订阅 wiki

Share wiki

Bookmark

Kelp DAO

0%

Kelp DAO

Kelp DAO 是一个针对以太坊和 EigenLayer 的跨链质押解决方案。它专注于为公共区块链网络开发流动性再质押解决方案。Kelp DAO 团队正在构建一个名为 rsETH 的 LRT 解决方案,用于 EigenLayer 上的以太坊。Amitej Gajjala 和 Dheeraj Borra 是 Kelp DAO 的联合创始人。 [1]

概述

Kelp DAO 于 2023 年 11 月推出,是一个跨链流动性质押平台,适用于 以太坊 和 EigenLayer。它通过将 以太坊 验证者 的提款凭证定向到 EigenPods,从而促进 EigenLayer 模块的验证和安全。这种机制使持有少于 32 个 ETH(验证者节点所需的最低数量)的 ETH 代币持有者能够在 以太坊 上质押 ETH,并在 EigenLayer 上重新质押。 [2][3]

Kelp DAO 简化了用户质押其 加密货币 持有的过程。传统上,质押 仅限于单个 区块链,但 Kelp DAO 通过启用多链 质押 进行了创新。它通过包装代币来实现这一点,这些代币代表不同 区块链 上的 加密货币,允许用户跨各种链质押资产。 [2][3]

Kelp DAO 将用户的质押资产汇集在一起,形成 流动性池,用于跨 区块链 的 DeFi 应用。通过贡献这些池,用户可以从 交易费用 和协议激励等来源获得奖励。 [2][3]

2024 年 5 月 22 日,Kelp DAO 宣布已在一轮私人代币销售中筹集了 900 万美元。SCB Limited 和 Laser Digital 领投,投资额合计 350 万美元。其他投资者包括 Bankless Ventures、Hypersphere Ventures、Draper Dragon、DACM、Cypher Capital、GSR、HTX Ventures 和 DWF Ventures。天使投资者如 Scott Moore、Sam Kazemian、Marc Zeller、Saurabh Sharma 和 Amrit Kumar 也参与了投资。Kelp 于 2 月份开始融资,3 月份结束了这轮融资,完全稀释后的估值为 9000 万美元。 [11]

KEP 代币

$KEP,或 Kelp Earned Points,是一种与通过 Kelp 平台赚取的 EigenLayer 积分相关的 ERC-20 代币。每个 $KEP 等于一个 EigenLayer 积分。用户可以完全控制其累积的 EigenLayer 积分,包括存储、交易和根据自己的喜好使用它们。重新质押者可以通过 Kelp 去中心化应用程序 申领他们的 $KEP 代币。每周,重新质押者可以申领与前一周赚取的 EigenLayer 积分相对应的 $KEP。[4]

作为一种 ERC-20 代币,$KEP 实现了自由转移和交易,增强了 EigenLayer 积分和潜在的重新质押奖励的 流动性。重新质押 ETH 或 LSTs 并不是获得 EigenLayer 积分的唯一方法;$KEP 提供了一种替代方案,使重新质押资本效率更高,并在不同的用户群体中引入了细分。这些群体包括积分生产者(生成 EigenLayer 积分和 $KEP)和积分累积者(交易/买入/卖出/做多/做空 $KEP,并且可能不一定拥有用于重新质押的 ETH 资本)。[4]

$KEP 的直接用例包括在 自动做市商 (AMM) 上进行交易,以及在 去中心化交易所 (DEX) 上提供 $KEP <> rsETH、$KEP <> USDC 交易对的 流动性,以赚取 Kelp 里程和交易费用等奖励。[4]

rsETH

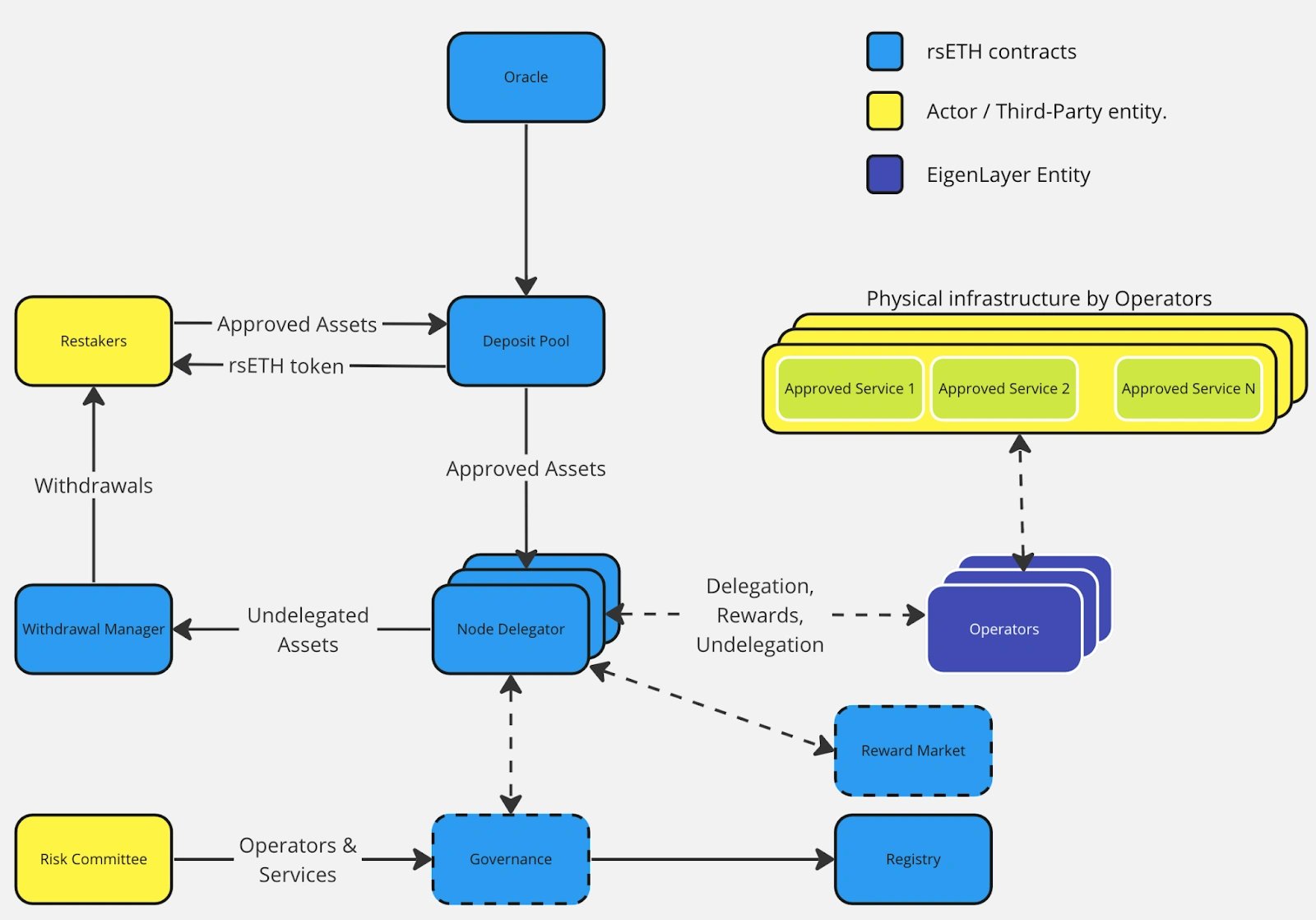

rsETH 是一种统一的流动性再质押代币,由批准作为 EigenLayer 上的抵押品的 LST 生成。它实现了质押资产的 fractional 所有权,简化了对再质押和去中心化金融 (DeFi)的访问,并利用 DeFi 协议中的可组合性。此外,它还解决了复杂的奖励系统和过高的 gas 费用等问题。 [2][5]

Kelp Miles

Kelp Miles 是对 EigenLayer 再质押积分的补充,为再质押者提供额外的激励。它们旨在提高再质押的回报,并根据再质押者的贡献提供相应的激励。使用 rsETH 的 DeFi 参与者可以赚取 Kelp Miles、EigenLayer 积分以及来自 DeFi 活动的额外收益。Kelp 将通过提供提升的 Kelp Miles 进一步激励 DeFi 机会,为用户提供参与 DeFi 的额外好处。 [6]

Pendle Finance

Kelp DAO 用户可以使用 rsETH 通过 Pendle 协议进行交互,该协议支持未来收益的代币化和交易,主要通过以下四种仓位:[7]

- PT-rsETH: PT 仓位仅代表到期时的本金。它涉及将 rsETH 存入 Pendle 协议中,以获得设定的期限,并在到期时获得固定收益。通过此策略,您将以基于汇率的折扣价收到 PT-rsETH。到期时,您将收到价值 1 ETH 的 rsETH 作为每个 PT-rsETH 的收益。值得注意的是,此仓位不赚取 EigenLayer 积分或 Kelp Miles;它仅用于确保固定收益。此外,PT-rsETH 可以在到期前的任何时间出售。

- YT-rsETH: YT 仓位代表基础资产在到期前的收益。每个 YT-rsETH 授予您由价值 1 ETH 的 rsETH 生成的所有收益和积分,直到池到期。YT 的价格由市场利率决定,反映了市场对其的估值。例如,如果 1 rsETH 交易价格为 10 YT-rsETH,则用户将为每个 YT-rsETH 赚取相当于 10 ETH 价值的 rsETH 的 Miles 和积分。对 YT-rsETH 价格的推测可能基于诸如长期收益 APY、EigenLayer 积分和 Kelp Miles 等因素,但建议进行彻底的研究。

- LP-rsETH: LP 仓位包含 PT-rsETH 和 SY-rsETH,其中 SY 部分赚取收益。此设置通过提供单资产敞口来最大程度地减少 无常损失 (IL)。好处包括 EigenLayer 积分、增加的 Kelp Miles、质押/再质押收益、来自 PT-rsETH 的固定收益、交换费用和 Pendle 激励。

- 流动性储物柜: rsETH 可在 Penpie 和 Equilibria 上访问,这是 Pendle 的两个流动性储物柜。

合作关系

集成

除了 Pendle 之外,Kelp DAO 还集成了 Uniswap、Curve 和 Balancer。提供流动性 的用户可以赚取 3 倍的 Kelp Miles 和 Eigenlayer 积分。 [7]

Polyhedra (ZK)

2024年4月16日,Kelp DAO 与 Polyhedra (ZK) 合作,Polyhedra 是一家使用零知识证明 (ZKP)的下一代 Web3 基础设施开发商。通过此次合作,Polyhedra 获得了价值 3 亿美元的质押 ETH,以加强其协议的安全性。 [8]

Laser Digital

2024年4月26日,Kelp宣布与野村集团的数字资产子公司Laser Digital建立战略合作伙伴关系。该合作将为Laser Digital当前和未来的数字基金引入再质押解决方案,使rsETH成为首个被纳入数字基金的LRT。 [9]

Planar Finance

2024年5月12日,Planar Finance 宣布与 Kelp DAO 建立合作伙伴关系。 通过此次合作,目标是通过利用来自两个协议的各种奖励来源来优化收益。 [10]

Anzen 协议

2024年6月,Kelp 宣布与 Anzen 协议建立合作伙伴关系,以加强 AVS 和重新质押者之间的支付优化。[12]

关于团队为何与 Anzen 合作,他们的回应是:

"Anzen 脱颖而出,成为首个致力于优化 AVS 到重新质押者互动的支付平台。他们的系统通过实时“安全系数”(SF)动态调整经济保障,类似于 DeFi 中的健康指标,确保稳定性和安全性。"

预计此次合作将提高收益并加强社区重新质押的 ETH 的安全性。[12]

Gain by Kelp

Gain 由 Kelp 提供支持,于 2024 年 8 月 13 日推出,是优化用户奖励方面的一大进步。该计划通过单一、多元化的策略,提供对多个 Layer 2 (L2) 空投 和 DeFi 机会的简化访问,从而增强了盈利潜力。[13]

"Gain 充当您的 degen 礼宾服务,一次性提供对多个 L2 网络和 DeFi 协议的访问。它简化了参与空投机会和 DeFi 策略的过程,而无需不断监控各个头寸。只需单击一下,用户即可解锁一个充满高增长机会的世界。" - 博客中提到[13]

发现错误了吗?