Subscribe to wiki

Share wiki

Bookmark

Usual

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Usual

Usual is a decentralized protocol that issues fiat-pegged and Ethereum-pegged assets backed by tokenized real-world assets and staked ETH. It offers a suite of financial products, including stablecoins, governance tokens, and yield-generating instruments designed for composability in DeFi. [2]

Overview

Usual is a decentralized stablecoin protocol that issues USD0, a fiat-pegged stablecoin backed by tokenized real-world assets (RWAs) from sources like BlackRock, Ondo, and others. It is a multi-chain infrastructure that transforms off-chain assets into on-chain, verifiable, and composable collateral. The system is built around three components: the USD0 stablecoin, a yield-bearing version called USD0++, and a governance token ($USUAL). Users swap USDC for USD0, which can be staked to earn USD0++ and eventually gain access to $USUAL. Protocol revenue is generated by allocating collateral into on-chain T-bills, with all proceeds directed to a treasury managed by $USUAL holders. $USUAL is issued deflationarily, with 90% of revenue supporting operations, staking, and liquidity, and 10% going to holders. [1] [7]

Products

USD0

USD0 is a fiat-backed stablecoin issued by the Usual protocol. It is designed to aggregate tokenized U.S. Treasury Bill assets from providers such as Hashnote, Ondo, and BlackRock. USD0 is a permissionless, composable, and transferable token for use in payments, trading, and as collateral within DeFi systems. Unlike traditional stablecoins, USD0 is not tied to bank deposits but derives its backing from fully collateralized real-world assets.

The stablecoin integrates multiple sources of tokenized Treasury exposure into a unified asset, providing a diversified and transparent collateral base. Each fund administrator offers real-time reporting of reserves, and the minting system uses a non-CDP model to support efficient issuance. A collateral controller supports peg stability. USD0 is available across DeFi platforms and is structured to comply with U.S. and EU regulatory standards.

USD0 can be minted through two methods within the Usual protocol. In a direct mint, users deposit eligible real-world assets (RWAs) and receive an equivalent amount of USD0. In an indirect mint, users deposit USDC, and a designated Collateral Provider supplies the RWA backing, allowing users to obtain USD0 without holding RWAs themselves. Initially, minting requests below 100,000 USD0 are routed through secondary market liquidity. [3] [6]

USD0++

USD0++ is a liquid staking token (LST) representing USD0 locked for four years. It offers exposure to the yield generated by the Usual protocol. The yield is distributed daily in $USUAL tokens and varies based on $USUAL’s market price. While the underlying USD0 is locked, USD0++ remains transferable and composable across DeFi protocols, allowing users to maintain flexibility and secondary market access.

This mechanism enables holders to earn additional value by participating in protocol governance and revenue distribution through $USUAL tokens. USD0++ can also be used for leverage via the Usual Stability Loan, and there is no minimum holding requirement. It functions similarly to a bond, offering a blend of fixed-term stability and liquid, on-chain utility. [4] [5]

Alpha Yield

USD0++ offers yield in the form of $USUAL tokens, referred to as Alpha Yield, which combines the protocol’s governance token with the base yield of the locked USD0. Users lock their USD0 into USD0++ for four years and can claim their yield daily in $USUAL, while the original USD0 is returned at the end of the term.

Alpha Yield introduces exposure to variable returns based on the market performance of $USUAL, adding a speculative component. This model intends to offer returns beyond risk-free assets by linking yield to the protocol’s growth and adoption. Early participants benefit from higher potential rewards due to the increasing value of $USUAL as the total value locked rises. [8]

Parity Arbitrage Right (PAR)

The Parity Arbitrage Right (PAR) is a governance-controlled mechanism that allows the Usual DAO to unlock USD0 backing the USD0++ token before its maturity, specifically if USD0++ trades significantly below its intended value. This mechanism helps maintain price stability by enabling redemptions when market depegging occurs.

The market prices are USD0++ and may deviate from their expected parity with USD0. If this happens, the DAO can intervene by executing PAR, unlocking the underlying USD0, and enabling redemption. This process aims to stabilize the token’s value while potentially benefiting the protocol treasury through arbitrage. [9]

ETH0

ETH0 is a synthetic asset issued by the Usual protocol that mirrors the value of ETH and is fully backed by Lido’s wrapped staked ETH (wstETH). It allows users to maintain 1:1 ETH exposure while accessing additional yield through USUAL token rewards. ETH0 is designed to be liquid, permissionless, and composable, functioning similarly to other stable assets like USD0 within DeFi environments.

The system operates by accepting wstETH as collateral. Users deposit wstETH into the protocol to mint ETH0, ensuring every ETH0 token is backed by an equivalent ETH value. A Chainlink oracle monitors the wstETH/ETH exchange rate to preserve peg stability, and automatic safeguards pause activity if major deviations occur. Unlike rebasing models, staking rewards are distributed separately in USUAL tokens, allowing holders to earn more than standard ETH staking yields.

Minting ETH0 is open to anyone with wstETH. Users connect their wallets, approve wstETH use, deposit it into the protocol, and receive an equal value of ETH0 in return. These tokens can be redeemed later by being returned to the contract, which releases the wstETH collateral. The process is fully on-chain, reinforcing transparency and security while maximizing staking efficiency. [10]

Stability Loans (USL)

Usual Stability Loans (USL) is a mechanism within the Usual protocol that enables users to borrow USD0 against USD0++ and similar assets when USD0++ trades below its expected value. This feature helps maintain peg stability and provides liquidity support, similar to stabilization modules in protocols like MakerDAO and Frax.

USL introduces fixed-rate borrowing with predictable terms, offering arbitrage opportunities and increasing protocol revenues through interest collection. It carries no direct risk to the DAO’s solvency or collateral base and creates upward pressure on USD0++’s market value. The module is governed by the DAO and is set for deployment on the Euler protocol, with veto rights available to USUAL holders. [11]

Usual Vaults

Usual Vaults extend the functionality of USD0++ by enabling holders to deposit their tokens into curated vaults that deploy integrated DeFi strategies, eliminating the need to sell tokens for external yield opportunities. This system enhances demand for USD0++, supports sustainable revenue for the USUAL DAO, and maintains active engagement of tokens within high-yield environments, fostering ecosystem growth and stability.

Vaults operate through partnerships like Lagoon Finance and are managed by curators who select optimal investment strategies, including Real-World Asset opportunities with timely settlement and safeguards against front-running. Deposits convert USD0++ to USD0 on a 1:1 basis and follow an epoch-based process, allowing users to request deposits, with the ability to cancel before settlement.

Withdrawals also proceed via epochs, where users submit redemption requests. Curators then settle the requests, burning vault shares and returning USD0++ plus accrued interest. Users can claim their funds through an optional redemption function.

Vault rewards comprise two components: base staking rewards on USD0++ paid in USUAL tokens and returns from the underlying DeFi strategies. The DAO retains yield up to a set benchmark as a management fee, while excess returns are shared between users and the DAO after performance fees. [12]

ustUSR++ Vault

ustUSR++ is the first vault offering exposure to stUSR, Resolv’s staked USR, by exchanging USD0++ for USD0 on a 1:1 basis and reinvesting it into stUSR. Earnings come from stUSR yield generated by basis trading strategies, Resolv points as additional incentives, and ongoing USUAL rewards. Withdrawals occur in USD0++, with an initial vault cap of $5 million that increases based on demand.

The vault delivers returns through a triple yield mechanism: USUAL rewards continue unaffected, stUSR yield compounds upon withdrawal, and Resolv points accumulate with potential airdrops. The fee structure includes a base fee up to 4%, compensating the DAO for foregone risk-free yield, and a 20% performance fee on yield exceeding 4%, split evenly between the curator and the DAO.

ustUSR++ improves capital efficiency by allowing depositors to receive full stUSR value even if USD0++ trades below $1, enabling lower entry costs without added risk or leverage. Vault funds are isolated from USD0++ reserves, containing stUSR-related risks within the vault and exposing users only to third-party protocol risk.

This vault initiates Usual’s strategy to increase USD0++ earning potential via external DeFi assets. Future vaults are expected to broaden yield opportunities, deepen protocol integration, and support sustainable DAO revenue. [13]

USUAL

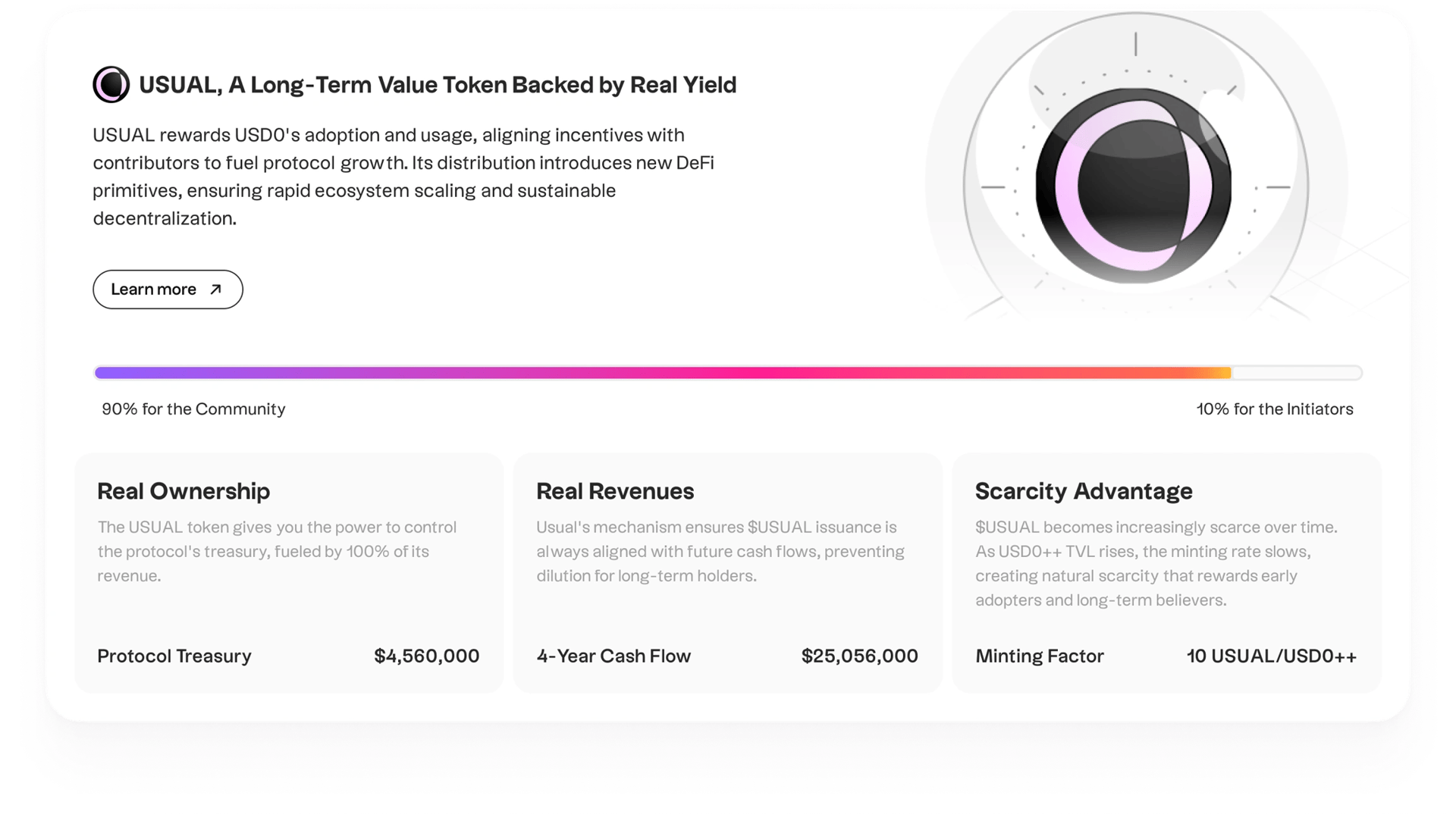

USUAL is the governance token of the Usual protocol. It is designed to represent ownership of all protocol revenue and align incentives with users who contribute to its growth. It distributes returns generated by products like USD0 and USD0++, enabling holders to participate in governance decisions.

The token follows a controlled emission model, where issuance remains below the protocol’s revenue growth to preserve long-term value. As more capital enters the system, the emission rate decreases relative to the total value locked, introducing scarcity over time. USUAL is distributed primarily to the community, with 90% allocated to users and 10% reserved for the team and investors. [14]

Tokenomics

USUAL has a total supply of 4B tokens and has the following allocation: [15]

- USD0++: 45%

- USD0/USD0++: 10.5%

- USUALx: 10%

- USUAL*: 10%

- DAO: 9.38%

- Ecosystem: 8.62%

- USD0/USDC: 2.5%

- USUAL/USD0: 2%

- MarkerMakers: 2%

Partnerships

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)