Subscribe to wiki

Share wiki

Bookmark

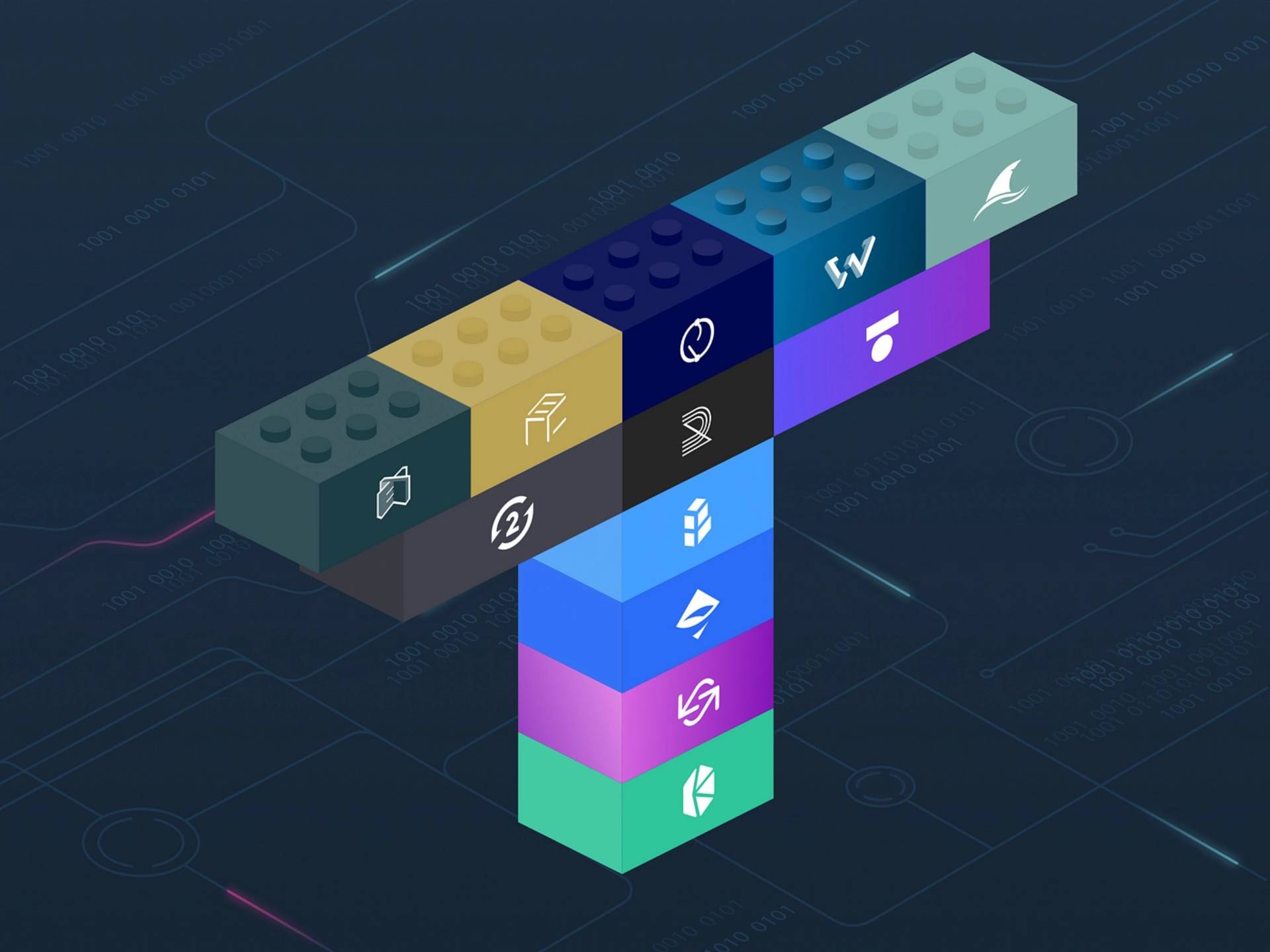

Money Legos

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Money Legos

Money Legos are composability concepts that describe the ability of different decentralized finance (DeFi) protocols to interact and function together in a variety of ways. The concept allows the integration of existing DeFi protocols into the building of new decentralized applications (dApps) on the same blockchain network. [1][2]

Money Legos save a lot of time when building new DeFi projects, as developers don’t need to build new smart contracts from scratch. They can simply integrate existing ones into their own protocol. [3]

Overview

The Money Legos concept describes DeFi platforms as "Lego blocks," each having its own functionality that can be incorporated together to build one protocol with multiple functions. These blocks can offer various financial functionalities like lending, borrowing, asset swapping, yield farming, and more. This concept saves a lot of time and prevents complications around creating a new financial application, as the tools needed to build such a protocol already exist in the form of money legos.[7]

Composability Concept

Composability is a system design principle that deals with component interrelationships. In a composable system, financial applications can be built in a variety of ways to create a new function using money legos. [7] Composability binds the parts of the DeFi ecosystem, such as decentralized exchanges (DEXs), synthetic assets, collateralized loans, lending and borrowing protocols, leveraged trading, payment networks, etc., together to create new applications. [9] Marius George Ciubotariu, the Project Head of Hubble Protocol, explains the concept of composability in DeFi by saying: [9]

“All DeFi dApps and protocols are Money Legos, because everything lives on an open global platform, without barriers, which means that you can pick whichever Lego piece you want, combine it with another piece, and build your own masterpiece. There is no limit to what you can create. All of this is to serve every kind of financial appetite on the entire risk/return spectrum. We, at Hubble Protocol, are also using the composability feature of smart contracts to build our yield-bearing stablecoin that can be collateralized with a basket of assets on the Solana blockchain, enabling capital efficiency with yield accumulation.”[9]

Money Legos in DeFi

Some examples of well-known money legos in DeFi are MakerDAO, Curve, Compound, Synthetix, Yearn, Sushi, etc. [11]

MakerDAO

MakerDAO is an Ethereum-based DeFi platform that allows anyone to create a vault and receive DAI, a highly composable stablecoin, as a debt against digital asset collateral such as ETH, BAT, USDC, etc. DAI, which can be minted on the MakerDAO platform, works with a vast number of decentralized applications (dApps), including Curve and Uniswap. [7][11]

Curve

Curve, an automated market maker (AMM), accepts only liquidity pools of similar-behaving assets, such as wrapped versions of the same assets or stablecoins. It incorporates protocols like Synthetix and Yearn into its ecosystem to maximize incentives for liquidity providers. Some Curve cryptocurrency types are wBTC, tBTC, etc. [11]

Compound

Compound uses MakerDAO’s borrowing capabilities as a Lego block to create a lending market. The platform favors both borrowers and lenders, as they both earn profits from their holdings. Borrowers can take out a collateralized loan in any cryptocurrency offered by Compound for a fee, and lenders can contribute to the lending pool and earn rewards in the form of interest in exchange. [7][12]

Aave

Aave is an Ethereum-based DeFi lending protocol that allows users to lend and borrow ETH and ERC-20 tokens permissionlessly. Aave integrates with many DeFi protocols and can issue flash loans through composability. Flash loans are used for profit-maximizing strategies via collateral swapping, arbitrage, and wash trading. Stablecoins like DAI on the Aave platform can be exchanged for aDAI, a token that accumulates interest when deposited. [10][11]

Synthetix

Synthetix is a liquidity protocol that creates synthetic assets, known as "synths." Its native token, SNX, can be used to mint synths of assets, including the following: [11]

- Digital assets such as BTC, ETH, etc

- Fiats such as USD, AUD, etc

- Precious metals such as gold

- Stocks such as TSLA

Synthetix employs Chainlink oracles to obtain accurate price feeds and leverages the composable nature of DeFi protocols. This allows for synths to be swapped with zero slippage, even for large quantities of BTC or ETH, using Curve.[10]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)