Subscribe to wiki

Share wiki

Bookmark

Stader Labs

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Stader Labs

Stader Labs is a non-custodial, smart contract-based staking platform designed to streamline the utilization of staking solutions. This platform serves as essential middleware infrastructure for various Proof-of-Stake (PoS) networks, catering to retail cryptocurrency users, exchanges, and custodians. [1]

Overview

Founded in April 2021 by Sidhartha Doddipalli and Amitej Gajjala, Stader Labs is dedicated to crafting decentralized financial protocols and solutions tailored for effective asset staking management across public blockchain networks. Stader's core innovation lies in liquid staking, a mechanism that enables users to generate tokens representing their staked assets. [1]

These tokens appreciate in value as staking rewards accumulate, fostering participation in both network security through staking and the Decentralized Finance (DeFi) space. Stader employs an efficient security approach that includes continuous code reviews, extensive testing, and external audits conducted by reputable auditors across multiple blockchain networks. Additionally, the platform implements Multi-signature (Multi-sig) administrative accounts to safeguard the integrity of smart contract parameters, aiming to provide a secure liquid staking solution. [1][2]

Funding

In January 2022, the Stader Labs team raised $12.5 million in a funding round led by Three Arrows Capital, valuing the company at $450 million. Blockchain.com, Accomplice, GoldenTree Asset Management, Accel, and other investors also provided funding. [28]

In October 2021, Stader Labs raised $4 million in a seed round led by Pantera Capital. Coinbase Ventures, True Ventures, Jump Capital, and Ledgerprime also participated in this round. [27]

SD Token

The Stader (SD) token serves as the value accrual and governance token for the Stader ecosystem. It conforms to the ERC-20 standard with a total supply capped at a total of 150 million tokens. [9][26]

Token Distribution

SD tokens are allocated across various segments, each with its specific percentages of the total supply, and release schedule, subject to governance determinations.

- Rewards + Farming (0.36%): The distribution schedule for this segment relies on individual rewards programs determined through governance.

- Team + Advisors (0.17%): A six-month cliff precedes a linear vesting period spanning 36 months.

- Private Sale (0.17%): Tokens are unlocked in the range of 0-5% at the Token Generation Event (TGE), followed by a linear vesting schedule covering 36 months post-TGE.

- DAO Fund (0.15%): Distribution details for this segment are yet to be finalized and will be subject to governance decisions.

- Ecosystem Fund (0.11%): Initially, 0.5%-1.5% of this segment's tokens will be unlocked at TGE, with the remaining unlock contingent on governance determinations.

- Public Sale (0.04%): Two options exist for this segment: Option 1 involves tokens sold at $4.50 with a 3 million supply, featuring a forty-day lockup followed by a twenty percent release on a monthly basis from March to July 2022. Option 2 offers tokens at $3.33 with a 3 million supply, featuring a three-month lockup followed by a twenty percent release on a bi-monthly basis from April to December 2022. [9]

Token Utilities

- Governance and Voting: SD token holders actively participate in various governance processes, enabling them to influence decisions related to rewards, validator selection criteria, protocol expansion, and more.

- Staking Rewards: SD token holders have the opportunity to stake their tokens, thereby becoming eligible to earn a share of protocol fees as staking rewards, contingent upon governance decisions.

- Liquidity Mining: Participants can engage in liquidity mining by providing SD liquidity across decentralized exchanges (DEXs), potentially receiving SD incentives as governed by the ecosystem.

- Preferential Delegations: The amount of SD tokens staked influences preferential delegations to validators, granting certain advantages based on the staked quantity. These preferences are determined through governance processes. [9]

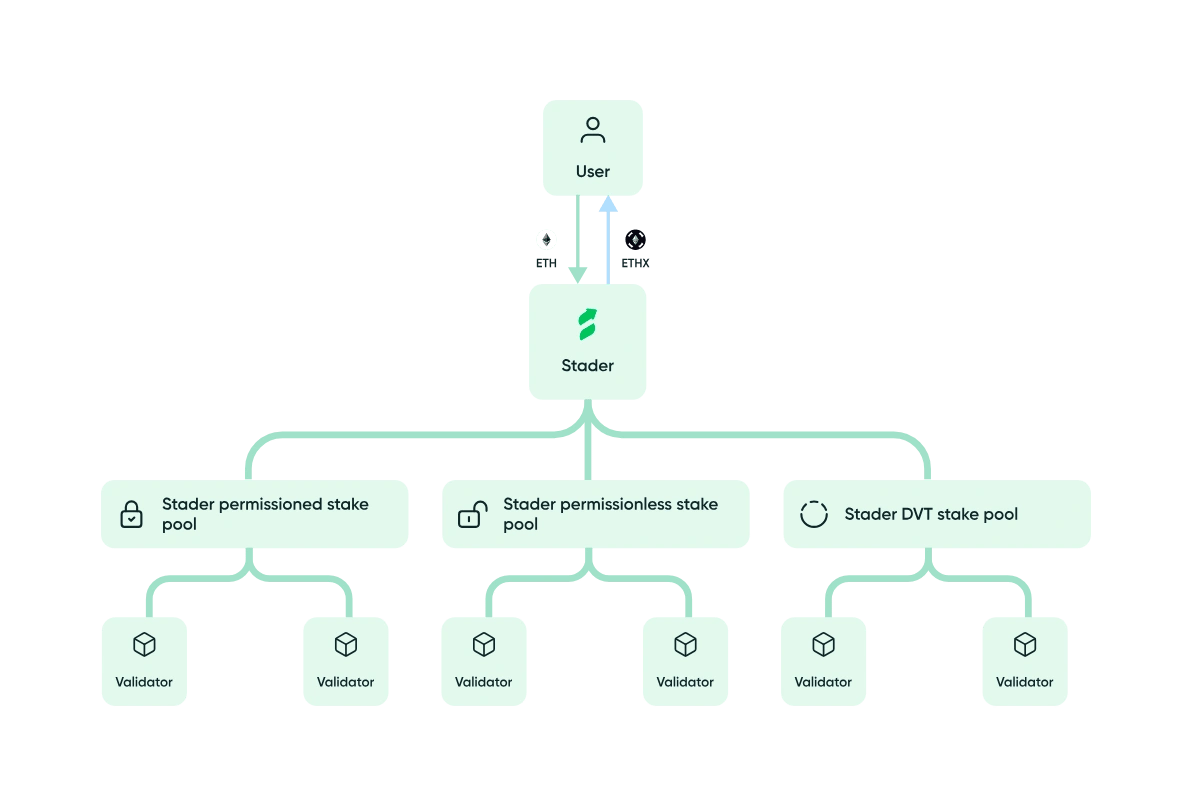

ETHx

ETHx introduces a multi-pool architecture designed for decentralization, scalability, and resilience. This architecture encompasses permissionless and permissioned pools, allowing anyone to operate nodes and curated validators with consistent performance. As Distributed Validator Technology (DVT) becomes more stable, ETHx will adopt dedicated DVT-based stake pools in the future, ensuring adaptability to the evolving ETH staking ecosystem. [3]

The ETHx token, launched on mainnet on July 10, 2023, is an ERC-20 liquid staking token by Stader, aiming to empower users with the flexibility to utilize their staked ETH assets while still accruing staking rewards and participating in the expanding DeFi ecosystem. ETHx ensures continuous staking rewards, enabling the growth of Ethereum holdings while integrating with dApps to allow users to explore additional yield farming and lending opportunities. Additionally, ETHx contributes to Ethereum's decentralization efforts, promoting scalability and resilience within the network. [3][7]

ETHx Governance

ETHx governance is maintained by three entities: the Community multisig, the Manager multisig, and the Operator. These entities collaborate to ensure transparency, accountability, and a balanced approach to decision-making and operations within the ETHx ecosystem. As part of Stader's future vision, on-chain governance will gradually be introduced, empowering Stader's governance token, SD, and ETHx holders to propose and implement protocol changes, thus fostering decentralized decision-making and inclusivity. [4]

ETHx Staking

ETHx introduces a novel approach to Ethereum staking, offering users the dual benefit of staking their ETH assets while maintaining liquidity. Here's a concise breakdown of how this process unfolds:

- Deposit and Token Issuance: When a user deposits their Ethereum holdings into ETHx staking contracts, the protocol reciprocates by issuing an equivalent amount of ETHx tokens to the user. These tokens serve as a fluid representation of the user's staked Ethereum, empowering them to retain control over their assets without relinquishing their potential staking rewards.

- Multi-Pool Architecture: Following the deposit, Stader's staking manager takes charge, utilizing a multi-pool architecture. The user's staked Ethereum is intelligently divided between Permissionless and Permissioned node operator pools. This design choice not only guarantees scalability and decentralization but also optimizes the earnings potential of the staked assets.

- Node Network and Reward Generation: The Ethereum sourced from these pools is then directed to the ETHx Node Network, a decentralized network of Ethereum nodes intricately engaged with the protocol's staking contracts. These nodes undertake critical validation tasks essential for the Ethereum Beacon Chain. The functions performed by these nodes translate into the generation of staking rewards.

- Accrued Rewards and Value Appreciation**:** As these nodes produce rewards, they accumulate and contribute to an elevation in the exchange rate of ETHx concerning Ethereum. This ingenious growth mechanism ensures that the value of ETHx tokens experiences continuous appreciation over time, mirroring the staking rewards garnered from the staked Ethereum.

Rolling Beta Launch

The ETHx Rolling Beta for permissionless node operators made its debut on March 27, 2023, on the Goerli Testnet. The Goerli Testnet, known as one of the most popular ETH testnets, had undergone the Shapella upgrade to test withdrawals, around the time of launch which created an ideal testing environment for the ETHx Rolling Beta. The ETHx Rolling Beta for permissionless node operators was structured into two phases. [8]

Launch Incentives

Accommodating the mainnet launch of ETHx, Stader had set launch incentives, tailored to cater to both ETHx Stakers and ETHx Node Operators. [5]

ETHx Stakers

The incentives set for ETHx Stakers were designed to benefit all participants who staked their Ethereum tokens with Stader during the launch month. This program offered a distinctive feature—an uncapped 50% boost on rewards. Participants had the opportunity to earn rewards that are dynamically calculated based on daily staking amounts and the protocol's daily APR. This enhanced reward structure enabled users to receive a 50% boost in earnings after a 10% commission deduction. This program was open to anyone, with no minimum stake requirements or holding periods, ensuring inclusivity and accessibility. Rewards were calculated on a daily basis and aggregated throughout the launch month, with disbursement taking place within 5 days of the launch month's conclusion. [6]

ETHx Node Operators

The ETHx-launched incentive programs for ETHx node operators have been introduced to reward individuals operating permissionless ETHx nodes on the Stader Network during the launch month. [19]

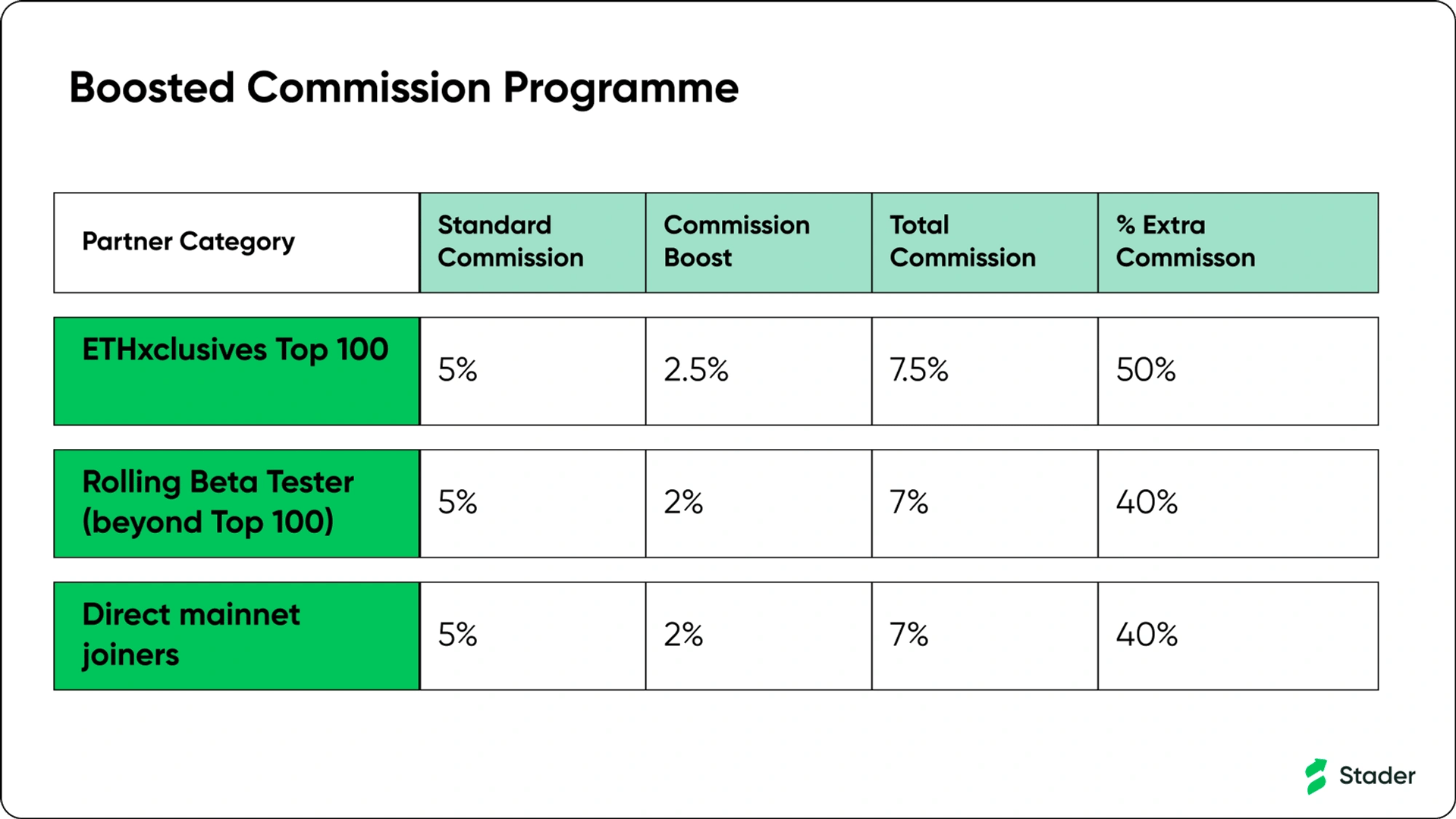

Boosted Commission

The Boosted Commission program was designed to incentivize early ETHx node operators, allowing them to earn a boosted commission for an entire year on the mainnet. To be eligible, node operators needed to have joined the ETHx Mainnet within a month of its launch, successfully registered a node on the Stader mainnet network and added validators to their node. The first 4 validators of qualifying node operators were eligible for the boosted commission, which was disbursed monthly based on performance. This commission boost is applied to the first 4 validators per node operator spun in the launch month, encouraging early participation and rewarding successful node operation. [20]

$SD Top-Up Pool

The $SD Top-Up pool was accessible to all community members who actively participated by setting up a testnet node during any of the two Rolling Beta phases. To be eligible for the airdrop, participants must have joined the ETHx mainnet within one month of its official launch. The total reward pool for this program consisted of 13,000 $SD tokens, which were distributed among eligible users. To claim rewards from the $SD Top-Up pool, Rolling Beta members needed to set up at least one validator on the ETHx mainnet within one month of its launch, as this was a key requirement for eligibility. The distribution process for the $SD tokens collected in this pool involved Stader collecting necessary details via a dedicated form and subsequently transferring the tokens to the Mainnet Operator Address provided by participants. [21]

$65,000 Reward Pool for AVADO Users

For participants in the AVADO incentive program, the rewards were exclusively in the form of $SD tokens, which were airdropped directly to the wallet provided by users. The maximum incentives for AVADO users depended on various factors, including whether they were new or existing Avado owners and the price of their device. New i5 device owners received up to $900 for setting up 9 ETHx validators, while new i7 device owners had the potential to earn up to $1,600 for 16 ETHx validators. Existing Avado device owners were able to receive a maximum of $400 for 8 ETHx validators. [22]

To qualify for these incentives, users needed to activate the Stader package and run an ETHx node on their Avado device. The maximum number of validators eligible per device varied depending on the device type: 9 ETHx validators for new i5 devices, 16 for new i7 devices, and 8 for existing owners. [22]

Other Liquid Staking Tokens

NearX

For Near Protocol, Stader introduced NearX, a liquid staking solution enabling users to earn Near staking rewards while participating in Defi protocols. Users connect their wallet to the Stader Dapp, deposit Near tokens into a smart contract, and receive NearX tokens representing their staked assets. As rewards accumulate, the value of NearX increases relative to Near. Validators on Stader must meet strict criteria, including voting power below 3% for higher decentralization, a commission rate below 3% for increased earnings, uptime exceeding 99.5% to prevent reward loss, and a minimum of 500 delegators for enhanced fund security. [10][11]

LunaX

LunaX, developed by Stader, is a liquid staking token designed to provide instant access to staked Luna tokens and unlock various possibilities within DeFi protocols. When Luna is deposited with Stader Liquid Staking, users receive LunaX in return. LunaX offers several advantages, including the automatic compounding of rewards reflected in its price, transferability, and usability in DeFi for collateralization, lending, and liquidity pool participation. [12]

LunaX operates as an auto-compounding accrual token, and users can mint it at the prevailing exchange rate when staking Luna with Stader Liquid Staking. The Luna to LunaX Exchange Rate starts at 1:1 at Genesis and is updated as staking rewards accumulate. Users can mint LunaX by participating in the Stader liquidity pool, and the rewards generated from staked Luna are regularly restaked, preventing an increase in LunaX supply and leading to an increase in its price relative to Luna. LunaX can be burned, allowing users to unstake Luna at the current exchange rate for a small fee. Additionally, LunaX can be instantly swapped for Luna on decentralized exchanges for a nominal fee. [12]

sFTMX

sFTMX is a liquid token obtained when users stake FTM (Fantom tokens) with Stader. These tokens represent the staked FTM and allow users to exchange them later for their staked FTM along with accrued rewards from Stader. As rewards accumulate, the value of sFTMX increases, and users can utilize it across various protocols on the Fantom network to engage in DeFi opportunities. The sFTMX exchange rate is initialized at 1 and increases with each addition of staking rewards, following a specific formula. Additionally, the FTM smart contracts developed by Stader have undergone audits by Peckshield and Halborn, receiving positive evaluations. [13]

Users can acquire sFTMX directly through the Stader dapp, which supports wallets such as Metamask, Coinbase Wallet, WalletConnect, and OKX Wallet. Alternatively, sFTMX can be obtained by swapping on popular DEXs like Spookyswap, Spiritswap, and Beethoven X. When users stake with Stader, their assets are automatically distributed among carefully selected validators, contributing to Fantom's decentralization while minimizing slashing risks. [13]

Key highlights of sFTMX

- sFTMX offers an annual percentage yield (APY) of approximately 4.7% or higher, akin to rewards associated with 365-day lock-ins.

- Users can enjoy instant liquidity for sFTMX on decentralized exchanges (DEXs).

- The cToken design of sFTMX facilitates effortless integration with diverse DeFi protocols, encompassing DEXs, lending and borrowing platforms, and yield optimizers. [13]

MATICX

Stader introduces MATICX, a liquid staking solution tailored for Polygon's MATIC token. With MATICX, users gain the opportunity to earn MATIC staking rewards while accessing various DeFi protocols, all the while accumulating rewards. [14]

MATICX serves as a representation of an individual's stake in the total MATIC pool deposited with Stader. Upon depositing MATIC into the Stader smart contract, users receive freshly minted MATICX tokens, the quantity determined by the prevailing exchange rate at the time of staking. The MATICX exchange rate symbolizes the aggregate value of the Stake Pool for each circulating MATICX token. At its inception, the MATICX exchange rate begins at an initialization value of 1. Upon staking MATIC, users receive MATICX tokens equivalent to their staked MATIC divided by the prevailing exchange rate. [15]

HBARX

Stader introduces HBARX, a token within the Hedera Token Service (HTS) framework, representing an individual's stake in the aggregated HBAR pool deposited with Stader. By engaging the Stader smart contract, users receive freshly minted HBARX tokens based on the exchange rate applicable at the time of staking. Notably, the value of HBARX increases in relation to HBAR as rewards are accrued. [16]

The HBARX exchange rate is a reflection of the collective value of the Stake Pool in correlation with the circulating HBARX tokens. During its inception, the HBARX exchange rate commences at an initial value of 1. As rewards are incorporated into the pool, the HBARX-to-HBAR exchange rate experiences an augmentation. Upon staking HBAR, users acquire HBARX tokens, with the quantity being equivalent to the staked HBAR divided by the current exchange rate. Importantly, the association of HBARX tokens with the user's wallet occurs automatically within the Stader smart contract. [16]

BNBx

BNBx is a liquid staking token designed for the BNB Chain. It offers users the opportunity to earn BNB staking rewards effortlessly while eliminating the need to maintain complex infrastructure. Additionally, BNBx enables users to engage in various DeFi strategies while continuously accumulating rewards. Key features of Stader for BNB Chain include liquidity through tokenization, allowing users to participate in the DeFi ecosystem using the liquid token, and a user-centric Dapp design for seamless staking experiences. [17]

Staking Process

To engage in BNB staking with Stader, BNB token holders connect their wallets to the Stader dApp and deposit their tokens into the smart contract. In return, they instantly receive BNBX tokens, which represent their staked assets. As staking rewards are distributed, the value of BNBX tokens increases in relation to BNB. [17]

BNBX Token

BNBX is a liquid token that mirrors an individual's share of the aggregated BNB pool deposited with Stader. When BNB is deposited into the Stader smart contract, users receive freshly minted BNBX tokens, the quantity of which is determined by the exchange rate applicable at the time of staking. As BNB rewards are added to the ecosystem, the value of BNBX tokens grows in tandem with BNB. [18]

The BNBX exchange rate reflects the overall value of the Stake Pool in relation to the circulating supply of BNBX tokens. Upon launch, the initial BNBX exchange rate is established at 1. As rewards are introduced into the pool, the BNBX-to-BNB exchange rate experiences upward adjustments. Stakers receive BNBX tokens commensurate with the amount of BNB staked, divided by the prevailing exchange rate. This process is executed automatically by the Stader smart contracts, simplifying the user experience and facilitating seamless participation in BNB staking. [18]

rsETH

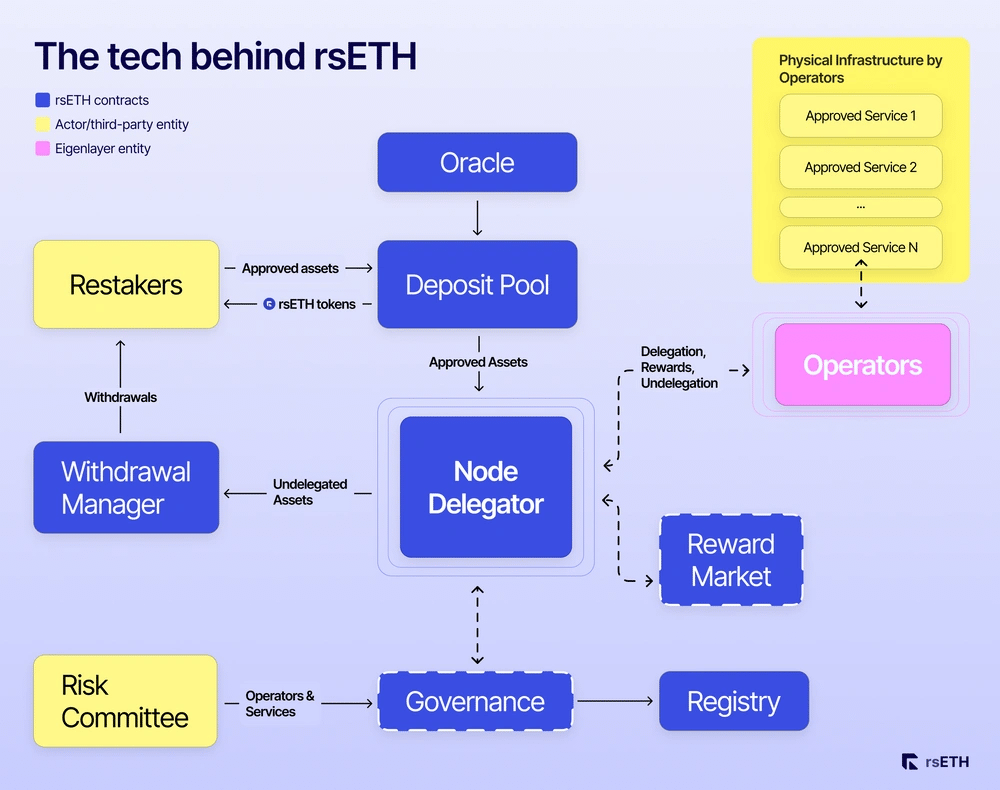

On August 22, 2023, Stader launched their Liquid Restaked Token (LRT), rsETH, on the Ethereum testnet, offering users the ability to receive Ethereum staking and restaking rewards while preserving liquidity and the capacity to participate in the DeFi space. [23][24]

Core Components

The core components driving rsETH consist of the deposit pool, node delegator, reward market, and withdrawal manager contracts. [25]

Deposit Pool

The deposit pool functions as a straightforward vault where restakers transfer their liquid staked tokens and, in return, receive rsETH tokens based on the prevailing rsETH exchange rate. This mechanism also streamlines the delegation of liquid-staked assets to different operators cooperating with the LRT DAO. It aims to simplify the restaking process for restakers by abstracting complexities related to rewards and validator delegation. [25]

Node Delegator Module

The node delegator module assumes the responsibility of transferring the deposited liquid-staked assets to contracts designed for each operator. Each node delegator holds assets that are delegated to a specific operator, thus ensuring economic security for delegated assets across various nodes operated by the chosen operator for multiple AVS’. Node delegators also play a role in claiming rewards and executing distinct strategies for different rewards, streamlining the reward redemption process for restakers and reducing gas expenditure. [25]

Reward Market

The reward market introduces a variety of strategies that can be employed for different rewards, with decisions driven by DAO through governance. This feature aids AVS’ in avoiding undesired token activities while optimizing returns for restakers. The reward market serves as the foundational layer for all rewards acquired through restaking. [25]

Withdrawal Manager

The Withdrawal Manager module facilitates the conversion of rsETH tokens into a share of all assets managed by the protocol. Redeemers can anticipate receiving a comprehensive set of various rewards obtained by Node Delegators for their delegation to operators subscribed to diverse AVS’. [25]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)