Subscribe to wiki

Share wiki

Bookmark

Minterest

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Minterest

Minterest is a cross-chain lending protocol providing a money market solution. It aims to deliver high long-term yields for suppliers and cost-effective rates for borrowers while protecting against predatory liquidations. [1]

Overview

Minterest is a cross-chain lending protocol offering high long-term yields for suppliers, cost-effective rates for borrowers, and protection from predatory liquidations. It captures extensive fee sources, redirecting earnings to users through a buyback process of the native governance token, MINTY. The protocol aligns incentives among liquidity providers, the protocol itself, and token holders involved in governance, distributing all generated fees to users who earn and stake MINTY tokens. Minterest employs novel tokenomics mechanisms to ensure long-term sustainability, enhance value capture, and manage on-market token supply, aiming to increase user rewards and attract users to the Taiko ecosystem for sustained growth. [1]

Features

Solvency Engine

The Minterest Solvency Engine operates through a combination of off-chain services and on-chain smart contracts, utilizing flash loans for its processes. Key components include continuous monitoring of borrower solvency via the Borrowers Tracker, which tracks real-time on-chain price data from Chainlink oracles. When a borrower's position becomes insolvent, the engine calculates a Redemption Rate to restore solvency and identifies assets for potential liquidation. It assesses the most cost-effective liquidation paths using the Uniswap router, considering factors like gas fees and exchange slippages. [2]

Once a profitable liquidation strategy is determined, a transaction is prepared, signed, and sent to the blockchain network. This transaction executes a flash loan to repay borrowed assets, seizes collateral, swaps assets to settle the loan, and returns any remaining funds to the protocol’s reserves. Automating these processes ensures efficient and fair liquidations, enhancing the overall health and stability of the Minterest protocol. [2]

Supplying

Supplying on Minterest involves providing an asset to a money market pool to be borrowed by another party. Suppliers earn a market interest rate and additional rewards in Minterest's native MINTY token. Unlike decentralized exchanges (DEXs) like Uniswap, where supplying two different assets can result in impermanent loss due to price volatility, Minterest's single-asset supplying and borrowing model incurs no impermanent loss. Minterest does not impose any minimum or maximum limits on the amount that can be provided, though transaction costs may exceed expected earnings for very low amounts. [3]

When assets are supplied on Minterest, suppliers earn market interest rate payments in the provided token and MINTY rewards. MINTY rewards are based on the supplier's share of the total supply amount. At the same time, interest rate payments depend on the market's utilization rate and the share of interest borrowers pay. Similarly, borrowers on Minterest pay interest rates on borrowed assets and receive MINTY rewards based on their share of the total borrowed amount. [3]

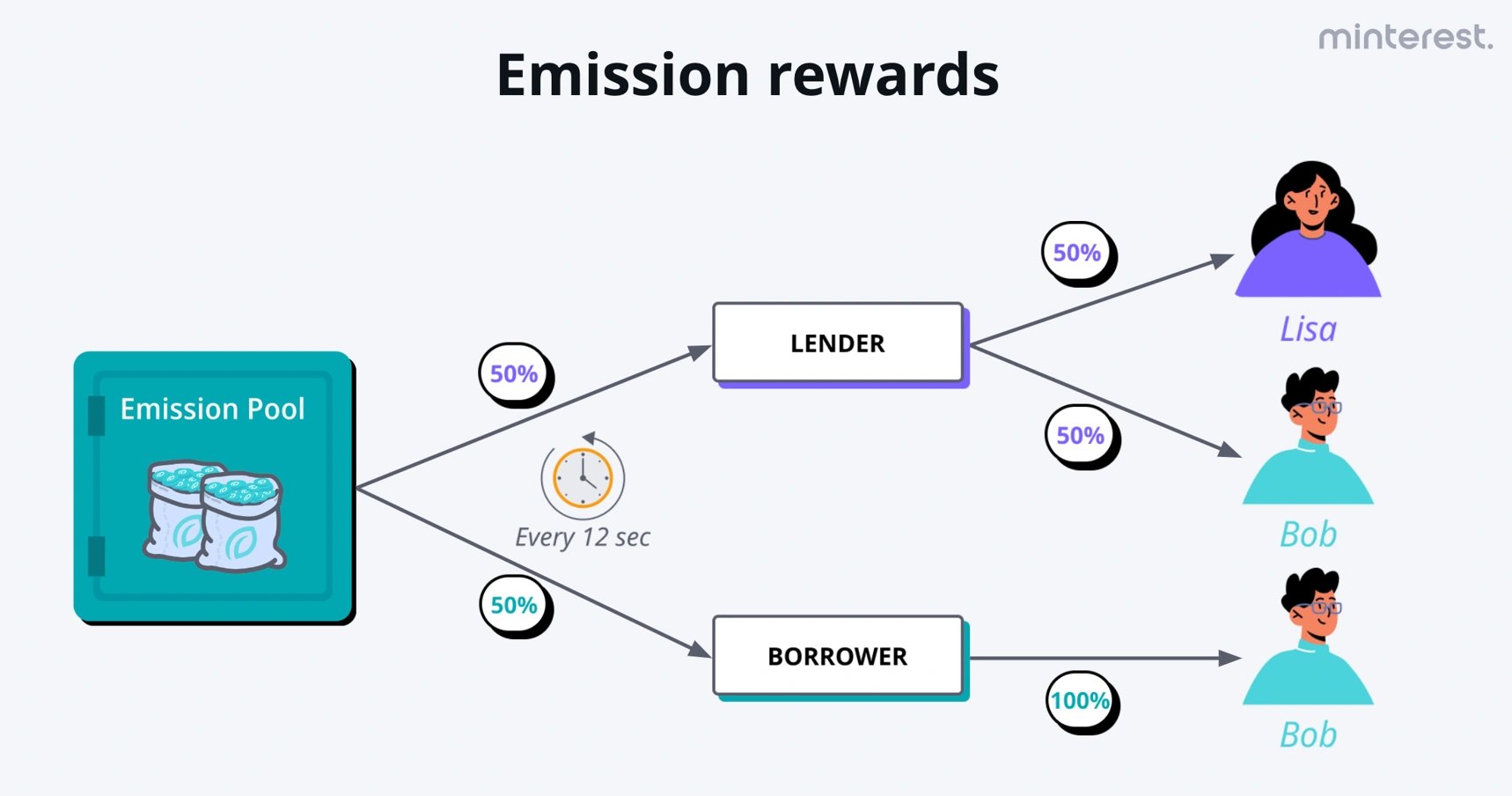

Emissions

Emissions on Minterest are rewards distributed to liquidity providers who supply and borrow assets on the platform, paid out as MINTY tokens, Minterest's native governance token. There are three types of emissions: Standard Emissions, Boost Emissions, and Governance rewards. Suppliers and borrowers on Minterest earn emission rewards based on the liquidity they provide relative to other participants in each market. These rewards are distributed from the emissions pool in MINTY tokens. It's important to note that all emission rewards are subject to a 12-month unlock period, distributed block by block on the Ethereum network. [4]

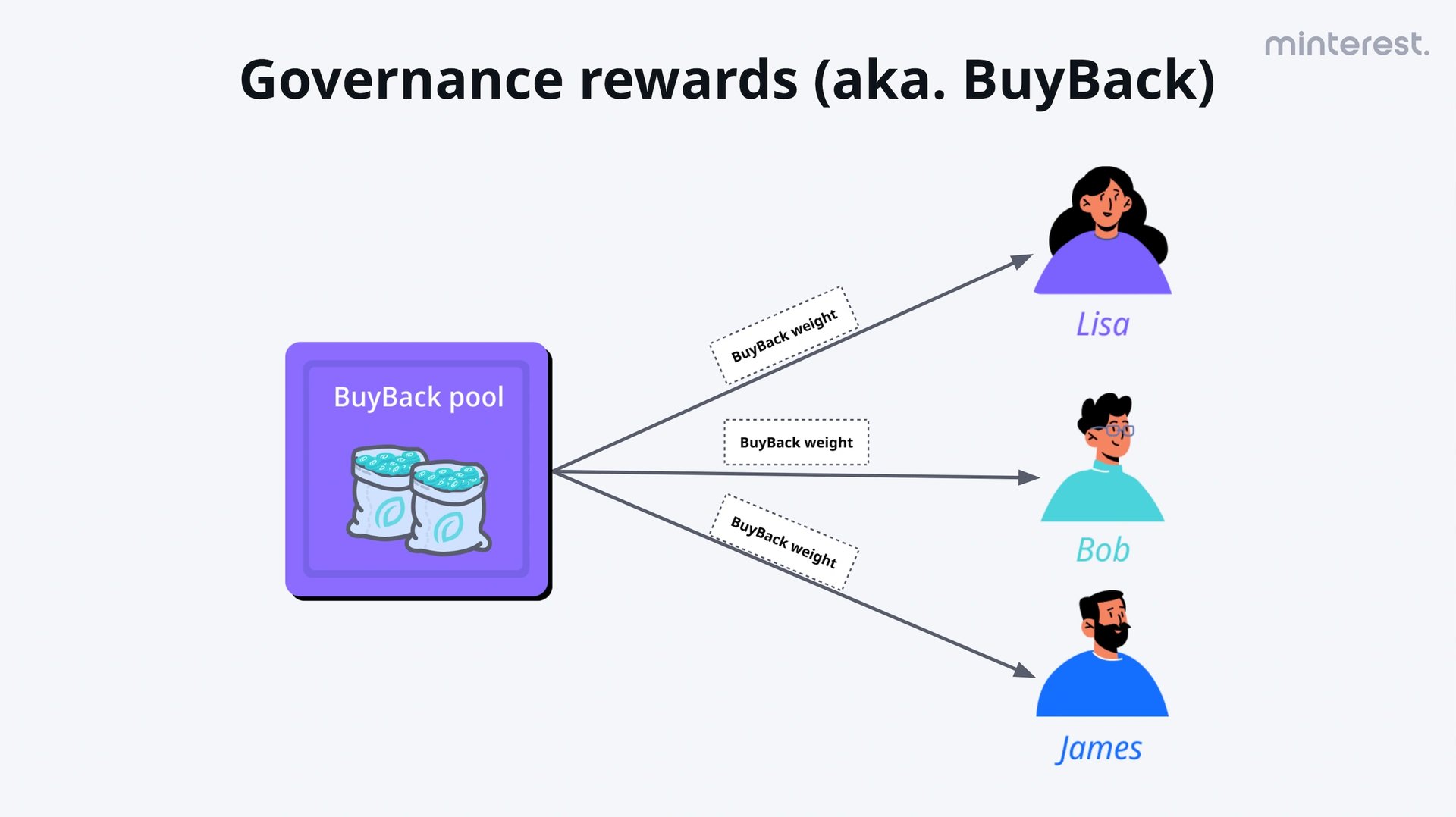

Buyback Engine

Minterest's Buyback Engine automates the conversion of all accrued fee values into its native MINTY tokens, which are then distributed to users participating in the protocol's governance. To maintain staking and reward eligibility, users must engage in governance at least once every 12 months. When participating in governance, MINTY token holders stake their tokens, granting them voting rights proportional to the amount staked. The weight of these votes in governance decisions is determined by the total amount of MINTY tokens a user has locked within the Minterest protocol. This balance comprises three types of MINTY tokens: [5]

- Withdrawable MINTY tokens earned from Standard emissions

- Withdrawable MINTY tokens earned from the Buyback process

- Manually staked MINTY tokens deposited directly into the protocol

The combined total of these MINTY tokens determines each user's buyback weight relative to the total buyback weight of all participants in governance. In addition to token balance, users also accrue a loyalty boost based on the duration of their participation and the number of MINTY tokens staked in the protocol. The loyalty boost percentage is directly added to each user's buyback weight, enhancing their influence in governance decisions. [5]

MINTY

MINTY is the primary token used by Minterest for rewards and governance. A portion of MINTY is distributed as a reward to suppliers and borrowers. By staking MINTY and participating in governance, users receive a share of governance rewards generated from Minterest's Buyback engine, which transfers all protocol fees back to users as MINTY rewards. Currently, Minterest is in its Private Launch phase, and MINTY is unavailable on the market. The token will become liquid and available during the Public Launch. [6]

Tokenomics

In preparation for the liquid token event, the Minterest team is recalibrating its tokenomics to ensure fairness and equity for all token holders. It particularly focuses on the Community Allocation Event (CAE) users most affected by these changes. To support these users, Minterest runs a two-week campaign called "Stack or Skip." Stack or Skip offers CAE users two options: [7]

- Stack a 20% MINTY bonus with an updated unlock schedule. The Standard CAE includes a 3-month cliff post-listing and a 6-month linear vest. The Lock & Load CAE involves a 6-month cliff post-listing and a 12-month linear vest. Users can use the CAE Calculator to preview their updated balance.

- Skip the changes entirely and opt for a full return of the initial contribution made during the CAE, which includes forfeiting all MINTY tokens related to their CAE participation.

For other participants, the token allocation is as follows: [8]

- Private Sale: The cliff is reduced from 11 to 8 months, followed by the original 12-month linear vest.

- Advisors: The cliff is reduced from 11 to 8 months, followed by the original 24-month linear vest.

- Marketing: The cliff is reduced from 11 to 8 months, followed by the original 12-month linear vest.

- Team: The cliff remains unchanged at 11 months, followed by the original 48-month linear vest.

- Ecosystem: Allocation is increased. An 11-month cliff is added, followed by the original 36-month linear vest.

- Strategic Reserve: Allocation is increased. An 11-month cliff is added, followed by an extended 60-month linear vest, increased from the original 36 months.

Governance

Governance rewards are central to the Minterest protocol's value. These rewards are directly sourced from the buyback mechanism. Users who stake $MINTY longer receive more incentives and greater voting rights due to a loyalty boost, promoting long-term active participation in governance. This system enriches governance, ensuring dedicated Minterest supporters receive generous yields and bonuses. [9]

Strategic Reserve

The Strategic Reserve is a treasury of $MINTY tokens designated for use by the future Minterest DAO to support the protocol's growth. A portion of this reserve is staked and accumulates rewards, which the Minterest DAO can use in various ways to benefit the protocol and its users. Fiscal and monetary policies inspire these methods and aim to enhance the protocol's sustainability and appeal. [9]

The DAO can utilize the treasury earned from buybacks to fund new developments that benefit the community. Additionally, it can manage token supply by staking and locking any buyback tokens to reduce on-market supply. Unlike lending protocols that eventually run out of token emissions, Minterest can recycle Strategic Reserve earnings back into emissions, providing greater rewards than other protocols. This approach ensures long-term growth and value for the Minterest ecosystem. [9]

Minterest NFTs

Minterest NFTs are a collection of 3,000 digital assets that enhance emission rewards for liquidity providers. Holders of these NFTs receive a yield boost on their emission rewards ranging from 20% to 50%, based on the NFT's rarity. The NFTs feature portraits of the 100 most influential figures in blockchain and cryptocurrency, created by digital artists worldwide. These NFTs play a role in DeFi as a core component of the Minterest protocol, spanning 12 levels, each providing different perks. The primary utility of the NFTs is the emission booster, which can increase yields by up to 50%, depending on the tier. [1][9]

These NFTs attract early adopters, bootstrap liquidity, and foster education and loyalty to the protocol. They increase emission rewards, effectively boosting the $MINTY staked in governance. This, in turn, enhances governance rewards received from the buyback mechanism, fulfilling a multi-layered mission within the Minterest ecosystem. [1][9]

Partnerships

FusionX

On December 20th, 2023, Minterest and FusionX collaborated to enhance users’ DeFi experience. This partnership aimed to integrate FusionX into Minterest's Solvency Engine pipeline, ensuring user health within the Minterest protocol while directing transaction volume to FusionX and boosting fees for its liquidity providers. The integration combined Minterest's yield-generation capabilities with FusionX's decentralized trading platform, promising users high yields and cost-effective decentralized transactions. [10]

Mantle Network

On January 4th, 2024, Minterest launched on the Mantle Network. Users could participate using assets like USDC, USDT, WETH, and MNT to earn reward tokens such as MINTY and MNT. Integrating Mantle Network with Minterest aims to optimize DeFi lending and borrowing. It leverages Optimistic Rollups for faster transactions and lower fees, maintaining EVM compatibility for seamless user access. The collaboration is expected to increase liquidity on Minterest, enhancing lending rates and scalability. It also promotes interoperability across blockchains, aligning with Minterest's goal to broaden DeFi accessibility and improve user experience through advanced technology partnerships. [11][12]

API3

On January 23rd, 2024, Minterest announced its integration with API3, a blockchain oracle provider. This partnership enhanced the connection between off-chain data and on-chain applications like Minterest, ensuring high security and minimal latency. The collaboration leveraged API3’s advanced data services to complement Minterest’s next-generation lending protocol. This integration facilitated seamless access to lending and borrowing within the Mantle Network, supporting assets such as $mETH and $MUSD. [13]

Taiko Network

Minterest integrated with Taiko's mainnet in May 2024, enhancing its cross-chain capabilities. Taiko's Layer 2 ZK-rollup technology reduces transaction costs and speeds up transactions for Minterest, improving operational efficiency. This integration also boosts scalability, allowing Minterest to handle higher transaction volumes concurrently and supporting more lending activities. Taiko's EVM compatibility facilitates seamless asset transfers across blockchains, aligning with Minterest's strategy to enhance DeFi liquidity and broaden its user base. Taiko's use of zero-knowledge proofs ensures transaction privacy and security, maintaining Ethereum's robust security measures while validating transactions off-chain. [14]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)