Subscribe to wiki

Share wiki

Bookmark

Bounce Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Bounce Finance

Bounce Finance is a decentralized auction platform that utilizes blockchain technology to provide transparent, efficient, and accessible auctioning, bidding, and buying processes for Web3 users. [1]

Overview

Launched in September 2020, Bounce gained popularity in the Web3 ecosystem, especially among DeFi and NFT buyers and sellers. It offers a wide selection of auctions, including English auctions starting at the lowest price and playable auctions involving simple games for asset purchase rights. Unlike centralized platforms, Bounce is non-custodial, meaning users maintain control over their funds and assets, with auctions managed by smart contracts for transparency and security.

Bounce integrates with DeFi protocols like Arbitrum One for efficient Ethereum transactions, allowing users to swap assets and participate in auctions using preferred tokens. The platform supports custom auctions with user-defined parameters, reserve prices, and durations and allows the allocation of auction proceeds to beneficiaries or charities. The launch of Bounce V3 in February 2023 introduced new auction sectors, marketplace offerings, development partnerships, and fairness mechanisms to prevent fraud. The version also added a regret function for fixed swap auctions, allowing participants to withdraw bids, and introduced Auction as a Service (AaaS). [1]

Bounce V3

Bounce V3 introduced a new phase for Bounce Finance as an Auction-as-a-Service (AaaS) platform. It offers on-chain auction tools for both Web3-native and traditional sectors while maintaining a familiar user experience. The product offerings were divided into three main categories: [2]

- Token & NFT Auction: Bounce provided 10 different types of auctions on over 40 blockchains, enabling anyone to create and participate in diverse auctions in a permissionless environment.

- Real-world Collectibles Auction: Physical collectibles could be minted into NFTs and auctioned on the blockchain, bridging the gap between physical and digital assets.

- Ad Space Auction: A new marketplace was introduced for advertisers and publishers to buy and sell ad space through decentralized auctions.

Bounce V3's infrastructure used a hybrid model, combining centralized account management with decentralized application and tool access. Users could log in and sign up using traditional methods like email or phone numbers, with decentralized access required only for utilizing the platform's DeFi components. This hybrid approach aimed to combine the advantages of traditional and blockchain infrastructure, enhancing user adoption and usage. [2]

Auction-as-a-Service (AaaS)

Bounce's Auction as a Service (AaaS) allows enterprises and individuals to access services like user registration and verification, simplifying the setup of digital auctions. Auction setups could be fully customized to meet specific host needs while maintaining Bounce's decentralized, on-chain security features. This service aimed to enhance efficiency and ease of use in digital auction creation and management. [3]

Auction Products

Ad Space Auctions

Bounce offers an automated bidding solution for advertising success, optimizing budgets to reach target audiences efficiently. The ad space auction platform features a marketplace for advertising needs, an on-chain management terminal, and seamless website integration for ideal ad placement. With transparent, secure, and efficient on-chain auctions, Bounce simplifies advertising campaigns, offering exclusive or joint bidding modes. By applying on-chain auction technology, Bounce improves transparency, expands reach, lowers costs, and eliminates the risk of fraud. Customizable options empower sellers and buyers, fostering engagement and community in advertising. [4]

Real World Collectible Auctions

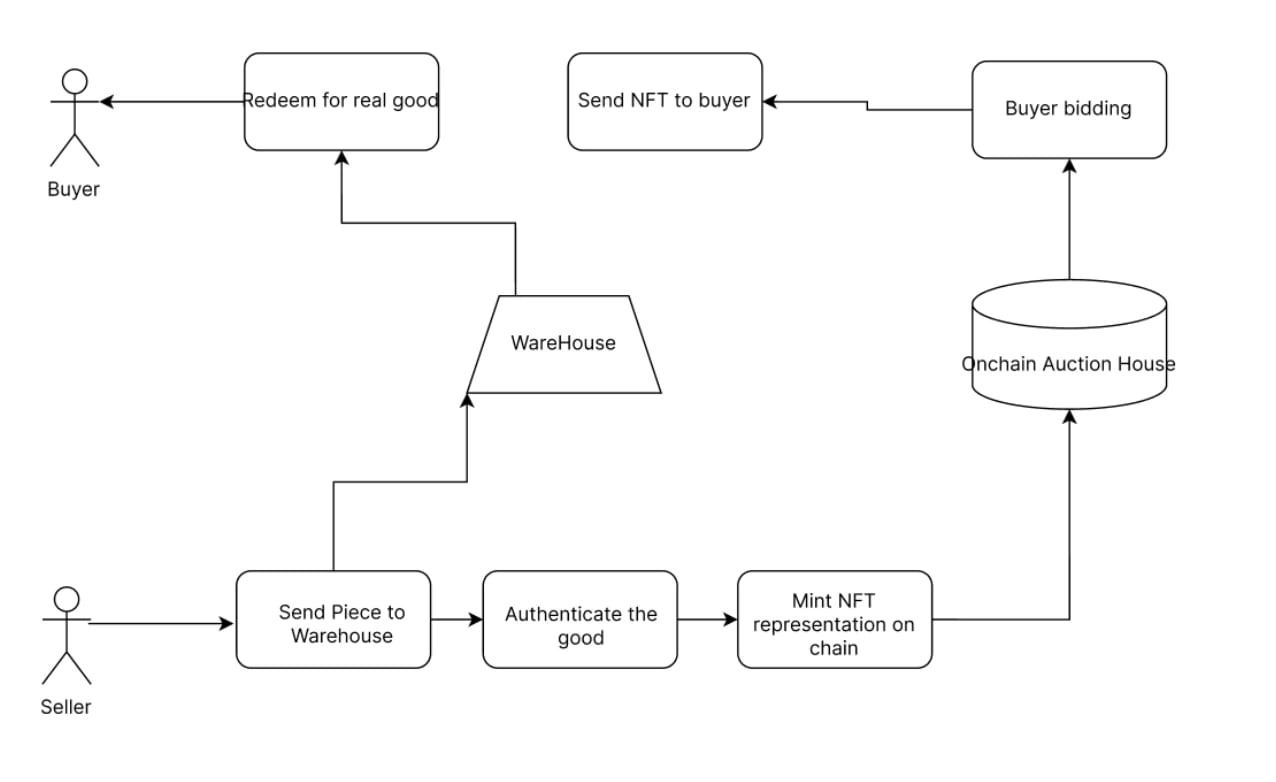

Bounce facilitates the tokenization of real-world collectibles, such as watches and bags, by representing them as digital assets on a blockchain network, a process known as on-chain real-world asset tokenization. Through Bounce, owners can create auctions for their digital representations of real-world collectibles on the blockchain, ensuring secure and transparent transactions using smart contracts that enforce auction rules automatically. [5]

Auction winners can redeem the real-world collectibles by burning the corresponding NFTs (Non-Fungible Tokens), which signify ownership rights to the assets. This ensures that only the rightful owner of the NFT can claim the associated real-world collectible. Bounce facilitates the integration of real-world collectibles into the blockchain, offering owners a streamlined method to represent their assets and conduct auctions securely and transparently. Buyers benefit from easily verifying the authenticity and ownership of the assets they acquire through the platform. [5]

Features

The on-chain Real World Collectible Auction has several key features. It enables tokenizing physical assets, digitally representing ownership rights for decentralized blockchain network trading. Additionally, the auction process is conducted on-chain, ensuring that transactions are recorded securely and transparently. Authentication and warehouse services are provided, with sellers sending assets to a secure warehouse for verification before delivery to buyers post-on-chain trading. Notably, Non-Fungible Tokens (NFTs) are created and traded for physical assets, facilitating ownership transfer within the auction process. [6]

Bounce M&A

Introduced on April 25th, 2024, Bounce M&A is a decentralized merger & acquisition protocol, enabling strategic alliances among projects and improving digital asset management. Users can explore different token combinations, fostering creativity and financial benefits. By merging tokens into synthetic ones, Bounce M&A enhances utility, reduces volatility, and introduces new financial instruments in DeFi. [7][8]

The key features of Bounce M&A include: [9]

- Chemistry: Users can initiate "Chemistries," which involves mixing selected tokens (inputs) to generate a new synthetic token (output). These Chemistries are customizable, enabling users to specify input combinations and desired outputs according to their preferences.

- Dynamic Configuration: Bounce M&A offers users a range of control options, such as setting lockup periods for outputs, determining the treatment of input tokens (burned, locked, or retained), and establishing quotas for reaction outputs. These features help manage the scarcity and availability of new tokens, allowing users to tailor their strategies according to their preferences.

- Secure & No-Code Execution: Bounce M&A, built on blockchain technology, guarantees secure, transparent, and immutable transactions, ensuring trust and integrity within the ecosystem. Users can seamlessly select and merge various tokens into synthetic tokens through automated smart contract execution on Bounce M&A without requiring coding skills.

Auction Mechanisms

Fixed-Price Auction

A fixed-price auction is a specific type of auction where the auctioneer and participants determine the price for the assets being auctioned. It's commonly utilized when the auctioneer has a specific value target for the sold assets. These auctions operate on a first-come, first-served basis and are time-contingent, with assets automatically swapped at the agreed-upon time. Bounce Finance provides fixed-price auctions for both ERC-20 tokens and BEP20-based assets. Additionally, Bounce V3 introduces a feature known as "regret functionality," enabling participants to enter and withdraw from an auction at any point during the auction process. [10]

English Auction

An on-chain English auction is a bidding process conducted on a blockchain platform where the auctioneer initiates with a low price, gradually increasing it until a bidder offers the highest amount. Typically, these auctions have a predefined end time, and the highest bidder at the conclusion wins. Entirely executed on the blockchain, bids are recorded, ensuring transparency and immutability. Commonly employed for selling non-fungible tokens (NFTs) or digital assets, on-chain English auctions provide a secure, transparent, and efficient method for global asset auctions. [11]

Mutant English Auction

Bounce Finance introduces the Mutant English Auction, a novel auction method blending elements of the traditional English auction with innovative features. This hybrid approach enhances the auction experience and boosts participant engagement. While bidders enjoy price appreciation, the auctioneer also benefits from achieving a higher final price. [12][13]

Dutch Auction

In a Dutch auction, also known as a descending price auction, the auctioneer begins with a high price and gradually decreases it until a bidder places an offer. The first bid wins, provided it meets or exceeds the reserve price, eliminating bidding wars commonly seen in other auction formats where prices start low and rise as multiple bidders compete. [14]

Sealed-Bid Auction

In a sealed bid auction, also called a blind auction, participants submit their bids simultaneously in sealed envelopes without knowing each other's offers. The highest bid among all submissions wins the auction. This format is common when items for sale are comparable, and bidders possess similar information about their value, ensuring fairness and confidentiality until bids are revealed. [15]

Random Selection Auction

In the Bounce Random Selection Auction, the winner is chosen randomly, like a lottery, rather than based on the highest bid. This format, also termed the "Lottery Auction," is employed when the item for sale is in high demand, attracting numerous bidders willing to pay a premium. [16]

Orderbook Auction

An on-chain order book auction operates within a blockchain framework, where buyers and sellers submit orders to purchase or sell a specific asset. These orders are matched based on predetermined criteria such as price and volume. Typically concluding at a specified end time, the matched orders are executed, and trades are settled on the blockchain. This auction method is commonly employed in cryptocurrency and digital asset trading, offering decentralization, transparency, and efficiency. Unlike centralized exchanges, where order books are managed by the exchange, on-chain order book auctions are recorded on the blockchain, ensuring transparency and immutability. [17]

Playable Auction

Bounce presents a novel auction approach where gameplay determines allocation, with participants earning their allocation according to their ranking scores. These games are individual, one-time engagements. Auctioneers can select the game type and set the allocation distribution guidelines. Participants have two choices for receiving allocation: an equal share for qualifying players or varied allocation sizes determined by game rank and score. [18]

Staking Auction

Bounce Finance introduces the Staking Auction, a mechanism tailored for token launches on the Bounce Private Launchpad. During the Subscription Period of an Initial DEX Offering (IDO) on the Bounce Launchpad, participants commit $AUCTION tokens to participate. Each participant's token allocation is determined by their committed $AUCTION amount, with higher commitments resulting in increased IDO token allocation. In the case of oversubscription, where the total committed $AUCTION exceeds the expected raise, all allocations are diluted. Once the Subscription Period concludes, allocations are calculated, $AUCTION tokens are deducted accordingly, and any excess $AUCTION is returned. Participants can then claim their IDO tokens and any refunded $AUCTION tokens. [19]

Bounce DAO

The Bounce decentralized governance system shifts from an administrator model to community governance, enabling participants to propose, discuss, and enact platform changes independently of the team's involvement or oversight. [20]

Bounce Syndicate

Bounce Syndicate is an additional layer of the existing DeFi auction framework, tailored to facilitate auction offerings for groups with shared interests. This feature benefits auction organizers and participants and offers flexibility in structuring to meet various objectives. To create a Syndicate, users need verification on Bounce V3 and must complete a profile form detailing their introduction, background, icon, and key resources. The Syndicate's creator, whether an individual or entity, can opt to make the group paid or free. Joining a Syndicate requires a Bounce V3 account, and applicants can apply by providing the necessary information requested by the Syndicate owner. Once approved, they gain membership. [20]

The Syndicate operates through two main mechanisms. The primary mechanism is where projects host exclusive auctions for Syndicate members, allowing them to participate and bid for allocations in a first-come-first-serve manner, similar to a whitelist mechanism. The secondary mechanism involves the Syndicate owner utilizing their connections to secure allocations from projects, subsequently distributing them to members through auctions or fair distribution methods. This interaction occurs directly between Syndicate members and the owner. [20]

AUCTION Token

Bounce Finance introduces its native platform token, AUCTION, which facilitates platform operations, captures utility, and fosters value creation. It's important to emphasize that AUCTION does not possess monetary value; it has been meticulously crafted with economic and game-theoretical principles to enhance platform functionality. The AUCTION token offers several key features, including governance voting rights. Each token represents a vote in the Bounce platform's governance process, granting holders greater influence with more tokens in their wallets. [21]

Additionally, AUCTION serves as a medium of exchange, with pool creators having the option to receive auction proceeds in AUCTION tokens, which can be utilized as currency. Moreover, AUCTION tokens enable creators to stake their auctions for enhanced visibility and promotion among platform users. Membership verification and privileged access to Bounce V3 are also available to AUCTION token holders. Furthermore, staking AUCTION tokens allows users to earn rewards from protocol fees generated, adding an additional layer of utility to the token. [21]

Tokenomics

AUCTION has a total supply of 10 million and was allocated as follows: [22]

- Community Incentive: 35%

- Private Investors: 24%

- Ecosystem: 10%

- Team: 10%

- Foundation: 10%

- Public Sale: 6%

- Market Making: 5%

Partnerships

Investors

On March 15th, 2021, Bounce received funding from the following investors in a funding round: [23][24]

- Coinbase Ventures

- Binance Labs

- Pantera Capital

- Blockchain Capital

- ParaFi Capital

- Hashed

- NGC Ventures

- Fundenmental Labs

- DHVC

- SNZ Capital

- Kain Warwick (SNX)

- George Lambeth (Balancer)

- Calvin Liu (Compound)

- Stani Kulechov (Aave)

- Nikita (1inch)

Integrations

DEGO

On November 7th, 2020, Bounce announced the launch of a series of co-branded NFTs in collaboration with DEGO.finance, a modular DeFi platform offering various services such as stablecoin liquidity, flash loans, decentralized trading, derivatives, insurance, and NFTs. [25]

KardiaChain

On November 24th, 2020, Bounce announced a partnership with KardiaChain, a hybrid blockchain infrastructure catering to enterprises and governments. The collaboration aimed to expand the range of NFT and DeFi use cases available on the Bounce platform. [26]

Chainlink

On December 18th, 2020, Bounce Finance announced its mainnet integration with Chainlink, a decentralized oracle network. This integration aimed to utilize Chainlink Price Feeds as the primary oracle solution, ensuring the reliability and security of outcome determinations for prediction markets. Additionally, it aimed to provide transparent and equitable exchange rates for assets used in auction offerings. [27]

ROCKI

On December 20th, 2020, Bounce Finance partnered with ROCKI, a blockchain-based music streaming platform focused on NFTs for royalty income rights. The collaboration aimed to explore the application of NFTs in the music industry. [28]

My Neighbor Alice

On January 15th, 2021, Bounce Finance partnered with My Neighbor Alice, a multiplayer builder game created by Swedish game studio Antler Interactive. The collaboration involves integrating NFT marketplaces and introducing gamified financial product initiatives. [29]

FM Gallery

On April 13, 2021, Bounce announced a partnership with FM Gallery, a blockchain-based distribution platform focusing on NFT artworks. The collaboration aims to empower the arts and fashion world through innovative art fragments and autonomous fan communities. [30]

Automata

On May 3rd, 2021, Bounce Finance revealed a strategic partnership with Automata Network, a decentralized protocol specializing in traceless privacy services for dApps. As part of this collaboration, Bounce integrated Automata Witness, an anonymous voting solution designed to safeguard users' identities and preferences for enhanced privacy and democratic governance. [31]

Neblio

On September 12th, 2022, Bounce partnered with Nebl.io, a distributed, high-performance blockchain platform for Enterprise & Industry applications, to further cross-chain compatibility. [32]

Salus

On January 18th, 2023, Bounce announced a partnership with Salus Security, a professional security services provider. [33]

On January 30th, 2024, Bounce Brand revealed a new partnership with Salus, a Web3 security firm known for its research-oriented methodology. This collaboration aims to transform ecosystem security by harnessing the strengths of both entities. As part of this alliance, Bounce Brand will offer various benefits to its community, such as ZK Integration advisory and security grants tailored for projects within the Bounce ecosystem. This initiative marks a substantial effort to enhance security measures and strengthen the platform against potential digital threats. [34]

Test Jar Labs

On February 16th, 2023, Bounce revealed a partnership with Test Jar Labs, an innovative gaming studio, to integrate playable auctions into specific Web3 gaming ecosystems. [35]

Kava

On April 4th, 2023, Bounce Finance announced integrating Kava, a decentralized layer-1 blockchain recognized for its advanced security, interoperability, and high-speed transaction capabilities. Serving as the inaugural auction protocol to integrate Kava, Bounce V3 now enables users to initiate and engage in decentralized auctions within the Kava ecosystem, underscoring our dedication to adopting cutting-edge technologies for the advantage of their users. [36]

Moonbeam/Moonriver

On April 5th, 2023, Bounce Finance expressed excitement about backing Moonbeam and Moonriver, two smart contract parachains tailored for the Polkadot and Kusama ecosystems. Users now have the capability to generate and engage in decentralized auctions on Moonbeam and Moonriver via Bounce V3. [37]

FOUNDO

On July 21st, 2023, Bounce Finance partnered with FOUNDO, a Web3-native luxury accessories brand. This collaboration bridges the gap between real-world assets and on-chain trading experience in the Web3 landscape. [38]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)