Subscribe to wiki

Share wiki

Bookmark

Pine Protocol

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

Pine Protocol

Pine Protocol is a decentralized, non-fungible token (NFT)-backed platform designed to facilitate asset-backed financing. It allows NFT owners to lend and borrow loan amounts in another cryptocurrency while helping them unlock liquidity without having to sell their tokens. [1]

Overview

Pine Protocol is a decentralized NFT collateral platform founded by Alex “Azure” Ho in January 2022 with the aim of making asset-backed financing more transparent on blockchains. The Pine Protocol leverages the Pine DeFi protocol to provide instant liquidity for NFT assets on various cryptocurrencies such as ETH, BSC, Solana, and stablecoins through smart contracts. [4]

The Pine ecosystem consists of two parts: PineDAO, which serves as an active liquidity provider and incubator in the NFT space, and Pine Token, the native token of the Pine protocol and PineDAO. [5][6]

The platform offers a non-custodial, decentralized asset-backed lending protocol that allows borrowers to borrow fungible digital tokens using NFTs as collateral. Also, it provides a two-sided loan marketplace and a decentralized application solution that enables lenders and borrowers to interact with the Pine Protocol. [4][5][6][7]

History

Pine Protocol first supported NFT collections such as Doodles, Mutant Ape Yacht Club (MAYC), Worldwide Webb Land, Phantabears, and Alien Frens. However, other collections, including CryptoPunks, Azuki, and Bored Ape Yacht Club (BAYC), were later added. [5]

In April 2022, the platform announced that it would launch its own NFT collection under the name "Pine Pieces." In support of the launch, it acquired the defunct NFT project, "Tempus by UTS." [7][8][9]

Pine Protocol has three product phases. The first functional version, V1, which is the Alpha product, was released in January 2022. It is an end-to-end functional NFT-backed loan protocol with a web interface for borrowers. [10]

The second version, V2, a beta product, was launched in March 2022. It included enhanced features and a lender's portal, as well as a simple flat fee structure for Pine Protocol fees. [10]

The third version, V3, released to the public as a robust NFT-backed loan protocol and a two-sided NFT-backed loan marketplace, was launched in the fourth quarter of 2022. V3 has a dynamic fee structure for Pine protocol fees with features including Pine listing and automatic loan repayment and rollover. [10]

In November 2022, Pine amassed over 40 NFT collections on offer, facilitated almost 2,000 ETH in loans, and reached a total value locked (TVL) of over $1 million in liquidity. In February 2023, it attained a TVL of over $3 million in liquidity for loans. [11]

In March 2023, the $PINE Bond was launched on the basis of four objectives: to increase the market cap and circulation of Pine tokens; to increase liquidity across decentralized platforms; to increase protocol usage through increased liquidity; and to scale up Pine protocol operations. [12]

On June 1, 2023, Pine Protocol launched Polygon Loans, its NFT lending platform on Polygon to improve capital efficiency and user experience. Speaking on the launch, Pine Protocol’s founder, Alex Ho, stated: [13]

“Polygon NFTs have the largest market capitalization after Ethereum.” He continued by saying, “Bringing the Pine Protocol technology stack to Polygon not only opens up the NFT lending market to the 200+ million wallets on Polygon but also enhances the utility and nature of the existing NFT collections across Polygon.”[13]

On July 27, 2023, Pine Protocol announced support for BTC collections on its platform.[26]

"Leverage your @BitcoinFrogs @OrdinalMaxiBiz @Bitcoin_Punks_ with our BTC lending and generate passive income.[26]

On August 11, 2023, Pine Protocol partnered with Solv Protocol[24], an on-chain fund platform to further collaborate on their shared mission to use blockchain technology to improve liquidity for fund investment. [25]

"It's an honor to embark on this journey with @SolvProtocol. Our united vision and commitment to the future of on-chain funds, blending tradFi with #DEFI and #NFTfi, is just the beginning - Pine Protocol tweeted[23]

Product Offerings

Asset-back Loans and Collateralized Lending

The main product of the protocol serves as a facilitating platform for asset-backed loan borrowing and underwriting. It enables individuals to use NFTs as collateral to fulfill their liquidity needs while generating additional yield from their unused crypto funds. [16]

Pine Now Pay Later (PNPL)

PNPL allows individuals to acquire NFTs with leverage in one atomic transaction. They can acquire NFT on an open platform and obtain a loan from Pine to finance the purchase, as all loans on the platform are term loans with fixed tenors and rates upon initiation. [17]

Pine Listing

This enables full-margin trading of NFTs. Users are allowed to list their NFTs for sale even if they are currently serving as collateral for an outstanding loan. When a sale is completed, a portion of the proceeds automatically repay any existing loan linked to the NFT, while the seller retains the remaining profit. [17]

Bid Now Pay Later (BNPL)

BNPL is built on PNPL and allows users to place bids rather than taking market offers directly. With this, users can place a bid for a particular NFT without holding the equivalent amount of ETH in their wallets. A bid can be placed through Pine’s smart contract with a margin of a fraction of the total amount, and whenever a user places an active bid, a loan is granted against the ETH margin to finance the leveraged bid. [17]

Bulk Borrowing

Bulk borrowing enables the smoothening of the BNPL and BidNPL processes. It permits the bid and purchase of NFT with a 0 ETH balance from the buyer’s wallet by scanning the borrower's wallet for all NFT collaterals that can be pledged. It then borrows the maximum available amount with the most favorable offers from the respective collections in a transaction. [18]

Pine Protocol’s Ecosystem

The ecosystem is divided into two parts: Pine Token and PineDAO. [5]

Pine Token ($PINE)

The Pine token is a transactional, utility, and governance token that works in conjunction with PineDAO. It was launched on the Ethereum mainnet and Polygon and is used within the Pine Protocol ecosystem. There are three types of Pine tokens available: PINE, vePINE, and sbPINE. [5]

PINE is the primary tradeable and transferable token and serves as the unit of account for the Pine protocol. vePINE and sbPINE are utility tokens and VIP membership proofs that provide access to perks and utilities within the ecosystem. To unlock these benefits, one must possess vePINE and sbPINE tokens. [5][12]

PINE Distribution

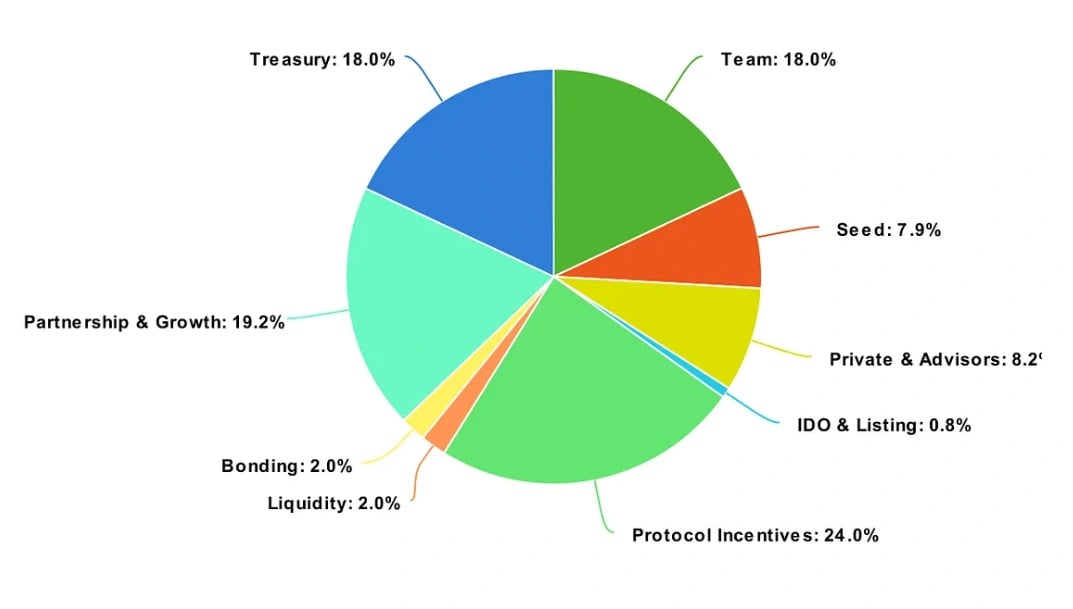

The Pine token can be used for governance, fee discounts, boosted rankings, liquidation protection, and many more. Its total supply is 200,000,000, and its distribution, as of February 2023, is represented in the image below: [18]

PineDAO

PineDAO operates in an autonomous manner, with decentralized voting taking place among vePINE and sbPINE holders. Both tokens are equivalent in value, allowing holders to create DAO proposals, vote on DAO proposals, and receive DAO rewards. The PineDAO ecosystem functions based on three key activities: providing liquidity in NFTfi, managing the treasury of the Pine Protocol, and the NFTfi Ecosystem Partnership. [19]

Providing liquidity in NFTfi

Liquidity in NFTfi is carried out on both the Pine Protocol and other reputable NFTfi platforms/protocols to provide interest yield, liquidation proceeds, and other fees associated with liquidity provision. [20]

Managing the Treasury

This activity provides fees from Pine loans or interest rate spread, auto-rollover fees, and liquidation fees. [20]

NFTfi Ecosystem Partnership

This allows for incubating and investing in other NFTfi platforms and protocols, as well as liquidity mining using tokens the DAO receives as protocol fees, such as BEND and JPEG. [20]

$PINE LP Staking

In June 2023, Pine Protocol announced the LP Staking & Incentives program, an initiative designed to enhance the strength and vitality of the $PINE token. [20]

Participating in the LP staking program is an opportunity for users to contribute to the $PINE ecosystem. By staking their $PINE tokens, they become valuable participants in the liquidity pool. As a reward for their contribution, they are entitled to receive $PINE rewards. [20]

Pine Protocol IDO

On February 1, 2023, Pine Protocol released its IDO (Initial Dex Offering) participation guide for the upcoming IDO slated for February 6 - 8, 2023. To participate, users were required to complete KYC, and stake IDIA and vIDIA tokens on Impossible Finance's Launchpad platform[21]. Balances and staked amounts were recorded on-chain, and users were able to purchase an amount of $PINE relative to all other users’ staked balances. [22]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)