Subscribe to wiki

Share wiki

Bookmark

Centrifuge

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Centrifuge

Centrifuge is a platform for onchain finance and real-world asset tokenization, providing investors access to a diverse range of assets. This framework aims to enhance transparency and offer investors better portfolio insights. [1][2][14]

History

Centrifuge was founded in 2017 to solve inefficiencies in the financial system with blockchain technology. [3]

In mid-2021, Centrifuge integrated the first real-world asset pool with MakerDAO. This was the first loan to use MakerDAO as a credit facility as well as the first instance of a stablecoin (DAI) being backed by real-world assets. Later in 2021, the RWA Market was launched, with the Aave protocol used to bring liquidity to RWAs on Centrifuge. [1][3]

In October 2022, BlockTower Credit became the first institutional credit fund to bring its collateralized lending operations onchain by funding $220M of real-world assets through Centrifuge — with MakerDAO providing $150M of senior capital to BlockTower's Centrifuge pools. This marked the largest onchain investment in real-world assets. [4][5]

In 2023, Centrifuge launched Centrifuge Prime: a product that helps DeFi-native organizations, like DAOs, stablecoins, and protocols, onboard and scale a portfolio of real-world assets. Customers include Frax and Gnosis. [6][7]

Also in 2023, Centrifuge held the first Real-World Asset Summit, where they brought together leaders from both traditional and DeFi to accelerate the future of the tokenized asset industry. Centrifuge was also one of the founding members of the Tokenized Asset Coalition alongside industry leaders like Circle, Coinbase, etc. [3]

In late 2023, Centrifuge also released Liquidity Pools: smart contracts that can be deployed on any EVM-based chain that allow users on these chains to invest in pools on Centrifuge. [3]

Onchain Fund Management Platform

On March 19, 2024, Centrifuge announced the launch of its fund management platform designed to onboard credit funds to public blockchains to provide a more frictionless way of fund management. [15][16][17]

"Institutional investors will come when the best opportunities are onchain," said Lucas Vogelsang, co-founder of Centrifuge. [15]

"So we're focused on enticing asset managers to tokenize their funds by providing the reporting, automation, and third-party integration capabilities they require to build a better business onchain."[15]

Funding

In November 2022, Centrifuge announced a strategic funding round of $4 million. This round was led by Coinbase Ventures with participation from L1 Digital and Scytale. This funding came at a time when Centrifuge had seen tremendous momentum and a growing focus on real assets in the financial and cryptocurrency sectors. [12][13]

Earlier that year, crypto and blockchain investment firm BlockTower Capital announced a $3 million strategic partnership with Centrifuge. [12]

"We're building the credit market of the future and along with that we need to build out the financial ecosystem for institutions to transact on chain." said Lucas Vogelsang, CEO and Co-Founder, Centrifuge. "Partners like Coinbase and BlockTower are essential in building critical parts of this infrastructure, as Centrifuge becomes the go-to platform for real-world assets and on chain secured credit."[12]

Overview

Centrifuge offers the necessary infrastructure and ecosystem for tokenizing, managing, and investing in a diversified portfolio of real-world assets. These asset pools are fully collateralized, providing investors with legal recourse. The protocol is asset-class agnostic, accommodating various assets such as structured credit, real estate, US treasuries, carbon credits, and consumer finance. [1][8]

Additionally, Centrifuge's ecosystem includes a DAO supported by finance professionals and developers. Its goal is to bring the entire structured credit market onto the blockchain, enhancing transparency and affordability in the financial system. [1][8]

Products

Centrifuge Chain

Centrifuge Chain is a layer-1 blockchain purpose-built for financing real-world assets (RWAs). Centrifuge Chain houses pools, their assets, tranches, onchain governance, the treasury, and the CFG token. Real-world assets are tokenized as NFTs (Non-Fungible Tokens) to create an onchain representation and are linked to detailed off-chain data. The assets are pooled together and securitized by the issuer. Centrifuge Chain enables the creation of essential features necessary for onchain RWAs and integration with traditional financial systems. [9]

The CFG Token, native to Centrifuge Chain, is used as an onchain governance mechanism that empowers CFG holders to manage the development of the Centrifuge Protocol. [9]

Via EVM compatibility, Centrifuge allows users to perform transactions via popular Ethereum-based wallets like MetaMask. With Liquidity Pools, users from across the Ethereum (and Ethereum Layer-2) ecosystem can contribute liquidity to Centrifuge Pools. [9]

Centrifuge App

The Centrifuge App provides an interface for investors to invest in RWAs and for issuers to manage their asset pools and draw financing from tokenized assets. [1][9]

This app is accessible on any supported EVM (Ethereum Virtual Machine) chain, as well as through direct connection with Centrifuge Chain. The integration of Liquidity Pools enables investments from any supported EVM chain, removing the necessity for users to switch from their preferred chain (e.g., Ethereum, Arbitrum) to invest and redeem from pools on Centrifuge. [9]

Liquidity Pools

Centrifuge's Liquidity Pools are sets of smart contracts that can be deployed on any Ethereum Virtual Machine (EVM) chain — like Ethereum and its Layer-2 networks, as well as "Alt-L1s". Liquidity Pools allow users and organizations on these chains to invest in pools on Centrifuge without having to leave their native chain. [9]

Centrifuge Prime

Centrifuge Prime is a product designed for onchain organizations such as DAOs, protocols, as well as entities like protocol foundations. Centrifuge Prime streamlines the process of onboarding and scaling a portfolio of RWAs for these organizations. It addresses both technical and legal/off-chain considerations involved in investing in RWAs. [9]

CFG Token

CFG is the native token of Centrifuge, facilitating an onchain governance system that empowers CFG holders to steer Centrifuge’s development without reliance on a centralized third party. CFG is also used to pay for transactions on Centrifuge Chain. All changes to the Centrifuge protocol or the CFG token model go through governance proposals and need to be implemented by CFG token holders. [10]

Governance

CFG tokens are utilized for the ability to participate in technical governance in proportion to their stake in the protocol by voting to upgrade the chain runtime code. CFG holders participate in governance through an onchain voting mechanism on proposals: runtime upgrade proposals are voted on by the token holders. Approved proposals are enacted programmatically onchain. [11]

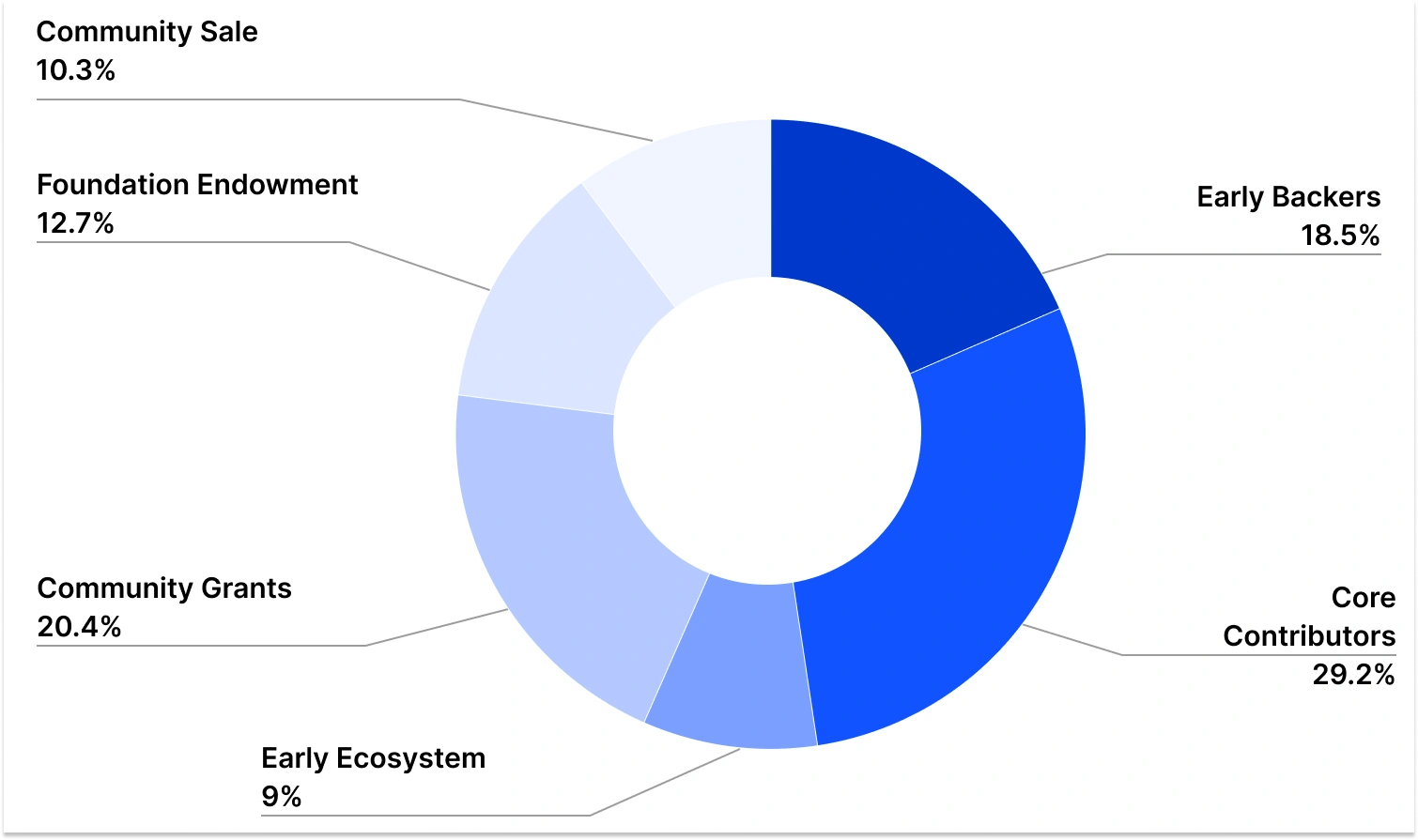

Tokenomics & Distribution

The CFG token lives natively on the Centrifuge Chain but can be bridged 1:1 to Ethereum and used as an ERC-20 token. The ERC20 Token is also called CFG on Ethereum. CFG can be used for governance, launching pools, and paying transaction/pool fees. [10]

The initial CFG Generation Event was executed by the Centrifuge Network Foundation. The initial distribution created 400,000,000 CFG, which was distributed to the Foundation and initial contributors, including; the core team, investors, and validators. Since genesis, additional tokens have been minted as rewards for chain security and to incentivize adoption. [10]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)