XY Finance

XY Finance addresses liquidity challenges through a community-driven platform. It ensures users access optimal routes while liquidity providers earn incentives. By aggregating DEXs and bridges, XY Finance enables cross-chain asset routing with minimized rates and instant transactions, prioritizing speed and security. Wilson Huang is the founder and CEO of XY Finance. [1]

Overview

XY Finance is a cross-chain interoperability protocol that provides users optimal routes and fast transfers across various tokens. It offers advanced SDKs, APIs, and Widgets for developers, facilitating seamless integration into their projects and connections to over 20 supported chains. The protocol introduces Swap and yBridge to enhance the cross-chain experience, enabling users to transfer tokens across different blockchains and L2 rollups easily. yBridge maintains a cross-chain liquidity pool, incentivizing liquidity providers with swap fees and the governance token ($XY), allowing users to earn passive income by deploying assets as liquidity. [1][2]

Products

Swap

Swap serves as a decentralized cross-chain DEX aggregator, aiming to streamline asset transfers across supported chains by finding the most efficient paths among DEXs. Users can execute cross-chain swaps instantly with a single click, eliminating the complexities of traditional procedures. XY Finance integrates numerous chains, including Ethereum, BSC, Polygon, Fantom, Cronos, ThunderCore, Avalanche C-Chain, KCC, Arbitrum, Optimism, Astar, Moonriver, Klaytn, and Cube, encompassing approximately 98% of the overall EVM ecosystem. [2]

yBridge

yBridge is a cross-chain liquidity pool protocol where users can earn trading fees by providing liquidity and receiving $XY rewards proportional to their share of total liquidity. One of yBridge's primary benefits is its ability to manage liquidity for the same asset across multiple chains. For instance, the USDT yBridge can pool USDT assets from various chains like ERC-20 USDT, BEP-20 USDT, Polygon USDT, etc., to facilitate liquidity provision for Swap. [2]

xAsset Bridge

xAsset Bridge is a feature of XY Finance, serving as a bridge and DEX aggregator supporting over 20 chains. It enables third-party partners to swiftly and efficiently build their token bridges, streamlining cross-chain transactions and expanding token utility. [3]

Developers benefit from XY Finance's xAsset Bridge structure by bypassing the time and cost typically associated with bridge development. Partners retain complete control over their token contracts, maintaining ownership and flexibility. They can withdraw operational authority from XY Finance, ensuring independence and mitigating systemic risks. Additionally, the mint/burn approach simplifies liquidity management, and xAsset Bridge does not affect partners' total token supply. [3]

Listing assets on XY Finance enhances user accessibility. Users can purchase partner tokens using any tokens from integrated chains, lowering the engagement threshold and making partner tokens more accessible. [3]

XY Dispatcher

XY Dispatcher is a batch-send token tool designed to facilitate the seamless transfer of tokens following ERC-20 standards across all supported chains to hundreds of addresses with just a few clicks. Automating the process offers the easiest and fastest solution for token airdrops. Unlike other alternatives, XY Dispatcher filters out repetitive wallet addresses and enables batch sending of funds to addresses with varying amounts. Additionally, users will soon be able to batch-send tokens with ENS addresses. It is convenient for individuals looking to process multiple transactions simultaneously and essential for crypto project managers, campaigners, and influencers managing token airdrops. [2]

GalaXY Kats

GalaXY Kats comprises 10,000 distinct meerkat NFTs on the Ethereum blockchain, aiming to offer practical utilities beyond their role as NFT/PFP. Holding a GalaXY Kats NFT grants access to the GalaXY blockchain game with enhanced stats and unlocks DeFi utilities like swap fee rebates and token airdrops through the XY Finance service. [4]

GalaXY Kats - Resurgence

GalaXY Kats, developed by XY Finance, is an NFT/GameFi project that combines dynamic NFTs, DeFi, and blockchain gaming. Collaborating with River Games, creators of the Bored Ape Yacht Club mobile game, GalaXY Kats offers users a novel blend of features. GalaXY Kats - Resurgence allows universal participation, irrespective of GalaXY Kats NFT ownership, enabling players to engage in the game, mint in-game equipment into NFTs, and compete for rewards from a significant prize pool. The game allows players to collect equipment and game currency through various modes, strengthen their characters, and climb the ranks, regardless of GalaXY Kats NFT ownership. [5]

XY Token

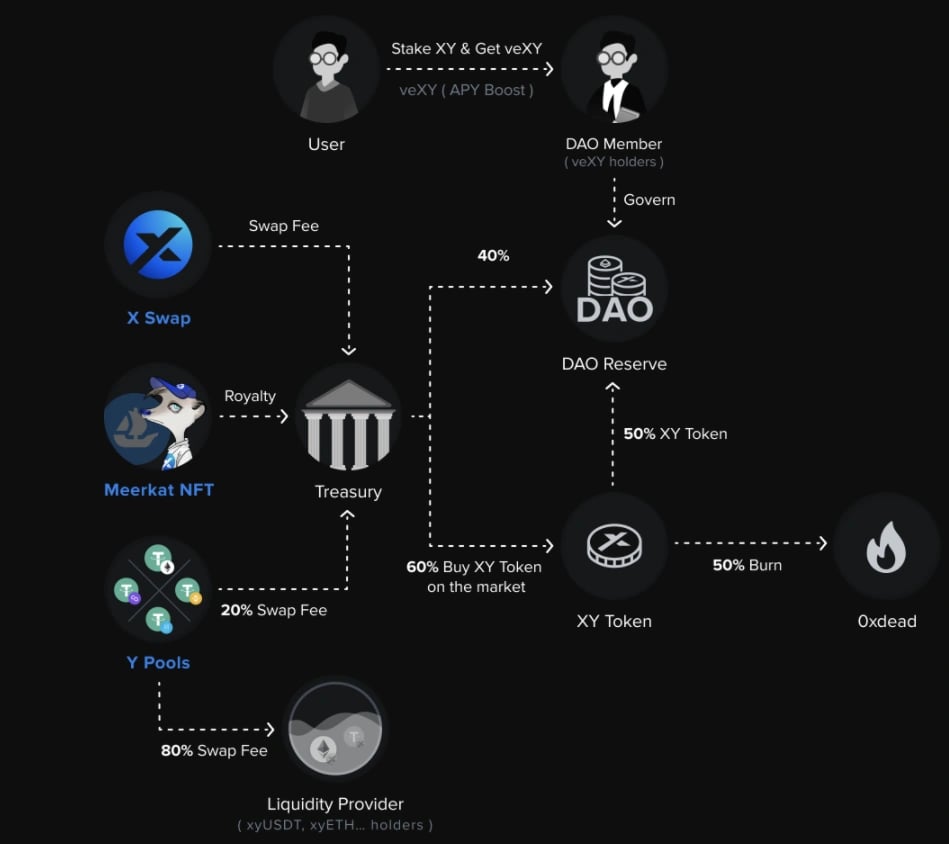

XY Token is XY Finance's native utility and governance token, offering staking incentives and governance participation. Token holders can stake XY Tokens to earn a share of the protocol's generated revenue. Additionally, they can engage in the governance process, influencing product features and key parameters of XY Finance to shape its development trajectory. [6]

XY Token is accessible across all chains supported by the XY protocol, ensuring widespread availability. Participating in liquidity mining programs on specific chains, such as Binance Smart Chain (BSC) or Ethereum, rewards users with XY Tokens native to those chains. XY Finance facilitates seamless token movement among supported chains through its official bridge, enabling users to deposit assets and receive rewards across multiple chains securely and efficiently. [6]

Tokenomics

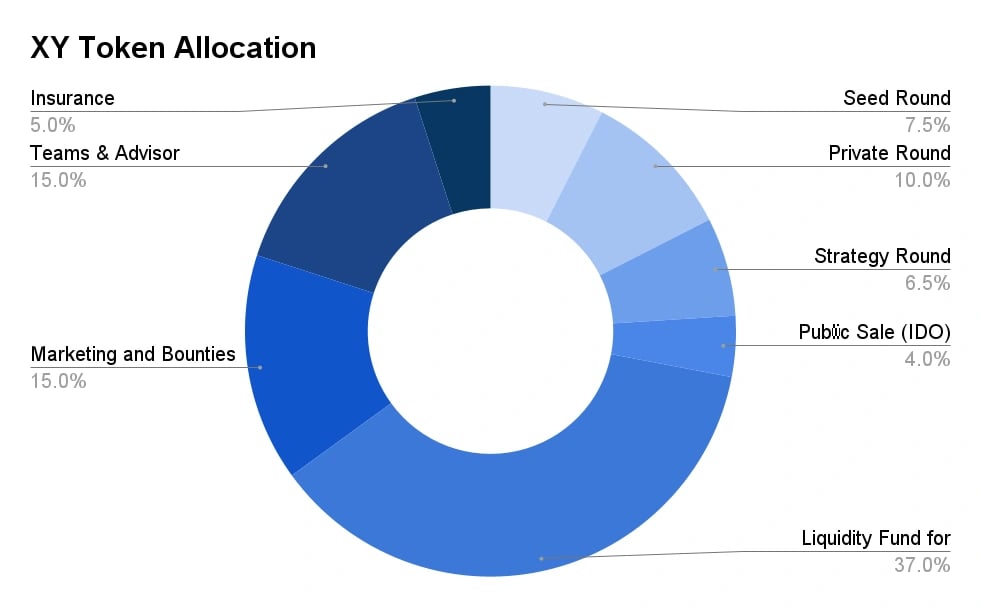

The total supply of XY Tokens will be 100,000,000, with no provision for future inflation. It will have the following allocation: [6]

- Liquidity Fund for Mining/GameFi Reward: 37%; asymptotic vesting over three years

- Marketing/Bounties: 15%; vesting over three years

- Teams & Advisors: 15%; vesting over three years with ten months cliff

- Private Round: 10%; vesting over two years with six months cliff

- Seed Round: 7.5%; vesting over three years with ten months cliff

- Strategy Round: 6.5%; vesting over 1.5 years with four months cliff

- Insurance: 5%

- Public Sale (IDO): 4%; TGE

veXY

Vote-Escrowed XY (veXY) Token holders govern and upgrade XY Finance, utilizing administrative functions within the veXY Token contract to propose, vote on, and implement changes. Proposals can adjust system parameters or introduce new protocol functionality. Users can lock their XY Tokens in the veXY contract to receive veXY Tokens, with lock-in periods ranging from 1 to 104 weeks. Longer lock-in periods offer higher incentives compared to shorter ones. [6]

XY DAOs

XY DAOs are established across supported chains, enabling multichain users to participate in XY Finance governance. If XY Tokens are locked in an Ethereum-based XY DAO and transferred to another chain's XY DAO is desired, waiting until the tokens are unlocked or acquiring additional XY Tokens on the desired chain to lock them into the DAO is necessary. [7]

For ongoing and future XY DAO mining campaigns, rewards are determined based on the total veXY across supported chains to encourage participation. The share of rewards is calculated according to veXY holdings, recorded in daily snapshots taken at random intervals. [7]

Each XY DAO operates independently, allowing XYers to choose lockup amounts and periods specific to each DAO, which may differ from those in other XY DAOs. Additionally, rewards for locked XY Tokens can only be claimed on the same chain where they were locked within the XY DAO. [7]

Partnerships

Wallet Integrations

On February 26th, 2024, XY Finance expanded its support to include all major blockchain wallets. Following a contract upgrade, the platform now supports ten wallets, providing users with a wider range of options for seamless integration. These supported wallets include MetaMask, WalletConnect, Coinbase Wallet, OKX Wallet, Trust Wallet, imToken, Bitget Wallet, Halo Wallet, Brave Wallet, and Binance Web3 Wallet. [8]

OKX

On January 5th, 2024, XY Finance announced the integration of OKX DEX across multiple platforms, including Ethereum, Cronos, Avalanche, zkSync, Linea, Arbitrum, Optimism, BNB, Base, and Fantom. This integration provides users with increased liquidity stability, access to a wider range of cross-chain routes, and the advantage of more cost-effective quotes with ease. [9]

Circle

On October 19th, 2023, XY Finance announced the integration of Circle's CCTP (Cross-Chain Transfer Protocol), providing improved liquidity and quotes on platforms such as Arbitrum, Avalanche, Base, Ethereum, Optimism, and Polygon. This integration offers users increased liquidity stability, access to additional cross-chain routes, and the advantage of more cost-effective quotes with ease. [10]

Mantle Network

On October 9th, 2023, XY Finance announced its integration with Mantle Network, offering several benefits to users and developers. For users, this integration enables easy bridging and swapping of tokens from over 20 chains to Mantle via XY Finance, as well as the opportunity to become liquidity providers and earn ETH, USDT, and USDC. The XY Dispatcher feature also allows batch sending of ERC-20 tokens across supported chains, including Mantle Network, to multiple addresses in a single transaction. [11]

Base

On August 30th, 2023, XY Finance announced its integration with Base by Coinbase, a highly anticipated Layer 2 solution built on the OP stack framework. This integration offers users the benefits of fast cross-chain transactions, reduced fees, enhanced security, and various opportunities within Base's dynamic ecosystem. [12]

Astar

On November 24th, 2022, the Astar community approved XY Finance to participate in Astar's #Build2Earn dApp staking program. Users gained the ability to stake $ASTR on XY Finance to offer support and earn additional $ASTR rewards. Additionally, XY Finance received rewards from the dApp staking program, which was allocated for the benefit of Astar's common goods and protocol operations. [13]

Curve

On October 24th, 2022, XY Finance integrated liquidity from Curve as part of its recent 1inch integration. Curve, a decentralized exchange (DEX) specializing in stablecoin trading, offered XY Finance and its users an enhancement in cross-chain experience, boasting the largest stablecoin liquidity pools in the ecosystem. [14]