Joe Biden’s Views on Cryptocurrency

小约瑟夫·罗比内特·拜登(Joseph Robinette Biden Jr.,1942年11月20日出生)是一位美国政治家,现任美国第46任总统。作为民主党成员,他曾在巴拉克·奥巴马总统领导下于2009年至2017年担任第47任副总统,并于1973年至2009年代表特拉华州在美国参议院任职。[1]

乔·拜登关于加密货币的行政命令

2022年3月9日,乔·拜登总统发布了一项期待已久的行政命令,指示各联邦机构协调数字资产政策。[2]

"虽然许多涉及数字资产的活动都在现有国内法律和法规的范围内,美国在这一领域一直是全球领导者,但数字资产及相关创新的不断发展和采用,以及在防御某些关键风险方面的不一致控制,需要美国政府对数字资产采取的方法进行演变和调整。" - 乔·拜登的行政命令

第2节。目标。美国在数字资产方面的主要政策目标:

"我们必须保护美国的消费者、投资者和企业。如果适当的保护措施不到位,数字资产的独特和多样化特征可能会给消费者、投资者和企业带来重大的财务风险。在缺乏充分的监督和标准的情况下,提供数字资产服务的公司可能无法为敏感的财务数据、托管和其他与客户资产和资金相关的安排提供充分的保护,或者无法充分披露与投资相关的风险。"

第5节。保护消费者、投资者和企业的措施:

"数字资产以及数字资产交易所和交易平台的日益普及可能会增加欺诈和盗窃等犯罪的风险,其他法定和监管违规行为、隐私和数据泄露、不公平和滥用行为或做法以及消费者、投资者和企业面临的其他网络事件。数字资产使用的增加以及社区之间的差异也可能给信息不足的市场参与者带来不同的财务风险,或加剧不平等。至关重要的是,要确保数字资产不会给消费者、投资者或企业带来不适当的风险,并采取保护措施,作为扩大获得安全且负担得起的金融服务的一部分。"[2]

乔·拜登总统的行政命令侧重于更新美国金融法规以应对加密货币,特别是通过指示联邦机构研究加密货币并提出新的监管规则。[39]

2023年债务上限谈判期间对加密货币交易员的评论

2023年5月21日,在日本广岛举行的七国集团(G7)峰会上,总统乔·拜登表示反对与共和党领导人达成的债务上限协议,该协议据称将使“富有的逃税者和加密货币交易员”受益。[3][4][8]

“让我明确一点,我不会同意一项保护富有的逃税者和加密货币交易员的协议,同时让近一百万——对不起——近100万美国人的食品援助面临风险。”[8]

据称对加密货币交易员的保护指的是税收损失收割。加密货币税收损失收割是投资者用来减少其总体纳税义务的一种策略。它涉及以亏损的价格出售加密货币,以抵消加密货币利润带来的资本收益。要申报损失,必须出售资产,并且必须在出售前或出售后30天内使用收益购买类似资产。该机制也适用于股票和其他资产。[3]

拟议的加密货币挖矿税

2023年5月2日,乔·拜登总统提议对加密货币挖矿公司征收30%的消费税。[10]

“目前,加密货币挖矿公司不必为其对他人造成的全部成本付费,这些成本包括当地环境污染、更高的能源价格以及温室气体排放对气候的影响。DAME税鼓励公司开始更好地考虑其对社会造成的危害,”总统经济顾问委员会(CEA)在一份声明中写道。[9]

该报告估计,2022年美国加密货币矿工消耗了约50,000吉瓦时的电力,比特币和以太坊的用电量几乎与电视一样多,明显多于家用电脑。[11]

作为拟议税收的一部分,数字资产矿工必须披露其用电量、来源(是否来自可再生能源)及其相关价值。它也适用于离网发电,例如转化原本会被浪费的天然气。[11]

除了引发环境问题外,政府还认为数字资产挖矿因污染而对有色人种社区产生不成比例的影响,并推高了可再生能源成本。该报告还对加密货币的价值做出了判断。[9][11]

“加密货币挖矿没有产生通常与使用类似电量的企业相关的本地和国家经济效益,”报告指出。“相反,这些能源被用于生成更广泛的社会效益尚未实现的数字资产。”[9]

美国加密货币争议

商品期货交易委员会 (CFTC)

2022年1月3日,商品期货交易委员会 (CFTC) 发布命令,要求 Blockratize, Inc. 支付 140 万美元的罚款,原因是其未注册为掉期执行机构,在其预测市场网站 Polymarket 上使用 加密货币 提供非法 二元 期权合约,并违反《商品交易法》关闭博彩市场。[12]

"该命令要求 Polymarket 支付 140 万美元的民事罚款,协助解决(即结束)Polymarket.com 上显示的所有不符合《商品交易法》(CEA) 和适用的 CFTC 法规的市场。

在 CFTC 宣布后,Polymarket 发表声明,解释说:

"我们很高兴地确认,我们已成功与 CFTC 达成和解……在 2022 年 1 月 14 日之后解决的三个不符合该法案的市场将提前结束,参与者将获得退款。"[12]

2022年2月9日,CFTC 主席 罗斯汀·贝南 在美国参议院农业、营养和林业委员会作证时,要求美国第 117 届国会授权监管某些加密货币,例如 比特币。[13]

2022年6月2日,CFTC 对 Gemini 提起诉讼,指控该加密货币交易所的高管在与监管机构的沟通中,就该公司于 2017 年提议提供的 比特币 期货合约 的 市场操纵 行为作出了 虚假 和 误导性陈述 和 遗漏。[14]

2022年6月7日,美国参议员 克尔斯滕·吉利布兰德 和 辛西娅·卢米斯 提出一项法案,为加密货币创建一个监管框架,该框架将把大多数数字资产视为受 CFTC 监管的商品,除非加密货币的持有者享有与公司投资者相同的特权,否则加密货币不受 SEC 的监管。[15] 2022年6月8日,贝南宣布支持该法案。[16]

在美国证券交易委员会 (SEC) 主席 加里·詹斯勒 于 2022 年 6 月 14 日在 华尔街日报 主办的会议上表达了对 Lummis-Gillibrand 法案可能会无意中破坏股票市场和共同基金的保护的担忧,并指出加密货币公司已经在从事受 SEC 监管的行为,并认为一些数字资产是证券,需要 SEC 而非商品的监管。[17]

美国联邦储备系统(Federal Reserve)

2021年10月14日,**联合批发抵押贷款公司(United Wholesale Mortgage)**宣布将停止接受以比特币偿还抵押贷款的试点项目。[18]

“由于目前加密货币领域的成本增加和监管不确定性,我们得出结论,目前不会扩大试点范围,”首席执行官马特·伊什比亚(Mat Ishbia)表示。

这家总部位于密歇根州的抵押贷款公司尝试了三种不同的加密货币——BTC、以太币和狗狗币——以及多个不同的借款人,以了解该流程的运作方式。UWM于2021年9月成功接受了其有史以来第一笔加密货币抵押贷款支付,并在10月份又接受了五笔。但最终,需求并不存在。伊什比亚告诉CNBC,借款人“喜欢它”并且“觉得它很酷”,但拥有以加密货币进行交易的选项“并不是一个驱动因素”。[18]

2022年7月8日,美联储副主席**莱尔·布雷纳德(Lael Brainard)**呼吁加强对加密货币的监管,以防该行业的规模威胁到金融系统。[19]

“创新有可能使金融服务更快、更便宜、更具包容性,并以数字生态系统固有的方式实现,”她在伦敦举行的英格兰银行会议上发表讲话时说。“重要的是,现在就要为健全的加密金融系统监管奠定基础,以防加密生态系统变得如此庞大或相互关联,以至于可能对更广泛的金融系统的稳定构成风险。”[19]

司法部和国土安全部

2021年3月5日,McAfee Corp. 创始人 约翰·迈克菲 在美国纽约南区地方法院被起诉,罪名是在他的 Twitter 账户上推广加密货币拉高抛售计划,从中获利 2300 万美元(此前,他因该计划的逃税行为被 司法部 起诉,并于去年 10 月被美国证券交易委员会起诉)[20]

“McAfee 团队成员从他们的山寨币倒卖活动中集体赚取了超过 200 万美元的非法利润,”司法部声称。[20]

2021年5月13日,据报道,币安 因用户用于 洗钱 和 逃税 而受到 美国司法部和国税局 的调查。[21]

“我们一直在努力建立一个强大的合规计划,该计划结合了反洗钱原则和金融机构使用的工具,以检测和处理可疑活动,”币安发言人在一封电子邮件中说。

2022年2月8日,美国司法部逮捕了商人 伊利亚·利希滕斯坦 和说唱歌手 希瑟·R·摩根,罪名是试图清洗在 2016 年 Bitfinex 黑客事件中被盗的价值 45 亿美元的 比特币 中的 36 亿美元。在从 Bitfinex 平台被盗的 119,756 个 BTC 中,美国司法部 (DOJ) 收回了近 94,000 个 BTC(当时价值约 36 亿美元)。副司法部长丽莎·摩纳哥在一份声明中表示,这是*“该部门有史以来规模最大的金融查获”*。[22]

2022年5月6日,美国司法部指控 Mining Capital Coin (MCC) 的首席执行官运营一项价值 6200 万美元的欺诈性加密货币计划。

“基于加密货币的欺诈破坏了全球金融市场,因为不良行为者欺骗投资者,并限制了合法企业家在这个新兴领域进行创新的能力,”司法部刑事司助理司法部长小肯尼斯·A·波利特说

起诉书进一步指控,MCC 的首席执行官兼创始人卡普西吹捧并以欺诈手段推销 MCC 所谓的“交易机器人”,作为投资者投资加密货币市场的另一种投资机制。卡普西声称,MCC 与“亚洲、俄罗斯和美国的顶级软件开发人员合作,创建了改进版本的交易机器人,这些机器人经过了前所未有的新技术测试”。[23]

2022年5月12日,EminiFX 的首席执行官亚历山大被联邦调查局指控在美国纽约南区地方法院运营一项价值 5900 万美元的欺诈性 加密货币 计划。亚历山大被捕并被指控犯有电汇欺诈和商品欺诈罪。[24]

“投资者应该警惕虚假声明和快速致富计划的下行风险,这些计划通常好得令人难以置信,”曼哈顿美国检察官达米安·威廉姆斯在一份宣布指控的声明中说。

2022年6月3日,联邦贸易委员会发布了一份报告,显示从 2021 年 1 月到 2022 年 3 月,约有 46,000 名投资者在加密货币诈骗中损失超过 10 亿美元(2022 年第一季度为 3.29 亿美元)。[25]

2022年6月30日,美国司法部对 EmpiresX 的领导人提起 证券欺诈 指控,EmpiresX 是一个超过 1 亿美元的加密货币交易所庞氏骗局。2022年9月8日,EmpiresX 首席交易员约书亚·大卫·尼古拉斯承认犯有全球加密货币投资欺诈罪,该罪行从投资者那里积累了约 1 亿美元。[26]

2022年6月,美国联邦调查局(FBI)将OneCoin加密货币创始人鲁娅·伊格纳托娃(又名“加密女王”)列入十大通缉要犯名单,原因是其涉嫌价值40亿美元的OneCoin庞氏骗局。 [27]

2022年7月21日,三名前Coinbase员工在美国纽约南区地方法院被起诉,原因是他们涉嫌内幕交易,涉及在该交易所上市的价值150万美元的加密货币资产。Coinbase公司32岁的前产品经理伊山·瓦希被指控向他的兄弟尼基尔·瓦希和朋友萨米尔·拉马尼透露了该公司开始提供某些数字代币的机密计划。 [28]

“虽然本案中的指控与在加密货币交易所进行的交易有关——而不是更传统的金融市场——但它们仍然构成内幕交易,”联邦调查局助理局长迈克尔·德里斯科尔在一份声明中说。

财政部和劳工部

2021年8月6日,拜登政府发布了一份新闻声明,宣布支持美国参议员罗布·波特曼、克里斯滕·西内玛和马克·华纳提出的对《基础设施投资和就业法案》的加密货币税务报告修正案,而不是美国参议员辛西娅·卢米斯、帕特·图米和罗恩·怀登提出的修正案。[29]

2021年8月9日,图米、华纳、卢米斯、西内玛和波特曼提出的妥协修正案(第2656号)未能通过图米提出的全体一致同意投票,原因是参议员理查德·谢尔比反对该修正案,除非它包括他提出的国防基础设施支出修正案(第2535号),图米同意了,但参议员伯尼·桑德斯和汤姆·卡珀反对。[30]

2021年11月15日,拜登总统签署了《基础设施投资和就业法案》成为法律,其中包含与加密货币税务报告和加密货币经纪人定义相关的原始措辞。在一封致每位众议院议员的信中,两党区块链核心小组成员对参议院的加密货币条款表示担忧。[31]

“如果不加以改变,这项条款将对我们国家的加密货币投资者产生广泛的影响,并进一步将创新监管赶出美国,”他们写道。[31]

2022年4月20日,美国财政部在2022年俄罗斯入侵乌克兰进入第三个月之际,制裁了俄罗斯的比特币矿工。[32]

BitRiver创始人兼首席执行官Igor Runets表示:“美国的这些行动显然应被视为对加密货币采矿业的干涉、不公平竞争以及试图改变全球力量平衡以支持美国公司的行为。”他还补充说,该公司“从未向俄罗斯政府机构提供服务,也没有与华盛顿已经制裁的客户合作。”

2022年5月6日,财政部制裁了加密货币混合器Blender.io,禁止其进入美国金融系统,原因是Lazarus Group(一个由朝鲜政府运营的网络犯罪组织)利用它清洗了据称从基于加密货币的游戏Axie Infinity中窃取的2050万美元的加密货币。财政部的新闻稿称,这是它首次对虚拟货币混合器实施制裁。[33]

美国证券交易委员会 (SEC)

2023年6月5日,美国证券交易委员会(SEC)对币安(一家加密货币交易所)及其首席执行官赵长鹏提起诉讼,原因是该机构称币安“公然无视”美国法律。在一份长达136页的诉状中[36],SEC 指控币安、其美国子公司币安美国和赵长鹏一直在运营未注册的美国金融机构,误导投资者关于公司的风险控制,夸大交易量,并将“数十亿美元的投资者资产”混合并发送给赵长鹏拥有的第三方实体。该案件已提交至美国哥伦比亚特区地方法院。[37]

“赵长鹏和币安实体从事了广泛的欺骗、利益冲突、缺乏披露和有计划地逃避法律的行为,”美国证券交易委员会主席加里·詹斯勒在一份声明中表示。

币安在一篇博客文章中[38]否认了美国证券交易委员会的指控,包括声称币安美国客户资产面临风险的说法。该公司表示,美国证券交易委员会在双方就和解进行谈判后决定将此案提交法院,这令其“感到沮丧”。

“虽然我们认真对待美国证券交易委员会的指控,但它们不应成为美国证券交易委员会强制执行行动的主题,更不用说是在紧急情况下。我们打算积极捍卫我们的平台。不幸的是,美国证券交易委员会拒绝与我们进行富有成效的接触,这只是委员会错误地、有意识地拒绝为数字资产行业提供急需的清晰度和指导的又一个例子。” - 币安在一篇博客文章中写道[38]

2023年6月6日,美国证券交易委员会起诉了Coinbase,一个中心化的加密货币交易所平台。联邦监管机构指控Coinbase将其加密资产交易平台作为未注册的国家证券交易所和经纪商运营。[40] 美国证券交易委员会还声称,Coinbase向客户提供的至少13种加密资产,包括Solana和Cardano的代币,根据诉状,符合“加密资产证券”的资格。[41]

在 SEC 宣布后的一条推文中,Coinbase 联合创始人兼首席执行官 Brian Armstrong 表示:

“关于今天 SEC 对我们提起的诉讼,我们很自豪能在法庭上代表该行业,以最终明确加密规则。”[42]

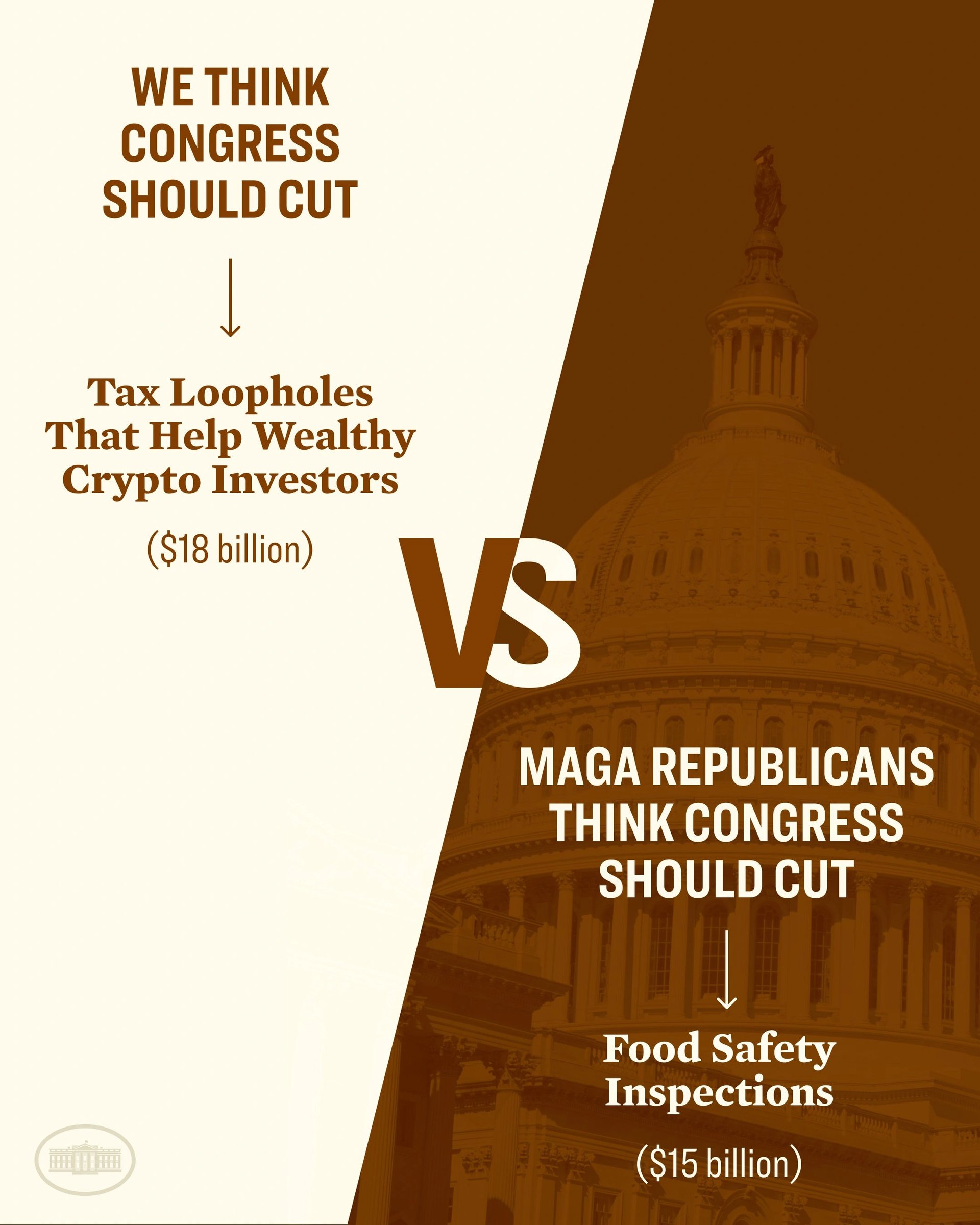

拜登呼吁结束 180 亿美元的“加密货币税收漏洞”

2023 年 5 月 9 日,美国总统乔·拜登在 Twitter 上分享了一张信息图,呼吁结束据称帮助富有的 加密货币 投资者避税的“税收漏洞”。社区成员回应了这条推文,质疑总统分享的数据,以及是否存在所谓的漏洞。[34][35]

狗狗币 联合创始人 比利·马库斯 也 回复 了拜登的推文。马库斯询问存在哪些漏洞,并声称他向政府缴纳的税款比他在加密货币中赚的钱还多,“同时承担了所有的风险”。马库斯随后指出,大多数美国加密货币用户并不富有,他们试图使用加密货币是因为他们无法维持生计。[34]

乔·拜登否决加密货币法案

2024年5月31日,美国总统乔·拜登否决了一项众议院联合决议,该决议本将废除美国证券交易委员会(SEC)的第121号员工会计公告(Staff Accounting Bulletin 121)。批评人士称,该公告使得加密货币公司难以与银行合作。 [43][44]

拜登在白宫发布的一份声明中表示:“以这种方式推翻美国证券交易委员会工作人员经过深思熟虑的判断,可能会削弱美国证券交易委员会在会计实务方面的更广泛权力。”[43] 他补充说:“我的政府不支持危及消费者和投资者福祉的措施。 保护消费者和投资者的适当保障措施对于利用加密资产创新的潜在利益和机会是必要的。”