Subscribe to wiki

Share wiki

Bookmark

Hacken

We've just announced IQ AI.

Hacken

Hacken is a blockchain security auditor specializing in comprehensive security solutions for Web3 projects, including audits, penetration testing, and vulnerability assessments. Established in 2017, the company focuses on safeguarding digital assets and ensuring compliance with industry standards. [1]

Overview

Hacken is a blockchain security auditor that provides comprehensive security services for Web3 projects, including audits, penetration testing, and vulnerability assessments. Established in 2017, the company aims to enhance the security and integrity of blockchain technologies through various offerings, such as smart contract audits, bug bounty programs, and compliance monitoring. Hacken employs a team of ethical hackers and security experts who leverage advanced methodologies and tools to identify vulnerabilities and mitigate risks. The company also emphasizes community engagement and transparency, promoting best practices in cybersecurity within the blockchain industry. [2][3]

Services

Smart Contract Audits

Hacken’s Smart Contract Code Audit provides a detailed code review and security analysis to detect and mitigate vulnerabilities in smart contracts before mainnet deployment. The process involves multiple stages to identify risks like data flow issues and unauthorized access, including preparation, manual code review, testing, and reporting. Hacken’s team of over 60 engineers conducts manual line-by-line reviews supported by automated tools and provides detailed reports with actionable recommendations. The service supports various programming languages and blockchain platforms, including Ethereum, BSC, Solana, and newer ecosystems like zkSync and Aptos. [2][3][4]

Blockchain Protocol Audits

Hacken’s Blockchain Protocol Audit offers a comprehensive security analysis for Layer 1 and Layer 2 protocols, focusing on identifying and addressing vulnerabilities in their architecture. The service includes reviewing functional requirements and technical documentation, performing manual code reviews, and using automated tools to detect consensus mechanisms, cryptography, and data storage issues. Hacken’s methodology also involves fuzzing, stress testing, and transaction simulations to assess resilience against real-world attacks. Hacken provides remediation support and a final report following the audit, ensuring the protocol’s security and stability. [2][5]

dApp Audits

Hacken’s dApp Audit service conducts secure code reviews and static security analysis for decentralized applications, identifying vulnerabilities such as unsafe private key storage, blockchain data duplication, and incorrect event validation. The audit includes testing aspects like private key handling, cross-chain operations, and message signing to ensure high-security standards. Tailored solutions are provided for sensitive dApps, including cross-chain bridges and crypto wallets, with remediation support and follow-up checks to resolve identified issues before a final report is delivered. [2][6]

Penetration Testing

Hacken’s Penetration Testing service evaluates the security of information systems, networks, and infrastructures by simulating real-world attacks to identify vulnerabilities. This service is crucial for Web3 projects, crypto wallets, exchanges, and traditional enterprises to meet standards like OWASP, NIST, and PCI DSS. It covers cloud environments, networks, web, and mobile applications, focusing on multi-cloud platforms like AWS, GCP, and Azure. [2][3][7]

Hacken begins by assessing a client’s infrastructure vulnerabilities and offering recommendations before conducting a deeper analysis. Mobile applications and company servers are tested to ensure secure operation, especially for cryptocurrency customers. Key assessment areas include authentication, session management, input/output manipulation, and information leakage. After the tests, Hacken provides a detailed report of identified vulnerabilities and recommendations for improving security. [2][3][7]

Tokenomics Audits

Hacken’s Tokenomics Audit and Design service provides an independent evaluation of token economies, focusing on distribution, allocation, and management to ensure the sustainability of digital asset ecosystems. This audit is important for Web3 projects either planning a token generation event (TGE) or with tokens already in circulation, aiming to build trust with investors and the community. [2][8]

The service employs agent-based modeling, game theory, structural analysis, and numerical price models to assess human behavior, incentive structures, and potential edge cases. Tailored for sectors such as stablecoins, DeFi platforms, and in-game economies, Hacken ensures balanced inflationary or deflationary mechanisms and sustainable token collateralization. [2][8]

Proof of Reserves Audits

Hacken’s Proof of Reserves Audit verifies an organization’s financial stability by evaluating its assets and liabilities, ensuring that on-chain and off-chain holdings match users' balances without revealing sensitive information. This audit is essential for centralized exchanges to demonstrate solvency and transparency to regulators and users. The process involves taking an anonymized snapshot of all client balances, which is then aggregated into a hash tree, providing a privacy-conscious way to confirm that exchange-held assets align with customer deposits. [2][9]

CCSS Audits

Hacken’s CCSS Audit assesses and certifies cryptographic asset management and operational security under the C4 CryptoCurrency Security Standard (CCSS). The audit helps organizations strengthen security controls, improve key management processes, and meet high industry standards, reducing the risk of asset loss. Hacken’s methodology evaluates compliance with CCSS Levels 1 to 3, progressively increasing security requirements. Led by certified CCSS auditors, Hacken conducts pre-certification audits, providing readiness assessments and recommendations for key security improvements. The audit covers key management, wallet security, and transaction handling, ensuring compliance with CCSS standards. [2][10]

Products

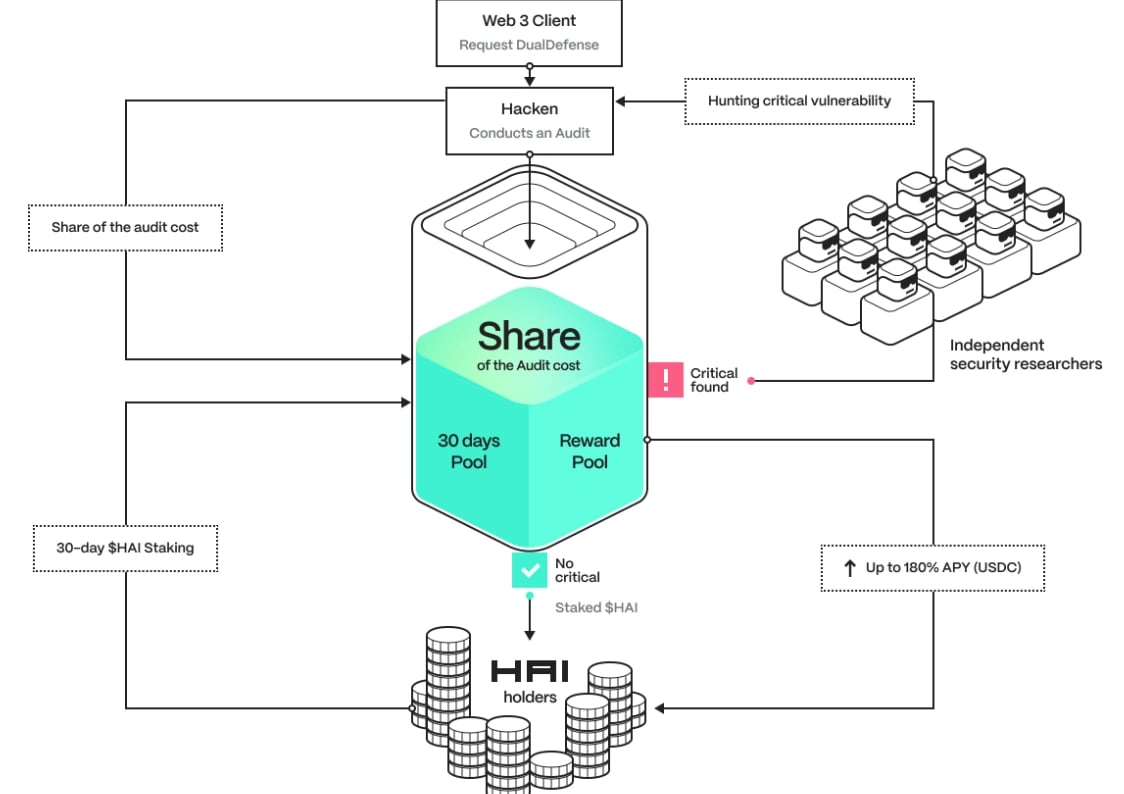

DualDefense

DualDefense combines Hacken’s auditing services with HackenProof's crowdsourced security expertise. After a professional audit, your code is reviewed by up to 40,000 independent security researchers. This dual approach offers a thorough assessment of vulnerabilities, with rewards for critical bug discoveries funded through a special pool. The service enhances security by involving experts and the wider community, ensuring immediate action on critical issues and boosting trust in the project's security. It also provides cost-effective protection without additional charges for crowdsourced bug findings. [11][12]

Flash Pool

The DualDefense Flash Pool will be a financial instrument designed to reward independent security researchers for identifying critical vulnerabilities. Funded by a portion of the audit cost and stakes from $HAI token holders, the pool will ensure that rewards for essential discoveries of bugs are paid without additional cost to the project. Hacken will contribute USDC, and $HAI holders can stake their tokens, earning up to 180% APY. This system will foster collaboration between auditors, ethical hackers, and the community, providing an efficient security model. [11][12]

HackenProof

HackenProof organizes bug bounty programs by connecting clients with ethical hackers to perform controlled penetration tests and other security assessments. These white hats conduct safe, pre-approved tests to enhance a client's cybersecurity, providing transparent reports. The bug bounty programs reward hackers for identifying software vulnerabilities, offering financial compensation while helping clients improve security. HackenProof has paid nearly $10 million to researchers and uncovered over 17,000 vulnerabilities. It provides cost-effective security for blockchain protocols, crypto wallets, and exchanges, with integration into tools like Jira, Slack, PagerDuty, and Zapier. [2][3][13]

Extractor

Hacken Extractor is an AI-driven platform designed to help Web3 projects meet regulatory compliance requirements, such as MiCA, DORA, and ADGM, while providing on-chain monitoring and security. Launched in 2023 as a post-deployment solution, it detects and prevents real-time crypto attacks. The platform monitors smart contracts for suspicious activities, identifies vulnerabilities, and prevents asset loss through automated protection mechanisms. In 2024, Hacken Extractor integrated Forta’s Attack Detector for machine learning-powered alerts. By August 2024, it added compliance monitoring features to align with regulatory standards, enhancing security and risk management for Web3 businesses. [2][14]

Crypto Exchange Ranks (CER)

Crypto Exchange Ranks (CER) is a Hacken Ecosystem product that analyzes cryptocurrency exchange data through advanced mathematical modeling, AI, machine learning, linguistic programming, and cybersecurity assessments. It delivers detailed reports on risk evaluation parameters, supporting decision-making for investors, traders, exchanges, government agencies, and financial institutions. CER offers tools for assessing exchanges across four areas: liquidity, public opinion, cybersecurity, and withdrawal limits. It also provides real-time analytics on liquidity and blockchain balance dynamics, identifying arbitrage opportunities and analyzing exchange balances and fund flows from hot and cold wallets. [3][15][16]

HAI

The Hacken Token (HAI) is a utility token within the Hacken ecosystem, used for transactions like payments for security services and rewards for ethical hackers. It supports work-to-earn tasks on the Trust Army platform, product access, governance through hDAO voting, bug bounty rewards on HackenProof, and payments for services on Hacken Extractor. [2][17][18]

Tokenomics

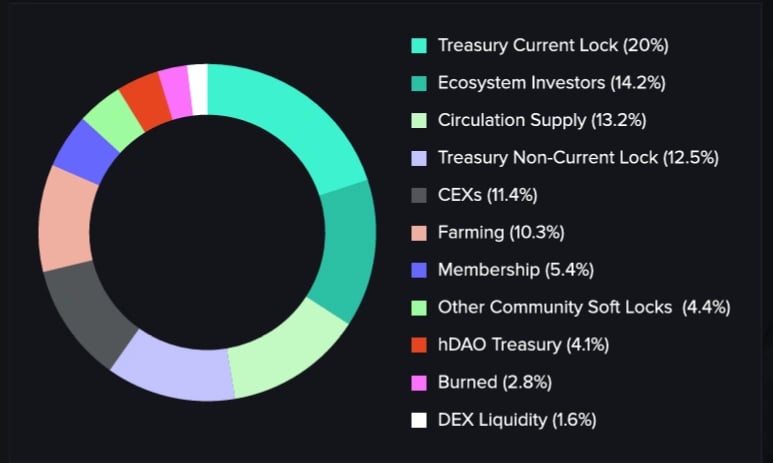

HAI has a total supply of 1B tokens and has the following distribution: [18]

- Treasury (locked): 20%

- Ecosystem Investors: 14.2%

- Circulation Supply: 13.2%

- Treasury (unlocked): 12.5%

- CEXs: 11.4%

- Farming: 10.3%

- Memberships: 5.4%

- Other Community Soft Locks: 4.4%

- hDAO Treasury: 4.1%

- Burned: 2.8%

- DEX Liquidity: 1.6%

Partnerships

- CoinGecko

- VeChain

- Avalanche

- DAO Maker

- NEAR

- 1inch

- Polkastarter

- IoTeX

- CoinMarketCap

- Secret Network

- ADGM

- Telos

- Cointelegraph Accelerator

- Linea

- KCC

- Solace

- zkSync

- Syscoin

- Kleva Protocol

- Flovtec

- Bubblemaps

- VENT

- SotaTek

- 111PG

- Genesis Pool

- Fractal Protocol

- A2DAO

- Openware

- The Crypto Launchpad

- Woodstock

- ScaleSwap

- FMFW.io

- InsurAce.io

- Avitar

- PAID Network

See something wrong?