Kelp DAO

Kelp DAO는 이더리움 및 EigenLayer를 위한 크로스 체인 스테이킹 솔루션입니다. 퍼블릭 블록체인 네트워크를 위한 유동성 리스테이킹 솔루션 개발에 집중하고 있습니다. Kelp DAO 팀은 EigenLayer에서 이더리움을 위한 rsETH라는 LRT 솔루션을 구축하고 있습니다. Amitej Gajjala와 Dheeraj Borra는 Kelp DAO의 공동 창립자입니다. [1]

개요

2023년 11월에 출시된 Kelp DAO는 이더리움 및 EigenLayer용 크로스체인 유동성 스테이킹 플랫폼입니다. 이더리움 검증자의 인출 자격 증명을 EigenPod로 전달하여 EigenLayer 모듈의 유효성 검사 및 보안을 용이하게 합니다. 이 메커니즘을 통해 검증자 노드에 대한 32 ETH 임계값 미만의 ETH 토큰 보유자는 이더리움에 ETH를 스테이킹하고 EigenLayer에 다시 스테이킹할 수 있습니다. [2][3]

Kelp DAO는 사용자가 암호화폐 보유량을 스테이킹하는 프로세스를 간소화합니다. 전통적으로 스테이킹은 단일 블록체인으로 제한되었지만 Kelp DAO는 멀티체인 스테이킹을 가능하게 함으로써 혁신을 이루었습니다. 이는 다양한 블록체인에서 암호화폐를 나타내는 래핑된 토큰을 통해 이를 달성하여 사용자가 다양한 체인에서 자산을 스테이킹할 수 있도록 합니다. [2][3]

Kelp DAO는 사용자의 스테이킹된 자산을 모아 블록체인에서 DeFi 애플리케이션에 사용되는 유동성 풀을 형성합니다. 이러한 풀에 기여함으로써 사용자는 거래 수수료 및 프로토콜 인센티브와 같은 소스에서 보상을 얻습니다. [2][3]

2024년 5월 22일, Kelp DAO는 비공개 토큰 판매 라운드에서 9백만 달러를 모금했다고 발표했습니다. SCB Limited와 Laser Digital이 350만 달러의 투자로 라운드를 주도했습니다. 다른 투자자로는 Bankless Ventures, Hypersphere Ventures, Draper Dragon, DACM, Cypher Capital, GSR, HTX Ventures 및 DWF Ventures가 있습니다. Scott Moore, Sam Kazemian, Marc Zeller, Saurabh Sharma 및 Amrit Kumar와 같은 엔젤 투자자도 참여했습니다. Kelp는 2월에 모금을 시작하여 3월에 9천만 달러의 완전 희석 가치로 라운드를 마감했습니다. [11]

KEP 토큰

$KEP(Kelp Earned Points)는 Kelp 플랫폼을 통해 획득한 EigenLayer 포인트와 관련된 ERC-20 토큰입니다. 각 $KEP는 1개의 EigenLayer 포인트와 같습니다. 사용자는 축적된 EigenLayer 포인트를 저장, 거래 및 선호도에 따라 활용하는 등 완전한 제어 권한을 가집니다. 리스테이커는 Kelp 탈중앙화 애플리케이션을 통해 $KEP 토큰을 청구할 수 있습니다. 매주 리스테이커는 전주에 획득한 EigenLayer 포인트에 해당하는 $KEP를 청구할 수 있습니다. [4]

ERC-20 토큰인 $KEP는 자유로운 전송 및 거래를 가능하게 하여 EigenLayer 포인트와 잠재적인 리스테이킹 보상의 유동성을 향상시킵니다. ETH 또는 LST를 리스테이킹하는 것만이 EigenLayer 포인트를 획득하는 유일한 방법은 아닙니다. $KEP는 대안을 제공하여 리스테이킹 자본 효율성을 높이고 다양한 사용자 그룹 간의 세분화를 도입합니다. 이러한 그룹에는 EigenLayer 포인트와 $KEP를 생성하는 포인트 생산자와 $KEP를 거래/구매/판매/롱/숏하며 리스테이킹을 위한 ETH 자본을 반드시 소유하지 않을 수도 있는 포인트 축적자가 포함됩니다. [4]

$KEP의 즉각적인 사용 사례에는 자동화된 마켓 메이커(AMM)에서 거래하고 $KEP <> rsETH, $KEP <> USDC 페어로 탈중앙화 거래소(DEX)에서 유동성을 제공하여 kelp miles 및 스왑 수수료와 같은 보상을 획득하는 것이 포함됩니다. [4]

rsETH

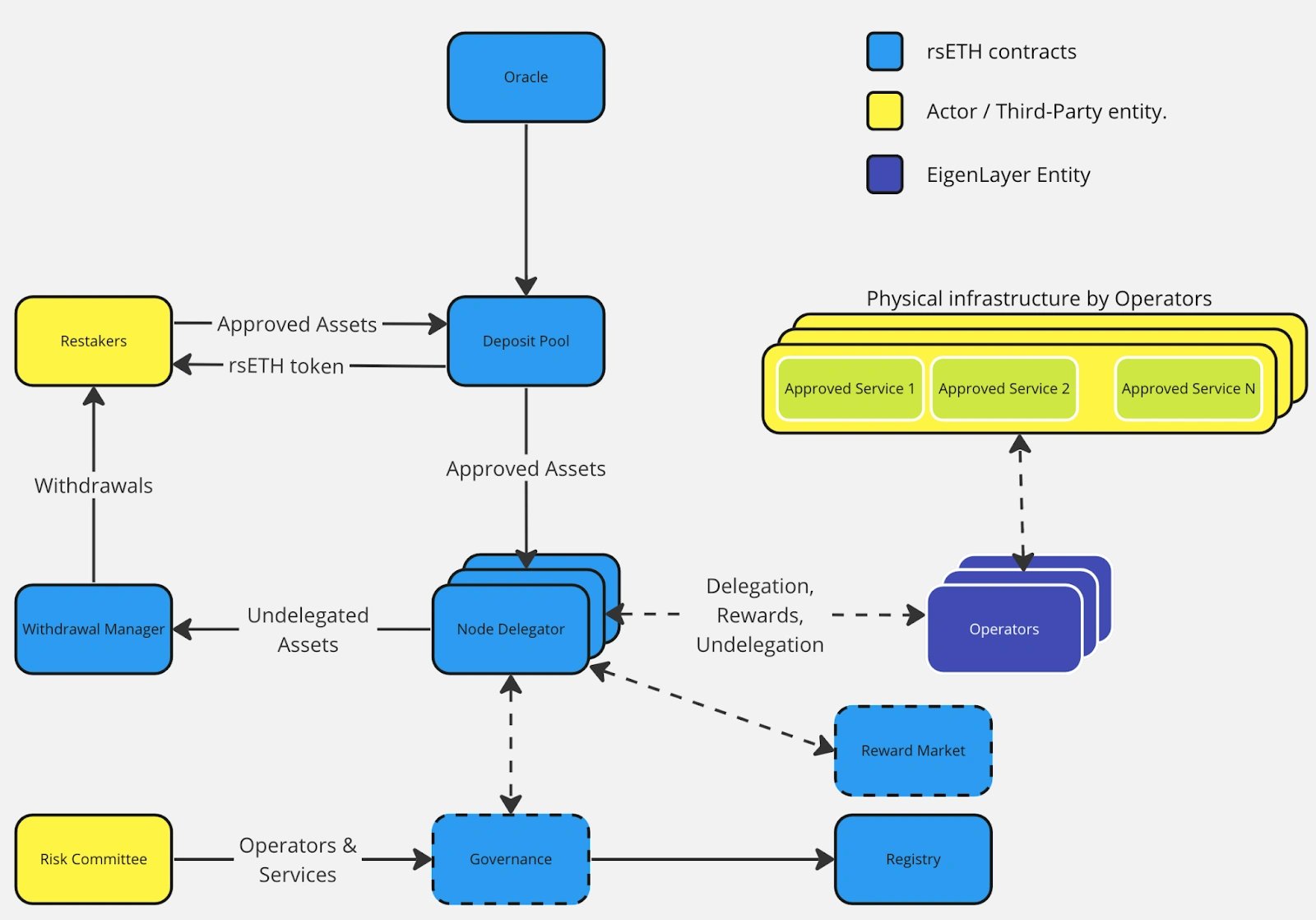

rsETH는 EigenLayer에서 담보로 승인된 LST에서 생성된 통합된 유동성 재스테이킹 토큰입니다. 스테이킹된 자산의 부분 소유를 가능하게 하고, 재스테이킹 및 탈중앙화 금융 (DeFi)에 대한 접근을 단순화하며, DeFi 프로토콜 내에서 구성성을 활용합니다. 또한 복잡한 보상 시스템 및 과도한 가스 요금과 같은 문제를 해결합니다. [2][5]

Kelp Miles

Kelp Miles는 EigenLayer 재스테이킹 포인트를 보완하여 재스테이커에게 추가적인 인센티브를 제공합니다. 그들은 재스테이킹 보상을 강화하고 재스테이커의 기여에 비례하는 인센티브를 제공하는 것을 목표로 합니다. rsETH를 사용하는 DeFi 참가자는 Kelp Miles, EigenLayer 포인트 및 DeFi 활동에서 추가 수익을 얻을 수 있습니다. Kelp는 부스트된 Kelp Miles를 제공하여 DeFi 기회를 더욱 장려하여 사용자에게 DeFi 참여에 대한 추가 혜택을 제공합니다. [6]

Pendle Finance

Kelp DAO 사용자는 rsETH를 사용하여 미래 수익의 토큰화 및 거래를 가능하게 하는 프로토콜인 Pendle과 네 가지 주요 포지션을 통해 상호 작용할 수 있습니다: [7]

- PT-rsETH: PT 포지션은 만기 시 원금만을 나타냅니다. 여기에는 설정된 기간 동안 rsETH를 Pendle 프로토콜에 예치하여 만기 시 고정 수익을 얻는 것이 포함됩니다. 이 전략을 통해 교환 비율에 따라 할인된 가격으로 PT-rsETH를 받습니다. 만기 시 각 PT-rsETH에 대해 1 ETH 상당의 rsETH를 받게 되며, 이는 수익을 구성합니다. 특히 이 포지션은 EigenLayer 포인트 또는 Kelp Miles를 얻지 못하며, 고정 수익을 확보하기 위한 것입니다. 또한 PT-rsETH는 만기 전 언제든지 판매할 수 있습니다.

- YT-rsETH: YT 포지션은 만기까지의 기초 자산 수익을 나타냅니다. 각 YT-rsETH는 풀 만기까지 1 ETH 상당의 rsETH에서 생성된 모든 수익과 포인트를 제공합니다. YT 가격은 시장 가치를 반영하여 시장 가격에 따라 결정됩니다. 예를 들어 1 rsETH가 10 YT-rsETH로 거래되는 경우 사용자는 각 YT-rsETH에 대해 10 ETH 상당의 rsETH에 해당하는 Miles 및 포인트를 얻습니다. YT-rsETH 가격에 대한 추측은 Long Yield APY, EigenLayer 포인트 및 Kelp Miles와 같은 요소를 기반으로 할 수 있지만 철저한 조사가 권장됩니다.

- LP-rsETH: LP 포지션은 PT-rsETH와 SY-rsETH로 구성되며, SY 부분은 수익을 얻습니다. 이 설정은 단일 자산 노출을 제공하여 비영구적 손실(IL)을 최소화합니다. 이점으로는 EigenLayer 포인트, 향상된 Kelp Miles, 스테이킹/재스테이킹 수익, PT-rsETH의 고정 수익, 스왑 수수료 및 Pendle 인센티브가 있습니다.

- Liquid Lockers: rsETH는 Pendle의 유동성 로커 중 두 곳인 Penpie와 Equilibria에서 액세스할 수 있습니다.

파트너십

통합

Kelp DAO는 Pendle 외에도 Uniswap, Curve 및 Balancer와 통합되었습니다. 유동성을 제공하는 사용자는 Kelp Miles와 Eigenlayer 포인트를 3배로 획득할 수 있습니다. [7]

Polyhedra (ZK)

2024년 4월 16일, Kelp DAO는 제로 지식 증명(ZKP)을 사용하는 차세대 Web3 인프라 개발업체인 Polyhedra (ZK)와 파트너십을 맺었습니다. 이 파트너십을 통해 Polyhedra는 프로토콜의 보안을 강화하기 위해 3억 달러 상당의 스테이킹된 ETH를 받았습니다. [8]

Laser Digital

2024년 4월 26일, Kelp는 Nomura 그룹의 디지털 자산 자회사인 Laser Digital과의 전략적 파트너십을 발표했습니다. 이 파트너십을 통해 Laser Digital의 현재 및 미래 디지털 펀드에 리스테이킹 솔루션이 도입되었으며, rsETH가 디지털 펀드에 통합된 최초의 LRT가 되었습니다. [9]

Planar Finance

2024년 5월 12일, Planar Finance는 Kelp DAO와의 파트너십을 발표했습니다. 이 파트너십을 통해 양쪽 프로토콜의 다양한 보상 소스를 활용하여 수익률을 최적화하는 것이 목표였습니다. [10]

Anzen 프로토콜

2024년 6월, Kelp은 AVS와 리스테이커 간의 결제 최적화를 강화하기 위해 Anzen 프로토콜과의 파트너십을 발표했습니다. [12]

팀이 Anzen과 파트너십을 맺은 이유에 대해 다음과 같이 응답했습니다.

"Anzen은 AVS-리스테이커 상호 작용을 위한 결제 최적화에 전념하는 최초의 플랫폼으로 두드러집니다. 그들의 시스템은 DeFi의 건전성 지표와 유사한 실시간 '안전 계수(SF)'를 통해 경제적 안전 장치를 동적으로 조정하여 안정성과 보안을 보장합니다."

이번 협력은 커뮤니티의 리스테이크된 ETH에 대한 수익을 높이고 보안을 강화할 것으로 예상됩니다. [12]

Gain by Kelp

2024년 8월 13일에 소개된 Kelp 기반의 Gain은 사용자 보상을 최적화하는 데 한 걸음 더 나아갔습니다. 이 프로그램은 단일하고 다각화된 전략을 통해 여러 Layer 2 (L2) 에어드랍 및 DeFi 기회에 간소화된 액세스를 제공하여 수익 잠재력을 향상시킵니다. [13]

"Gain은 여러 L2 네트워크 및 DeFi 프로토콜에 한 번에 액세스할 수 있도록 지원하는 디젠 컨시어지 역할을 합니다. 개별 포지션을 지속적으로 모니터링할 필요 없이 에어드랍 기회 및 DeFi 전략에 대한 참여를 단순화합니다. 단 한 번의 클릭으로 사용자는 높은 성장 기회의 세계를 열 수 있습니다." - 블로그 언급[13]