Subscribe to wiki

Share wiki

Bookmark

dTRINITY

We've just announced IQ AI.

dTRINITY

dTRINITY is a stablecoin liquidity protocol designed to reduce borrowing costs and provide sustainable interest rates, thereby improving looping strategies for yield-bearing assets like sFRAX, sUSDe, and sDAI. [1]

Overview

dTRINITY is a decentralized liquidity protocol that delivers lower borrowing costs, sustainable yields, and essential DeFi infrastructure on new Ethereum Layer 2 and Layer 3 ecosystems. Launching in Q3 2024, it will initially operate on Fraxtal, a Layer 2 network that offers native blockspace incentives. dTRINITY has three core components: dUSD stablecoin, dLEND money market, and dSWAP exchange, along with the TRIN governance token. dUSD is a community-centric US Dollar stablecoin on the Fraxtal L2 network, redeemable for USDC or fiat collateral, facilitating on-chain transactions and fiat on/off-ramp activities, with yield from its collateral reserve subsidizing borrower interest rates. dLEND, a fork of Aave v3, supports collateralized lending/borrowing of dUSD and other digital assets, while dSWAP, a fork of Uniswap v3, enables efficient trading and collateral liquidation, with dUSD as the base pair. [2]

Fraxtal

Fraxtal is an Optimism (OP) Stack modular rollup Layer 2 blockchain featuring "fractal scaling." It is an EVM-equivalent rollup using the OP stack for its smart contract platform, enabling secure, cost-effective application deployment similar to Ethereum rollups like Optimism and Base. Fraxtal is modular, incorporating multiple components and middleware for other chains and networks, and currently employs a data availability module developed by the Frax Core Team. It offers blockspace incentives (Flox) that reward users and developers with FXTL points for gas spending and smart contract interactions, which are convertible to tokens. The native gas token is Frax Ether (frxETH) from Frax Finance, allowing users and smart contracts like dTRINITY to earn FXTL points for additional incentives. [3]

Features

dUSD Stablecoin

dTRINITY USD (dUSD) is a decentralized, full-reserve stablecoin backed by an on-chain reserve of USD-denominated stablecoins and yield-generating assets. Issued on Fraxtal L2, dUSD maintains collateralization through smart contracts without fees aside from gas costs. Its reserve assets are selected based on factors such as quality, track record, and risk profile, with at least 90% allocated to yieldcoins that generate revenue for borrowers. Price stability is maintained using API3 oracles, which determine asset values based on underlying holdings rather than market-traded prices. Governance oversees risk management by adjusting reserve assets, suspending minting if necessary, and mitigating de-pegging risks caused by liquidity fluctuations. [4]

Utility

dUSD is dTRINTY’s native stablecoin and unified liquidity layer, serving as the base pair for both dLEND and dSWAP. Unlike centralized stablecoins that do not externalize the float income from their reserves, dUSD prioritizes the dTRINITY community by sharing a majority of its float income as interest rate subsidies to stimulate growth and adoption of the protocol. [4]

This approach reinforces a community-centric model where the success of protocol translates directly into enhanced value for community members as both dTRINITY and dUSD continue to scale. [4]

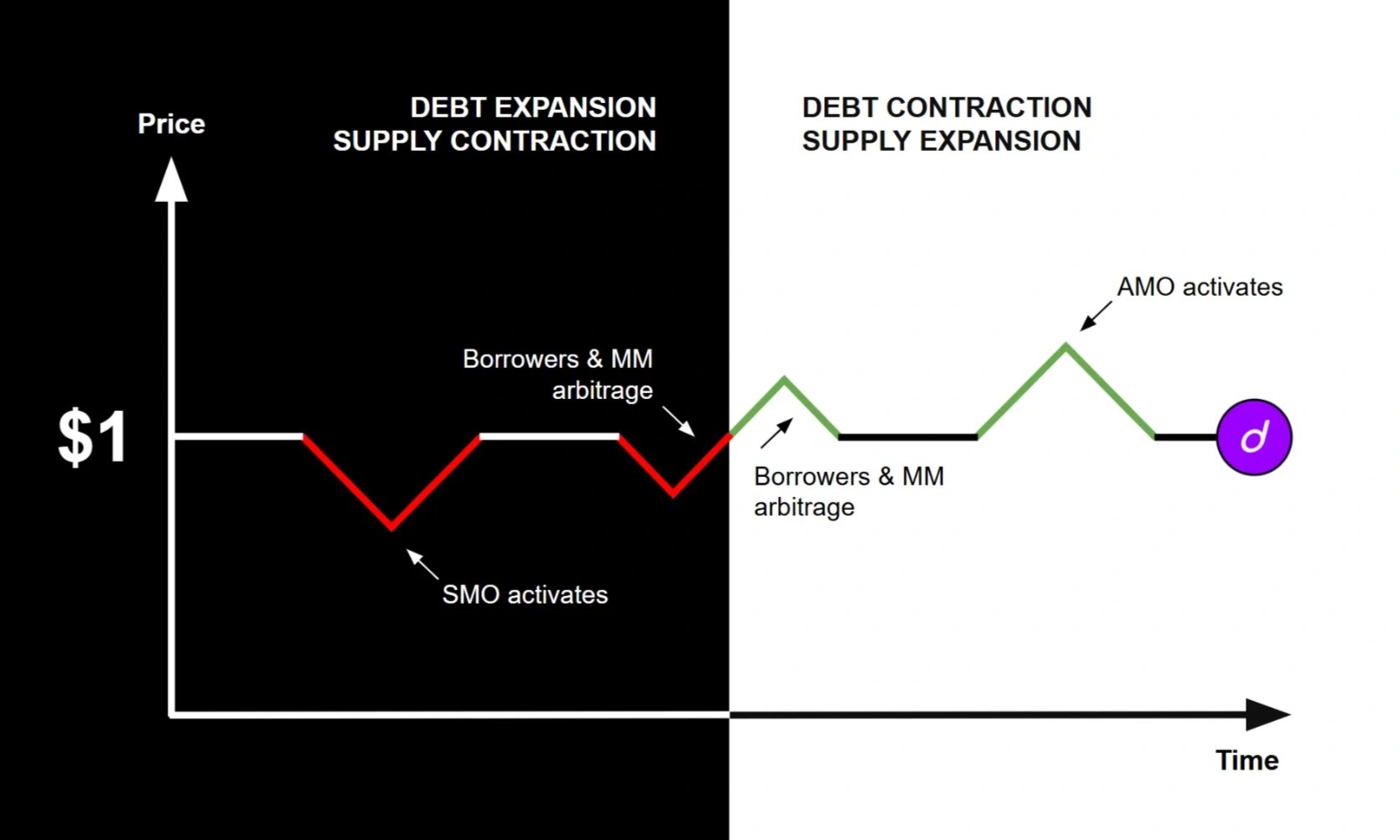

Stability Mechanisms

- Non-Redeemability: dUSD does not allow direct redemption for reserves, instead relying on arbitrage from borrowers, traders, and liquidity providers, as well as open market operations, to maintain a soft peg to $1 on decentralized exchanges.

- Stability Market Operations (SMO): When dUSD trades below $1, the protocol buys back tokens from exchanges, reducing supply and stabilizing the peg. This process also increases over-collateralization by generating arbitrage profits.

- Algorithmic Market Operations (AMO): When dUSD trades above $1, the protocol supplies additional tokens to designated liquidity pools, expanding supply and stabilizing the peg while accumulating reserves through arbitrage.

- Borrower Arbitrage: Borrowers can repay debt at a discount when dUSD trades below $1 and profit by borrowing at $1 and selling at a premium when it trades above. These actions reinforce price stability.

- Market Maker (MM) Arbitrage: Market makers capitalize on price fluctuations by buying dUSD at a discount or minting it at $1 to sell at a premium, adding liquidity and reducing reliance on protocol-driven stabilization mechanisms.

- Collateral Ratio (CR): Excess reserves from protocol operations may push dUSD's collateral ratio above 100%, strengthening confidence, stabilizing price movements, and creating a buffer against reserve devaluation. Governance can decide how to allocate surplus reserves when thresholds are exceeded. [4]

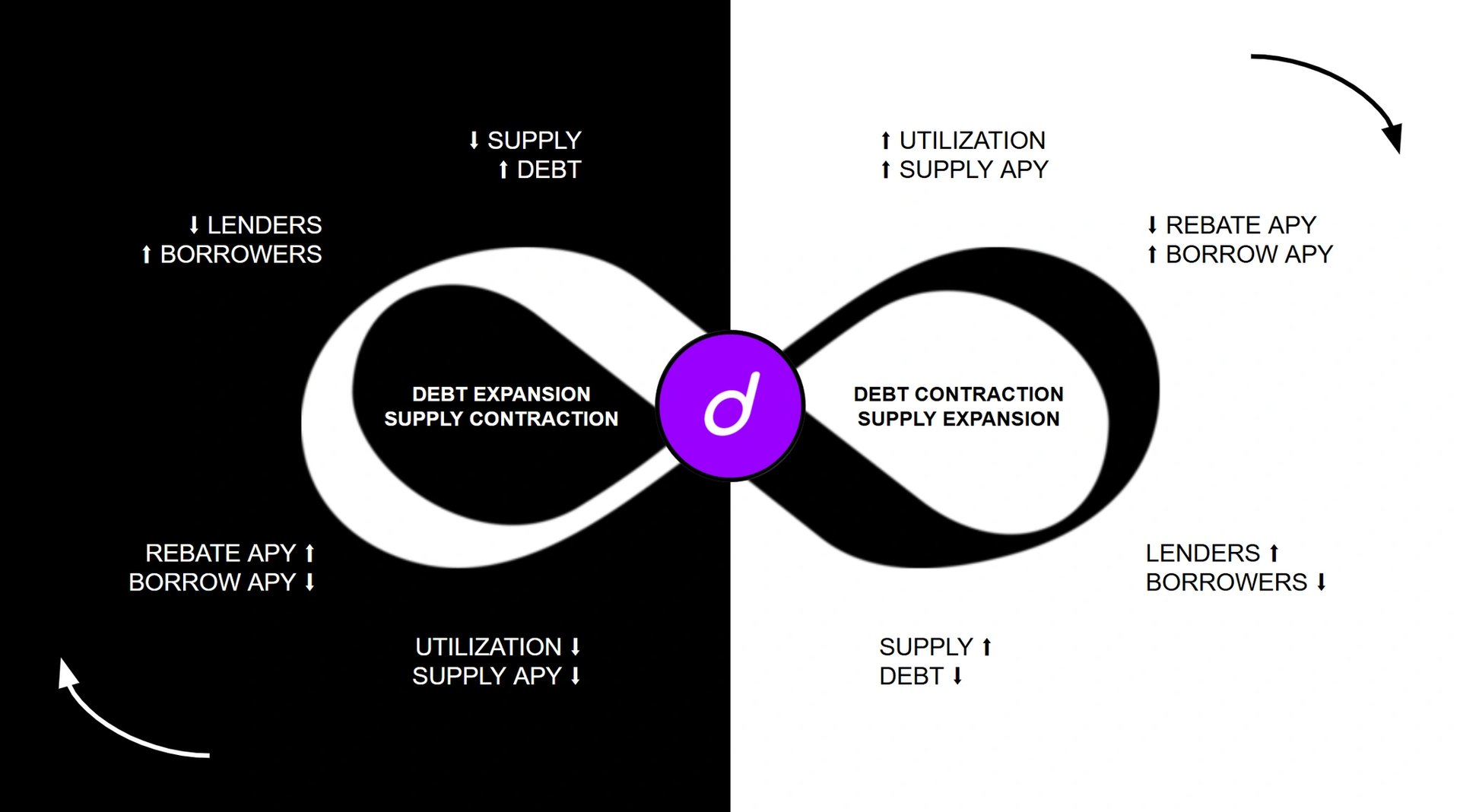

Dynamic Interest

dUSD mints new tokens weekly using at least 90% of reserve earnings to subsidize borrowing costs, distributing them as rebates to borrowers based on their outstanding debt. The rebate rate varies depending on the reserve's yield and the ratio of circulating dUSD to total debt. Additionally, dUSD can be re-lent multiple times, creating a multiplier effect similar to traditional banking, where the total borrowed and supplied value may exceed the base money supply. [4]

Interest Rate Cycles

dUSD’s interest rate cycles function inversely to traditional Federal Reserve cycles, as borrowing rates adjust dynamically based on market supply and demand. When borrowing demand is low, interest rates fall, leading to increased debt issuance and reduced dUSD supply through Stability Market Operations (SMO). Conversely, when borrowing demand rises, interest rates increase, prompting lenders to supply more dUSD while borrowers repay loans, expanding dUSD’s supply through Algorithmic Market Operations (AMO). The protocol maintains utilization by subsidizing borrowers, ensuring lender incentives remain attractive and fostering sustained ecosystem participation. [4]

dLEND Money Market

dLEND is a collateralized lending market fork of Aave V3 on Fraxtal, allowing users to borrow against their collateral and provide liquidity to borrowers in return for continuous interest payments. It supports various financial strategies, including leverage, short positions, and hedging, focusing on yield looping strategies. [5]

The protocol facilitates collateralized lending and borrowing of dUSD and other digital assets on Fraxtal. dUSD borrowing rates on dLEND are regularly subsidized to stimulate demand and utilization, generating sustainable stablecoin yields for dUSD lenders alongside other protocol and network incentives. [5]

On dLEND, lenders earn interest on their lent capital when borrowers utilize it, often resulting in loans paying a higher APR than what lenders earn. Interest rates for lending and borrowing are determined by utilization rates, with higher rates incentivizing borrowers to repay loans and attracting more lenders, ensuring liquidity for new borrowers. [5]

Borrowing Subsidies

Borrowing dUSD benefits from subsidies, making it the most cost-effective option against collateral. Projects on dLEND can further boost usage by rewarding lenders or borrowers with additional tokens. dTRINITY's governance can introduce new reward tokens for current markets, incentivizing user participation. Due to these subsidies, dUSD's borrowing APR might fall below its supply APY, leading to higher utilization rates than in non-subsidized markets. [5]

dUSD Markets

dUSD is the designated stablecoin for borrowing on dLEND, offering borrowers consistent and lower borrowing costs without switching between stablecoins. This simplifies the borrowing process and ensures lenders benefit from sustained utilization and higher yields, supported by ongoing borrower subsidies. [5]

Oracles

dLEND utilizes a mixed oracle approach depending on market conditions. It primarily relies on RedStone Oracles for assets with extensive external price discovery venues. For assets exclusive to Fraxtal or lacking liquidity on external markets, dSWAP is the price oracle. If RedStone prices are outdated, dSWAP also acts as the fallback oracle. [5]

Liquidation

Borrowers on dLEND face potential liquidation if their loan-to-value (LTV) ratio drops below a specified threshold, which varies by market. To avoid liquidation, borrowers can add more collateral or repay a portion of their debt. When liquidation occurs, both the liquidator and the protocol levy a fee, the amount of which depends on the specific market involved. [5]

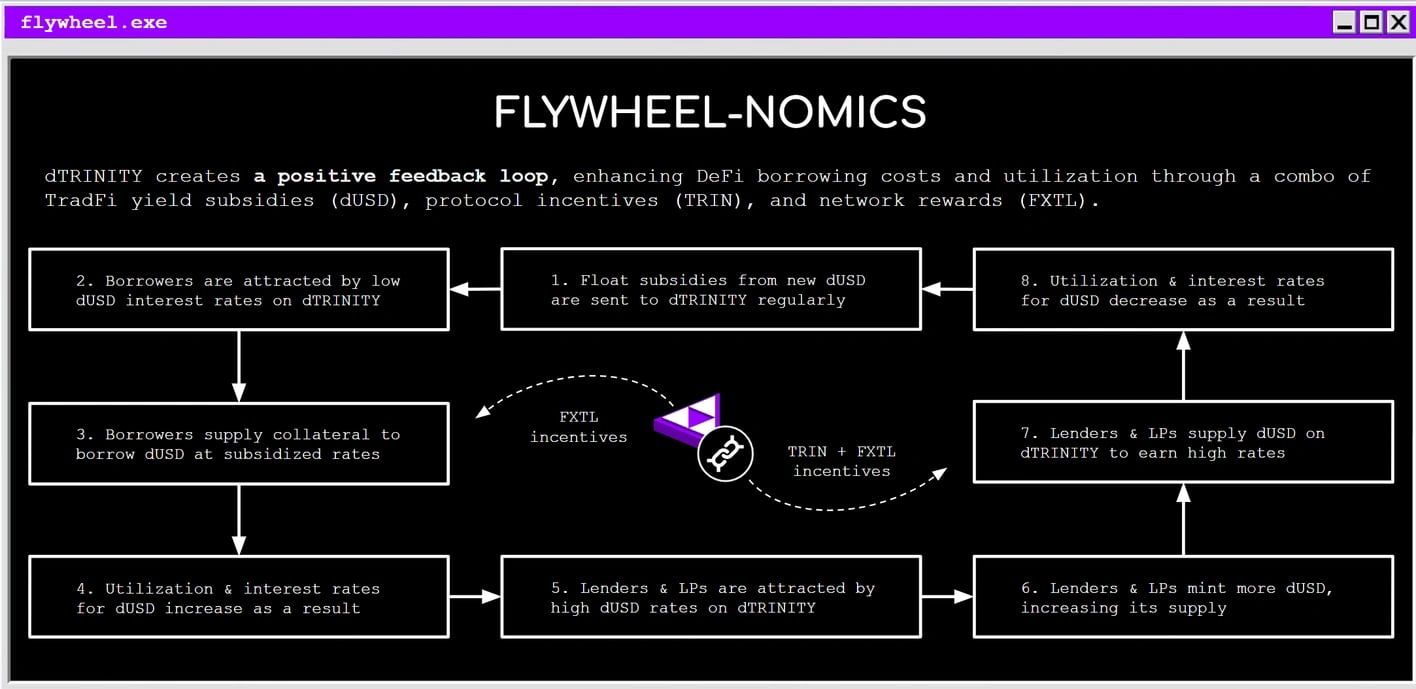

DeFi FlyWheel

dTRINITY’s FlyWheel is designed to attract liquidity and user activity through exogenous and endogenous incentives, scaling sustainably with TVL growth. The protocol incorporates the ve(3,3) framework to enhance interaction between governance token holders and supply-side participants, such as lenders and LPs providing dUSD liquidity. [6] [7]

Exogenous incentives include dUSD rewards and subsidies, FXTL network rewards, and incentives from ecosystem partners. Endogenous incentives include TRIN token/point rewards and protocol fee sharing with vote-escrowed TRIN (veTRIN) token holders post-TGE. [6]

Partnerships

- Stably

- Frax

- Fraxtal

- Cream Labs

- Coin98

- Verichains

- RedStone Oracles [8]

See something wrong?