Subscribe to wiki

Share wiki

Bookmark

Lombard Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Lombard Finance

Lombard Finance is a decentralized finance (DeFi) platform that seeks to extend the utility of Bitcoin within the DeFi ecosystem by providing staking, lending, and other decentralized financial services through its main token, Lombard Staked BTC (LBTC). [1]

Overview

Lombard Finance focuses on increasing Bitcoin’s utility by integrating it into decentralized finance (DeFi). Recognizing that a large portion of Bitcoin's $1.5 trillion market cap often remains inactive, Lombard aims to convert a fraction of this capital into active use within DeFi systems. The company introduces LBTC, a liquid staked token (LST) built on Babylon, which enables Bitcoin holders to earn yield and contribute to network security while retaining the underlying asset. This approach seeks to bridge Bitcoin’s economic value with staking and DeFi opportunities, enhancing its role in the digital economy. [5]

Features

Lombard Ledger

The Lombard Ledger is a Cosmos app chain operating under Proof-of-Authority and forms the backbone of the Lombard Protocol by providing transparent on-chain records of all operations. The Security Consortium maintains and validates this ledger—a network of independent, Bitcoin-aligned digital asset institutions that ensures multiple parties sign off every transaction. This decentralized validation method eliminates any single point of failure and uses multi-party approvals and time locks to enhance the protocol’s security and integrity.

The Security Consortium is responsible for verifying Bitcoin deposits, authorizing LBTC mints and redemptions, facilitating staking transactions through the Babylon ecosystem, and securely managing cross-chain bridging with additional safeguards like Chainlink CCIP. In addition to governing protocol upgrades, the Consortium oversees the collection and distribution of BSN rewards while maintaining a Byzantine fault-tolerant ledger that provides verifiable and immutable records of all activities. [7] [8]

Luminary Program

The Lux and Luminary Program is Lombard’s long-term initiative to reward user participation in the LBTC ecosystem. Lux is earned by staking BTC, holding LBTC, or using LBTC in approved DeFi integrations. LBTC alone accumulates Lux at a rate based on the amount and duration. Users can also earn boosted Lux rewards by depositing LBTC into high-multiplier options like the Lombard DeFi Vault or participating in whitelisted DeFi platforms listed on the “LBTC in DeFi” page. Accumulating rewards in a single address is recommended for efficiency, and direct staking to Babylon’s Finality Provider does not qualify for Lux.

In addition to regular accumulation, Lux can be earned through special Luminary Program events. These include flash opportunities, community-driven challenges like referrals or content creation, and retroactive rewards for consistent engagement. Lux balances are tracked by Sentio, which monitors wallet and DeFi activity to calculate holdings and durations. Users can view their Lux on the Lombard App by connecting their wallets. The program helps align user engagement with LBTC’s growth by offering transparent and ongoing incentives. [4]

CubeSigner

CubeSigner is a non-custodial key management platform developed by Cubist that integrates secure hardware to safeguard cryptographic keys used within Lombard’s infrastructure. By storing keys in HSM-sealed Nitro enclaves, CubeSigner ensures that keys are never exposed, even to Cubist or Lombard, thereby preventing theft and unauthorized access. Signing sessions are limited in scope, time-bound, and revocable, which reduces the risk of breaches and insider threats. Additionally, per-key policies control key usage, such as requiring multi-party approvals for large transactions. CubeSigner also includes protections specific to Babylon, like anti-slashing measures to prevent validators from signing harmful messages due to operational errors.

Within Lombard’s architecture, CubeSigner generates and manages Bitcoin keys tied to custom, hardware-enforced policies—what Cubist calls off-chain, hardware-enshrined smart contracts. These policies define access control, transaction types, usage limits, multi-party authorization, and time-based restrictions. For example, user keys are limited to specific Babylon transaction types and require trusted counterparties for deposits and withdrawals. Multi-party authorization ensures that sensitive operations require multiple signers and authentication factors, while timelocks add another layer of security by enforcing delays even for approved actions. This architecture allows Lombard to manage keys securely while maintaining operational flexibility and decentralization. [9]

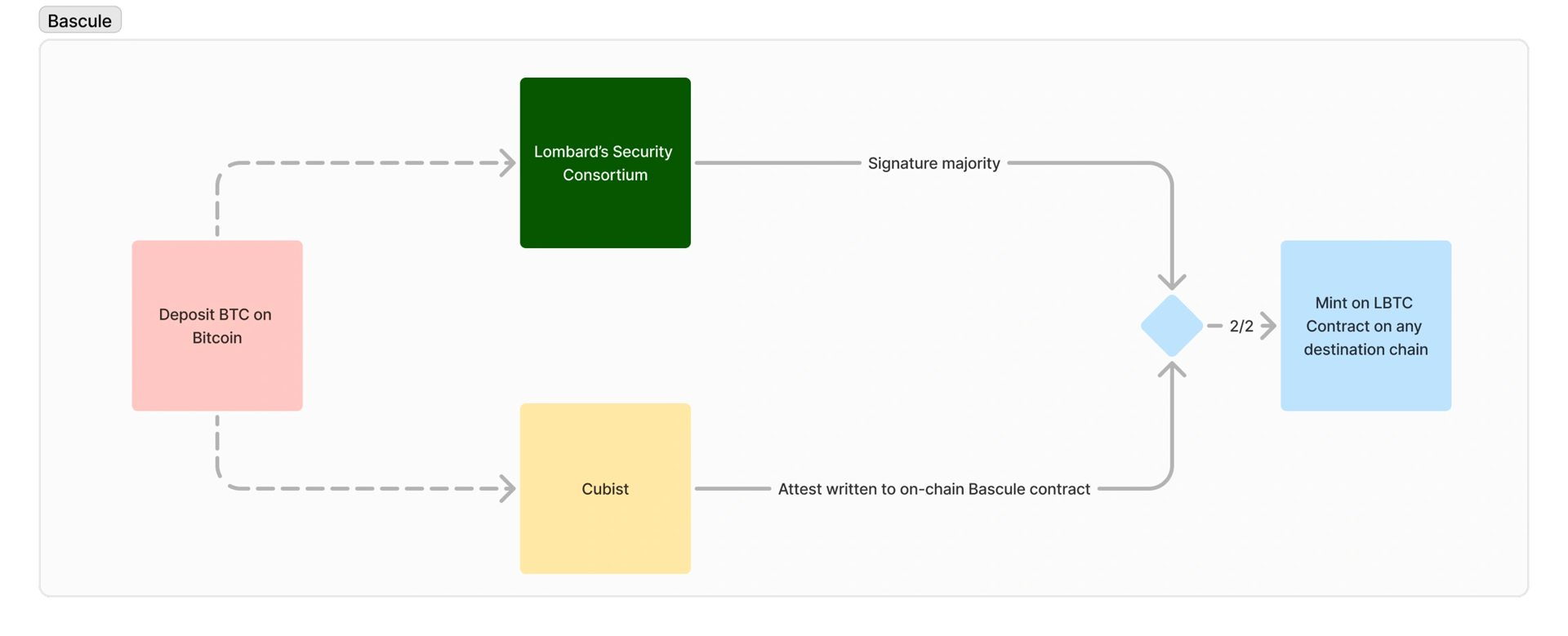

Bascule Drawbridge

The Bascule Drawbridge is an added layer of security in Lombard's architecture, independently operated by Cubist to validate actions performed by the Security Consortium. It functions as a state oracle with its smart contract, verifying the accuracy of Bitcoin network data on supported destination chains. This mechanism allows the Bascule to act as a secondary authority, ensuring that all Bitcoin deposits are confirmed with six block confirmations before being acknowledged. For LBTC to be minted, a valid signature from the Security Consortium and a matching attestation from the Bascule Drawbridge are required, creating a dual-validation process that strengthens resistance against cross-chain bridge exploits.

The Reverse Bascule Drawbridge operates off-chain and handles LBTC redemptions. When a user initiates a redeem function, the LBTC is burned on-chain, and Cubist monitors these events. After a confirmation period, the redemption state is written into CubeSigner. CubeSigner then verifies that the redemption has occurred before proceeding with the Bitcoin withdrawal initiated by the Consortium. This bidirectional check, on-chain and off-chain, ensures accuracy and alignment between the Bitcoin and LBTC ecosystems, minimizing the risk of false or unauthorized transactions. [10]

PMM Module

The PMM (Private Market Maker) module is a smart contract deployed by Lombard Protocol on select blockchains to improve the onboarding experience for users holding BTC-derived assets like BTCB. It allows these assets to be exchanged for LBTC under predefined risk limits, while ensuring the majority of LBTC remains backed by native Bitcoin. The module applies a fee based on the asset being swapped and is intended solely as a user convenience feature, not for financial arbitrage. Additional security restrictions may be implemented if misuse is detected.

On chains like BNB Smart Chain, the PMM facilitates BTCB-to-LBTC conversions while tracking how much LBTC remains available for minting and applying a fee to cover operational costs. These smart contracts ensure temporary, capped exposure to non-native Bitcoin assets, maintaining the stability of LBTC. Any BTC acquired this way is staked into Babylon to preserve the asset’s underlying Bitcoin backing. [11]

LBTC

LBTC is a liquid, yield-generating Bitcoin token that maintains a 1:1 backing with BTC and is designed for cross-chain use. It integrates Bitcoin into the DeFi ecosystem while preserving the asset’s original security. LBTC supports movement across major blockchain networks without fragmenting liquidity and can be used as collateral in various DeFi applications, such as lending, borrowing, and trading.

LBTC earns native yield through Babylon staking and other mechanisms, with additional rewards from participating in supported protocols and ecosystems. Its security model relies on a consortium structure to provide a more robust alternative to centralized or unverified wrapped tokens. Holders can increase returns by engaging in DeFi activities using their LBTC. [6]

DeFi Vault

The Lombard DeFi Vault is an automated yield management system that allocates Bitcoin-backed assets, such as LBTC, wBTC, eBTC, and cbBTC, across DeFi protocols to optimize returns. Developed in partnership with Veda, the vault reduces the complexity of participating in DeFi by automating strategy selection, execution, and reward compounding.

Users deposit supported Bitcoin derivatives into the vault and receive LBTCv, a token representing their share of the vault’s total balance, including principal, yield, and additional point-based rewards. The vault distributes capital across strategies such as Uniswap and Curve liquidity provision, Gearbox and Morpho lending, and yield trading via Pendle. Performance is actively managed and rebalanced.

Yields are automatically reinvested, with rewards proportionally distributed to LBTCv holders. Withdrawals are processed through a queue, typically within three days, and may include small fees depending on the token type. Additional point incentives are awarded, and deposits are currently supported on the Ethereum and Base networks. [12]

Funding

In July 2024, Lombard Finance raised $16 million in a seed round led by Polychain Capital to support the development of a Bitcoin restaking ecosystem in partnership with Babylon. Participants included BabylonChain, dao5, Franklin Templeton, Foresight Ventures, HTX Ventures, Mirana Ventures, Mantle EcoFund, Nomad Capital, OKX Ventures, and Robot Ventures, with additional support from exchanges such as Bitget, Bybit, OKX, and HTX for LBTC liquidity and broader DeFi integration.

Lombard’s work focuses on enabling Bitcoin to act as collateral in Proof-of-Stake (PoS) systems using Babylon’s protocol, which allows BTC to be staked natively and self-custodially to secure PoS networks. The team included individuals with experience from firms such as Argent, Coinbase, and Maple. Babylon, founded in 2022 by David Tse and Dr. Fisher Yu, develops infrastructure that extends Bitcoin’s utility into PoS ecosystems while maintaining its security properties. [2][3]

Partnerships

- EigenLayer

- Babylon

- Polychain Capital

- Franklin Templeton

- OKX

- ByBit

- ether.fi

- Maple

- Chainlink

- Sui

- Pendle

- Veda

- Immunefi

- Halborn

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)