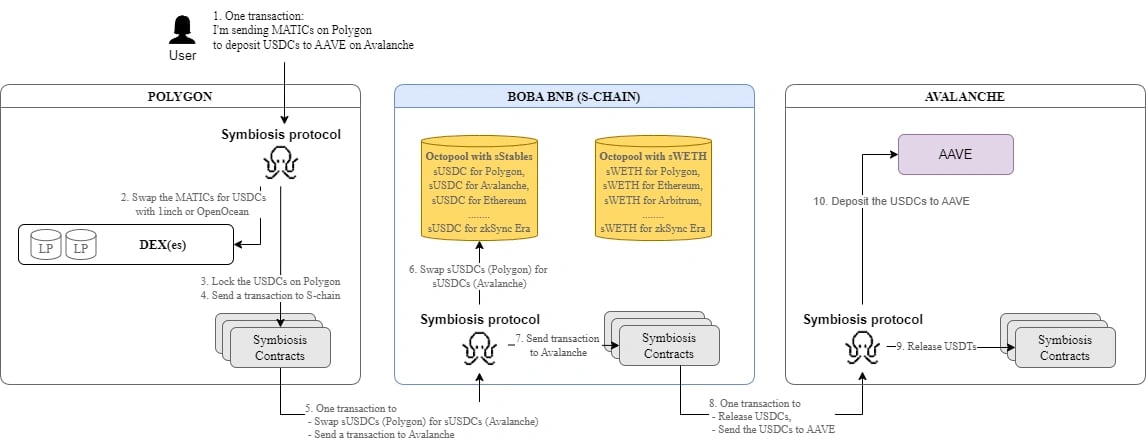

Symbiosis operates Octopools on its host chain, Boba BNB, designed to facilitate cross-chain liquidity provision efficiently. These pools aim to reduce volatility risks for liquidity providers while offering competitive APYs on deposited assets.

Cross-chain Zaps simplify the process of adding liquidity to Symbiosis Octopools. Users can deposit assets from any supported blockchain into the Octopool on Boba BNB with a single transaction. For example, a user holding UNI tokens on Ethereum can convert them into stablecoins, mint sTokens on Boba BNB, and supply them to the Octopool to earn LP tokens.

Cross-chain liquidity withdrawal, currently in QA testing, will soon enable liquidity providers to withdraw assets from Boba BNB's Octopools to any supported blockchain. This functionality enhances flexibility by allowing LP tokens to be converted back to assets on the originating blockchain, facilitating seamless movement of liquidity across different chains.[1][11]

Interchain Communication

Symbiosis operates as an interchain communication protocol that facilitates seamless asset integration across different blockchains through mechanisms like cross-chain Zaps and token exchanges.

The protocol aims to enable users to interact with various decentralized finance protocols across supported blockchains via cross-contract calls. This functionality includes supporting lending, farming, and staking protocols, using transit tokens such as WETH and stablecoins for executing cross-chain operations.

Moreover, Symbiosis integrates with ThorChain to facilitate token exchanges, allowing users to swap supported tokens for Bitcoin (BTC) on the Bitcoin network. This utilizes ThorChain's smart contracts on Ethereum and Avalanche networks to ensure efficient and secure token swaps.

These capabilities are designed to enhance interoperability and efficiency in decentralized finance, providing users with increased flexibility and utility across multiple blockchain ecosystems.[12]

Gas Fees

Gas fees within the Symbiosis protocol are handled efficiently to ensure transparent cost distribution during cross-chain operations.

Users initiate cross-chain actions by signing and sending a transaction on their source blockchain, where they are responsible for covering associated gas fees.

Relayers execute transactions on S-chain and the destination blockchain upon receiving Oracle requests from Symbiosis contracts. They undertake these gas fees themselves, simplifying the process for users who only incur fees for their initial transaction.

Throughout the process, the protocol calculates and deducts gas fees in USD equivalent from transactions on S-chain and the destination blockchain. This ensures clarity and equitable distribution of costs.

Developers and users benefit from Symbiosis SDKs and APIs, which facilitate accurate gas price estimation and transaction preparation, thereby streamlining cross-chain transactions.[13]

Tokenomics

Symbiosis Token ($SIS)

The SIS token serves as the governance token for the Symbiosis protocol, allowing token holders to participate in governance decisions. Initially deployed on Ethereum's Layer 1 (L1), SIS can also be bridged to other blockchain networks such as BNB (Boba BNB), Arbitrum One, zkSync Era, Linea, and Scroll. This broad accessibility aims to facilitate trading, exchange, and staking of SIS tokens across diverse blockchain ecosystems.

Through bridging mechanisms, SIS tokens can seamlessly move between Ethereum and compatible Layer 2 (L2) networks while maintaining their original identity and supply. The protocol utilizes dedicated pools to optimize cross-chain transactions involving SIS tokens, focusing on reducing transaction fees and ensuring efficient operation for users.[14]

Allocation

The SIS token allocation for the Symbiosis protocol is structured across various rounds and categories to support its operational and ecosystem needs. These allocations include:

- Seed Round: Reserved for initial strategic investors and supporters of the project, totaling 10% of the total token supply.

- Private Round: Allocated to private investors and contributors, comprising 6% of the total token supply.

- Strategic Round: Set aside for strategic partnerships and alliances, accounting for 4.7% of the total token supply.

- Public Round DaoMaker: Designated for community participation via the DaoMaker platform, amounting to 0.55% of the total token supply.

- Public Round Y: Reserved for broader public participation, constituting 0.65% of the total token supply.

- Public Round Z: Allotted for additional public distribution, comprising 0.1% of the total token supply.

- Liquidity Farming: Tokens allocated for liquidity providers within the protocol, making up 10% of the total token supply.

- Node Runners Reward: Tokens distributed to network nodes and validators, totaling 15% of the total token supply.

- Protocol Liquidity: Reserved for maintaining liquidity pools within the protocol, comprising 10% of the total token supply.

- Relayers Auction: Allocated for auctions and incentives for protocol relayers, accounting for 5% of the total token supply.

- Advisory: Tokens reserved for advisors and consultants to the protocol, making up 5% of the total token supply.

- Founders Team: Tokens allocated to the founding team members, comprising 18% of the total token supply.

- Treasury Reserve: Tokens held in reserve for future operational and strategic purposes, totaling 15% of the total token supply.

In total, the SIS token has a maximum supply of 100,000,000 tokens, distributed across these various categories to ensure sustainable growth and development of the Symbiosis ecosystem.[14]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)