订阅 wiki

Share wiki

Bookmark

VaultCraft

VaultCraft

VaultCraft 是一个无需许可的 DeFi 基础设施,用于在任何 EVM 链上部署具有永久看涨期权的自定义收益策略。VCX 持有者,或 VaultCraftDAO,负责 VaultCraft 的所有软件开发。 [1]

概述

VaultCraft 是一个抗审查的 DeFi 协议,允许任何人部署和 LP 具有程序化永久看涨期权的自动化收益策略。用户行使期权产生的所有收入都用于从市场上回购 VCX。VaultCraft 使用协议认可的 VaultFactory 来确保策略和合约的安全性。这些金库可以通过 ERC4626-Wrapper 与各种协议交互,并且可以相互堆叠。 [2]

VaultCraft 为所有 DeFi 原语提供专门的模块功能,大大减少了零售和企业扩展其 DeFi 敞口和产品所需的时间和资本。它允许编码知识最少的用户轻松混合和匹配协议和策略,以创建复杂的 DeFi 产品。该协议旨在为企业和零售用户提供模块化工具,以创建自动化的收益生成资产策略,从而有助于 DeFi 生态系统的可扩展性。 [2]

VaultCraft 还为用户提供了一套全面的功能:通过智能金库优化收益,使用 SDK 部署自定义 DeFi 策略,只需单击一下即可轻松地跨多个链进行 zapping 和存款,通过旗舰产品赚取看涨期权 (oVCX),通过锁定 VCX 流动性 来提高 oVCX 奖励,并通过与 VaultCraft 智能合约的交互来累积 XP 点数。 [2]

历史

2021年,PopcornDAO作为一个社区驱动的“为善的DeFi”协议而出现。随着时间的推移,该项目不断发展,推出了VaultCraft v1,旨在简化创建资金并将其存入跨EVM的具有永久看涨期权的保险库策略的过程。 [3]

展望未来,VaultCraft v1.5引入了自动再平衡的多策略和杠杆智能保险库,为用户提供了对任何加密货币和DeFi叙事的多元化敞口,并提高了资本效率。这种愿景的转变促使了品牌重塑,将项目整合在VaultCraft的名下,以简化沟通并反映开发和创新的新时代。 [3]

VaultCraft V1.5

2024年5月6日,VaultCraft宣布即将发布VaultCraft V1.5版本,该版本旨在使平台更经济实惠、更简单且资本效率更高。平台的新功能包括:[16]

XP 积分

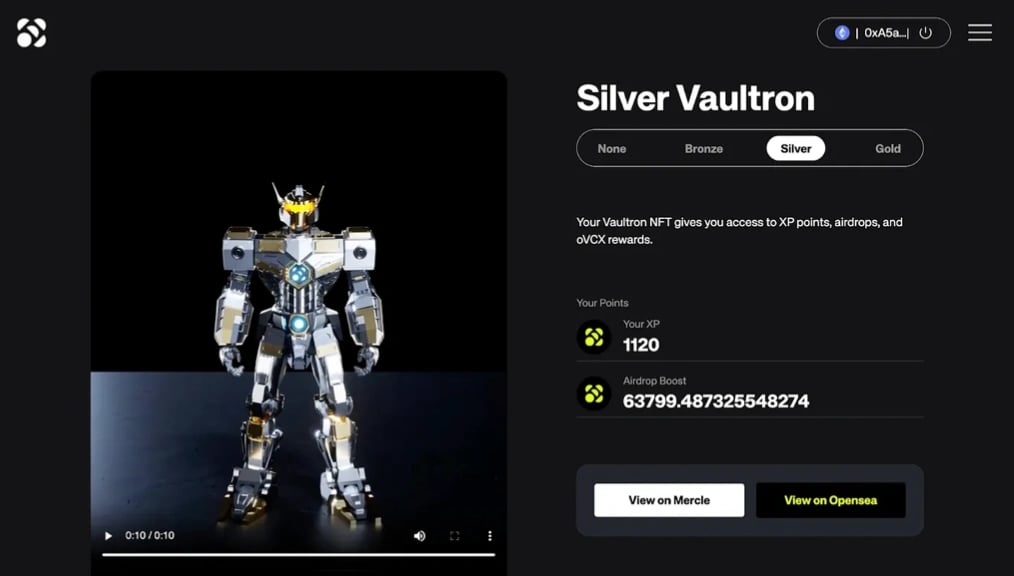

自发布以来,大约有 900 个独特的地址铸造了 Vaultron NFT 奖励优化器。Vaultron 已成为该协议的重要组成部分,允许用户积累 XP 积分,这些积分可以转换为未来的 VCX 空投。主页现在显示用户的 XP 积分,并提供有关如何通过将其存入智能金库并提高其价值来赚取更多积分的工具提示。 [16]

Arbitrum和Optimism上的多链计量器

以太坊的日益普及导致交易成本增加,提高了领取oVCX的费用。为了解决这个问题,引入了多链计量器,允许用户通过Arbitrum和Optimism上的智能金库计量器赚取和领取oVCX。 [16]

利用货币市场进行杠杆挖矿

在Layer 2解决方案上进行oVCX挖矿已经变得具有成本效益,用户现在可以通过抵押他们的加密货币,借入资金,并将借入的资金存入智能金库来提高资本效率。VaultCraft的货币市场使用户能够利用借来的流动性来增加他们的存款收益。 [16]

多策略智能金库

VaultCraft的智能金库基础设施现在支持在单个金库中重新平衡多种策略。此功能将LRT、RWA、DePin、AI和$oVCX集成到统一的智能金库体验中。 [16]

第一个多策略智能金库将提供跨所有Pendle LRT市场的多元化敞口。用户可以存入单个资产,并赚取LRT基础APR、重新质押APR、Eigenlayer积分、LRT积分和VaultCraft的看涨期权。 [16]

Vaultron NFT 优化器

Vaultron 是 VaultCraft 新推出的 NFT 奖励优化器,现在拥有专门的页面。用户可以在 Polygon 上免费 铸造 VAULTRON,参与 VaultCraft 活动,并赚取 XP 积分。从青铜到白银再到黄金级别,有资格获得 VCX 空投。 [16]

Multi-zaps

VaultCraft已与1inch、Enso Finance和OpenOcean合作,可以使用任何资产存入智能金库。 [16]

Smart Vault Pages

随着VaultCraft上货币市场的推出,所有带有计量器的智能金库都推出了单独的页面。此功能使用户可以更轻松地提高其存款的资本效率。 [16]

技术

DeFi 自动化

目前,VaultCraft 已经封装了超过 50 个 DeFi 协议,用户可以在底层策略或智能金库中使用。值得注意的协议包括:

- Aave

- Aura

- Balancer

- Beefy

- Compound

- Convex

- Curve

- Etherfi

- Gearbox

- Ichi

- Ion

- KelpDAO

- Lido

- Origin

- Pendle

- Radian

- Renzo

- Stargate

- Sushi

- Velodrome

- Yearn

智能金库

智能金库(原名 Sweet Vaults)是自主保管、无需许可的自动化资产策略,可在单资产 加密货币 存款上产生收益。它们还具有分配 oVCX 的计量器,oVCX 是协议对治理代币 VCX 的永久看涨期权。创建金库是为了应对 收益耕作 和 流动性挖矿,使得寻找最高收益比在不同借贷协议之间切换复杂得多。智能金库不一定是 收益耕作 策略。底层策略可能有所不同,但原理保持不变。 [4]

LRT智能金库

2024年1月,VaultCraft推出了rsETH智能金库,简化了存入rsETH的过程,同时最大化了奖励。重新质押可能很复杂,涉及使用ETH、LSTs或LRT协议等方法进行EigenLayer存款,每种LST存款的奖励各不相同。VaultCraft通过提供从ETH到ETHx再到rsETH的直接路径来简化此过程,确保用户从Stader和KelpDAO获得最佳的boost奖励,同时保留EigenLayer积分和收益。VaultCraft的oVCX机制还提供每周排放,以提高金库的APY,从而进一步增加用户收益。 [5]

VCX智能金库

2024年5月8日,VaultCraft推出了他们新的VCX智能金库,专为所有VCX利益相关者设计。以前,用户可以锁定他们的20个WETH和80个VCX BPT代币,参与智能金库计量器中oVCX排放的投票,并提高存款奖励。有两种方法可以赚取VCX流动性的倍数,使VCX智能金库成为流动性激励工具。 [15]

该金库使用来自20个WETH和80个VCX流动性池的Balancer池代币产生复利。这些BPT在Aura上的计量器中进行质押,以赚取治理代币。然后,奖励被转换为额外的BPT代币并重新投资于该策略。对于持有VCX多头头寸的利益相关者,该金库通过提供VCX(oVCX)的看涨期权来提供对冲,每周排放价值约为7000美元。随着VCX贿赂于2024年5月9日推出,预计收益将超过30%的APY。 [15]

Aura Finance

Aura Finance 是建立在 Balancer 系统之上的协议,旨在为 Balancer 流动性提供者 提供最大的激励。Aura 简化了向 Balancer 计量系统存款的流程,确保了流畅的入门体验。Aura 使存款人能够通过协议拥有的 veBAL 实现高额提升,同时积累额外的 AURA 奖励。 [15]

LRT Lend

VaultCraft与Ion Protocol合作推出了LRT Lend,这是一个自动化的货币市场,旨在为用户提供额外的ETH收益,以及额外的LRT和oVCX奖励。Ion Protocol专门从事借贷,特别是为以安全和资本高效的方式支持质押和再质押资产而量身定制。用户可以将各种验证器支持的资产(如流动性质押代币(LST)和流动性再质押代币)存入Ion,从而增强他们对再质押生态系统的敞口,而无需面临基于价格的清算风险。此外,贷款人可以赚取市场上最高的以ETH计价的收益。 [8]

代币经济学

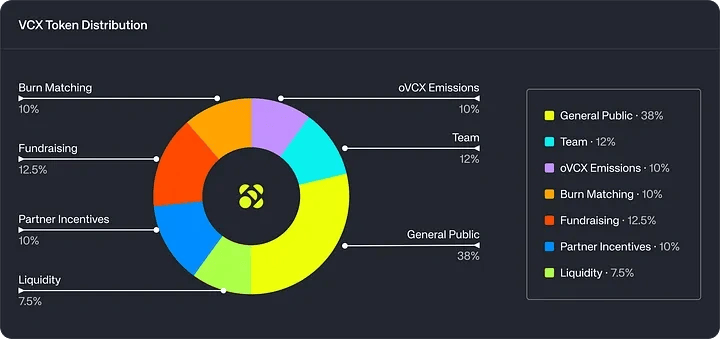

- 流动性:75,000,000.00;7.50%

- 合作伙伴激励:100,000,000.00;10.00%

- 筹款:125,000,000.00;12.50%

- 燃烧匹配:100,000,000.00;10.00%

- oVCX 排放:100,000,000.00;10.00%

- 团队:120,000,000.00;12.00%

- 普通大众:379,996,998.20;38.00%

veVCX

veVCX代表向Balancer 80VCX-20WETH池提供流动性的用户的投票权。它作为一种独特的ERC20实现运行,每个账户的投票权由其veVCX持有量决定。例如,将一个80VCX-20WETH LP代币锁定四年,将获得一个veVCX的初始余额。[11]

oVCX

oVCX作为VCX的永久看涨期权代币,使持有者能够以VaultCraftDAO治理预先确定的折扣价购买VCX。这种用oVCX奖励取代VCX奖励的战略旨在增加协议收入,用于回购计划和资源扩张等举措。通过允许忠实的VCX持有者以折扣价购买VCX,oVCX优化了激励效率、收入重新分配和持续的代币销售。[12]

实施oVCX引入了多项好处,包括激励用户向Balancer 80VCX-20WETH池提供流动性,以折扣价获得VCX,从而提高协议收入。此外,协议所有权向LP以及随后的流动性提供者的过渡也得到了促进。由于用户寻求提高其在智能金库上的收益,并通过增加其veVCX持有量来赚取协议收入,因此它减少了抛售压力。Gauges根据其veVCX gauge分配向智能金库LP分配oVCX激励,鼓励参与流动性提供并为协议增长做出贡献。[12]

合作关系

Frax Finance

2022年12月22日,VaultCraft与Frax Finance合作,宣布在Arbitrum上推出Fraxlend智能金库。用户有机会将其FRAX代币存入Arbitrum上的智能金库,从而在Fraxlend上创建一个货币市场,潜在收益率高达6% APY。通过智能金库,FRAX存款被用作Fraxlend上的抵押品,生成fToken作为交换。这些fToken代表存款金额,并随着时间的推移累积利息,利息由借款人支付,以借入资金抵押其抵押品。[13]

KelpDAO & EigenLayer

VaultCraft推出了rsETH智能金库,为用户提供了一种更简便的存入rsETH并最大化奖励的方法。这项新服务允许用户赚取包括原生ETH 质押收益、EigenLayer积分、Kelp里程和AVS奖励在内的多种奖励。[14]

发现错误了吗?