Metronome

Metronome is a decentralized finance (DeFi) protocol for creating multi-collateral synthetic assets. Through its decentralized application (dApp), users can deposit various crypto assets as collateral to mint "synths," which are synthetic versions of other popular cryptocurrencies. These assets are designed for capital efficiency, enabling slippage-free swaps and automated yield farming strategies. [17] [14]

Overview

Metronome allows users to use their existing cryptocurrency holdings as collateral to create synthetic versions of their assets. This collateral can be in the form of productive assets like yield-bearing vTokens from Vesper Finance, or standard assets such as ETH, WBTC, DAI, and USDC. By depositing collateral, users can mint synthetic assets (msAssets), which can then be traded on the Metronome Synth Marketplace without slippage, or used for yield farming. The protocol and its ecosystem are governed by the Metronome DAO via the MET token. The protocol is deployed on the Ethereum, Optimism, Base, and Plasma networks. [1] [14] [15]

History

Metronome relaunched with Metronome 2.0 in 2022. This updated version introduced new primitives designed to generate value for the Metronome DAO and enable the "Metronome 2.0 flywheel." [9] As part of the upgrade, a snapshot of Metronome 1.0 token holders was taken on August 23, 2022, to facilitate the migration to a new governance token. [11]

Metronome Synth

Metronome Synth is the core protocol that allows users to deposit collateral, mint synthetic assets, and manage their positions.

Features

- Productive Collateral: Metronome allows users to utilize productive collateral, such as Vesper pool share tokens, to enhance capital efficiency. This enables users to earn yield on their collateral while utilizing the offerings of Metronome Synth. [2]

- Yield Farming: The protocol also offers an automated process for users to reinvest their deposits into additional productive collateral, potentially increasing APY through yield farming. [2]

- Zero Slippage Swaps: Metronome Synthetic Assets can be traded or swapped with zero slippage, though trading fees apply as outlined elsewhere. [2]

- Simplistic UI: The user interface of Metronome Synth is intentionally designed with a straightforward and elegant layout to ensure ease of use and a pleasant user experience. [2]

Metronome Dashboard

Users can deposit collateral, create their initial synthetic assets, and oversee their current collateral positions through the metronome dashboard. [3]

Productive Collateral

Users of Metronome have the option to use yield-bearing assets as collateral for minting synthetic assets. This allows users to enhance capital efficiency, as their collateral becomes productive. Metronome accepts certain pool tokens from Vesper Finance. Supported collateral assets include yield-bearing tokens from Vesper (e.g., vaETH, vaUSDC) and other standard crypto assets such as Ether (ETH), Wrapped Bitcoin (WBTC), Dai (DAI), USDC, and Frax (FRAX). [14] [18]

Liquidations and Collateral Factors

Synthetic positions require users to deposit more collateral than the amount of synthetics they generate. Collateral assets have varying collateral factors, which determine the maximum amount of synthetics that can be generated from a deposit. If the value of the synthetic assets falls below the required collateral ratio, a partial or full liquidation may occur. [4]

Asset Collateral Ratios

ETH:

- ETH: 83%

- vaETH: 80%

- sfrxETH: 80%

- vastETH: 78%

- varETH: 75%

- vacbETH: 67%

Others

- WBTC: 80%

Synth Marketplace

The Synth Marketplace in the Metronome Synth dApp facilitates the exchange of synthetic assets. To participate in swaps, users must first deposit collateral and mint a synthetic asset through the Metronome Dashboard. Alternatively, users may acquire synthetic assets from the open market (such as DEXes) before engaging in swaps on the Metronome marketplace. [5]

Swaps on the Synth Marketplace have zero slippage and incur a low trading fee of 0.25%. This feature enables users to effectively create both long and short positions. The liquidity of MET Synth is determined by mintage caps placed on individual synthetic assets. These caps are applicable to all users on the platform, preventing an excessive concentration in any specific synthetic or posted collateral. [5]

Collateral assets also adhere to a global cap shared by all depositors, with the same aim of maintaining system health. Individuals have their own liquidity limits based on their collateral factor. Users can exchange synths for other synthetics at prevailing market prices, as long as they stay within the global synth mintage limitation. These measures are in place to prevent unfavorable conditions for the synthetic assets, like an overwhelming number of traders swapping one synthetic for another, potentially disconnecting synthetic collateral from outstanding mintage. [5]

Core Synthetic Assets

Metronome enables the creation of several synthetic assets, referred to as msAssets. The primary synthetic assets available for minting are msETH, msBTC, and msUSDC. [14]

Metronome Synth USD (msUSDC)

msUSDC is a synthetic stablecoin pegged to the US dollar. It is a multi-chain asset available on Ethereum, Base, Optimism, and Plasma. Its contract addresses are: [16]

- Ethereum:

0xab5eb14c09d416f0ac63661e57edb7aecdb9befa - Base:

0x526728dbc96689597f85ae4cd716d4f7fccbae9d - Optimism:

0x9dabae7274d28a45f0b65bf8ed201a5731492ca0 - Plasma:

0x29ad7fe4516909b9e498b5a65339e54791293234

Metronome Synth USD (msUSD)

Metronome Synth USD (msUSD) is a synthetic stablecoin created within the Metronome protocol ecosystem, designed to maintain a peg to the U.S. Dollar. Users can mint msUSD by depositing various crypto assets as collateral into the Metronome Synth protocol. It is categorized as a synthetic dollar. [1] [16]

The asset is a multi-chain token and is tradable on decentralized exchanges such as Curve, Uniswap, and Aerodrome. [16]

Market Data

As of December 18, 2025, the market data for msUSD was as follows: [16]

- Market Cap: $23,902,319

- 24-Hour Trading Volume: $9,227,755

- Fully Diluted Valuation (FDV): $23,275,818

- Circulating Supply: 24,008,889 msUSD

- Total Supply: 23,379,594 msUSD

- Maximum Supply: Infinite.

Contract Addresses

msUSD is deployed on several blockchain networks. The contract addresses are: [16] [1]

- Ethereum:

0xab5eb14c09d416f0ac63661e57edb7aecdb9befa - Base:

0x526728dbc96689597f85ae4cd716d4f7fccbae9d - Optimism:

0x9dabae7274d28a45f0b65bf8ed201a5731492ca0 - Plasma:

0x29ad7fe4516909b9e498b5a65339e54791293234

Smart Farming

Smart Farming is an automated DeFi yield looping engine. It utilizes advanced yield automation technology to simplify complex strategies into a unified process, allowing users to attain looped yield. [7]

Users can deposit productive yield-bearing assets, specifically supported vTokens, to set their loop amount and generate synthetic assets that represent the same underlying assets as their collateral. These synthetics can then be swapped for the original underlying asset on a supported decentralized exchange, like Curve, and subsequently converted back into the yield-bearing productive instrument in Vesper. [7]

Auto Repay

Auto repay is Metronome’s process for unlooping a position, providing users with a straightforward method to repay. If a user wishes to unloop their position, they can specify the number of collateral assets they intend to use for repayment (the corresponding dollar value will be displayed). Upon doing so, users will be presented with their expected collateral ratio after repayment, along with an estimate of how many synths will be repurchased during the process. [8]

If a user deposits naked collateral (for example, USDC) for use in Smart Farming, the contract will allocate the user's USDC into Vesper, creating vaUSDC. Upon unlooping, this can easily be converted back to the original USDC position through the Vesper pools on Metronome, or by visiting the Vesper app. [8]

Revenue Model

Metronome Synth generates revenue through various channels, including fees and liquidations. All generated revenue is allocated to the Metronome Treasury. [6]

- Synth Balance Fee: This fee is a mechanism to mitigate risk associated with generating synthetic assets on the Synth protocol. Each synthetic asset carries its own specific balance fee, determined by its risk profile. The fee is annualized and applied on a per-second basis, augmenting the user's outstanding synthetic position. It can be viewed on the Metronome Dashboard by hovering over each individual synthetic asset.

- Marketplace Trading Fee: Users incur a fee when conducting swaps on the Synth Marketplace. This fee amounts to 0.25% of the transaction.

- Liquidation Fee: Whenever liquidation takes place, user positions are subject to a premium fee. This fee is divided between the liquidator and the Synth Protocol. Presently, the liquidation fee stands at an additional 18%, with 10% allocated to the liquidator and 8% to Metronome.

Protocol Metrics

As of December 2025, Metronome Synth holds a Total Value Locked (TVL) of $20.1 million across the blockchains it operates on. Of this total, approximately $16.74 million is on Ethereum, $2.57 million on OP Mainnet, and $792,074 on Base. The protocol has generated over $7.59 million in cumulative fees. [15]

MET Token

Metronome's native token, MET, is an ERC-20 utility token on the Ethereum network. The MET token serves three primary purposes. Firstly, it can be locked to acquire esMET, the governance token for the Metronome DAO, enabling users to participate in governance proposals and voting. Additionally, users can "stake" their MET by depositing it into a smart contract with a specified lockup duration. Through a tiered system based on the amount of esMET held and the chosen lockup period, users will receive discounts on all synthetic trading fees. [10]

esMET

esMET follows the ve(3,3) model introduced by Andre Cronje. Users can lock their MET tokens for esMET in return. When a user chooses to lock their $MET for esMET, the amount received is calculated based on various factors. These factors include the maximum boost (set at a fixed value of 4), the duration of the lock-up, and the maximum allowable lock-up period (2 years or 730 days). Unlike other protocols, esMET does not undergo a decay over time. Therefore, there is no need for users to relock their tokens in order to maintain the maximum benefits. esMET is designed to be transferable (as an ERC-721 token), enabling users to directly send or receive it. [19]

Trading Fee Discount

The Synth Marketplace within the Metronome dApp allows users to exchange synthetic assets. Transactions in this marketplace have zero slippage and a trading fee of 0.25%. Additionally, users holding esMET can enjoy reduced fees based on the following tiered structure: [13]

- 500 esMET = 0.20% fee (20% discount) - 5,000 esMET = 0.15% fee (40% discount) - 50,000 esMET = 0.10% fee (60% discount) - 500,000 esMET = 0.05% fee (80% discount)

To qualify for the highest tier (80% discount), a user would need to hold 500,000 esMET. With the maximum lockup boost of 4x, this can be achieved by locking 125,000 MET for a period of 2 years.

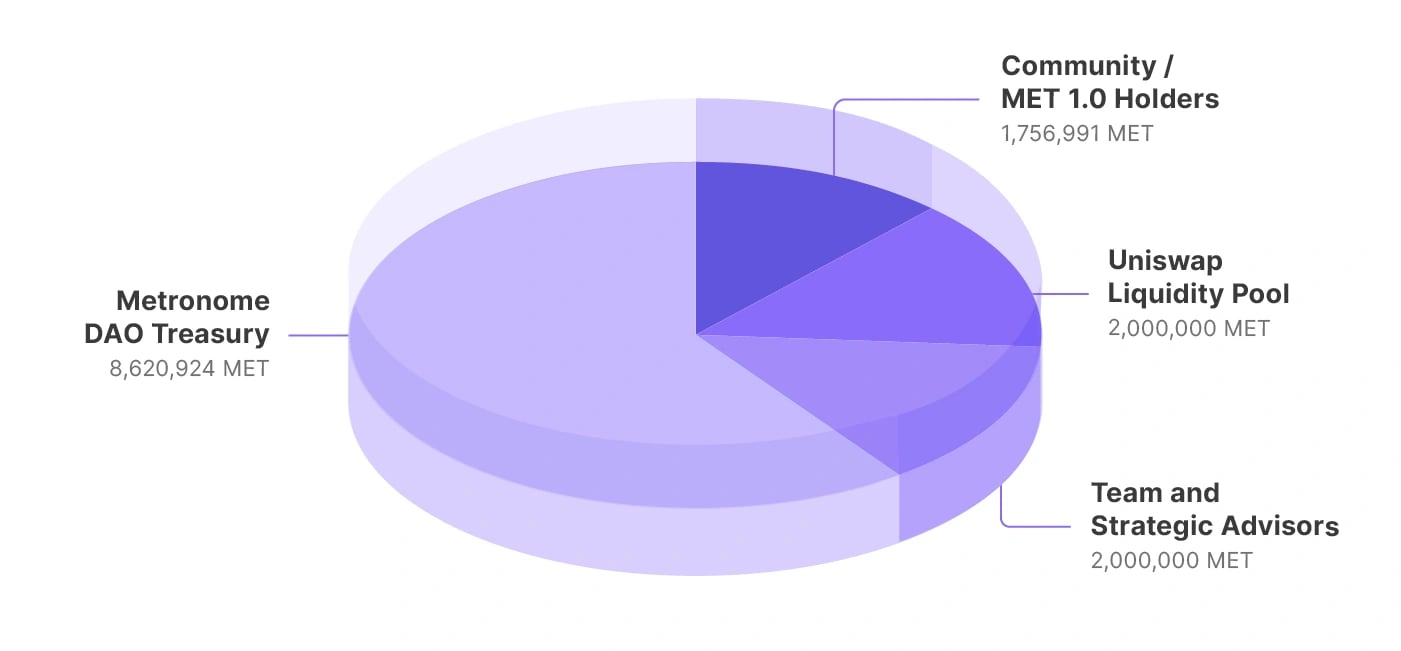

Supply Distribution

During the migration process to Metronome 2.0, Metronome had a total supply of 14,377,915 MET. A snapshot of Metronome token holders was taken on August 23, 2022, to determine the supply distribution for the MET 2.0 governance token. [11]

- Community/MET 1.0 token holders (1,874,178 MET): MET 1.0 token holders can claim MET 2.0 tokens at a 1:1 ratio.

- Uniswap Liquidity pool (2,000,000 MET): An initial allocation of 2,000,000 MET 2.0 tokens will be used to support a Uniswap V3 liquidity pair.

- Team and Strategic Advisors (2,000,000 MET): Similar to the MET 1.0 launch, 2,000,000 MET 2.0 tokens will be allotted (with an even release over a 24-month vesting period) for the Metronome 2.0 founding team and strategic advisors.

- Metronome DAO Treasury (8,203,669 MET): The entire amount of MET 1.0 in the Autonomous Converter Contract, minus the allocation to Uniswap at the snapshot time, has been designated for the Metronome DAO Treasury.

Governance

The Metronome protocol is governed by the Metronome DAO, a decentralized autonomous organization where holders of the MET token are responsible for directing the protocol's future. [20] To participate in proposal voting, users must lock their MET tokens to acquire esMET. Holders of esMET can participate in emission-related decisions. This includes voting on directions for the Smart Farming boost, setting liquidity and esMET requirements to qualify for the boost, deciding on what assets should be added to the application, and making choices on protocol-specific matters, such as increasing or decreasing collateral ratios. [12]