Subscribe to wiki

Share wiki

Bookmark

Gains Network

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Gains Network

Gains Network is a decentralized trading platform focusing on synthetic derivatives and leveraged trading, operating across multiple blockchain networks. It emphasizes security through independent audits and bug bounty programs, aiming to mitigate user risks within the DeFi ecosystem. [1]

Overview

Gains Network is a decentralized trading platform that allows users to trade cryptocurrencies and forex with leverage. Leverage involves using borrowed capital to trade financial assets. The platform aims to create a decentralized finance ecosystem of the future. Gains Network launched its first decentralized leverage trading platform, gTrade, on the Polygon blockchain. The network claims that gTrade's unique architecture makes it more capital-efficient than competitors' platforms. [2]

Gains Network offers reward pools to its users to enhance the trading experience, provide system resilience, and boost capital efficiency. The two reward pools are the DAI Vault, where users can stake DAI to earn rewards based on the platform's volume, and the GNS/DAI Pool, accessible only on the Polygon mainnet, offering GNS and dQUICK rewards for staking LPs. Gains Network offers five types of NFTs, which serve as master keys to the ecosystem, with 1,500 NFTs across different categories: Bronze Keys, Silver Keys, Golden Keys, Platinum Keys, and Diamond Keys. [2]

gTrade Platform

Gains Network's gTrade offers a decentralized trading experience with full custody of funds, eliminating the need for deposits or signups. The platform uses median spot prices to avoid scamwicks and guarantees order execution with zero slippage. Users can trade crypto, forex, and commodities with high leverage, up to 150x on cryptos, 1000x on forex, and 250x on commodities, all at competitive fees. gTrade ensures transparency and decentralization with 100% on-chain trade execution, delivering a user experience shaped by over three years of user feedback. [3]

The trading engine of gTrade does not rely on order books or individual liquidity for each pair but uses gToken vaults for all trading pairs, making it over 100 times more capital efficient. Synthetic leverage is used instead of borrowed leverage, further enhancing capital efficiency depending on the leverage used. gTrade employs a real-time custom Chainlink decentralized oracle network (DON) to provide on-demand, on-chain spot prices, marking the first mainnet deployment of such an oracle network. [3]

gTrade Credits

gTrade Credits is a fee discount program introduced in April 2024 designed to reward traders based on their trading volume over a trailing 30-day period. Traders earn credits with each open and closed trade, normalized across different asset classes to ensure fairness. These credits accumulate to unlock tiered fee discounts, up to 40% off on opening and closing fees. The program does not apply discounts to time-based fees like borrowing fees. As traders accumulate credits, they move up tiers for greater discounts, reflecting their ongoing trading activity. [4]

Listed Tokens

- Lista DAO

- ZKsync

- Aethir

- IO.NET

- BRETT

- Renzo Protocol

- Meson Network

- Safe

- Saga

- Parcl Protocol

- Omni Network

- Toncoin

- Pendle

- Bittensor

- Zeus Network

- Tensor

gToken Vaults

gToken vaults, adhering to the ERC-4626 standard, represent shares of an underlying ERC-20 asset (e.g., gDAI for DAI). These vaults act as counterparties to all platform trades, with winnings paid out from the vault and losses deposited. In return, the vault earns a portion of trading fees distributed among gToken holders, incentivizing them to remain staked. [5]

The vault's collateralization hinges on trader PnL. As long as the fees earned exceed the payouts, stakers receive positive returns, a trend maintained for over two years. The protocol has risk management measures to uphold this balance. When overall PnL is negative, the vault creates a buffer with those funds to protect stakers and the protocol from future discrepancies. An epoch system captures snapshots of open PnL to approximate the real collateralization ratio and minimize risks. [5]

gDAI Vault

The gDAI vault addresses previous issues with the former DAI vault, such as uneven risk distribution and misaligned incentives, focusing on enhanced efficiency and risk management. Built around gDAI, an ERC-20 token representing staker ownership of DAI, the vault follows the ERC-4626 tokenized vault standard for yield-bearing assets. This design simplifies composability for users and developers. [6]

gDAI is minted and burned at its current price without impacting the token's price. It uses an exchange rate model where the rate between gDAI and DAI changes algorithmically, ensuring losses and risks are shared equally among all stakers. This model also enables the protocol to implement strong financial incentives during periods of higher liquidity risk. The price of gDAI is determined by the PnL value of open trades at the start of each epoch and the accumulated DAI rewards. [6]

gToken

gTokens are ERC-20 tokens representing ownership of the underlying asset, with their exchange rate changing in real time based on accumulated fees and trader PnL (both open and closed). The vault comprises two components: the staked asset, representing 100% collateralization, and the over-collateralization (OC) layer, anything beyond 100%. For instance, a vault at 110% means the OC is 10%. [5]

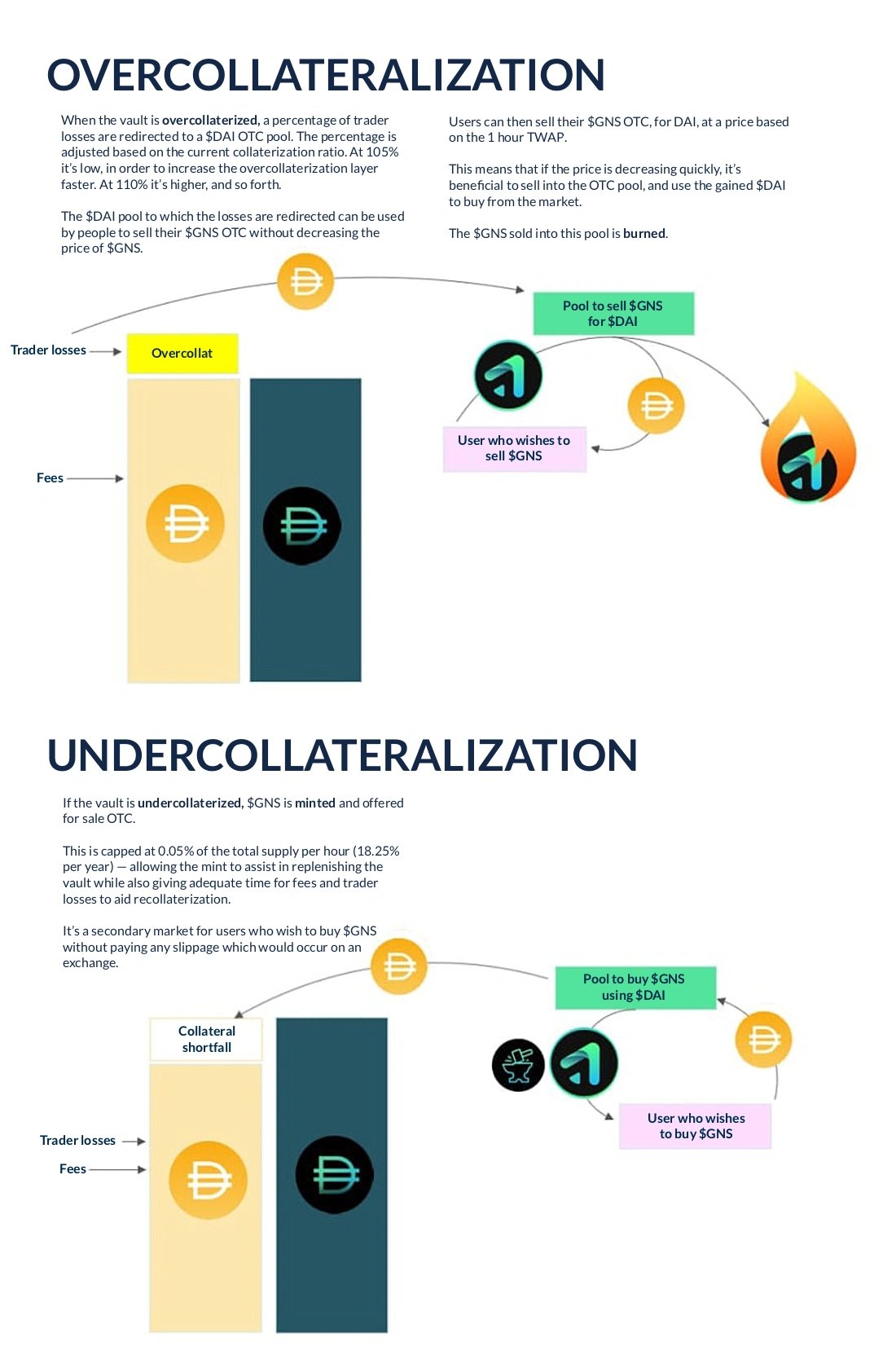

The OC layer serves as a buffer between traders and lenders, with profits and losses affecting the OC as long as it exists. The vault can be either over-collateralized (>=100%) or under-collateralized (<100%). In an over-collateralized state, a portion of trader losses is diverted to a pool where users can sell GNS for the asset over-the-counter (OTC) using the 1-hour TWAP, avoiding slippage and price impact. The sold GNS is then burned to counteract any minting when under-collateralized. [5]

In an under-collateralized state, GNS is minted and sold OTC for the asset to replenish the vault. A maximum of 0.05% of the total GNS supply is minted every 24 hours (18.25% per year). Both minting and burning are decentralized and occur only when someone interacts with the vault. [5]

gNFT

gNFT is an ERC-721 token representing ownership of locked gToken shares. These gTokens are bought at a discount, depending on the lock-up duration chosen by the lender. The locked gTokens can be unlocked once the specified lock period ends. [5]

Epoch System

The epoch system provides open PnL data to the decentralized vault, enhancing its understanding of its collateralization ratio. Calculating open PnL in real time on the chain is too computationally expensive. The epoch system operates in two states: [5]

- Withdraw Window: The period before open PnL values are received, allowing stakers to make withdraw-related actions such as requests and withdrawals.

- Open PnL Window: The period before the epoch closes when the protocol requests open PnL snapshots from oracles. Multiple requests are made to a network of oracles, and the median values are averaged across the request periods. This resulting PnL value is then used in the succeeding epoch.

Withdraw Locks

To enhance vault security and prevent the front-running of PnL changes, assets are withdrawn through a request system rather than immediately. The withdrawal period depends on the vault's collateralization ratio, with stakers waiting for 1, 2, or 3 epochs after their request, based on the ratio. If a staker misses the withdrawal window, they must submit a new request. [5]

GNS Token

The GNS token ($GNS) is designed to enhance liquidity efficiency, optimize resources, and provide ecosystem participants with a quality trading experience and returns. Initially launched as the $GFARM2 token on Ethereum and fairly distributed in ETH and GFARM2/ETH LP pools, it was later bridged to Polygon and split at a 1:1000 ratio to become $GNS. As the utility token of Gains Network, GNS follows the ERC-20 standard with a total supply of 38,500,000 GNS and a maximum supply of 100,000,000 GNS. [7]

$GNS supports vault liquidity by minting rewards for oracle bots and affiliates, maintaining asset stability within the vaults, and supporting over-collateralization. It balances gToken vaults through a minting and burning mechanism, with vaults acting as short-term counterparties to trades on gTrade and $GNS as the long-term counterparty. This mechanism prevents early supporters' platform interest from being diluted by future large investors, ensuring fairness. [7]

$GNS will also play a key role in governing the protocol. Over 10% of the token supply has been burnt through organic deflation generated by gTrade. [7]

GNS Staking

Staking $GNS tokens allows earning rewards generated by platform fees, paid in the native collateral of each trade. Currently supported collaterals include $USDC, $DAI, and $WETH. Rewards are accrued from platform revenue on the respective chain, meaning staking $GNS on Arbitrum earns rewards from trades on Arbitrum, and similarly for Polygon. [8]

62.5% of fees from market orders and 57.5% from limit orders are allocated to $GNS staking. As 70% of trades are market orders, approximately 61% of fees from all orders, on average, go to $GNS staking. There is no timelock for staking $GNS, allowing withdrawals at any time. Rewards are accrued in real-time based on the collateral used by traders opening and closing trades. [8]

Partnerships

Available Chains

InsurAce

On March 2nd, 2022, Gains Network partnered with InsurAce to secure insurance coverage for their $DAI Trading Vault. InsurAce offers comprehensive insurance services to protect DeFi users' investment assets from Smart Contract Vulnerability, Custodian Risk, IDO Event Risk, and Stablecoin Depeg Risk. [9]

Immunefi

On March 10th, 2022, Gains Network partnered with Immunefi to launch bug bounties across their platforms. Gains Network prioritizes security and ensures that CertiK audits all smart contracts before updates. The bug bounty program with Immunefi is a crucial investment to proactively identify and address potential vulnerabilities, mitigating exploitation risks through hacks. [10]

QiDAO

On March 3rd, 2023, QiDAO launched Gains Network's gDAI vaults on Polygon, facilitating the use of gDAI as collateral for minting MAI without interest charges. Later in March, a similar vault version was deployed on Arbitrum, expanding accessibility and functionality across different blockchain networks. [11]

Silo Finance

On March 8th, 2023, gTrade partnered with Silo Finance to introduce a $GNS Silo, enabling users to lend, borrow, or collateralize their $GNS tokens with co-incentivization benefits. [12]

Pendle Finance

On March 9th, 2023, Pendle Finance introduced an interest-rate product using $gDAI. This product enables users to secure fixed yield returns with $PT-gDAI, providing stability against volatility in their positions. [13]

Perpy Finance

On March 6th, 2023, Perpy announced the integration of gTrade pairs and asset classes into their vaults, aiming to broaden yield-earning opportunities and enhance trading volume on gTrade. [14]

Ramses

On March 15th, 2023, Arbitrum-native DEX Ramses integrated $GNS and $gDAI into their liquidity layer. Collaboration with the Ramses team focuses on leveraging their ve(3,3) infrastructure to enhance liquidity depth and accessibility for both pairs. [15]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)