Subscribe to wiki

Share wiki

Bookmark

Morpho

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Morpho

Morpho is a decentralized, noncustodial lending protocol implemented on the Ethereum Virtual Machine. It is designed to facilitate overcollateralized lending and borrowing of crypto assets. It functions as an immutable base layer for users and applications, enabling the creation of isolated lending markets. [2]

Overview

Morpho is a decentralized lending protocol built on the Ethereum Virtual Machine (EVM). It allows users to lend and borrow crypto assets trustlessly, non-custodially, and overcollateralized. It operates through immutable smart contracts that serve as a foundational layer for decentralized finance (DeFi) applications, enabling open participation from any user without intermediaries. The protocol supports ERC-20 and ERC-4626 tokens and includes core mechanisms such as collateral management, liquidation protections based on loan-to-value ratios, and dynamic interest rate adjustments driven by market conditions.

The Morpho ecosystem is composed of several distinct components. The Morpho Protocol refers to the smart contracts facilitating lending and borrowing operations. Morpho Interfaces are web-based frontends that allow users to interact with the protocol. Morpho Governance is a decentralized system governed by holders of the MORPHO token, giving the community control over decisions like protocol upgrades. Morpho Labs is the original development entity responsible for building the protocol and related tools. Finally, the Morpho Association, a registered non-profit in France, coordinates contributors—including Morpho Labs—and promotes the decentralization and development of the ecosystem.

Morpho is licensed under a dual licensing model (BUSL-1.1 and GPLv2). Once deployed, its smart contracts are designed to run indefinitely if the underlying blockchain infrastructure persists. The protocol prioritizes composability, transparency, and security, aiming to create a robust, permissionless base layer for lending markets in the decentralized economy. [1]

Morpho Association

The Morpho Association is a nonprofit organization based in France that supports the development and accessibility of the Morpho protocol. It brings together contributors and users to advance the protocol through funding initiatives and infrastructure support rather than direct software development.

Its responsibilities include hosting the main front-end interface of Morpho’s website, providing access for new users, and maintaining technical documentation to assist developers. The association also manages intellectual property related to open-source projects like morpho-optimizers, which it publishes under a GPL3 license on the morpho-org GitHub. While the association provides essential infrastructure, development is handled by entities such as Morpho Labs and the Institut Louis Bachelier (ILB). [2]

Technology

Morpho Market

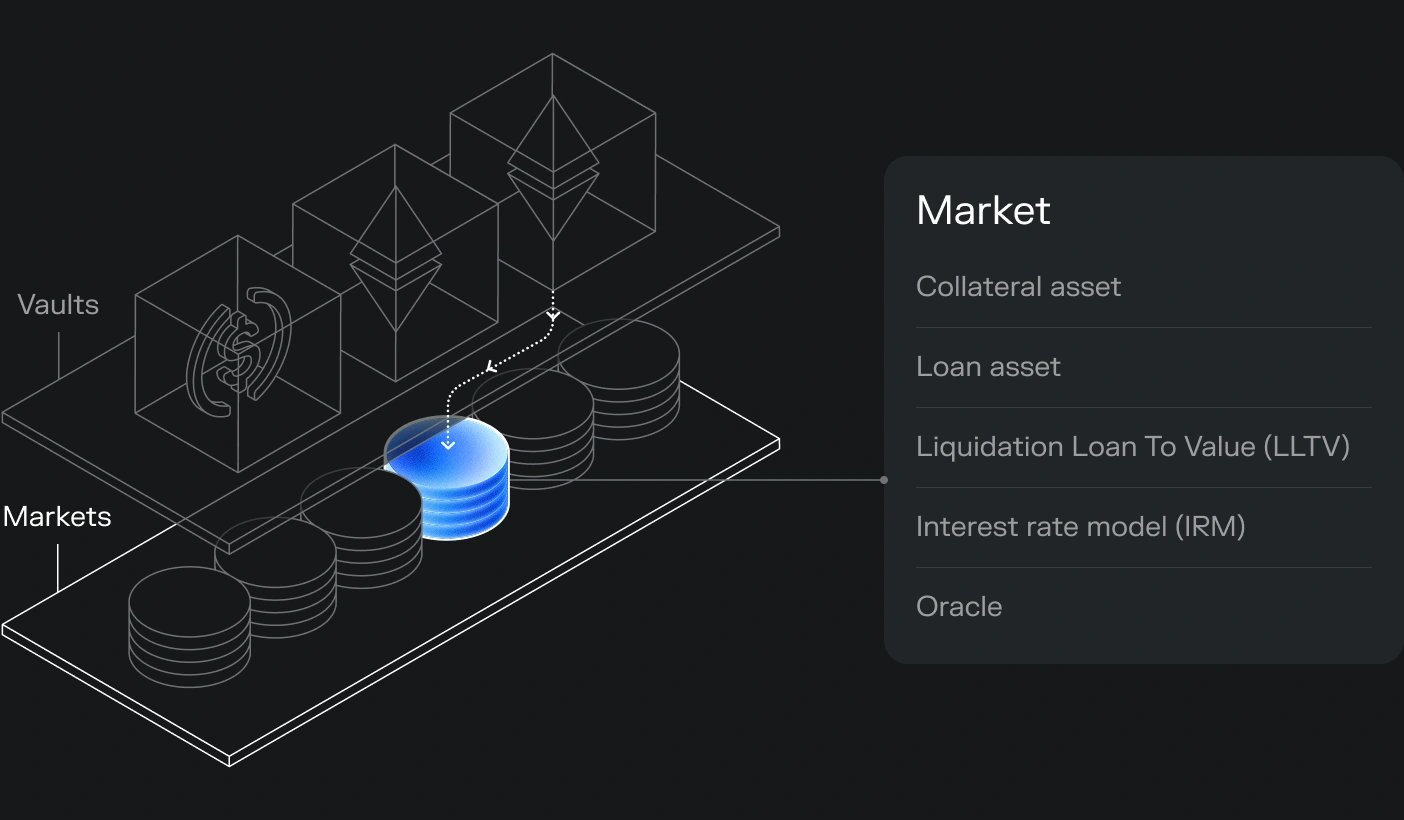

A Morpho Market is an isolated lending pool that pairs a single collateral asset with a single loan asset. These markets are immutable, meaning their parameters cannot be changed after deployment, and they are designed to operate independently of one another, containing risk within each market. This structure ensures consistent and predictable behavior for both lenders and borrowers.

Each Morpho Market is created permissionlessly, requiring no governance approval, which supports rapid and decentralized expansion of the lending ecosystem. The rules governing lending and borrowing are transparent from the start, and the simplicity of having just one collateral and one loan asset per market reduces complexity while improving risk management. As long as the underlying blockchain remains active, these markets remain functional and secure. [3]

Morpho Vault

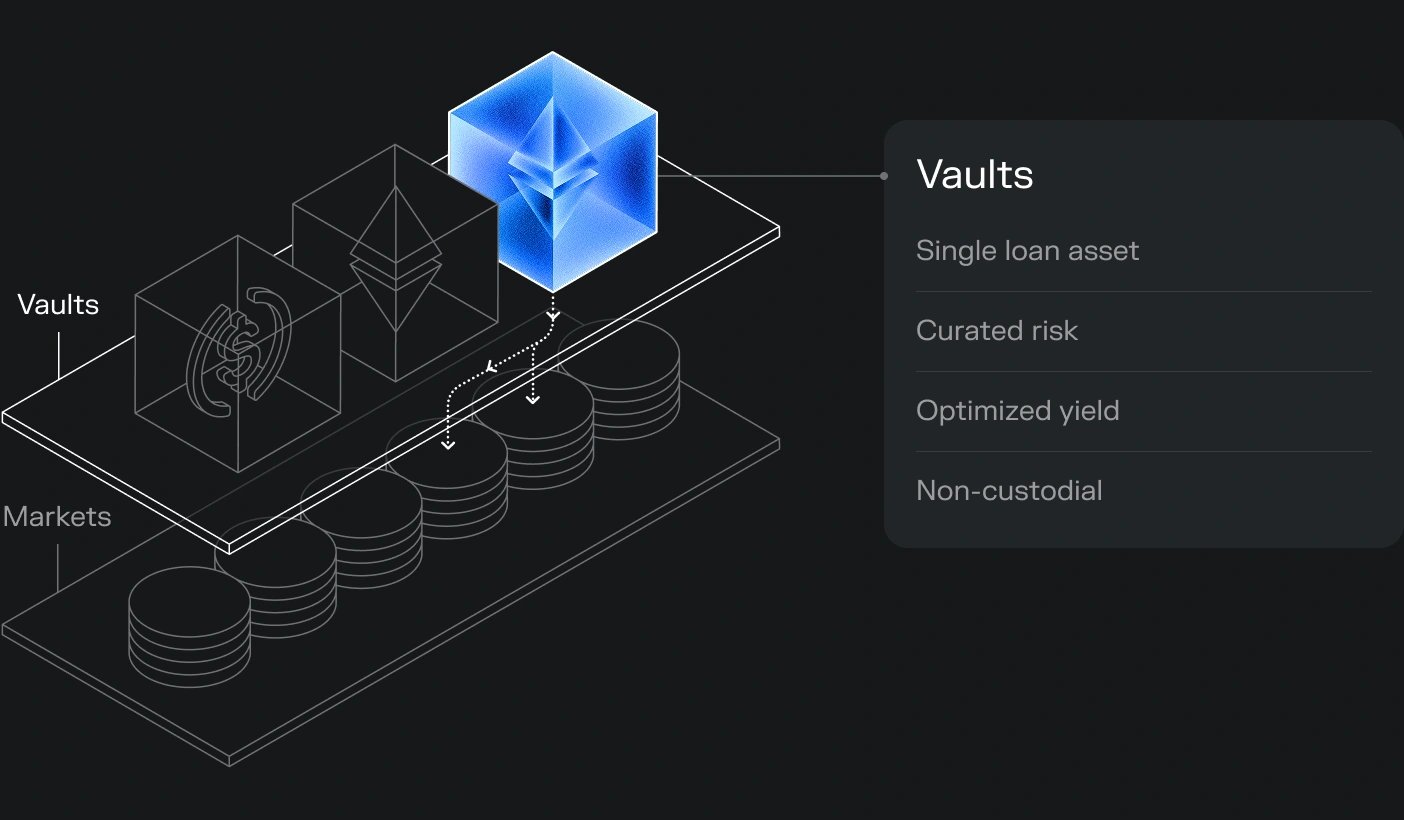

Morpho Vaults is a permissionless protocol built on top of Morpho Markets that allows users to deposit assets into vaults and earn yield from borrowers across multiple lending markets. Each vault is tied to a specific loan asset and automatically allocates deposits to various Morpho Markets to optimize returns. This setup removes the need for users to manage individual market positions or assess risk themselves, as vaults include automated risk management mechanisms that handle these decisions.

Vaults follow the ERC-4626 tokenized vault standard, enabling compatibility and integration across the DeFi ecosystem. Users retain full control over their funds and can deposit or withdraw anytime, depending on available liquidity. All operations are transparent and managed through clearly defined roles that handle risk curation and capital allocation. Morpho Vaults aims to simplify access to DeFi lending by offering a single, streamlined interface for generating passive yield with risk management handled by the protocol. [4]

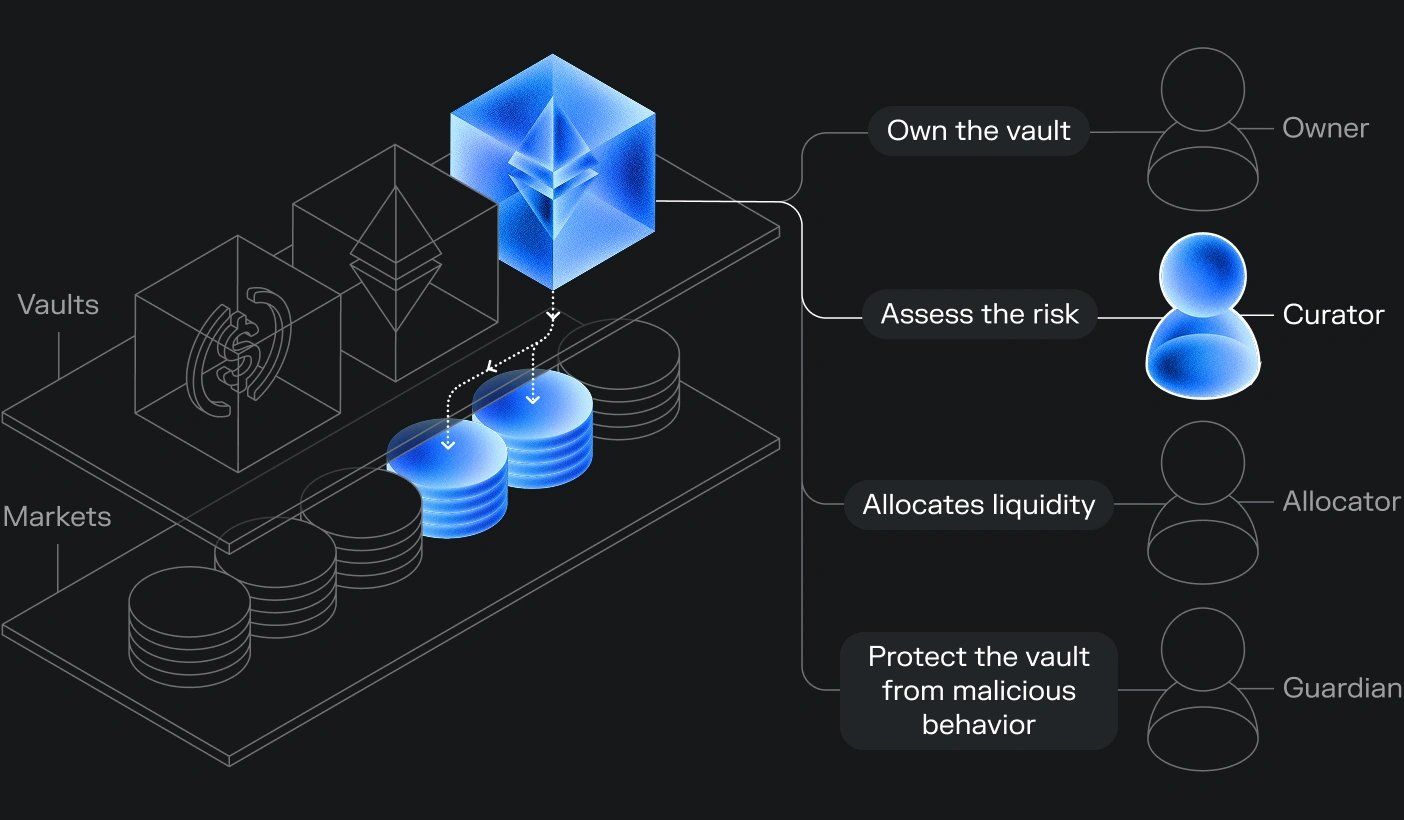

Curator

In the Morpho ecosystem, a Curator is responsible for overseeing the strategic operation of a lending vault, with the primary goal of maximizing risk-adjusted returns for depositors. Curators determine which Morpho Markets to include in a vault, allocate capital, and actively manage associated risks. Their decisions affect the performance, yield, and security of the vaults they manage.

Curators handle market selection, rate optimization, and capital allocation, ensuring yields remain competitive while minimizing risk exposure. They monitor collateral quality, price oracle reliability, and liquidity conditions to avoid potential losses. Curators also communicate openly with users about vault performance and risk settings. Vaults operate under a broader management framework that includes additional roles—Owner, Guardian, and Allocator—each with defined permissions supporting the curator’s strategy and ensuring the system functions securely and transparently. [5]

Interest Rate Model

Morpho’s interest rate model (IRM) system is designed to be modular and governance-controlled, allowing different models to govern how interest is calculated in lending markets. Each Morpho Market selects an IRM at creation from a governance-approved set; this choice cannot be changed afterward. The IRM determines the rate borrowers pay and, in turn, what lenders earn. Borrow and supply annual percentage yields (APYs) are derived from the IRM’s per-second rate calculations and reflect the cost of borrowing and the yield for lenders, respectively. The system is designed to be transparent and predictable, with supply APYs factoring in utilization and fees (currently set to zero). [6]

Adaptive Curve

The primary model currently in use is the AdaptiveCurveIRM, which aims to keep the utilization rate of a market (borrowed/supplied ratio) around 90%. This model comprises two mechanisms. First is the curve mechanism, which establishes short-term responsiveness: when utilization spikes, the interest rate rises sharply, and when it drops, the rate decreases. For instance, if the target rate is 4% at 90% utilization, then at 100% utilization, the rate jumps to 16%, and at 0%, it drops to 1%.

Second is the adaptive mechanism, which adjusts the curve over time based on utilization trends. If utilization is persistently too high or too low, the model shifts the curve upward or downward, creating incentives to balance borrowing and lending. This dynamic structure allows the AdaptiveCurveIRM to adjust across market conditions and asset types without external intervention. [6]

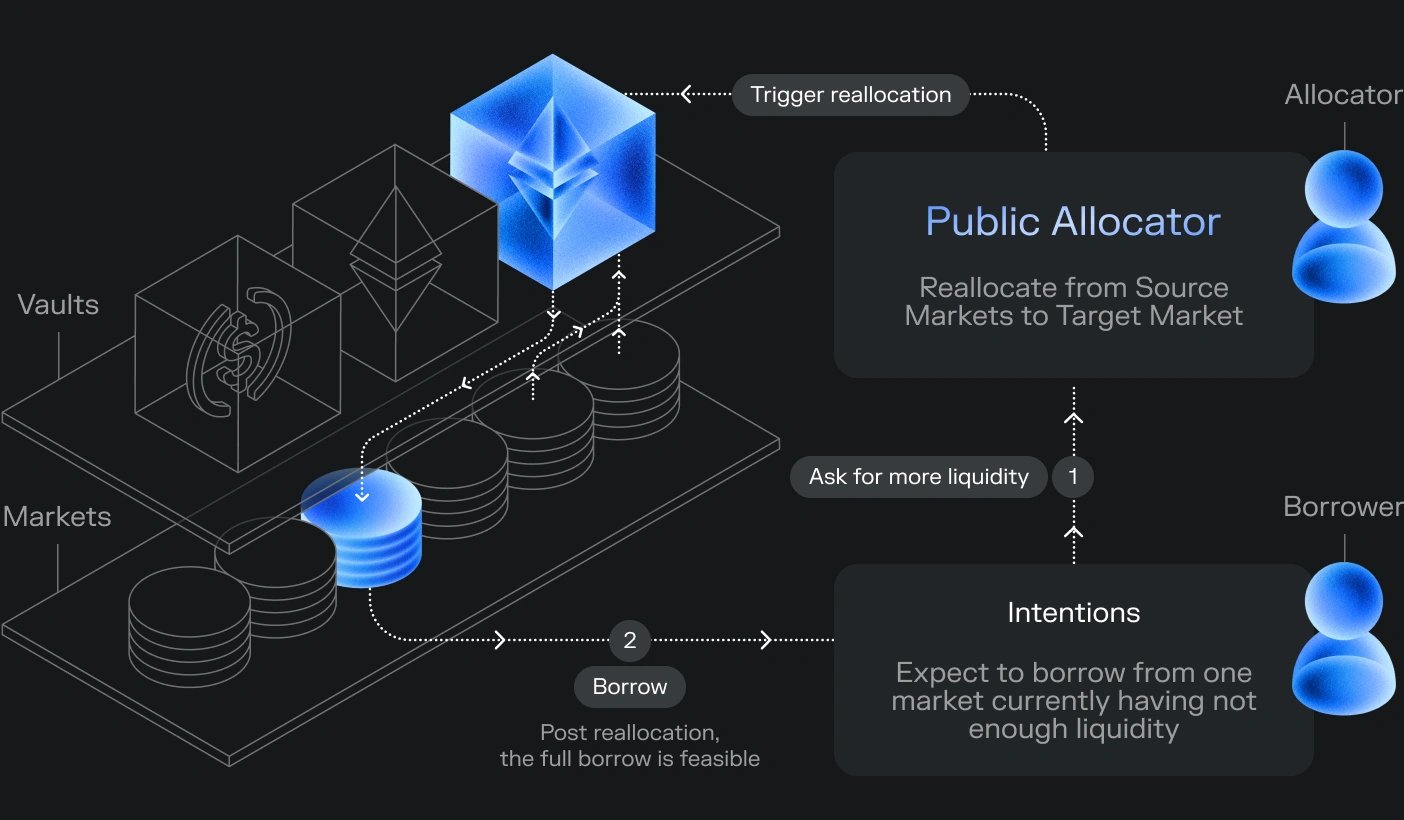

Public Allocator

The Morpho Public Allocator is a smart contract designed to address the challenge of fragmented liquidity across isolated lending markets. In Morpho, each market is isolated to contain risk, but this can lead to inefficiencies when liquidity is spread thin across multiple pools. The Public Allocator enables borrowers to access larger amounts of capital by reallocating idle liquidity from one market to another on demand. Instead of requiring borrowers to split their transactions across several markets, the allocator automatically sources the needed liquidity and makes it available in a single borrowing operation.

This mechanism enhances user experience by providing deep liquidity through a seamless process that’s invisible to the borrower. It also benefits the broader ecosystem by creating liquidity network effects, making markets more efficient without sacrificing isolation security. Vault curators retain control over the allocator’s behavior by defining flow caps, preferred market routes, and optional fee structures. This ensures that while liquidity becomes more mobile and accessible, the underlying risk controls remain in place. The Public Allocator thus merges the safety of isolated lending markets with the convenience of pooled borrowing, improving efficiency without compromising decentralization or risk management. [7]

Bundlers

In the Morpho ecosystem, Bundlers are smart contracts that group multiple operations—such as lending, borrowing, or swapping—into a single transaction. This structure simplifies user workflows by removing the need to manually execute and confirm each step individually, reducing friction and gas costs.

There are currently two versions of bundlers: Bundler2 and Bundler3. Bundler3 is the most advanced version, directly integrated into the Morpho interface. It enables users to perform complex actions in a single click, streamlining DeFi operations. With Bundler3, users can perform multi-step processes efficiently, avoid unnecessary gas expenditures by paying for just one transaction, and ensure atomicity. If any part of the transaction fails, the entire operation reverts. This bundling capability improves the user experience and minimizes cost and risk when interacting with the protocol. [8]

MORPHO

MORPHO is the governance token for the Morpho Protocol, granting holders voting rights within the Morpho DAO. Governance decisions are made using a weighted voting system, where influence is based on the amount of MORPHO held or delegated. Participants can vote on proposed changes or upgrades to the protocol.

The original MORPHO token, now considered legacy, was deployed without support for on-chain vote tracking. To address this, the community approved creating a wrapped version in MIP-75. Wrapped MORPHO enables on-chain governance functionality and is designed to support future cross-chain interoperability. Legacy tokens can still be converted 1:1 into wrapped MORPHO using a wrapper contract on the Morpho App. However, only wrapped MORPHO is transferable, reducing the risk of confusion or misuse in external integrations. [9]

Tokenomics

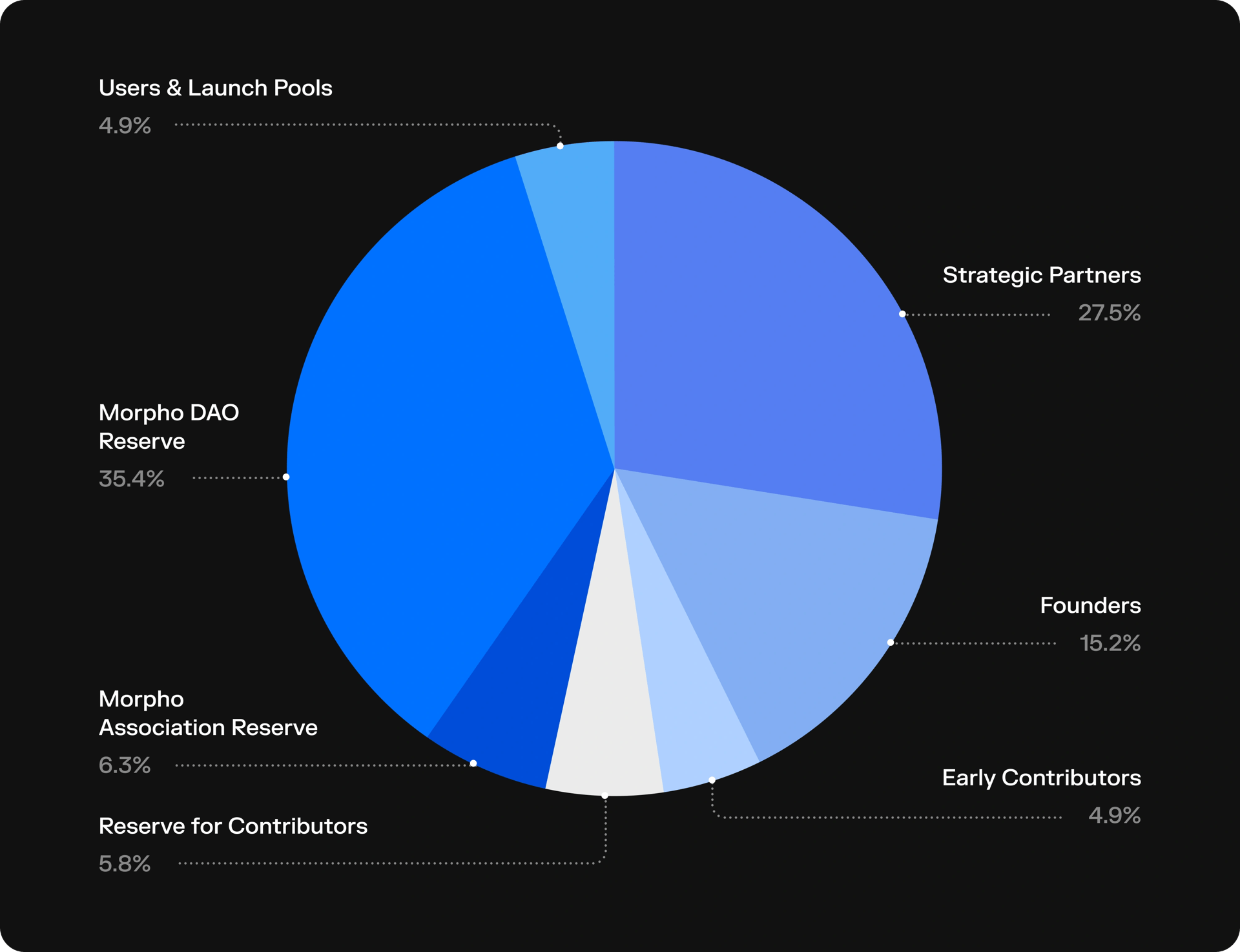

MORPHO has a total supply of 1B tokens and has the following distribution: [9]

- Morpho DAO: 35.4%

- Strategic Partners: 27.5%

- Founders: 15.2%

- Morpho Association: 6.3%

- Contributor Reserve: 5.8%

- Users & Launch Pool: 4.9%

- Early Contributors: 4.9%

The circulating supply on transferability date was approximately 11.2%. [9]

Partnerships

- Ribbit Capital

- a16z Crypto

- Coinbase Ventures

- Variant

- Pantera

- Prelude

- Kraken Ventures

- Nascent

- Blocktower

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)