Subscribe to wiki

Share wiki

Bookmark

Lybra Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Lybra Finance

Lybra Finance is a decentralized finance platform that provides algorithmic stablecoin management and liquidity provision services. It primarily relies on Liquid Staking Tokens (LSTs), incorporating ETH and other compatible ETH proof-of-stake LSTs as its fundamental components. [1]

Lybra Finance is the omnichain LST-backed, yield-bearing stablecoin solution created to provide profit-generating utility for Liquid Staking Tokens (LSTs). [1]

Overview

Lybra Finance aims to establish a stable and interest-bearing cryptocurrency, eUSD, characterized by security, decentralization, and yield for its holders. The protocol achieves this by allowing users to mint eUSD through collateral deposits of ETH and other supported Liquid Staking Tokens (LSTs). [1]

In addition to eUSD, Lybra V2 introduced peUSD, an omnichain variant of eUSD. Both eUSD and peUSD can be exchanged at a 1:1 ratio within the protocol. [1]

eUSD, functioning as an over-collateralized asset, provides users stability in the volatile cryptocurrency market. On the other hand, peUSD instills confidence in DeFi transactions, offering a versatile solution with a broad range of use cases. [1]

Lybra Protocol

The Lybra Protocol, launched on April 24, 2023, is a layer zero, decentralized platform that utilizes Liquid Staking Derivatives (LSD). It relies on Lido Finance-issued ETH and stETH, with plans to support additional LSD assets in the future. The protocol's primary goal is to maintain a stablecoin called eUSD. Users can borrow against their deposited ETH and stETH to mint eUSD, providing a stable and secure asset for transactions. [2]

One notable feature of the Lybra Protocol is its provision for users to earn stable income by holding minted eUSD. This income is derived from Liquid Staking Derivatives generated by deposited ETH and stETH. Users depositing these assets and minting eUSD receive a stable income in stETH (approximately 5%), converted to eUSD through the protocol. The Lybra Foundation and Lybra DAO community advocate for a decentralized stablecoin, asserting that eUSD, supported by ETH and stETH, allows users to engage confidently and securely in the DeFi ecosystem. [2]

Layer Zero

LayerZero is an interoperability protocol for omnichain communication, facilitating cross-chain messaging. It enables decentralized applications (dApps) developed using blockchain technology to connect to over 30 supported blockchains. Through LayerZero, users of these dApps can securely and efficiently interact with assets across different chains. [12]

LayerZero employs a two-party system—the Oracle and the Relayer—to facilitate message transfers between on-chain endpoints. When a User Application (UA) initiates a message from chain A to chain B, the message travels through the endpoint on chain A. This endpoint informs the UA's specified Oracle and Relayer about the message and destination chain. Subsequently, the Oracle transmits the packet hash to the endpoint on chain B, and the Relayer submits the packet for on-chain verification against the hash, delivering the message. [12]

Lybra V2

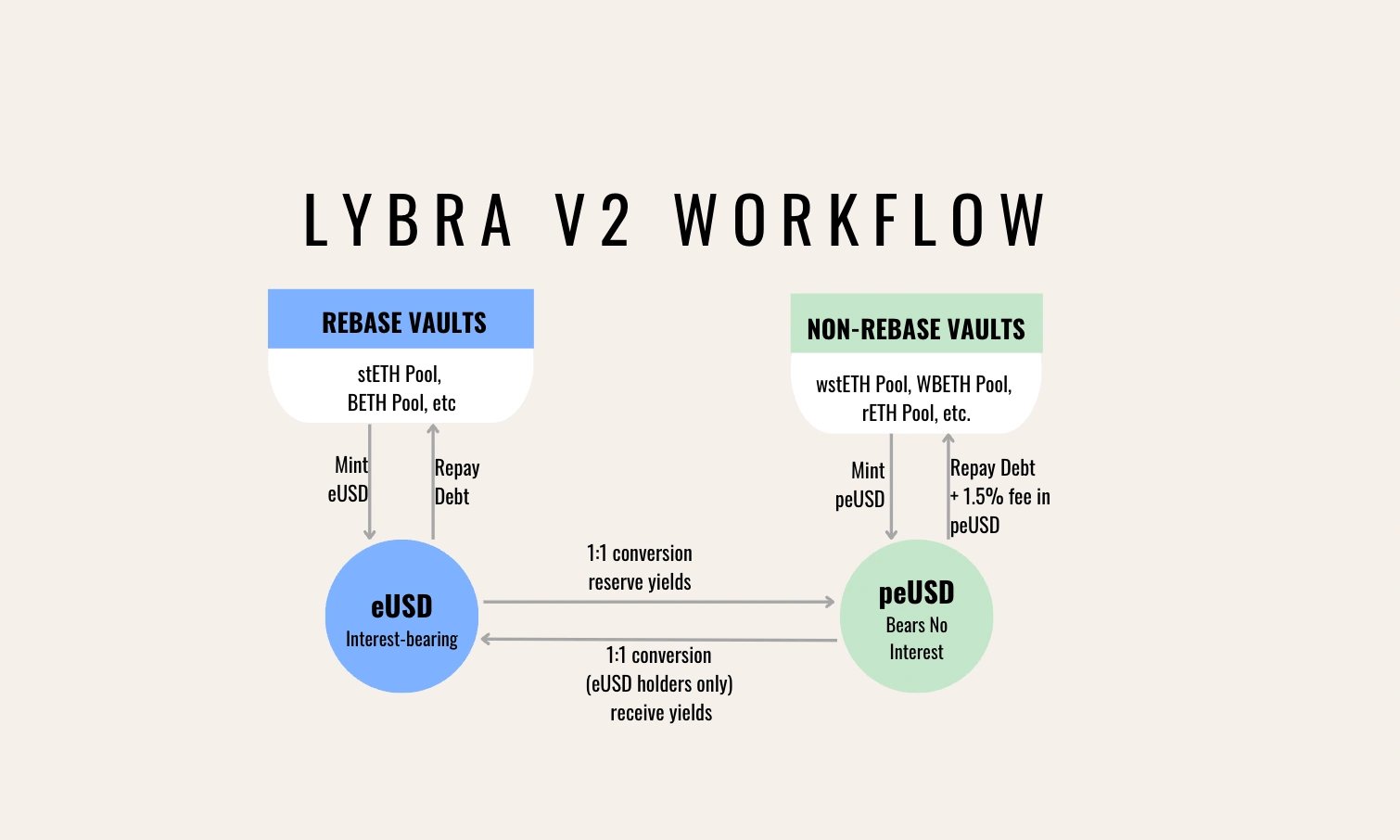

On August 31, 2023, Lybra Finance launched Lybra V2, introducing peUSD, an OFT (Omnichain Fungible Token) stablecoin derived from eUSD through the Lybra Protocol. The protocol broadens its collateral options by accepting rETH and WBETH alongside existing Liquid Staking Tokens (LSTs), enhancing user interaction flexibility. [3]

An important V2 feature allows the conversion of eUSD to peUSD without sacrificing interest, contributing to protocol resilience. The community-centric approach provides esLBR token holders with governance rights, voting privileges, and the ability to choose preferred minting pools. Bounty programs offer discounts on esLBR through LBR or eUSD, and a Stability Fund ensures eUSD peg stability amidst cryptocurrency market fluctuations. V2 introduces revenue streams, directing service and repayment fees to esLBR holders, aligning incentives for protocol and token holder benefits. [3]

peUSD

peUSD, or Pegged eUSD, offers a unique feature by allowing the conversion of eUSD from the Ethereum mainnet to supported Layer 2 solutions, starting with Arbitrum. Unlike eUSD, peUSD does not generate interest but serves various functions in decentralized finance (DeFi) protocols, including lending, borrowing, and asset swapping. [4]

Within the V2 update, a dedicated vault for Non-Rebase Liquid Staking Tokens (LSTs) accommodates these tokens' distinct value recognition mechanisms. Holders of Rebase LSTs can mint eUSD, which can be converted to peUSD at a 1:1 ratio, providing the additional advantage of earning interest. [4]

Non-Rebase LST holders can directly mint peUSD, benefiting from the value accrual of the underlying LST collateral. [4]

Lybra Vaults

Lybra V2 accommodates various types of Liquidity Staking Tokens (LSTs) through distinct vaults: one for Rebase LSTs and another for Non-Rebase (Value-Accruing) LSTs. [5][6]

Each vault imposes a unique minimum Collateral Ratio, representing the ratio between the dollar value of LSTs used as collateral in the Lybra Protocol Vault and the dollar value of the minted eUSD. The Rebase Vault necessitates a minimum Collateral Ratio of 150%, while the Non-Rebase Vault requires a minimum Collateral Ratio of 130%. [5][6]

Within each vault, specific pools are designated for individual assets. For instance, the Rebase Vault contains pools for stETH, swETH, BETH, etc., while the Non-Rebase Vault hosts pools for wBETH, rETH, wstETH, etc. [5][6]

Decisions regarding including or removing individual LST assets and determining the vault limit (i.e., the maximum eUSD that can be minted for each asset) are subject to Lybra's decentralized autonomous organization (DAO) vote. This approach empowers governance token holders and establishes a decentralized decision-making process. [5][6]

Lybra Mechanisms

Minting

The Lybra Protocol operates without borrowing costs or interest charges. Instead, it distributes revenue from Liquidity Staking Tokens (LST) generated through the rebasing of LST into eUSD, providing proportional airdrops to eUSD holders, allowing users to benefit more the longer they borrow (mint/hold). [7]

Loans issued by the Lybra Protocol have no predetermined repayment timeline. Borrowers can maintain an open loan if they uphold a collateral ratio of at least 150% and have the flexibility to pay off their debt at their convenience. [7]

The Minimum Collateral Rate (MCR) is the lowest loan-to-collateral ratio that avoids liquidation under normal operations. Lybra Protocol initially sets this ratio at 150% for both eUSD and peUSD, subject to adjustment through Lybra DAO Vote. [7]

Regarding deposits and withdrawals, a 0.1% fee is applied to withdrawals within three days of deposit to discourage short-term transactions intended to exploit Rebase LST rebasing interest. [7]

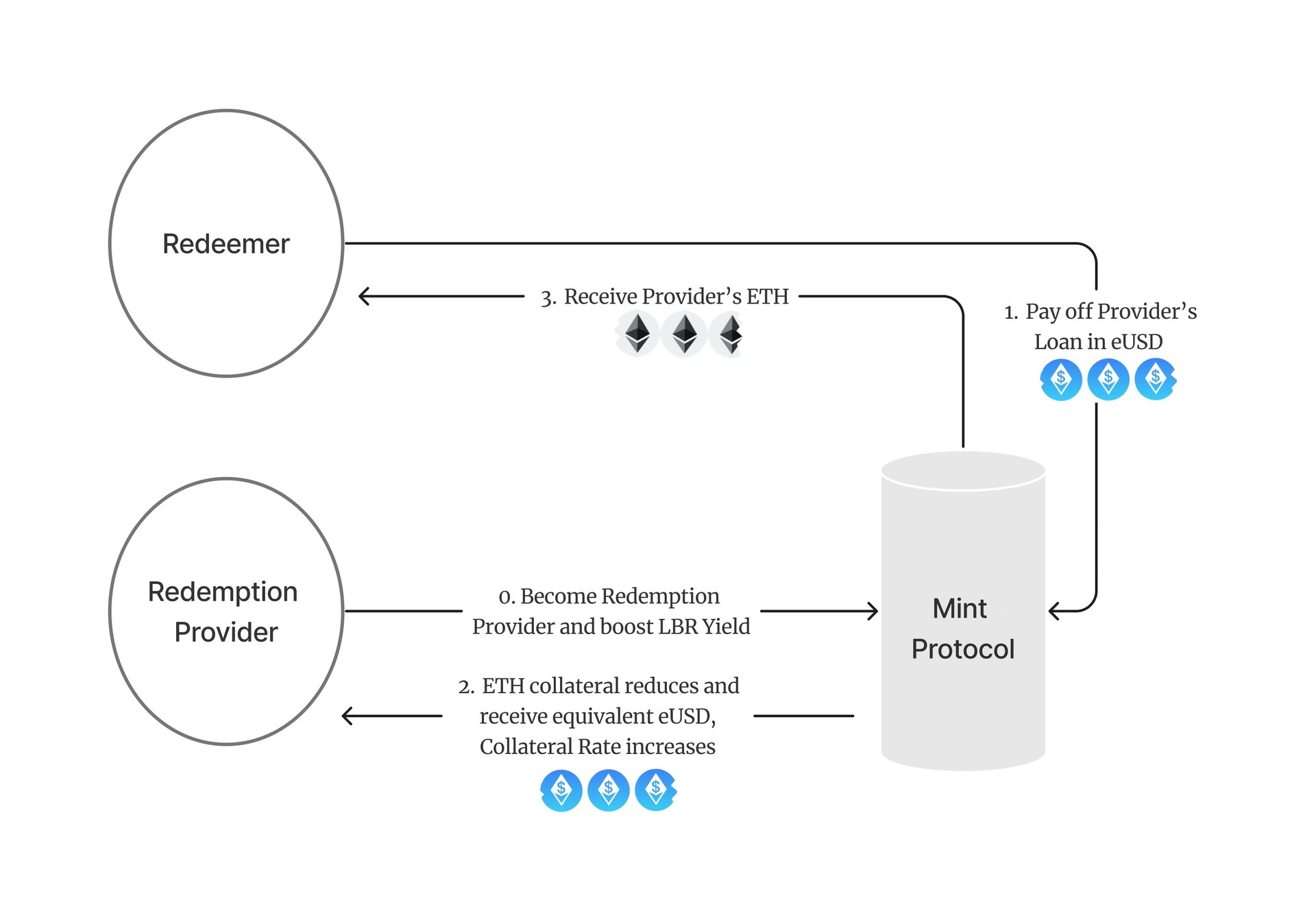

Rigid Redemption

Rigid redemption within the Lybra Protocol involves exchanging eUSD/peUSD for ETH at face value, equating one eUSD to precisely $1. Users can redeem their eUSD/peUSD for ETH at any time, albeit with a 0.5% Rigid Redemption fee (potentially subject to revision by the Lybra Community DAO), entirely directed to the redemption provider. [8]

The Rigid Redemption mechanism uses the increased Liquidity Staking Tokens (LST) passively accrued in the Lybra Protocol. This is calculated as the difference between the LST balance and the total deposited rebase LST. Users opting to provide Rigid Redemption services are incentivized through service fee compensations and other incentives yet to be determined. [8]

The advantages of being a Redemption Provider include the ability to impose a 0.5% fee on each eUSD redemption against ETH collateral. In the event of redemption, only a portion of the ETH position is lost, reducing the eUSD debt proportionally. Furthermore, the collateral rate improves, reaching a healthier level post-redemption. Additionally, as a redemption provider, the yield of the LBR reward is augmented by 10%, subject to potential adjustments through a Lybra DAO Vote. [8]

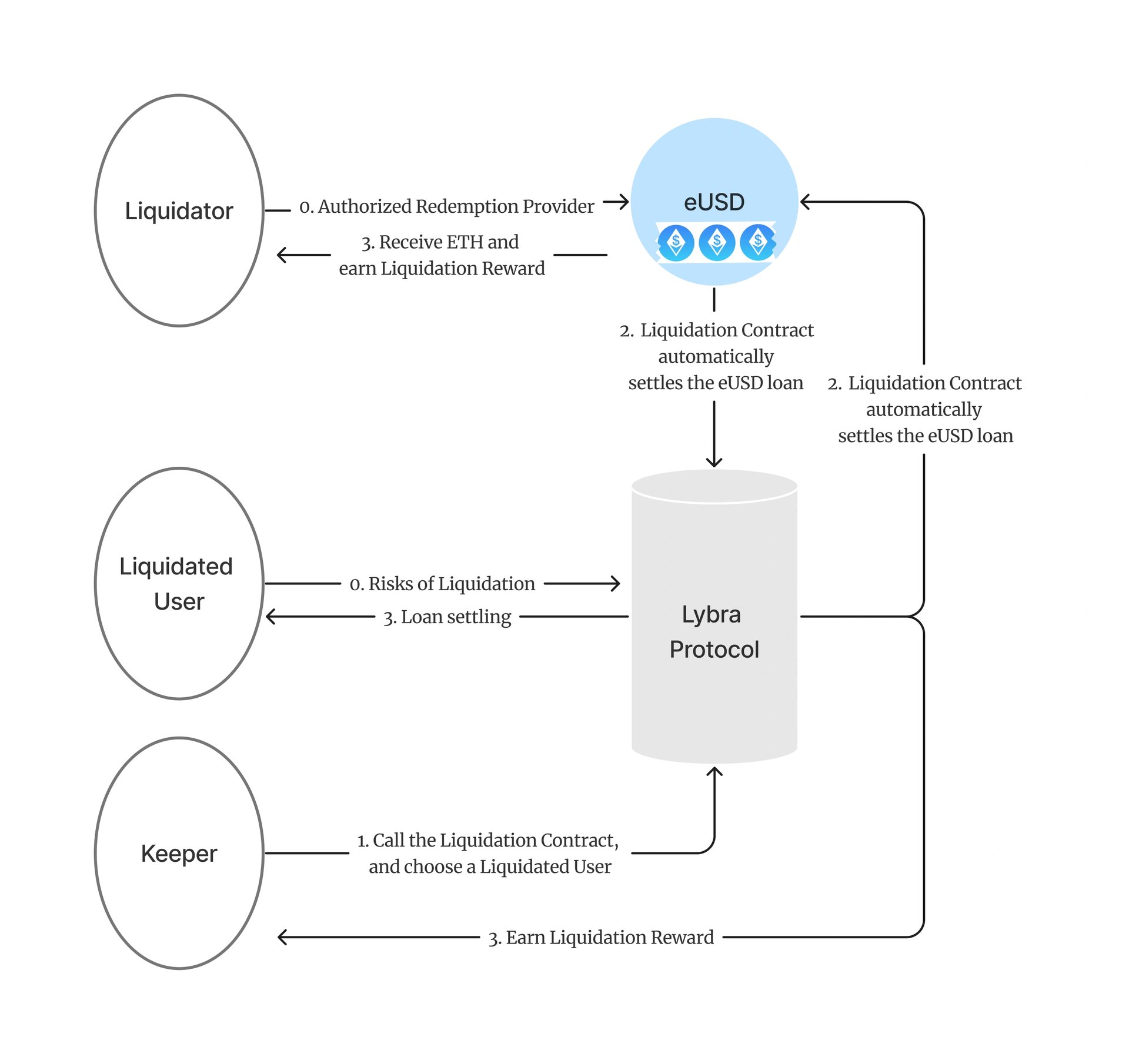

Liquidation

In the Lybra Protocol, borrowers facing collateral rates below 150% of the minimum are subject to liquidation, ensuring full backing for the eUSD stablecoin. During liquidation, the borrower's debt decreases, and liquidators acquire collateral assets, burning up to 50% of the borrower's collateral. In return, the liquidator receives collateral assets valued at 109% of the repaid eUSD, with at least 0.5% directed to the Keeper. [9]

Keepers, operated by third parties, monitor liquidators and borrowers. When liquidation is needed, Keepers can execute using eUSD from liquidators, receiving 1% of the liquidated assets. Overall liquidation occurs when the Lybra Protocol Collateral Rate drops below 150%, allowing liquidation of borrowers below 125% collateral rate. The liquidator pays X eUSD to obtain X * (current collateral rate - 1%) from the borrower, with a 1% reward for the Keeper. [9]

For peUSD, the liquidation process mirrors eUSD but lacks V1's global liquidation, providing enhanced security for borrowers with collateral ratios below 125%. [9]

LBR and esLBR Tokens

LBR and esLBR are the native governance tokens of Lybra Finance.

LBR, functioning as an OFT token aligned with LayerZero's OFT standard, can be bridged to and traded on supported L2s without encountering liquidity restrictions. LBR and esLBR play pivotal roles as core tokens within the Lybra Finance ecosystem. LBR owners can stake their tokens, transforming them into esLBR, denoting escrowed LBR. [10]

Maintaining an equivalent value to LBR, the value of esLBR is linked to the total supply of LBR. Holders of esLBR gain voting privileges, empowering them to engage in governance decisions and participate in the protocol's earnings distribution. This framework fosters active community engagement while equitably sharing rewards among stakeholders. [10]

Tokenomics

After upgrading to Lybra V2, V1's tokenomics were adjusted to secure the Lybra Protocol's long-term development. The adjustments aimed to balance emissions and burning, making the LBR token deflationary and increasing its value within the ecosystem. Following the IDO raise, the notable demand for LBR led to interest from various institutions and funds willing to invest and contribute to protocol development. In response to this interest, subtle modifications were made to tokenomics, allowing the protocol to reserve a portion of the total supply for potential institutional onboarding. The introduction of the Institutional Reserve provides flexibility, with the onboarding of institutions remaining optional and dependent on strategic benefits for Lybra Finance's goals and the protocol's future. [13]

V2 Token Allocation:

- Mining Pool: 60%

- Ecosystem Incentives: 7.5%

- Protocol Treasury: 10%

- Team: 8.5%

- IDO: 5.5%

- Advisors: 5%

- LP Reserve: 1%

- Institution Reserve: 5% [11][13]

V2 Burn Mechanisms

In Lybra V2, multiple new token-burning mechanisms were introduced: Dynamic Liquidity Provision (dLP), Vesting Penalty, and Unmigrated LBR Token Burn. [14]

Dynamic Liquidity Provision (dLP) Token Burn

To qualify for esLBR emissions from the eUSD loan pool, users must uphold a minimum 2.5% threshold in locked Dynamic Liquidity concerning their loan's total value. For instance, generating 1,000 eUSD requires a minimum of $25 worth of LBR/ETH dLP tokens for eligibility. [14]

A dLP Token Burn Mechanism is initiated when a user falls below the 2.5% minimum. This results in the user losing eligibility for unclaimed esLBR emissions. In contrast, a bounty equivalent to the user's earned emissions is offered at a 40% discount in LBR or eUSD, purchasable by any user. The LBR used in the bounty is permanently removed from circulation, introducing deflationary pressure and supporting token value. [14]

The bounty allows users to acquire discounted esLBR, particularly in Lybra DAO voting. esLBR holders gain voting power in DAO propositions relative to their esLBR/LBR holdings. Purchasing the dLP Bounty allows users to accumulate discounted voting power, creating a scenario that benefits buyers and the Lybra ecosystem. [14]

Vesting Penalty Token Burn

The Vesting Penalty Bounty operates similarly to the dLP mechanism, contributing to token burns. While the standard vesting period for converting esLBR to LBR on Lybra V2 is 90 days, users can vest their tokens earlier. However, for each day earlier than the standard 90 days, the amount of LBR received decreases proportionally. For instance, vesting four days early incurs a 95% penalty, receiving only 5% of the regular LBR amount. The penalty is reduced by 1% each subsequent day. [14]

Like the dLP mechanism, tokens forfeited by users vesting early are offered as a bounty, purchasable by any user at a 40% discount, creating demand. Importantly, any LBR used to buy the Vesting Penalty Bounty is permanently burnt. [14]

The dLP Bounty Mechanism and the Vesting Penalty Bounty Mechanism work together, offering users opportunities to accumulate discounted voting power. Simultaneously, they continuously remove LBR from circulation, aiming to support its value. [14]

Unmigrated LBR Token Burn

On September 30th, 2023, Lybra Finance held a one-off token-burning event for all V1 LBRs that hadn't migrated to V2. All tokens still in V1, which accounted for over 2 million LBR tokens at the time, were permanently burnt. [14]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)