Subscribe to wiki

Share wiki

Bookmark

Vesper Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Vesper Finance

Vesper Finance operates as a decentralized finance (DeFi) protocol with a focus on user-friendly experiences in the DeFi landscape. At the core of Vesper's ecosystem is the Vesper token (VSP), a native token that plays a role in advancing Vesper's functionalities and its community. The DeFi products offered by Vesper are designed to generate passive income for users. [1][2]

Overview

The Vesper project is structured around three key elements: accessible yield-generating strategies, an incentivizing token (Vesper token or VSP), and a community framework. VSP facilitates participation, governance, and community involvement. The platform offers various interest-yielding strategies of differing aggressiveness and asset holdings to generate passive income. Vesper aims to streamline the DeFi landscape for user convenience, and independent audits of its yield-generating strategies are conducted for safety. [2][3]

Main Components and Services

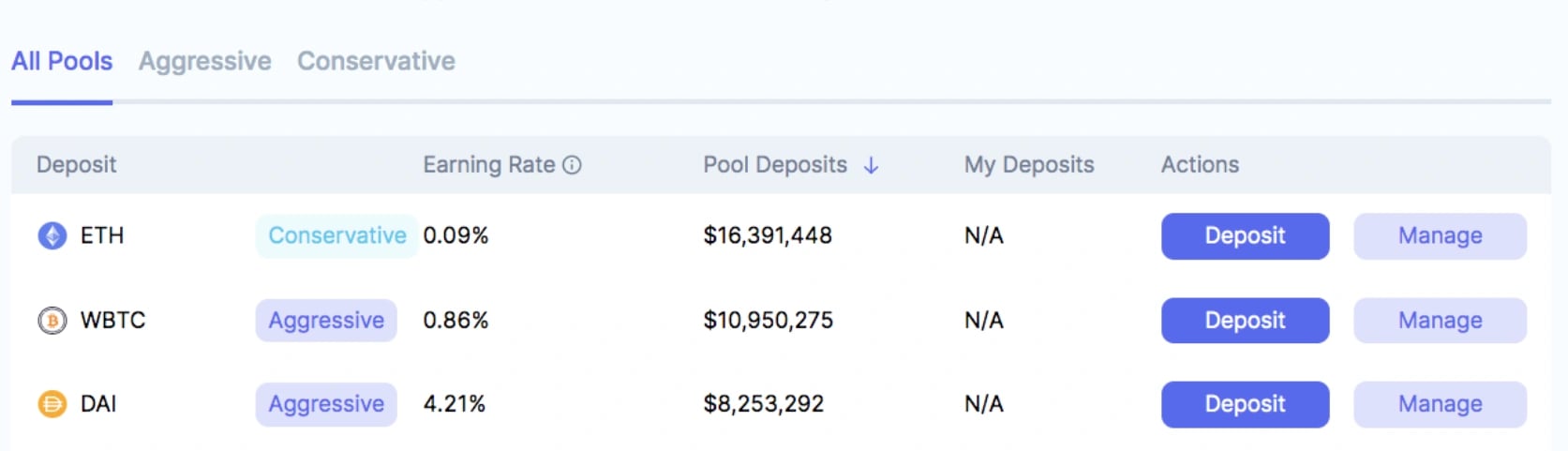

Vesper Pools

Vesper Pools serve as the cornerstone of Vesper's ecosystem, facilitating the consolidation of tokens from diverse depositors to generate yields for participants. These pooled assets are actively employed for lending, borrowing, and yield farming. Each pool possesses distinct characteristics, including the type of deposit and yield assets, deployment strategies, and associated risk profiles. Users can select the pool that aligns with their desired assets and risk tolerance. Additionally, select pools offer VSP rewards in the form of Vesper's native token, providing an extra incentive for participation. [4]

vTokens

vTokens are integral to the Vesper Pools ecosystem, representing a user's share of the pooled assets. The conversion rate from deposited tokens to vTokens varies based on the type of pool. For instance, in Grow Pools, as the pool accumulates yield and acquires more of its asset, the vToken's value increases. This mechanism enables users to benefit from the compound growth of their assets. However, the initial conversion ratio may not be 1:1, as it appreciates over time. [4]

Fees

Vesper initially featured withdrawal and platform fees within its first year of operation. As of April 2022, these fees have transitioned to a Universal Fee structure. The Universal Fee imposes a 2% annual fee on deposited assets at the time of rebalance, which is capped at 50% of the earned yield. [4]

VSP Rewards

Certain pools offer additional VSP rewards, which can be claimed and utilized at the user's discretion. One common approach is to deposit VSP into the Vesper Governance Pool, where it converts into vVSP, enhancing users' voting power in governance decisions. VSP can also serve as collateral for other DeFi activities. [4]

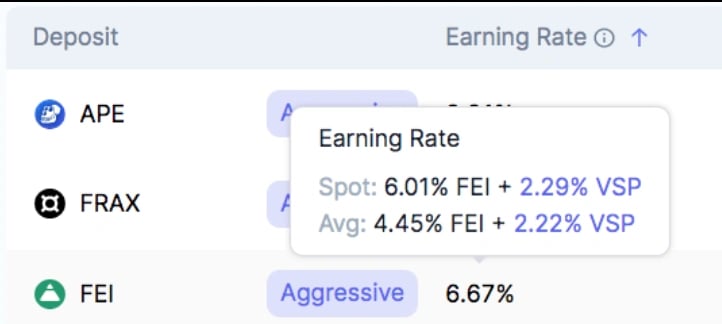

Yield

Earning rates, often referred to as yield or APY (Annual Percentage Yield), are a sum of two components: the underlying yield generated by the pool's assets and VSP rewards. The earning rate is specific to each pool and is displayed in the Vesper App. [4]

The rebalancing process is pivotal to yield allocation within Vesper pools, ensuring that the pool maintains its target collateralization ratios. Rebalances are influenced by network congestion and total value locked (TVL) in the pool, with smaller pools and costlier strategies rebalancing less frequently to optimize gas efficiency. [4]

Types of Vesper Pools

Vesper offers various types of pools, each designed to cater to specific user preferences and objectives:[4]

- Vesper Grow Pools: These pools gather specific assets and employ them in accordance with active strategies. The yield generated is used to acquire more of the deposited asset, benefiting pool participants.

- VSP/vVSP Governance Pool: Users can deposit VSP into this pool, where revenues from all Vesper products are used to repurchase VSP from the open market. Depositors earn VSP interest proportionate to their deposit size.

- Vesper Earn Pools: These pools operate similarly to Grow Pools but yield a different asset than the deposited one, introducing a novel concept in DeFi.

- Vesper Lend Pools: Vesper Lend facilitates lending crypto-assets through custom lending platforms to attain the highest safely obtainable yield.

- Vesper Orbit Pools: These pools aim to generate higher yields by dealing with newer, less established assets and protocols, offering potentially higher returns.

Vesper Grow Pools

Vesper Grow Pools enable users to increase their holdings by routing deposits through various DeFi yield sources. Deposit one asset and earn more of the same asset, with conservative and aggressive strategies available. These pools employ algorithmic loan rebalancing, differing in their criteria for additional loans and loan refunds. Conservative pools offer lower risk than their aggressive counterparts. [5]

Vesper Earn Pools

Vesper Earn Pools offer a unique approach, allowing users to earn yields in a different asset from their deposit. The key distinction is that the yield is accrued in an asset distinct from the deposited one, providing a novel concept in DeFi. These pools follow similar processes as other Vesper pools but differentiate in terms of their asset and yield token pairings. [6]

Vesper Orbit

In November 2021, the Vesper DAO endorsed the creation of Vesper Orbit, a distinct category of Vesper pools. The primary aim of Vesper Orbit is to seek higher yields by incorporating newer tokens and protocols into Vesper's automated investment products. The pools and strategies employed by Vesper Orbit adhere to the same policies applied to all Vesper products. However, Vesper Orbit products inherently carry higher risk due to their focus on new, less proven assets and protocols. [7]

Features

- Universal Fee: Vesper Orbit pools, like other Vesper products, impose a 2% annual fee on the assets deposited at the time of rebalance. If this fee surpasses 50% of the yield earned, it is capped at 50% of the yield.

- Vesper Orbit Rewards: Participants in Vesper Orbit may receive rewards in VSP, which can be claimed at any time. The initial batch of Orbit pools is boosted with 1,250 VSP each to promote these new products. Additional VSP allocations are based on contributions from represented token communities and individual pool performance. The documentation is updated when new VSP is added to a pool's reward account.

- Strategy Updates: Vesper Orbit plays a pivotal role in providing up-and-coming strategies and assets to Vesper users. With increasing success and TVL (Total Value Locked) of these pools, they may "graduate" to the main Vesper app. This status change signifies the perceived safety of the pool, with no underlying code alterations. An example of this transition is the DPI pool, which started on Orbit but has "graduated" to the main Vesper app.[7]

Adding New Tokens to Vesper Orbit

The addition of tokens and protocols to the Vesper Orbit suite is determined through votes by the Vesper DAO. Before formal voting, community discussion primarily takes place on the Vesper Discord channel. [7]

Multi-Chain and Cross-Chain Deployments

Multi-Chain Approach

Vesper's architecture has been designed to facilitate the migration of its contracts across multiple blockchain platforms such as Ethereum, Polygon, Avalanche, and Optimism. The long-term goal is to extend support to emerging protocols that diverge from the Ethereum Virtual Machine (EVM) model. [8]

Vesper Pools on Polygon and Avalanche

Vesper recognizes the impediment posed by high fees on the Ethereum Network, particularly affecting those with limited resources, who are thereby excluded from DeFi participation. To increase accessibility Vesper deployed its native VSP token and a selection of Grow pools on the Polygon and Avalanche Networks. Moreover, the Vesper community has participated in governance proposals to endorse various chains and Layer 2 (L2) platforms, including Polygon. [8]

Although Vesper pools on sidechains share the same smart contract code with their counterparts on the Ethereum mainnet, the yield sources, and consequently the returns, are likely to differ. [9]

Several Vesper Grow pools offer incentives to participants in the form of VSP tokens, adding to the base asset yield. VSP rewards on different blockchains may not always align with the schedules applied to equivalent Grow Pools on Ethereum, as periodic adjustments to these rewards can be imposed. [10]

Vesper Modular Pool

Vesper adopts a modular, multi-pool architecture to increase flexibility and adaptability for smart contract administrators. This architecture allows swift adjustments of strategies, responding to dynamic changes in the DeFi market and facilitating uninterrupted product upgrades. The modularity extends throughout Vesper's software development, enabling the integration of various strategies and easy porting of products between blockchain platforms. This modular philosophy serves as the foundation for tackling 'strategy fade,' a common issue in DeFi environments where users chase higher yields, leaving old pools dormant. Vesper, by contrast, continuously introduces improved strategies while phasing out underperforming ones. [11]

Sustainability

To combat 'strategy fade,' Vesper gradually incorporates superior strategies into existing pools, with a fraction of user funds dedicated to the new approach. This process can eventually lead to the replacement of the older strategy, creating a sustainable, set-and-forget experience for depositors. Unlike users in many DeFi ecosystems who constantly seek new yield sources, Vesper users can rely on the platform to manage these transitions. [12]

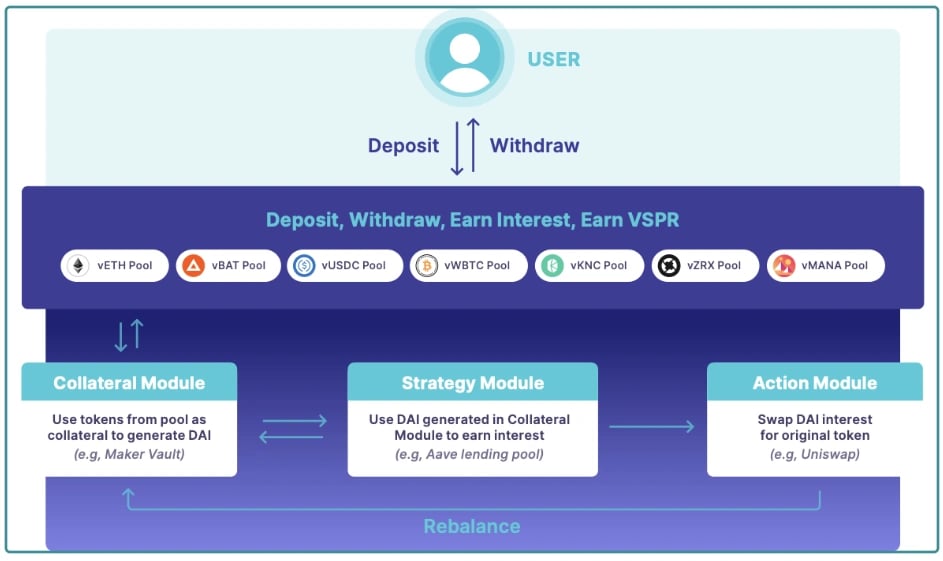

Structure of Vesper Pools

Each Vesper pool comprises three primary modules: Collateral, Strategy, and Action. The Collateral module handles fund deposits and withdrawals, directing them to platforms like Maker, Aave, or Compound. The Strategy module deploys capital for yield generation, which can range from simple lending to complex fractional loans. The Action module governs interest claims, deciding whether to reinvest it or withdraw the deposit asset. [13]

Modular Multi-Pool Approach

Vesper pools consist of frontend components for handling deposits and withdrawals and backend strategies for directing and aggregating yields. This design enables developers to create diverse yield-earning strategies and combine or replace them for higher yield opportunities. The architecture also supports the parallel execution of multiple strategies, aiming to offer better yield optimization by lending to various platforms simultaneously. [14]

Governors and Keepers

Vesper pool smart contracts involve privileged addresses, including a "governor" and one or more "keepers." Governors handle more crucial updates, while keepers manage daily operations and frequent updates to ensure pool health. There is no fixed limit on the number of keepers, and they can be added or removed at any time. The governor has the authority to pause contract execution and designate addresses as keepers. Keepers can adjust strategy weights and upgrade modules, facilitating continuous pool upgrades without interrupting user experiences. [15]

Sweeping

Sweeping is a contract function that converts non-native ERC-20 tokens and deposits them back into the collateral module, preventing tokens from getting stuck in the contract. [16]

Vesper Strategies

The Vesper ecosystem utilizes different strategies in connecting Vesper Pools with various DeFi protocols, organizing a range of interactions across these platforms. While users select pools, the strategies employed are determined by the pool's internal logic. These strategies encompass interactions with platforms like MakerDAO, Aave, Compound, Yearn, and others. [17]

Strategies come with distinct risk levels, classified as medium-risk or higher-risk. The risk level relates to the safety of underlying contract interactions, with medium-risk strategies entailing fewer interactions with audited platforms. Higher-risk strategies may involve more complex interactions and exposure to unaudited contracts. [18]

Strategies may be deployed in either conservative or aggressive pools, based on their likelihood of realizing losses, primarily concerning loan liquidation susceptibility. Conservative pools employ strategies with higher collateral ratios for enhanced protection against unexpected events. [18]

Categories of Strategies

Vesper strategies are categorized based on their core functions and interactions:

- <Platform> Deposit: This fundamental strategy involves depositing assets into a specific protocol.

- <Platform> LP: In this strategy, total value locked (TVL) is converted into the platform's relevant liquidity provision (LP) token.

- <Platform> to <Platform>: After initial depositing, the output is then redeposited into another platform.

- <Platform> Leverage: This approach leverages deposited assets as collateral to borrow the same token repeatedly, amplifying the assets contributed to the platform.

- <Platform> Borrow: Deposits serve as collateral to borrow a different token, subsequently routed through the corresponding Vesper pool.

- Vesper Proxy: This strategy, exclusive to Earn Pools, channels deposits to the corresponding Vesper Grow pool for handling.[18]

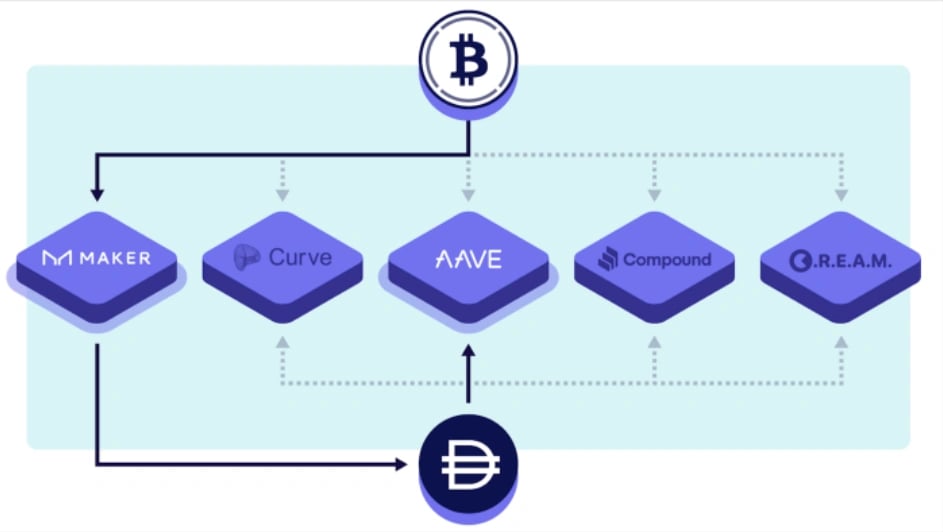

Maker-to-Lending-Platform Strategy

This strategy combines MakerDAO with Aave or Compound:

- Assets are deposited into a Maker vault as collateral.

- DAI loans are taken against the collateral.

- DAI is deposited into Aave or Compound to generate yield.

- The yield is either swapped on the open market back for the deposit asset or redeposited to Aave/Compound for compounding returns.

This is a medium-risk strategy, and its risk level can be conservative or aggressive, depending on the collateralization benchmarks used. [19]

Direct-to-Lending-Platform

This strategy involves depositing assets directly to lending platforms, such as Aave or Compound, without intermediaries:

- Deposit 100% of the pool asset straight into Aave or Compound, where yield is maximized.

- Claim and redeposit accrued yield as it is earned.

This is a medium-risk, conservative strategy, with well-audited contracts and conservative collateralization ratios. [20]

Maker-to-Vesper

Maker-to-Vesper leverages DAI loans via MakerDAO and vDAI to generate yield:

- Assets are deposited into a Maker vault as collateral.

- DAI loans are acquired against the collateral.

- DAI is deposited into a vDAI pool.

- vDAI can utilize various strategies, usually direct-to strategies, given DAI's nature.

This strategy can be configured as either conservative or aggressive, dependent on the collateral ratio and strategies used through vDAI. [21]

VSP Token

Launched on February 17, 2021, the VSP token is the utility and governance token within the Vesper ecosystem, offering opportunities for users to earn rewards beyond the yields generated by the pools. [22]

Utility

Earning VSP Through Vesper Pools

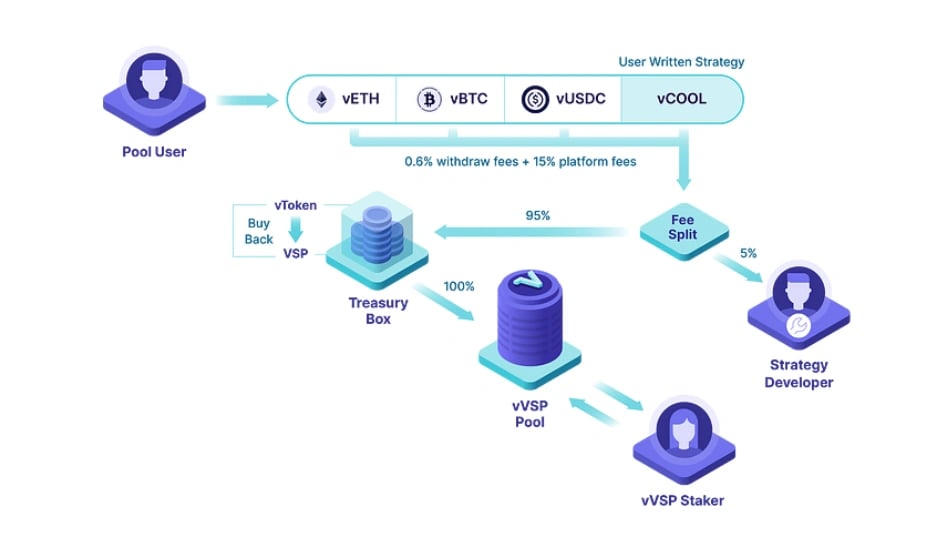

Users can acquire VSP tokens by participating in Vesper pools. The VSP earned is proportionate to the user's stake in a given pool. With each block, a portion of VSP is distributed to participants. This VSP is held by the smart contract until the user withdraws from the pool, at which point the tokens are transferred to their address. New pools are incentivized upon their launch, further encouraging participation. These VSP tokens serve as an additional reward alongside the passive real yield generated by the pool. [22][31]

Earning VSP Through Locking VSP for esVSP

Locking VSP tokens provides users with esVSP (ERC-721 tokens), akin to how depositing ETH yields vETH. After withdrawal and the collection of yield fees within the pool (in assets such as ETH, BTC, USDC, etc.), these funds are directed to the Treasury Box. This treasury is employed to purchase VSP tokens from the open market, which are then distributed to esVSP participants. These tokens can subsequently be claimed. [22][31]

Vesper Launch Details

Supply Dynamics

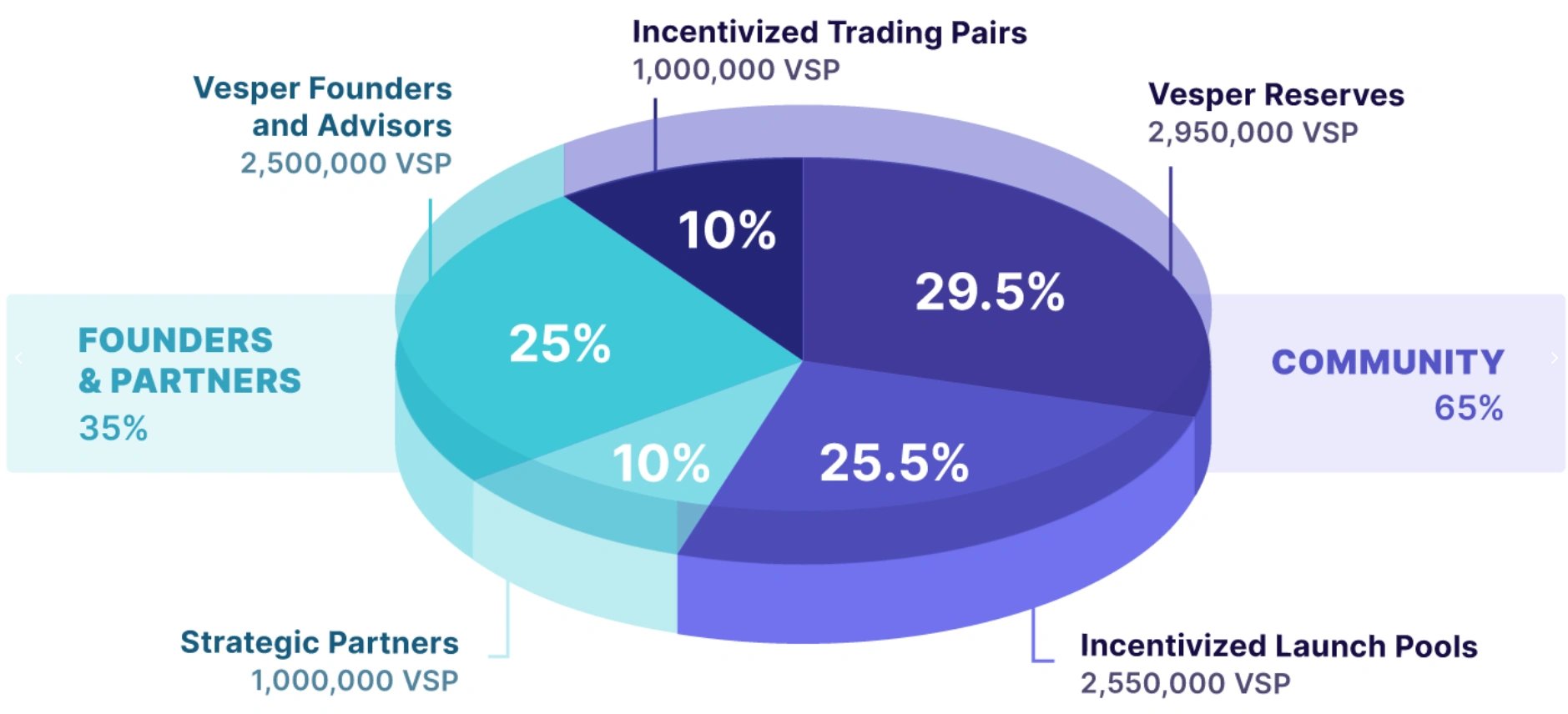

At its launch, Vesper introduced a total supply of 10,000,000 VSP, with a breakdown as follows:[23]

- 6.5 million VSP (65%) are allocated to the community. This includes 2.55 million designated for Incentivized Launch Pools, 1 million to incentivize liquidity providers, and 2.95 million for the Vesper Reserves.

- 3.5 million VSP (35%) are reserved for the Vesper team, advisors, and strategic partners, subject to a vesting period of twelve months.

Beta Program

Prior to the official Vesper launch, a beta program allows users to deposit funds and engage in the initial Vesper pools. During the beta phase, there were no active VSP drip. Instead, average balances across the entire period were recorded, and beta participants subsequently received VSP tokens proportional to their deposited assets after the beta concluded. Initially set at 375,000 VSP, the beta rewards were raised to a total of 450,000 VSP, allocated to early users of Vesper's open beta, and delivered as an airdrop to participants' wallets on launch day without further action required. [24][25]

Token Emissions

These emissions are subject to community discretion and may be adjusted. The distribution includes:[26]

- Launch Pools (2,550,000 VSP): This allocation includes 450,000 VSP for pre-launch Beta participants, airdropped at launch, and 2,100,000 VSP to be distributed over twelve months, with a significant emphasis on the first three months.

- Reserves (2,950,000 VSP): These reserves are earmarked for ecosystem growth and developer/community incentives, to be determined through VSP voter decisions. A fraction of reserves has been leveraged to enhance rewards on Grow Pools.

- Liquidity Providers (1,000,000 VSP): Incentivization for liquidity providers on Uniswap, SushiSwap, 1inch, and Loopring (with SushiSwap retaining the majority). This distribution spans 12 months, with a pronounced focus on the first month.

- Team and Advisors (2,500,000 VSP): These tokens are held in a Sablier contract, with a portion unlocked at launch and the remainder vested with a streaming unlock over eleven months.

- Strategic Partners (1,000,000 VSP): A section of these tokens is unlocked at launch, while the bulk is vested with a streaming unlock over eleven months.

VSP emissions are distributed to various participants, including Vesper pools and liquidity providers. The allocation to Vesper Pools is based on a point system reflecting each pool's importance and TVL. For liquidity providers, a similar point system is utilized to gauge trading volume. These metrics are assessed monthly, with weights updated accordingly for the following month.[26]

Governance

Vesper introduces an on-chain governance model with the advent of esVSP. This model is underpinned by a modified version of Compound Governance's code, coupled with the user interface provided by Tally.xyz. To engage in governance, users must lock their VSP tokens in exchange for esVSP, with voting influence contingent on the quantity of esVSP held. These esVSP holders possess the authority to propose and vote on changes to the Vesper protocol based on a weighted system. [27]

Key features

- Rewarding long-term users with a share of revenue.

- Allowing for tradable, liquid positions where users can trade their locked esVSP as an ERC-721 token.

- Implementing an early exit option with fees directed to the Vesper DAO Treasury.[28]

Locking

To begin earning rewards, such as a revenue share, users must initiate the locking of their VSP tokens. The revenue each esVSP holder receives is determined by their respective weights. These weights hinge on the amount of VSP locked and the lock's duration, which ranges from one week to two years (730 days), with a maximum multiplier of 4x. [29]

Unlocking

The concept of early unlock fee within DeFi serves as a safeguard to encourage users to remain in the ecosystem. With Vesper, the early unlock fee represents the penalty for unlocking VSP tokens before the chosen lock-up period concludes. This penalty begins at 50% and diminishes linearly over time until it reaches 0% upon lock expiration. Any penalty fees collected are channeled back into the Vesper DAO Treasury. [30]

Revenue Model

Universal Fee

Vesper's revenue model incorporates a Universal Fee, charging a 2% annual fee on the principal assets at the time of rebalance. If this fee surpasses 50% of the yield earned, it is adjusted to equal 50% of the yield. [30]

Yield Mechanics

For community pools, 5% of both Universal Fee and Universal Yield Fee are allocated to the developer responsible for the strategy, and this fee is disbursed in the pool's assets. [30]

Incentives

Rebalance-Collateral

Users can initiate a Rebalance-Collateral operation to mitigate pool-wide systemic risk and enhance stablecoin yield. If the collateral's price falls below the Low Water threshold, this operation prevents liquidation. Conversely, if the collateral price surpasses the High Water threshold, this operation generates additional DAI, enhancing the yield for the entire pool. Users are incentivized to use this operation to maximize their yield and evade liquidation. [30]

Rebalance-Earned

Users can also trigger a Rebalance-Earned operation, which swaps earned stablecoin interest for underlying collateral, adding it to the pool's holdings. Users are motivated to balance the timing of this operation: they have an incentive to delay the operation to accrue more yield but are encouraged to perform it before withdrawal to maximize their share of the withdrawn collateral. [30]

Team

Founding Team

- Jeff Garzik: Chief Designer & Co-founder

- Jordan Kruger: CEO & Co-founder

- Matthew Roszak: Co-Founder

- Zane Huffman: Co-Founder and Strategy

- Manoj Patidar: Co-Founder and Principal Engineer

Core Team

- Jelena Keatley: Head of Marketing

- Dean Curran: Marketing Manager

- Dominic Mann: Content Manager

- Jon Greenwood: Community

- Gabriel Montes: Blockchain Engineer

- Rohit Solia: Smart Contract Engineer

- Martin Bon Foster: Javascript Engineer

- John Vernaleo: Pool Operations

- Nayat Cheikh: Lead Product Designer

- Michael McQuaid: Head of Operations

Advisors

- Qiao Wang: Co-Founder, DeFi Alliance (formerly Messari and Tower Research)

- Ian Lee: IDEO CoLab Ventures

Ambassadors

- Cindy Wang: China

- Onur Sait Sevim: Turkey

- Remy Peretti: Vietnam

- Dziomin Yahor: Russia/CIS[2]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)