위키 구독하기

Share wiki

Bookmark

PAID Network

0%

PAID Network

PAID Network와 Ignition 플랫폼은 블록체인 기술을 사용하여 탈중앙화된 비즈니스 운영, 스마트 계약 및 크라우드 펀딩 이니셔티브에 중점을 둡니다. 이는 거래 투명성과 효율성을 개선하고 암호화폐 생태계의 혁신적인 프로젝트를 지원하기 위해 노력합니다. [1]

개요

2021년에 설립된 Ignition은 PAID Network의 탈중앙화된 크라우드 펀딩 플랫폼입니다. 상당한 수익을 올린 수많은 Web3 및 암호화폐 프로젝트를 출시한 것으로 알려져 있으며, PAID Network는 크라우드 소싱 자금을 제공하여 고도로 검증된 프로젝트와 창립자를 지원하는 것을 목표로 합니다. Web3 런치패드 및 크라우드 펀딩 부문 내에서 투명성, 보안 및 효율성 개선의 필요성을 인식하고 PBO(Public Beneficiary Offering) 모델을 제안합니다. [1][9]

PBO 모델은 모든 이해 관계자가 프로젝트 및 자금 조달 프로세스에 대한 관련 정보에 액세스할 수 있도록 보장하여 투명성을 향상시킵니다. 블록체인 기술을 사용하여 거래의 변경 불가능한 기록과 스마트 계약을 제공하여 프로세스를 자동화하고 사기 위험을 줄임으로써 보안 문제를 해결합니다. 또한 크라우드 펀딩 프로세스를 간소화하고 승인 시간과 거래 비용을 줄이며 접근성을 높여 효율성을 향상시킵니다. PAID Network는 PBO 모델과 블록체인 기술이 런치패드 및 크라우드 펀딩 산업에 상당한 혁신을 가져와 프로젝트 제작자와 투자자 모두에게 이익이 될 것이라고 믿습니다. [1][9]

순환 경제

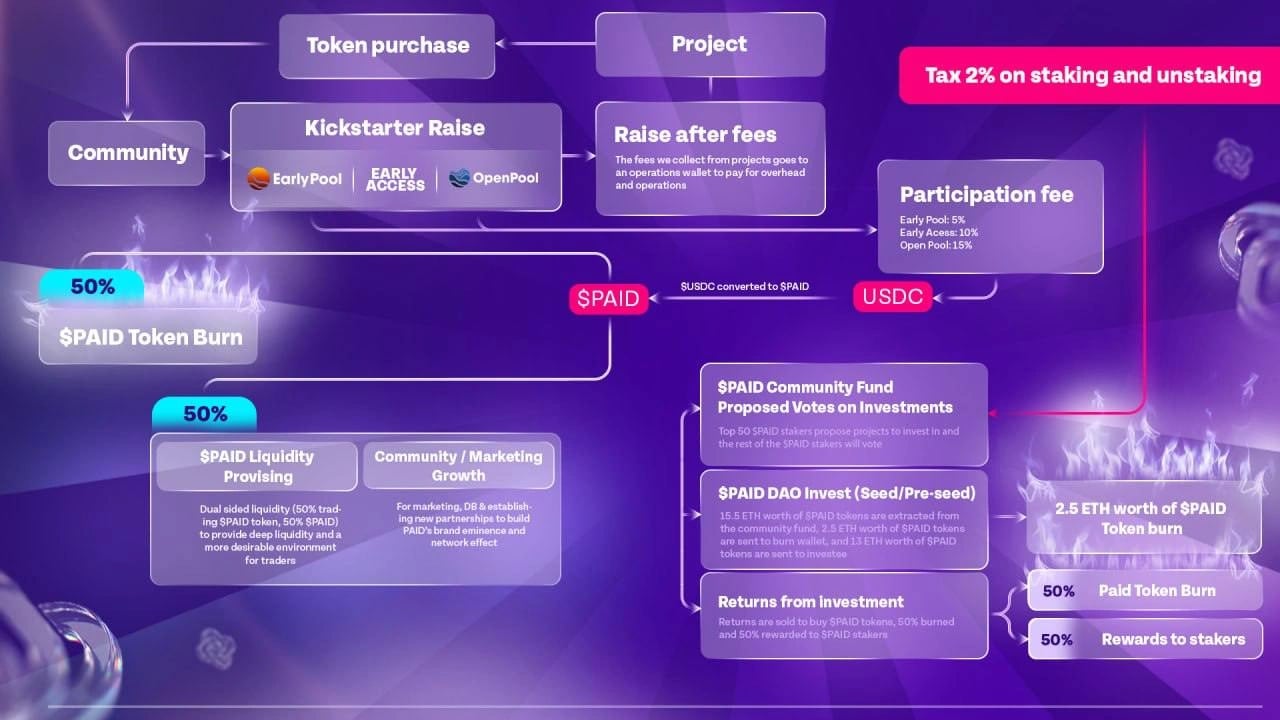

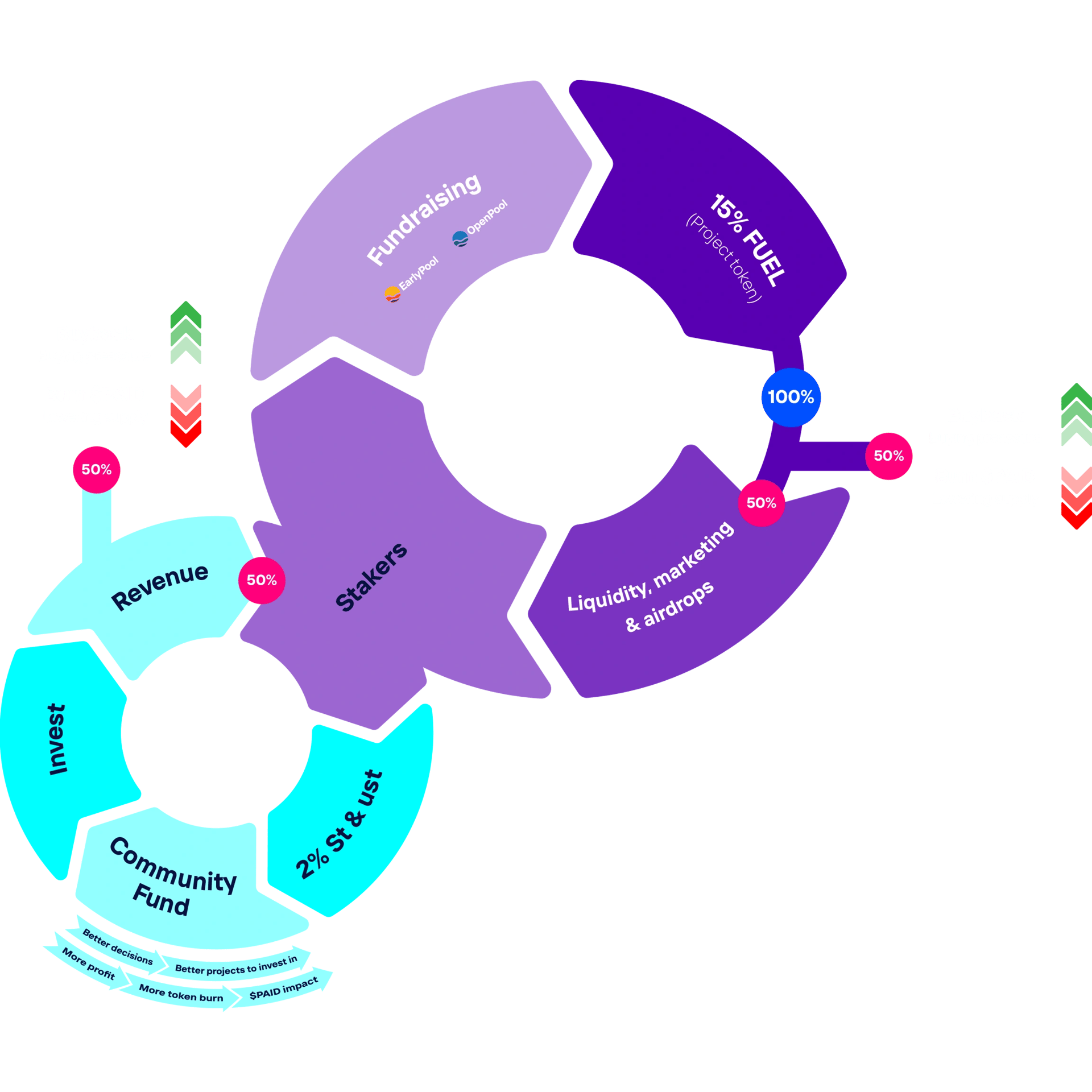

$PAID 팀은 순환 경제를 통해 프로젝트 모금 활동을 지원합니다. 참가자들은 $PAID 토큰을 보유할 필요 없이 투자 금액에 대한 비율 기반 서비스 수수료를 지불합니다. 상당한 보유량을 가진 $PAID 토큰 보유자는 EarlyPool을 통해 우선적으로 접근할 수 있어 EarlyPool과 OpenPool 모두에 조기에 참여할 수 있습니다. 동시에 다른 참가자들은 선착순으로 OpenPool에 참여합니다. [5][9]

수집된 참가 수수료는 $PAID의 유통량을 줄이고, 토큰 유틸리티를 강화하며, 토큰 보유자에게 가치를 제공하는 것을 목표로 하는 네 가지 활동에 할당됩니다. [5][9]

- 토큰 소각: 이는 유통량을 줄이고 잠재적으로 가격 변동을 개선하기 위한 $PAID 바이백을 포함합니다.

- 유동성 공급: 충분한 유동성을 확보하면 슬리피지를 줄이면서 더 높은 거래량을 가능하게 하여 더 유리한 거래 환경을 조성합니다.

- 커뮤니티 성장 및 마케팅: 비즈니스 개발 및 커뮤니티 구축 노력을 지원하기 위한 마케팅 자금을 구축하여 $PAID에 대한 수요를 증가시킬 수 있습니다.

- $PAID 커뮤니티 펀드: 이 펀드는 스테이킹 및 언스테이킹에 대한 2% 거래세로 자금을 조달합니다. 초기 단계 프로젝트에 투자합니다. 보상은 $PAID 토큰으로 전환되어 스테이커에게 인센티브로 제공됩니다.

이러한 조치는 $PAID 토큰의 가치와 유틸리티를 향상시키면서 프로젝트 모금 활동을 지원하는 것을 목표로 합니다. [5][9]

자가 유지 토큰 경제

스테이킹 및 언스테이킹과 같은 플랫폼 관련 상호 작용은 PAID 커뮤니티 펀드를 채우기 위해 2%의 수수료가 부과됩니다. 이러한 거래 수수료는 플랫폼의 지속 가능성을 향상시키는 것을 목표로 합니다. [5][9]

실질 수익 APY

새로운 모델로 전환하면서 $PAID는 이전의 선형 APY 접근 방식에서 벗어나 실질 수익 APY를 채택할 것입니다. 이러한 전환은 두 가지 주요 요인에 의해 추진됩니다. [5][9]

- 지속 가능한 경제 모델로의 블록체인 전환: 급속한 혁신이 특징인 블록체인 산업은 끊임없이 새로운 아이디어와 전략을 제시합니다. 기업은 이러한 새로운 접근 방식을 평가하고 채택함으로써 이익을 얻습니다. 실질 수익 전략 및 APY는 이미 여러 프로토콜(예: GMX, SNX, IMX)에서 성공적으로 구현되었으며, 이전 전략의 지속 불가능한 토큰 배출에 대한 지속 가능한 대안을 제공합니다.

- $PAID의 지속 가능성: 이전 선형 스테이킹 배출로 인한 높은 APY(15%~60%)는 상당한 토큰 배출로 인해 지속 불가능했습니다. 토큰 수익을 기반으로 하는 보다 지속 가능한 APY로 전환하면 $PAID의 수명을 늘리는 데 도움이 됩니다.

이러한 전환은 지속 불가능한 관행과 높은 APY 의존에서 벗어나 사용자에게 실질적인 가치를 제공하려는 PAID Network의 약속을 반영합니다. [5][9]

PAID 토큰

$PAID는 장기적인 커뮤니티 가치를 육성하는 다양한 유틸리티를 가진 유틸리티 토큰입니다. 크라우드 펀딩 활동에서 생성된 참여 연료는 $PAID 바이백에 사용되며, 수집된 연료의 절반은 공개 시장에서 토큰을 구매하는 데 사용됩니다. 이후 연료는 소각되어 유통량을 줄이고 희소성을 높입니다. 이러한 디플레이션 전략은 시간이 지남에 따라 $PAID의 가치를 지원하기 위한 것입니다. [4]

$PAID 및 $ETH/$BNB와 같은 주요 페어와의 양면 유동성은 강력한 유동성 깊이를 보장하여 슬리피지를 줄여 더 높은 거래량을 촉진하며, 이는 거래자에게 유리합니다. 프로토콜 수익은 주로 $PAID 스테이커에게 실질 수익률 APY와 $PAID 커뮤니티 펀드 수익을 통해 보상하여 지속 가능한 토큰 경제를 촉진합니다. [4]

또한, Ignition에 $PAID를 스테이킹하는 토큰 보유자는 플랫폼에서 출시되는 파트너 프로젝트로부터 에어드랍을 받을 수 있습니다. 프로젝트 공급량의 일정 비율로 할당된 이러한 에어드랍은 스테이킹된 $PAID 보유자에게 비례적으로 분배되어 장기적인 참여와 참여를 더욱 장려합니다. [4]

크라우드 펀딩 활동에서 생성된 참여 연료는 다음과 같이 할당될 $PAID 바이백에 사용됩니다. [4][9]

토큰 소각

- 각 모금 후, 수집된 연료의 절반은 공개 시장에서 $PAID를 다시 구매하는 데 사용되며, 구매한 토큰은 소각됩니다. 이 프로세스는 토큰을 유통에서 제거하여 희소성을 높이고 $PAID에 대한 디플레이션 모델을 지원합니다. [4][9]

유동성 공급

- $PAID와 $ETH/$BNB를 이용한 양방향 유동성 공급은 프로젝트의 거래 환경을 개선합니다. 풍부한 유동성은 더 높은 거래량을 가능하게 하고 슬리피지를 줄여 거래자에게 더 유리한 시장을 조성합니다. [4][9]

스테이킹 보상

- 프로토콜 수익은 주로 $PAID 스테이커에게 보상을 제공합니다. 스테이커는 실질 수익률 APY와 $PAID 커뮤니티 펀드로부터 토큰을 받아 장기적으로 더욱 지속 가능하고 순환적인 토큰 경제를 조성합니다. [4][9]

파트너 에어드랍

$PAID 커뮤니티 펀드

$PAID 커뮤니티 펀드는 $PAID 생태계의 핵심 구성 요소로, 커뮤니티 협업에 대한 새로운 접근 방식을 제공합니다. 주요 목표는 $PAID 토큰 스테이커에게 지속 가능한 방식으로 보상을 제공하고, 새로운 참가자를 생태계로 유치하며, 구조화된 투자를 통해 토큰 소각률을 높이는 것입니다. 초기에는 내부 팀 구성원이 감독하지만, 궁극적인 목표는 운영 통제권을 $PAID 토큰 스테이커로 구성된 분산형 자율 조직(DAO)으로 이전하는 것입니다. [6]

$PAID 커뮤니티 펀드의 주요 기능으로는 모든 스테이커에게 개방된 제안 및 투표 메커니즘이 있으며, 더 높은 토큰 스테이크에 더 큰 투표권이 연결되어 있습니다. 이 구조는 커뮤니티가 프로젝트 투자를 제안하고 결정할 수 있도록 권한을 부여하며, 기존 런치패드가 간과하는 초기 단계 벤처에 중점을 둡니다. 펀드의 수익은 $PAID 토큰에 재투자되어 스테이커에게 인센티브로 분배되고, 스테이킹 관련 거래에 대한 2% 온체인 세금을 통해 자금을 조달합니다. 이 모델은 지속 가능성을 보장하면서 암호화폐 공간에서 떠오르는 프로젝트에 대한 강력한 지원을 가능하게 합니다. [6]

핵심 오피니언 리더(KOL)

PAID 네트워크와 Ignition은 핵심 오피니언 리더(KOL)와의 협력을 통해 모든 참가자가 암호화폐 및 프로젝트에 포괄적으로 접근할 수 있도록 노력하고 있습니다. KOL을 활용하면 다음과 같은 여러 가지 이점이 있습니다. [3]

- 노출도 향상: KOL과의 파트너십은 소셜 미디어 플랫폼 전반에서 가시성을 높여 더 많은 청중에게 도달하고 브랜드 인지도를 높입니다.

- 신뢰성 및 자신감: 커뮤니티 내에서 신뢰성을 인정받는 KOL은 잠재적 사용자 및 이해 관계자 사이에서 PAID 네트워크 및 Ignition에 대한 신뢰를 높입니다.

- 커뮤니티 참여: KOL은 토론, 이벤트 및 옹호를 통해 적극적인 커뮤니티 참여를 촉진하여 팔로워가 커뮤니티 및 PAID 네트워크와 소통하도록 장려합니다.

- 교육적 옹호: KOL은 PAID 네트워크의 발전과 경제 모델에 대해 커뮤니티를 교육하는 데 중요한 역할을 하며 사용자 및 이해 관계자 간의 명확성과 이해를 보장합니다.

KOL 자문위원

- Alex Becker

- Altcoin Daily

- Crypto Banter

- Ivan On Tech

- Sheldon the Sniper

- Virtual Bacon

- Kyle Chasse

출시된 프로젝트

- Thetan Arena

- Star Atlas

- Aioz

- Cryowar

- ShopX

- Sidus NFT Heroes

- Metis

- Good Games Guild

파트너십

후원자

PAID 네트워크에는 다음과 같은 다양한 투자자들이 있습니다.

- Crypto.com Capital

- Animoca Brands

- A+ Ventures

- Newtribe Capital

- Huobi Ventures

- Andromeda Capital

- NEAR

- Spartan

- Solana Ventures

- KuCoin

- Cypher Capital

통합

거래소

스나이퍼 스쿨

2024년 3월 19일, PAID Network는 Crypto Banter가 주최한 Sheldon’s Sniper School과 협력했습니다. 이번 파트너십은 PAID Network가 새로운 사용자를 유치하고 온보딩하는 동시에 복잡한 암호화폐 세계를 자신 있게 탐색할 수 있도록 필수적인 교육과 지침을 제공하는 것을 목표로 하는 진전된 발걸음이었습니다. [7]

Lossless

2021년 12월 10일, PAID Network와 Master Ventures는 고급 DeFi 해킹 및 사기 완화 도구인 Lossless와의 새로운 파트너십을 자랑스럽게 발표했습니다. 이 협력을 통해 양측은 Lossless와 긴밀히 협력하여 블록체인 및 DeFi 공간 내에서 사기 행위를 최소화할 수 있었습니다. Lossless의 기술은 자금의 긴급 동결, 사기 분석 및 사기 행위 확인 시 도난 자금의 잠재적 반환을 가능하게 했습니다. [8]

잘못된 내용이 있나요?