위키 구독하기

Share wiki

Bookmark

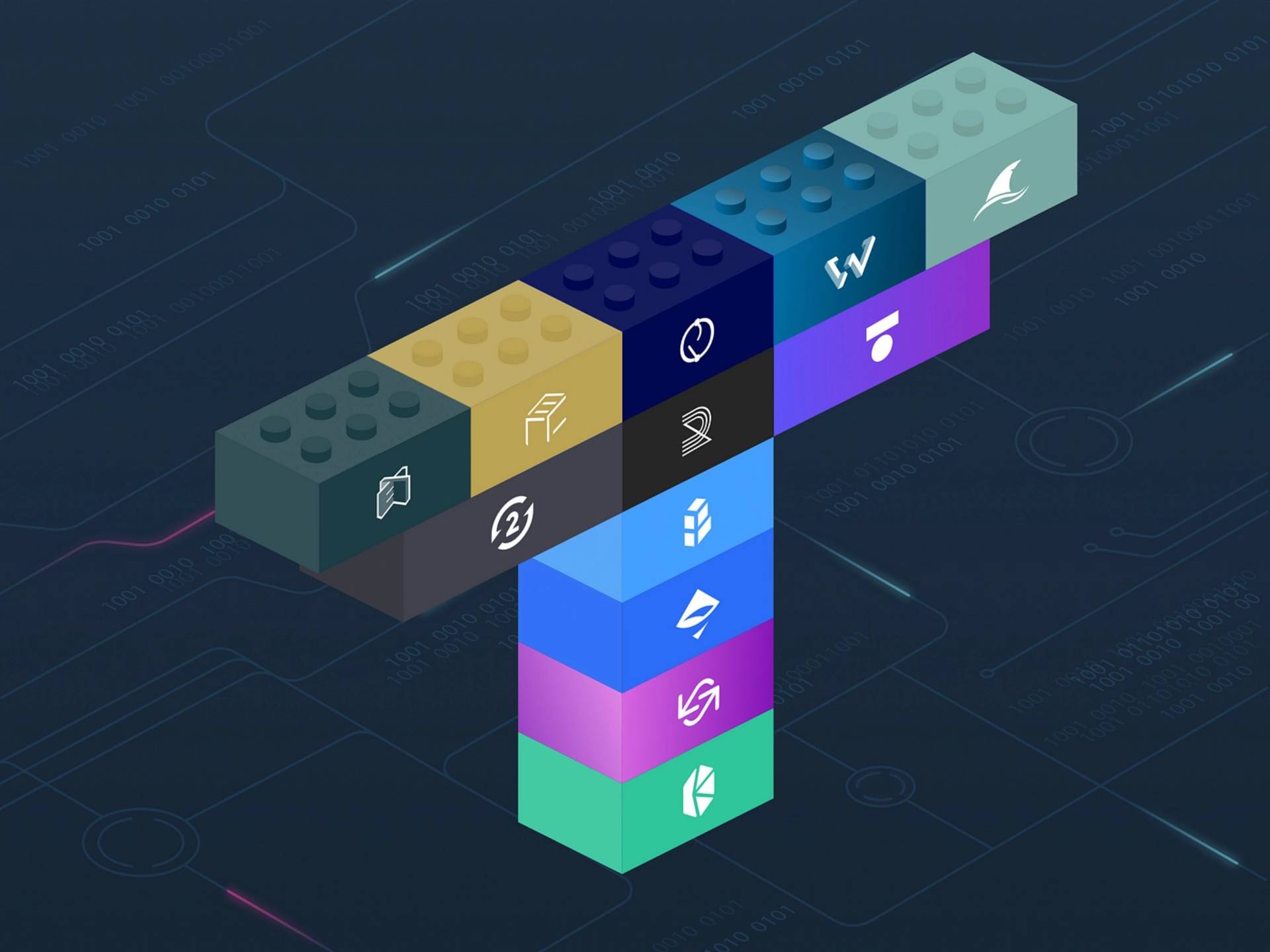

Money Legos

0%

Money Legos

머니 레고는 다양한 방식으로 상호 작용하고 함께 기능할 수 있는 다양한 탈중앙화 금융 (DeFi) 프로토콜의 기능을 설명하는 구성 가능성 개념입니다. 이 개념을 통해 기존 DeFi 프로토콜을 통합하여 동일한 블록체인 네트워크에서 새로운 탈중앙화 애플리케이션 (dApp)을 구축할 수 있습니다. [1][2]

머니 레고는 개발자가 처음부터 새로운 스마트 계약을 구축할 필요가 없으므로 새로운 DeFi 프로젝트를 구축할 때 많은 시간을 절약해 줍니다. 기존 스마트 계약을 자체 프로토콜에 통합하기만 하면 됩니다. [3]

개요

머니 레고 개념은 DeFi 플랫폼을 여러 기능을 가진 하나의 프로토콜을 구축하기 위해 함께 통합할 수 있는 자체 기능을 가진 "레고 블록"으로 설명합니다. 이러한 블록은 대출, 차입, 자산 스왑, 수익률 파밍 등과 같은 다양한 금융 기능을 제공할 수 있습니다. 이 개념은 금융 애플리케이션을 구축하는 데 필요한 도구가 이미 머니 레고 형태로 존재하므로 많은 시간을 절약하고 새로운 금융 애플리케이션을 만드는 데 따른 복잡성을 방지합니다.[7]

구성 가능성 개념

구성 가능성은 구성 요소 간의 상호 관계를 다루는 시스템 설계 원칙입니다. 구성 가능한 시스템에서는 머니 레고를 사용하여 새로운 기능을 만들기 위해 다양한 방식으로 금융 애플리케이션을 구축할 수 있습니다. [7] 구성 가능성은 탈중앙화 거래소(DEX), 합성 자산, 담보 대출, 대출 및 차입 프로토콜, 레버리지 거래, 결제 네트워크 등과 같은 DeFi 생태계의 부분을 함께 묶어 새로운 애플리케이션을 만듭니다. [9] Hubble Protocol의 프로젝트 책임자인 Marius George Ciubotariu는 DeFi에서 구성 가능성의 개념을 다음과 같이 설명합니다. [9]

“모든 DeFi dApp 및 프로토콜은 머니 레고입니다. 왜냐하면 모든 것이 장벽 없이 개방된 글로벌 플랫폼에 존재하므로 원하는 레고 조각을 선택하여 다른 조각과 결합하고 자신만의 걸작을 만들 수 있기 때문입니다. 만들 수 있는 것에는 제한이 없습니다. 이 모든 것은 전체 위험/수익 스펙트럼에서 모든 종류의 금융 욕구를 충족시키기 위한 것입니다. Hubble Protocol에서도 스마트 계약의 구성 가능성 기능을 사용하여 Solana 블록체인의 자산 바구니로 담보할 수 있는 수익 창출 스테이블코인을 구축하여 수익 축적을 통해 자본 효율성을 높이고 있습니다.”[9]

DeFi의 머니 레고

DeFi에서 잘 알려진 머니 레고의 몇 가지 예는 MakerDAO, Curve, Compound, Synthetix, Yearn, Sushi 등입니다. [11]

MakerDAO

MakerDAO는 Ethereum 기반 DeFi 플랫폼으로, 누구나 볼트를 만들고 ETH, BAT, USDC 등과 같은 디지털 자산 담보에 대한 부채로 고도로 구성 가능한 스테이블코인인 DAI를 받을 수 있습니다. MakerDAO 플랫폼에서 발행할 수 있는 DAI는 Curve 및 Uniswap을 포함한 광범위한 탈중앙화 애플리케이션(dApp)과 함께 작동합니다. [7][11]

Curve

Curve는 자동화된 마켓 메이커 (AMM)로, 동일한 자산의 래핑된 버전 또는 스테이블코인과 같이 유사하게 작동하는 자산의 유동성 풀만 허용합니다. Synthetix 및 Yearn과 같은 프로토콜을 생태계에 통합하여 유동성 공급자에 대한 인센티브를 극대화합니다. 일부 Curve 암호화폐 유형은 wBTC, tBTC 등입니다. [11]

Compound

Compound는 MakerDAO의 차입 기능을 레고 블록으로 사용하여 대출 시장을 만듭니다. 이 플랫폼은 차용인과 대출인 모두에게 유리하며, 둘 다 보유 자산에서 이익을 얻습니다. 차용인은 수수료를 내고 Compound에서 제공하는 모든 암호화폐로 담보 대출을 받을 수 있으며, 대출인은 대출 풀에 기여하고 그 대가로 이자 형태로 보상을 받을 수 있습니다. [7][12]

Aave

Aave는 Ethereum 기반 DeFi 대출 프로토콜로, 사용자가 ETH 및 ERC-20 토큰을 허가 없이 대출하고 차입할 수 있습니다. Aave는 많은 DeFi 프로토콜과 통합되어 있으며 구성 가능성을 통해 플래시 대출을 발행할 수 있습니다. 플래시 대출은 담보 스왑, 차익 거래 및 워시 거래를 통해 이익 극대화 전략에 사용됩니다. Aave 플랫폼의 DAI와 같은 스테이블코인은 입금 시 이자가 누적되는 토큰인 aDAI로 교환할 수 있습니다. [10][11]

Synthetix

Synthetix는 "신스"로 알려진 합성 자산을 만드는 유동성 프로토콜입니다. 기본 토큰인 SNX는 다음과 같은 자산의 신스를 발행하는 데 사용할 수 있습니다. [11]

- BTC, ETH 등과 같은 디지털 자산

- USD, AUD 등과 같은 명목 화폐

- 금과 같은 귀금속

- TSLA와 같은 주식

Synthetix는 Chainlink 오라클을 사용하여 정확한 가격 피드를 얻고 DeFi 프로토콜의 구성 가능한 특성을 활용합니다. 이를 통해 Curve를 사용하여 BTC 또는 ETH의 대량 거래에도 슬리피지 없이 신스를 교환할 수 있습니다.[10]

잘못된 내용이 있나요?