Mantle Network

Mantle Network is Layer-2 scaling solution compatible with Ethereum Virtual Machine (EVM). It employs Optimistic rollups to enable swift and cost-effective transactions. By processing transactions off-chain and settling them on-chain, Mantle Network ensures efficiency while utilizing Ethereum's capabilities. [1]

Overview

Mantle Network is founded by Anon. Mantle Network focuses on developing a scaling solution compatible with Ethereum's ecosystem, ensuring seamless interoperability for existing contracts and tools with minimal adjustments. Leveraging its modular architecture, Mantle Network integrates an optimistic rollup mechanism with innovative data availability solutions, enhancing accessibility and affordability while maintaining Ethereum's security standards. [1]

The protocol design emphasizes enhancing user experience by reducing costs and improving usability, simplifying developer development processes, and providing a robust infrastructure for the emerging generation of decentralized applications (dApps). By adopting a rollup structure, Mantle Network harnesses Ethereum's validators and consensus protocols to significantly diminish gas fees, decrease transaction latency, and augment throughput. Users have the flexibility to tailor transaction confirmation requirements, enabling near real-time confirmation with optimized security parameters. [1]

Mantle Network's modular architecture segregates transaction execution, consensus, settlement, and storage functions into distinct modules within the chain. This includes an EVM-compatible execution layer for transaction processing, a consensus and settlement layer executed on Ethereum's platform, and an external data availability component, currently Mantle DA powered by EigenDA technology. [1]

History

The Mantle Network, initiated in July 2023, was the first Layer-2 solution launched by a DAO. Originating from BitDAO, known for its substantial treasury in the crypto realm, the network underwent consolidation with Mantle following a community vote in May 2023. This merger led to the rebranding of BitDAO under Mantle, with all BIT tokens available for conversion to MNT tokens at a 1:1 ration from June 2023 onwards. [2]

Everest Update

Mantle v2 Everest is a significant upgrade to the Mantle network, following over a year of stable operation under Mantle v2 Tectonic. This update improves the network’s infrastructure and aligns it with Ethereum’s upcoming Pectra upgrade, ensuring technical compatibility and preparing the system for future development.

A core component of the upgrade is the integration of EigenDA. Previously, Mantle relied on Mantle DA, a data availability layer built on EigenDA technology. With EigenDA now live, Mantle has fully transitioned to it across testnet and mainnet environments. This integration is expected to enhance data handling and network security. The upgrade also includes adaptations for Ethereum’s Pectra update. Mantle now supports changes introduced by EIP-7685 and EIP-7702, including adding the RequestsHash field in block headers and a new transaction type, SetCodeTx, ensuring alignment with Ethereum Layer 1 developments.

New features introduced in the Everest upgrade include support for the RIP-7212 precompiled contract and expanding op-geth's capabilities. These changes reflect continued development on the OP Stack Bedrock framework. The MetaTX feature, which previously allowed gas fee sponsorship, has been removed. Its functionality will be replaced by implementing EIP-7702 as part of the broader Ethereum upgrade, aligning Mantle’s approach with the updated Ethereum ecosystem. [20]

Features

Modular Blockchain Rollups

Mantle Network implements a layered approach to its execution, consensus, settlement, and data availability functions, allowing different network actors to manage specialized layers. This architectural design enables Mantle Network to achieve notable reductions in gas costs and overall performance enhancements. [3]

Employing a Modular Rollup model, Mantle Network optimizes fundamental blockchain operations, addressing a significant challenge in the blockchain community: the Scalability, Security, and Decentralization trilemma. [3]

The segregation of resources enhances network efficiency by allocating specific tasks to each layer, ensuring that all users benefit from improved security, unlike the reliance solely on full node validators in Layer-1 (L1). Operating on separate layers alleviates the execution and validation burden on nodes, as technologies like fraud proofs and ZK proofs no longer require them to execute all transactions for validity checks. [3]

Data Availability

Mantle Network addresses security concerns inherent in rollup architecture by leveraging EigenLayer, a re-staking protocol. EigenLayer utilizes Ethereum's trusted network to ensure data availability for Layer-2 solutions while maintaining security levels akin to the Ethereum Mainnet. Through EigenLayer's data availability solution, known as EigenDA, Mantle Network enables nodes to furnish data availability services. Validators engage in Mantle Network's economic model by staking $MNT tokens, unlocking additional yield prospects. This participation enhances block data completeness and accuracy within Mantle Network's execution layer. [3]

EigenDA separates the data availability from the consensus layer and implements a unicast channel for efficient data storage and transmission among network participants. It also maintains an erasure rate, facilitating complete block data reconstruction through data pieces from both Layer-2 and Layer-1 sources. This solution enhances the utility of $MNT beyond governance functions, while furnishing the requisite high throughput for next-generation Web3 applications. [3]

Fraud Proofs

In the optimistic model embraced by rollups, trust in network participants' good behavior is assumed, necessitating robust fraud proofs implementation to fortify network integrity. However, implementing fraud proofs poses challenges. [3]

Currently, the on-chain verifier can only execute instructions in a lower-level virtual machine, requiring fraud proofs to be translated into this language by EVM clients. Consequently, the content of fraud proofs is often not directly obtained from compliant EVM clients, and there are no means of verifying their source, as the on-chain verifier lacks visibility of the fraud proof producer. This hampers trust minimization embedded in Ethereum clients. [3]

Mantle Network tackles this issue by adopting an approach that directly compiles and verifies fraud proofs using EVM instructions. This allows all Ethereum clients to openly interact with a shared proof system, reducing trust assumptions among verifiers, compilers, and clients. [3]

Transaction Lifecycle

Transactions within Mantle Network begin when initiated by a wallet user, dApp, or script. Tools like Mantle SDK facilitate request creation, signing, and submission for Sequencer processing. Upon verification, transactions are added to pending blocks, leveraging batch processing to distribute fixed costs and minimize transaction fees. [3]

Subsequently, Threshold Signature Scheme nodes verify block data before transmission to the Ethereum network through Sequencer. Rollup verifiers synchronize data within the Mantle Network for accessibility by users and dApps, while Ethereum records transmitted data on-chain via its consensus mechanism. Moreover, Data Availability nodes synchronize and ensure data access within the Mantle Network, earning $MNT tokens as rewards. [3]

$MNT Token

The $MNT tokens fulfill dual roles within the Mantle Ecosystem, serving as governance and utility tokens. In governance, each $MNT token carries an equal weight in voting rights, allowing token holders to engage in DAO decision-making processes. As a utility token, $MNT is utilized to cover gas fees on the Mantle Network and can also serve as collateral for Mantle Network nodes. Operating as a native token, $MNT shares comparable functionality with other Layer-2 blockchain tokens. [3]

Tokenomics

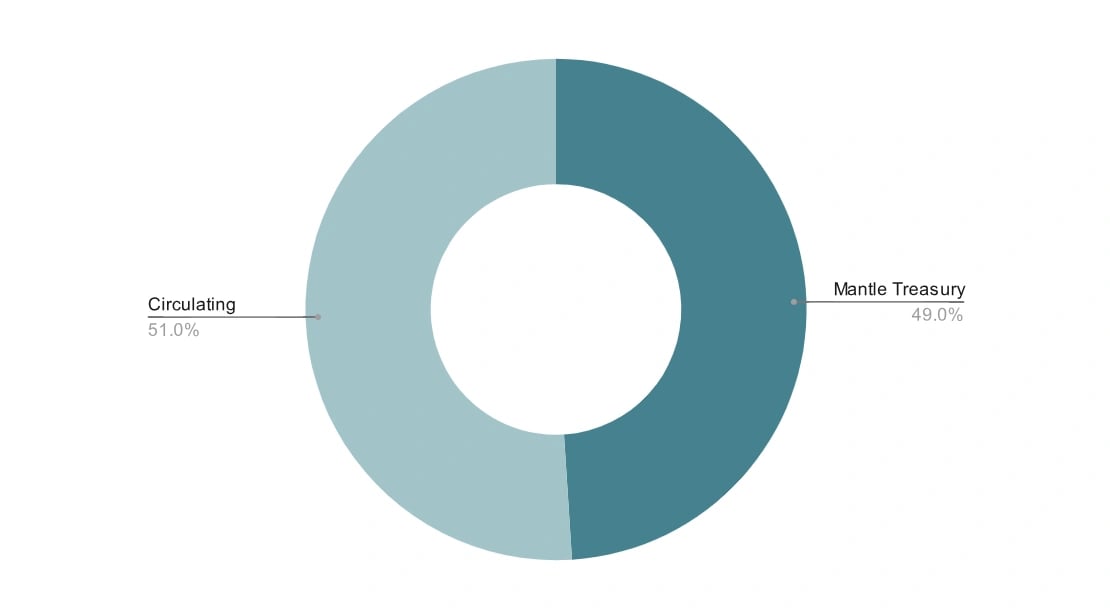

The initial distribution of Mantle (MNT) tokens was as follows: [4]

- 49.00% is allocated to Treasury

- 51.00% is allocated to Circulating

Citizens of Mantle

Citizens of Mantle is an inaugural native modular NFT collection created with visual artist Chen Man. This collection of avatars aims to reward active community members. It is designed to synchronize with the Mantle Journey program, offering additional incentives for engaging with the Mantle community. Users can join the whitelist by connecting their wallets to verify eligibility. [5]

Becoming a Citizen of Mantle provides individuals access to an immersive experience within the Mantle Ecosystem. A Citizen of Mantle NFT avatar is a faithful companion on a journey of building, connecting, playing, earning, and trading within the Mantle network. As users achieve milestones within the Mantle Ecosystem, their NFT avatars will evolve, gaining various traits. These avatars reflect the engagement and accomplishments within the Mantle Ecosystem, unlocking future benefits and opportunities as participants progress. [5]

mETH Protocol

mETH Protocol operates as a permissionless and non-custodial ETH liquid staking protocol deployed on Ethereum L1 and governed by Mantle. It features a simple and modern design coupled with robust risk management measures, drawing on Mantle Ecosystem resources to offer a rewarding experience and bolster Mantle's yield potential. Mantle Staked Ether ($mETH) functions as the value-accumulating receipt token within mETH Protocol facilitating the pooling of ETH deposits from stakers. Stakers receive $mETH tokens representing their claim to the staked principal and accrued rewards, which can be utilized in other applications. Upon unstaking, stakers receive their staked ETH and any rewards earned during the staking period, including issuance, priority fees, and maximal extractible value (MEV), distributed among stakers, LSP, and node operators. [6]

Mantle Index Four (MI4)

Mantle Index Four (MI4) is a fund that provides regulated exposure to major digital assets while incorporating decentralized yield strategies. It is aimed at both traditional and crypto-native investors seeking simplified access to crypto markets without requiring direct custody or manual portfolio management.

The fund is organized as a BVI Limited Partnership and managed by Mantle Guard Limited. It offers a curated portfolio of BTC, ETH, SOL, and USD-based stable assets, with allocations adjusted quarterly based on market capitalization and risk metrics. The strategy includes staking components such as mETH, bbSOL, and sUSDe to increase returns through DeFi mechanisms, while maintaining adherence to compliance standards.

Following DAO approval, Mantle Treasury has committed up to $400 million to MI4 as an initial investment. The fund uses tokenization services from Securitize to issue investor interests on the Mantle Network.

Operational infrastructure includes institutional-grade tools like Fireblocks and multi-signature wallets, with additional custody solutions being considered to enhance security. MI4 is intended as a reference point for crypto beta exposure with integrated yield features, connecting traditional finance structures with decentralized finance protocols. [21]