Subscribe to wiki

Share wiki

Bookmark

Lido DAO

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Lido DAO

The Lido DAO (LDO) is a Decentralized Autonomous Organization (DAO) that enables users to stake their ETH without locking assets or maintaining infrastructure. It provides liquidity for staked proof-of-stake tokens by issuing users 1:1 tokenized versions of staked assets. [6]

Lido Staked Ethereum (stETH) is an example of a token that represents staked Ethereum in Lido, combining the value of the initial deposit and staking rewards. [12]

Lido supports Ethereum and other layer-1 proof-of-stake blockchains, such as Solana, Polygon, Polkadot, and Kusama. Its voting power is determined by governance token (LDO), which decides the key parameters of liquid staking protocols. By participating in other DeFi on-chain activities, users can compound their staking rewards on Lido for additional yields. [1][2][3]

History

Lido launched in December 2020, shortly after the Ethereum 2.0 Beacon Chain[16] went live. Staking on the Ethereum blockchain presented challenges, including only allowing multiples of 32 ETH and requiring technical expertise to stake. Staked ETH were locked during the initial phase of ETH 2.0, preventing them from being used in other protocols. [5]

Lido offers non-custodial staking services as a potential solution to capital inefficiency issues, allowing users to tokenize their staked ETH as stETH and utilize it across other protocols. [12]

Lido's focus was initially only on Ethereum. Still, it has expanded to other blockchains: Lido on Solana launched in September 2021, on Polygon in November 2021, on Polkadot in May 2022, and on Kusama in February 2022. Stakers of Solana's native SOL asset receive a derivative token, bSOL; Polygon stakers receive stMATIC, Polkadot stakers receive stDOT, and Kusama stakers receive stKSM. [4][5][6]

Lido Technology

Users can deposit ether into the Lido smart contract on Ethereum 1.0 to receive stETH in return. stETH tokens can be used to participate in other decentralized protocols, such as lending. stETH tokens are minted upon deposit and burned when withdrawn. When deposited, ether is distributed among node operators chosen by the Lido DAO and is locked into the Ethereum proof-of-stake deposit contract. [16]

Oracles facilitate communication between the beacon chain and the Ethereum 1.0 chain. Specifically, the oracles monitor the balances of validators on the beacon chain, transmitting this information to Lido's Ethereum 1.0 smart contract daily. The balance of validators may fluctuate due to rewards, slashing, and staking penalties. [17]

The oracle updates the stETH token ratio, with staking rewards exceeding slashing penalties, resulting in a profit. The stETH balance increases accordingly, and a 10% fee is applied to the staking rewards, with half allocated to node operators as per their stake value and the other half sent to the Lido treasury. [18]

Tokenomics

Lido has two tokens: the stETH token, a tokenized version of staked Ethereum, and LDO, which grants governance rights in the Lido DAO.

stETH token

stETH is a token representing staked ether in Lido, combining the value of the initial deposit + staking rewards - penalties. stETH tokens are minted upon deposit and burned when redeemed. stETH token balances are pegged 1:1 to the ETH staked using Lido. stETH token balances are updated daily when the oracle reports changes in total stakes.

stETH tokens can be used as one would use ETH, allowing users to earn ETH 2.0 staking rewards whilst benefiting from, among other things, yields across decentralized finance products.

The stETH token is a tokenized version of staked ether. When a user sends ether into the Lido liquid staking smart contract, the user receives the corresponding amount of stETH tokens. The stETH token represents Lido users’ deposits and the corresponding staking rewards and slashing penalties. The stETH token is a liquid alternative for the staked ether: it could be transferred, traded, or used in DeFi applications. Lido makes the stETH token balance track the balance of the corresponding beacon chain ether. A user’s balance of stETH tokens corresponds 1 to 1 amount of ether a user could receive if withdrawals were enabled and instant.

LDO token

LDO is an Ethereum token granting governance rights in the Lido DAO. The Lido DAO governs a set of liquid staking protocols, decides on key parameters (e.g., fees), and executes protocol upgrades to ensure efficiency and stability. Holding the LDO token grants voting rights within the Lido DAO. The more LDO is locked in a user’s voting contract, the greater the decision-making power the voter gets. [7]

Launch & Initial Token Distribution

1 billion LDO tokens were minted during the LDO launch in December 2020. The token allocation was as follows:

- DAO Treasury: 36.32%

- Investors: 22.18%

- Initial developers: 20%

- Founders and future employees: 15%

- Validators and withdrawal key signers: 6.5%

The tokens have a one-year lock-up, which is followed by a one-year vesting period, except for the DAO Treasury. [7]

Utility

The LDO token grants voting rights in the Lido DAO, with voting weight proportional to the amount of LDO tokens staked in the voting contract. The Lido DAO is responsible for upgrades, node operators, fee structures, and oracles.

Users receive a tokenized version of their staked assets. When staking on the Ethereum blockchain via Lido, users receive stETH in return (stPOLY for staking on the Polygon blockchain, and stSOL for staking on the Solana blockchain, etc.). These tokenized assets can be used in other decentralized protocols (e.g., lending). [8]

Governance

Lido’s governance follows three steps: open discussion, off-chain voting, and on-chain execution. This structure allows for broad participation, enabling community members to engage through public forums, gas-free signaling, and final protocol-level decisions at different stages.

Each phase is publicly documented to ensure transparency and record proposal development and outcomes. The structured, time-bound process slows decision-making to minimize rushed or malicious proposals, supporting deliberate, decentralized governance aligned with Lido’s goals. [25]

On-Chain Voting

Lido’s on-chain voting process is split into two phases: a main phase and an objection phase. In March 2025, the durations were extended to 72 hours for the main phase and 48 hours for the objection phase to improve voter engagement and address declining participation.

The adjustments respond to concerns about short voting windows, reduced active voting despite wider token distribution, and the need for oversight in delegated voting. The revised timeline gives participants more time to assess proposals and respond to delegated actions, aiming to balance timely decision-making with thorough community involvement. The voting schedule runs from Wednesday to Monday, allowing structured and deliberate governance. [25]

GateSeal

GateSeal is an emergency mechanism in the Lido protocol that allows certain smart contracts to be paused quickly in response to critical vulnerabilities. It prevents unauthorized fund movement by halting functions such as user withdrawals and node operator exits while leaving the rest of the protocol operational to limit disruption.

The mechanism creates a time buffer, enabling the community to assess incidents and vote on solutions before contracts automatically resume. GateSeal can only be activated by a committee with at least 3 of 6 members in agreement, preventing unilateral decisions. Following recent governance updates, the pause duration is 11 days, allowing sufficient time for proposal preparation, voting, and re-voting if needed. [25]

DAO Committees

Lido DAO uses specialized committees to manage node operations, rewards, and treasury oversight, combining subject-matter expertise with decentralized governance. Multisig groups make decisions with set quorum requirements, and all actions are recorded on-chain to ensure transparency.

For treasury security, any multisig holding over $50,000 must grant unlimited allowance to the Lido Aragon Agent, allowing the DAO to recover funds if necessary. Routine operations are handled through the Easy Track system, which streamlines approvals while preserving accountability. [25]

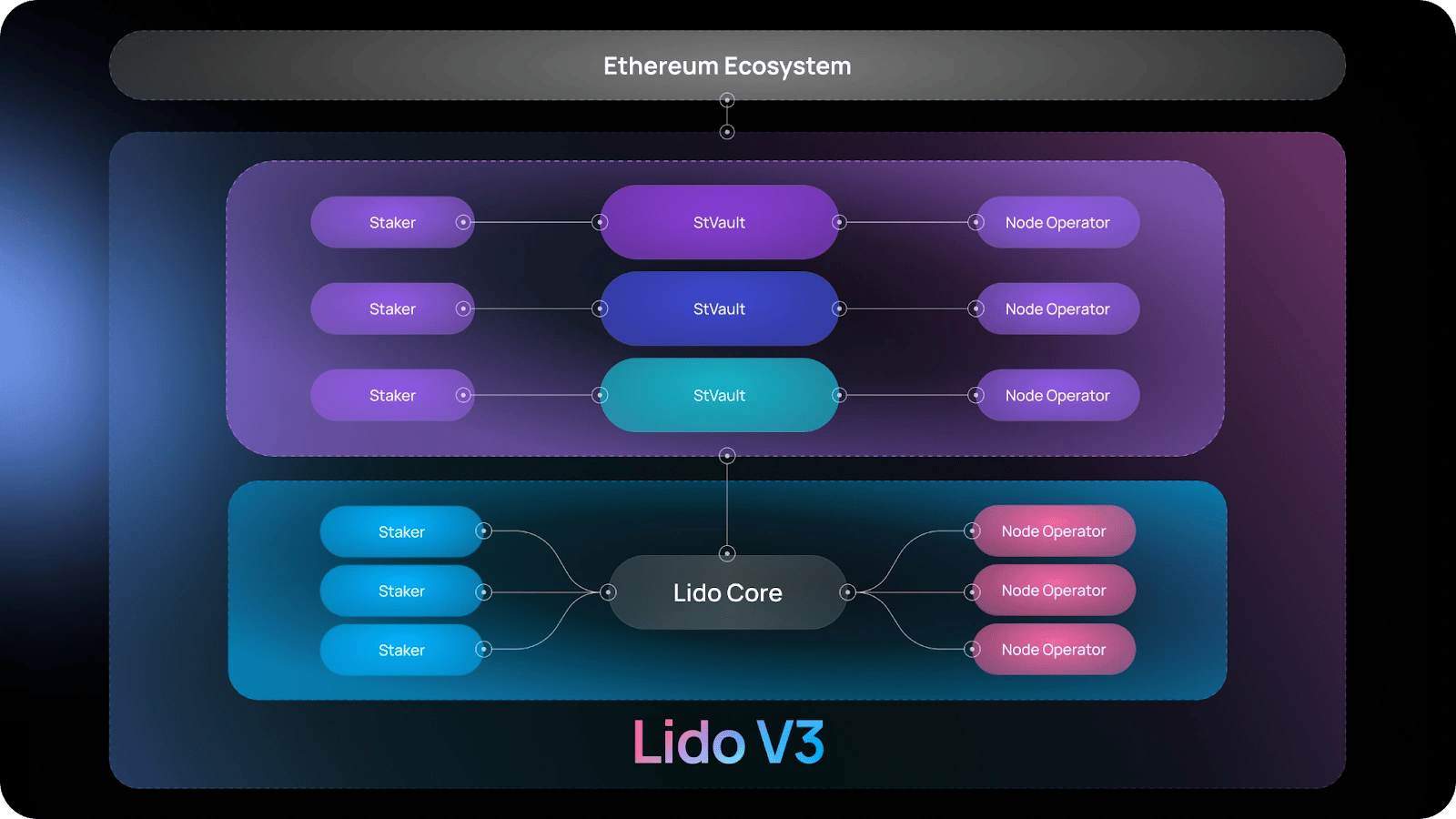

Lido V3

In February 2025, Lido implemented the Lido V3 testnet. V3 introduces stVaults, a modular staking framework that allows users to customize validator setups while maintaining access to stETH liquidity and integrations. This design supports tailored configurations for institutional stakers, Node Operators, and asset managers, enabling strategies that align with specific compliance, operational, or financial goals.

stVaults contribute to Ethereum’s decentralization by enabling validator diversity through user-defined fees, infrastructure, and bonding rules while maintaining stETH fungibility. The system balances security and performance by requiring bonded ETH to reduce slashing risk and using dynamic fees to encourage validator competition. stVaults also offer optional upgradeability, allowing users to opt in or out of Lido governance, preserving flexibility and control within Ethereum’s decentralized framework. [26] [27]

stVaults

stVaults in Lido V3 offer customizable staking setups that allow users to configure validation methods, fee structures, and risk-reward profiles while maintaining access to stETH liquidity. The system is designed to accommodate various stakeholders—institutions can meet compliance needs, Node Operators gain access to high-volume stakers, and asset managers can adapt strategies using stETH as collateral.

Operating alongside the Lido Core Protocol, stVaults are non-custodial and allow ETH to be staked with selected Node Operators. This enables personalized staking configurations while still minting stETH, providing broad integrations and liquidity access. To reduce slashing risks, stVaults use a Reserve Ratio (RR) that requires a minimum bonded amount of ETH, keeping minted stETH overcollateralized. This approach enhances stETH’s security and supports network stability through flexible bonding requirements and reputation-based risk management. [26] [27]

Vault Customization

stVaults offer customizable staking configurations that allow users to tailor validation setups, optimize reward strategies, and develop specialized products while leveraging the liquidity and security of stETH. Institutional users can create dedicated stVaults with selected Node Operators, control access, and integrate as needed while maintaining non-custodial control over deposited ETH.

stVaults also support leveraged staking by enabling strategies that source ETH from primary or secondary markets. Additionally, they offer optional exposure to restaking, allowing participants to explore shared security models without affecting the broader Lido ecosystem. [26] [27]

Lido V2

On February 7, 2023, the Lido team proposed upgrading the Lido protocol. The two major focal points of the upgrade are: [22]

Staking Router

Lido's Staking Router is a major protocol upgrade that moves the operator registry to a modular and more composable architecture. The Staking Router will act as the nucleus of the Lido vision: a platform where stakers, developers, and node operators can collaborate without friction and drive the future of a decentralized Ethereum together. [18]

Stakers will benefit from a more diverse and secure Node Operator set, as their deposits will be distributed over many independent entities, mitigating network downtime risk and improving Ethereum’s resiliency. [18]

Node Operators benefit through the new modules, and additional types of Node Operators, such as solo stakers, small groups, DAOs, and professional node operators, can increase their avenues of participating in the Lido protocol. [18]

For developers, users can propose and implement modules using different node operator compositions and with various competitive characteristics (such as cover options and fee structures) and apply for inclusion into the Staking Router’s module set. [18]

Withdrawals

Withdrawals enable users to unstake their stETH and, in return, receive ETH at a 1:1 ratio for their staked ETH. The withdrawal mechanism added to Lido’s protocol design includes two modes: [18]

- Turbo Mode is the default mode unless a catastrophic event or unforeseen scenario affects the Ethereum network. In Turbo Mode, withdrawal requests are fulfilled quickly, using all available ETH from user deposits and rewards. The time to exit the network is uncertain; however, in the best case, withdrawal requests can be processed within hours without requiring a validator exit. [19]

- Bunker Mode is proposed to process withdrawals in an orderly manner under catastrophic scenarios. Its purpose is to prevent sophisticated actors from gaining an unfair advantage against other stakers by delaying withdrawals in the whole protocol and socializing the negative impact. [19]

Advanced DeFi Strategies for stETH Launch

In June 2024, Lido announced a partnership with Mellow Finance - one of two inaugural Lido Alliance members alongside Drop - to provide stETH holders with access to a number of advanced DeFi vaults - including restaking - in collaboration with Symbiotic. [22]

The vaults are part of Lido's vision to enter the Ethereum restaking space and to provide Ethereum stakers with access to restaking opportunities. [22]

The advanced DeFi strategies are launched in collaboration with Mellow Finance, a restaking primitive enabling permissionless Liquid Restaking Token (LRT) creation based on individual risk profiles and curation models. [22]

Decentralized Validator Vault

Introduced on August 13, 2024, the Decentralized Validator Vault (the “Vault”) - implemented by Mellow - is designed to boost the number of Distributed Validators active in the Simple DVT Module, advance the decentralization and resilience of the Lido on Ethereum node operator set, improve network security, and allow stakers to potentially benefit from DVT provider incentives. [24][23]

"This vault aims to boost the adoption of Distributed Validators via the Lido Simple DVT Module, enhancing network security and increasing overall validator numbers." - the team tweeted[24]

This Vault will stake ETH through Lido on Ethereum, with 90% of potential Obol and SSV Network incentives directed to vault stakers, with 10% going toward Node Operators. The Vault offers stakers the chance to receive stETH rewards and DVT provider incentives from protocols like SSV, Obol, and Mellow. [24]

Partnerships

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)